The rave on the new layer1 blockchain dropping its token was well anticipated. With the mainnet, Aptos Autumn launched earlier today, the community took to crypto Twitter on their uncertainty with the tokenomics of the new kid in the block.

After two incentivizes testnets, Aptos is set for mass adoption with the team behind the project set out to bridge the gaps between Web2 and Web3.

Also Read: Introducing Aptos – The Layer 1 For Crypto Mass Adoption

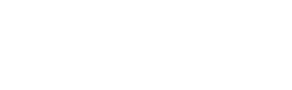

Currently, BTC TPS > APTOS TPS

By using Software Transactional memory (STM), they can process transactions more efficiently, leading to 160,000 non-trivial transactions per second (TPS). However, the mainnet told a different tale.

According to Paradigm Engineer, Aptos promised upwards of 100k TPS in its finalized version. Their mainnet currently showed a current TPS of around 4 transactions per second.

While the Aptos Blockchain claims to handle three times the amount of transactions per second than Solana (Solana’s currently around 40,000 TPS), the current TPS is currently slower than the largest cryptocurrency, Bitcoin, famously known for its sluggish TPS speeds at 7 TPS.

However, according to a tweet posted by the Aptos account, the network has been “performing as expected,” which left many wondering if the current TPS reflected on the explorer accomplished its intended purpose.

I personally doubt 4 TPS will be able to handle the loads which come with mass adoption. The majority of transactions which are made on the network not being actual transactions, instead they are “merely validators communicating, setting block checkpoints and writing metadata to the blockchain.”

Could the mainnet drop just be a trial instead of the intended full mainnet launch? Only time can give us an answer.

Tokenomics before launch or launch before tokenomics?

Aptos did the latter. This came as a surprise to those on crypto Twitter as the norm to drop information on the tokenomics before the mainnet launch was widely adopted.

This could be all part of the plan, but it created a common consensus on the ground, fear and uncertainty.

While major exchanges like Binance and FTX posted listing details of the token after the mainnet launch, the Aptos team only published the tokenomics details on the $APT token a few hours after.

It's not great that FTX/Binance etc are all listing Aptos without any tokenomics transparency at all. Surely it should be a prerequisite to listing something that users can have the basic information on what they're buying lol

— Cobie (@cobie) October 18, 2022

While this operational choice of Aptos may be an unorthodox one, it did not live up to its hype but instead, brought negative comments from crypto leaders in the space.

$APT looks cool. But no f*cking chance I’m putting a cent in until we have full clarity on the tokenomics.

— Miles Deutscher (@milesdeutscher) October 18, 2022

Pretty disgusting that exchanges are already listing it without making this information transparent.

While others may theorize that this move was intentional, there is no doubt this move by Aptos was not widely reciprocated.

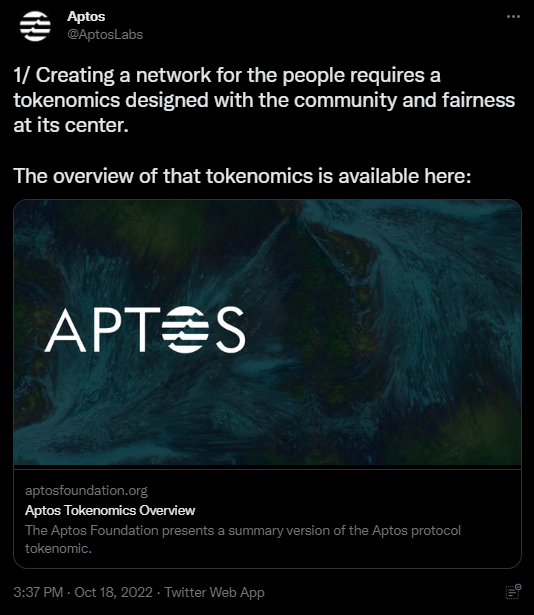

Aptos raised at a $2B valuation and failed to make their tokenomics information available at launch.

— Aylo (@alpha_pls) October 18, 2022

There is no way this was an oversight.

This was intentional.

Being one of the most hyped, with a valuation of $2B, and backing from big VC names, Binance, a16z, Multicoin Capital and Coinbase Ventures among many others, their decision to do so, in my opinion, was sub-par.

Disabling discord

Aptos’s decision to disable their discord on mainnet launch day caused further fear and uncertainty on the ground. (At least that was what I felt waking up and reading tweets on Twitter).

They’ve only recently opened a few channels, but important channels like dev-resources are still closed.

Also Read: Binance & FTX Both Backed Aptos – Here’s Why They’re Bullish On This Layer 1

Airdrop eligibility

So currently, the $APT is only airdropped to those who participated in their incentivized testnet. Find out your eligibility in the thread done by Coreleone below.

How to get the Aptos Airdrop

— Corleone (@corleonescrypto) October 13, 2022

1. Incentivized testnet

Aptos launched its "Incentivized Testnets" program. Where users can perform tasks on its testnet to earn $APT when the token launches.

Let’s talk tokenomics (TLDR)

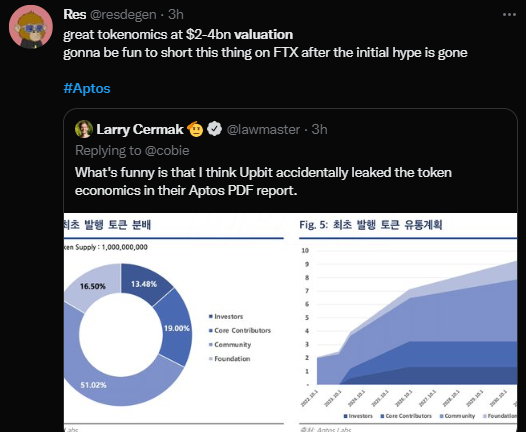

Before the formal release of the tokenomics details, Upbit accidentally leaked the token economics in their Aptos PDF report.

While this could be a breather for the Aptos community to know that the $APT token will come with a tokenomic design, information being leaked not from the intended source decreases the overall credibility. It is not a good sight to see.

Aptos’s tokenomics is all about “creating a network for the people requires a tokenomics designed with the community and fairness at its center.”

TLDR

$APT Token

510,217,359.767 $APT [51.02%] is reserved for the community

Of which 125,000K APT is for the projects on Aptos (might be #Airdrops ), grants, and other community initiatives and 5,000K APT for the foundation.

Find out more by checking out the dapps on Aptos using this list here.

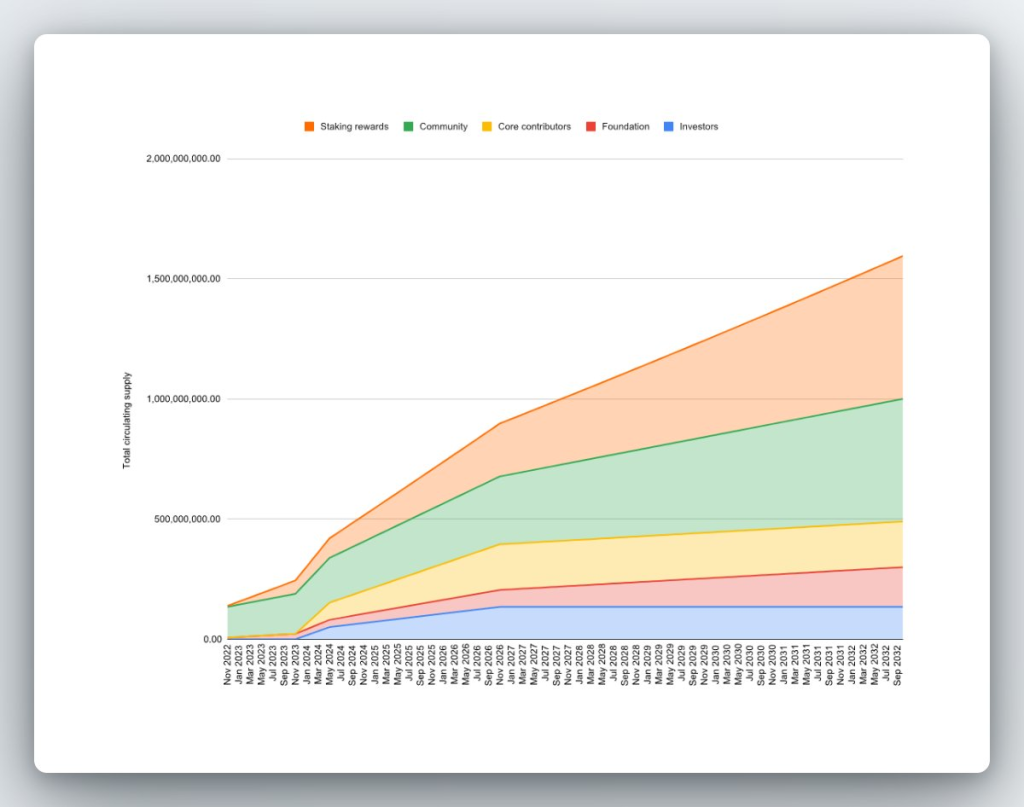

Unlocking schedule

Remaining 1/120 will unlock monthly for the next 10 years. 32.48% is reserved for Core Contributors and investors.

The unlocking schedule will be as follows:

• Locked for the first 12 months

• 3/48th unlocked each month from the 13th-18th month

• 1/48th unlocked each month thereafter

Currently, 82% of the tokens are staked and a majority of these are locked. No prizes for those who guess who these may be. Definitely not retail investors.

Anticipated changes in supply

The maximum reward rate for staking starts at 7% annually and is evaluated at every epoch. The maximum reward rate will decline by 1.5% annually until a lower bound of 3.25% annually.

As of now, transaction fees will be burned, but there might be changes in the future with on-chain governance voting.

For a complete guide on Aptos’s tokenomics, find all of that here.

1/ Creating a network for the people requires a tokenomics designed with the community and fairness at its center.

— Aptos (@AptosLabs) October 18, 2022

The overview of that tokenomics is available here: https://t.co/KeU7RXANkd

Closing thoughts

There is no doubt Aptos was the latest and new blockchain to watch. With massive funding and seeming good tech, it seemed like the next big thing in the space. The bear market gave investors opportunities to search for the next big thing, and Aptos was in the sights of many. The hype also comes with heavy scrutiny when things don’t go the way expected.

The series of events occurring today did not set a positive pedestal for Aptos, especially on its release day. The harsh critics by crypto Twitter set a negative tone for the blockchain, which mainly came from conversations talking about how retail investors “will get dumped on” to how there are jarring red flags too hard to ignore.

While other opinions like the ones above may be out of humour and banters, they further worsen the image.

mfers didn't even edit the metadata on the post LMWO pic.twitter.com/ddcDio80le

— Awawat (@Awawat_Trades) October 18, 2022

It will take more than an explanation for all that we’ve talked about in this article. I think the only way Aptos can prove the space wrong is to execute what they are intended to do, especially with a huge backing, a bumpy start may be met with a smooth and upwards journey from here. They have good intentions, but their execution has to be right as well.

Also Read: Thanks For The Free Money: Here’s How I’ve Been Trading The CPI with a 100% Win Rate

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief