The Federal Reserve announced that it is keeping interest rates steady following its meeting on 26 January 2022, leaving the federal funds rate at a range of 0 to 0.25 percent.

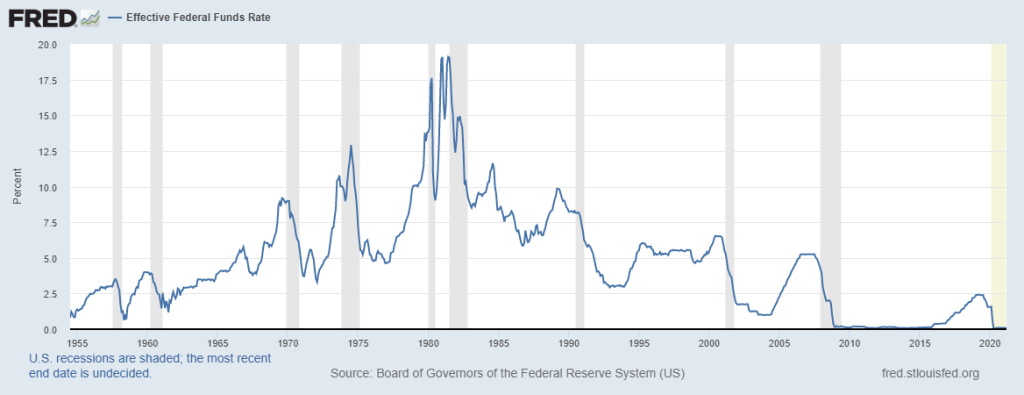

Despite the passivity in rates for now, analysts are still expecting the central bank to hike rates a number of times in 2022, with a high probability that it does so at its next meeting in March.

What are interest rates?

Interest rates are the amount a lender charges a borrower usually in a percentage of the principal amount loaned out. The interest rate on a loan is noted on an annual basis known as the annual percentage rate (APR).

Interest rates affect everyone — from consumers to businesses to nations. They are a tool of monetary policy set by central banks and used as a measure for business and consumer borrowing.

History of interest rates

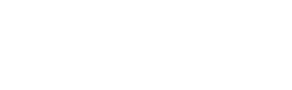

The lowest rate of 0.00–0.25% in the Federal Reserve’s history came in the period during December 2008 and December 2015, as a response to the financial crisis of 2007–2008 and its aftermath.

The first hike post financial crisis came in December 2015 and it steadily grew up till 2020 where rates were at 1.00–1.25% on March 2020.

Just two weeks later, the Federal Reserve decided to cut interest rate by a full percentage point back to 0.00–0.25% amidst the emerging Covid-19 pandemic.

Will the Federal Reserve raise interest rates?

It is almost a certainty that the Federal Reserve will raise interest rate and will continue to do so gradually over a period of time.

An economist from Goldman Sachs predicts that there’s a case to be made for a 50 basis point hike in March given the combination of very high inflation, hot wage growth and high short-term inflation expectations.

Indications from policy makers are pointing to more incremental moves in the near future.

How do rising interest rates affect crypto?

The Fed’s willingness to keep rates at near zero for as long as it takes for the economy to recover has benefitted many.

The ability to borrow at extremely low cost incentivises borrowing, and borrowers do so in an attempt to earn more on the capital borrowed to repay the interest loaned and profit from it.

Low rates are beneficial for risky assets such as stocks and crypto, making them look like a more attractive investment in comparison to rates on bonds and fixed income investments such as certificate of deposits (CDs).

However, a rise in interest rates makes it harder and more costly for both consumers and businesses to borrow. This may then lead to a decline in activity in risky assets such as crypto.

Investors may also sell their crypto in exchange for fiat to pay off high interest loans which will result in the decline of price.

Crypto winter?

Prices have been falling since November 2021, when crypto hit an all time high in terms of price.

A decline in activity could spell a lull period for crypto investors as there will be reduced interest in investment in the asset class. This would not attract firms and individuals to look into crypto as a form of investment as they can get better returns elsewhere.

Technical analysis

Price action has an overall big Head and Shoulders pattern with a neckline of USD $44,000 and a target of USD $19,000.

Prices have already rejected the US$44,000 level three times, and getting a reaction to the downside thus far. If it breaks and closes below US$40,000 this could mean that we are poised for further downside.

There is a case for the bullish narrative, but I am leaning more towards the bearish side of things for now due to rising interest rates and geopolitical risks.

This can easily cause fear in the market and see price tumbling down in a cascading effect.

With the aforementioned, I personally think it is possible to see Bitcoin trading under $10,000 should a recession hit. Majority would not have thought it’s possible because no one likes hearing the max pain scenario. However, it is during these times where you should actually start accumulating and hodl on for the next few years.

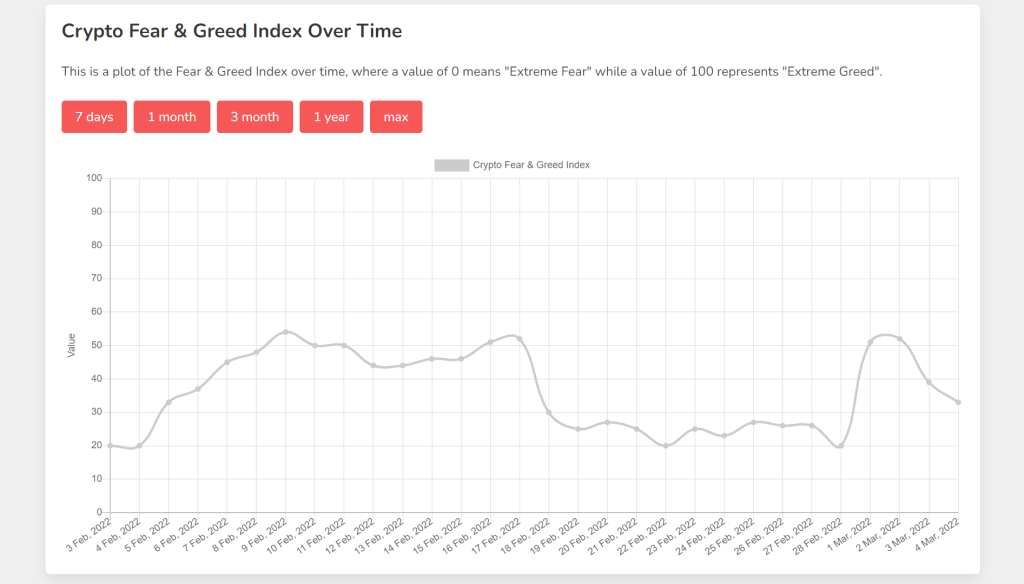

Fear & Greed Index

The crypto market behaviour is very erratic. Retail tend to get greedy when the market is rising which results in FOMO (fear of missing out). At the same time, people often sell their holdings irrationally when faced with red numbers.

With the Fear and Greed Index, retail investors can get a general sense of when the market is too optimistic or pessimistic. The Fear and Greed Index currently has a reading of 33 (fear).

There are two simple assumptions:

- Extreme fear can be a sign that investors are too worried. This can be a buying opportunity.

- Extreme greed can be a sign that the market is overextended and could be due for a correction.

Closing thoughts

The Federal Reserve tends to keep interest rate within a 2.0% to 5.0% sweet spot that helps to maintain a healthy economy.

However, there have been times where interest rate is well above that range to curb runaway inflation. We are currently facing hyperinflation and we could move towards that range or even beyond that for the next few years.

This means that the cost of borrowing is much more expensive, and there will be less borrowers in the market.

This will affect the amount of risk willing to be taken on which will see investors ditch their risk on assets (e.g. stocks, crypto) and flock to risk off assets (e.g. high yield savings account, treasury bills and bonds).

Are we about to face a crypto winter?

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: CNBC

Also Read: What The Fear And Uncertainty Around Russia And Ukraine Means For Crypto