Genesis is the only full-service prime broker in crypto. They are critical in enabling large institutions to access and manage risk. Genesis started as the first OTC (Over the counter) Bitcoin desk in 2013; fast forward to the present day, they are now the largest lending desk in the crypto industry.

Also part of DCG, also known as Digital Currency Group, is part of a group of companies Barry’s Silbert owns, including CoinDesk, Foundry, Grayscale and Luno.

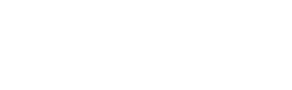

At the height of the market, the size Genesis was moving at sheer size.

With deep ties in many different areas of crypto, from CeFi platforms to institutions that borrow, the implications of Genesis falling make the FTX fall seems nothing more than child’s play.

3AC happened

The contagion caused by 3AC revealed Genesis’s exposure to the fallen venture firm.

Genesis was the biggest contributor to 3AC, having lent $2.4B, which is said to have suffered nine-figure losses partly through exposure to Three Arrows Capital.

Furthermore, when things started to unravel, it was found that Genesis also had significant exposure to Babel Finance, the CeFi platform that got caught in the contagion wind.

Crypto Broker Genesis Cutting 20% of Workforce as CEO Michael Moro Exits

— Crypto RSS (@TheCryptoRss) August 17, 2022

Michael Moro, the CEO of #crypto broker Genesis has quit as the company cuts 20% of jobs.https://t.co/JBb8iK7Ijl pic.twitter.com/bWPUP4IcBw

The hit was hard enough for long-time CEO of Genesis Michael Moro to quit the company. By Q3 of 2022, Genesis numbers had fallen drastically.

Why is the fall of Genesis so bad?

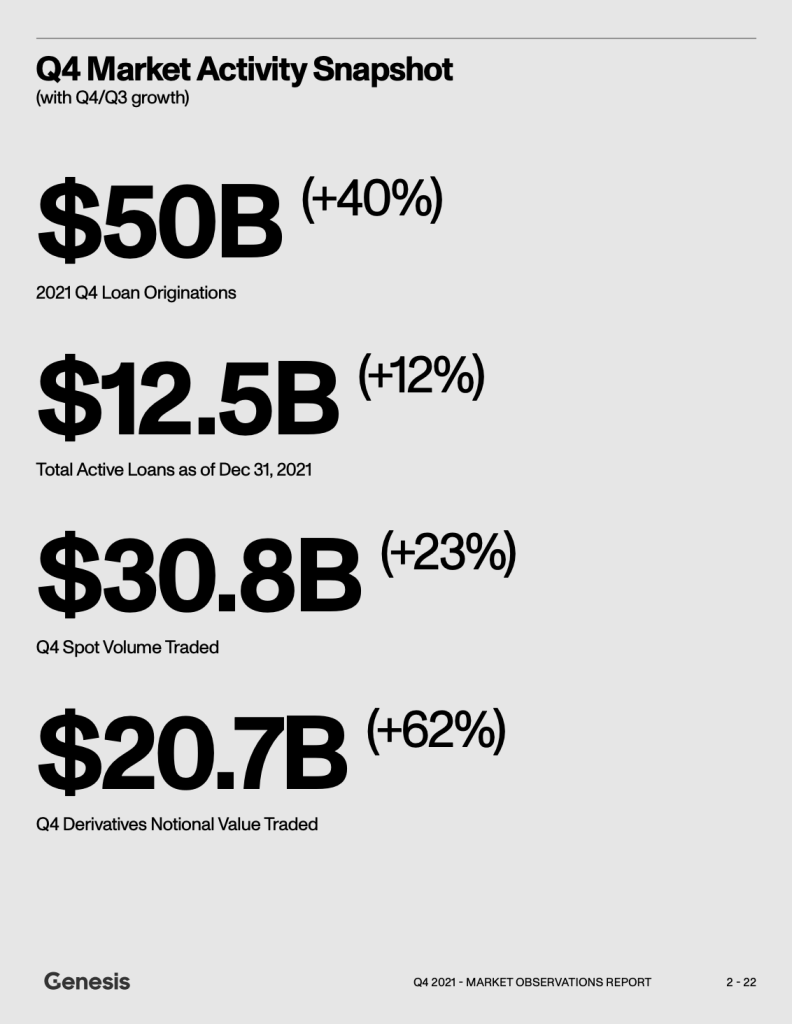

Being the backbone of many “earn” products for CeFi crypto products, Genesis plays an essential role in helping CeFi platforms help consumers earn their yield.

How?

CeFi platforms that host these “earn” products will give your crypto to Genesis, who will, thereafter, “lend your crypto out to a fund for X+2%. In exchange, Genesis gives the platform X+1% and the platform gives you X%.”

If you have heard about Gemini Earn or any CeFi platform that offers yield, you probably use Genesis.

While you can think of them as the biggest middlemen in the crypto space, this earning model can only work if counterparties that Genesis lent to can repay their borrow.

If Genesis can’t get their crypto back, they can’t give it back to Gemini, which means you don’t get back your crypto.

Ok, what about the whales? Well, most of the whales approach Genesis directly. Instead of delegating their funds to earn on BlockFi / Gemini platforms, they go straight to Genesis to make their yield.

Imagine whales, institutions and family offices not being able to get their crypto back. Catastrophic.

While we process this thought fearfully, the early signs have already started in motion.

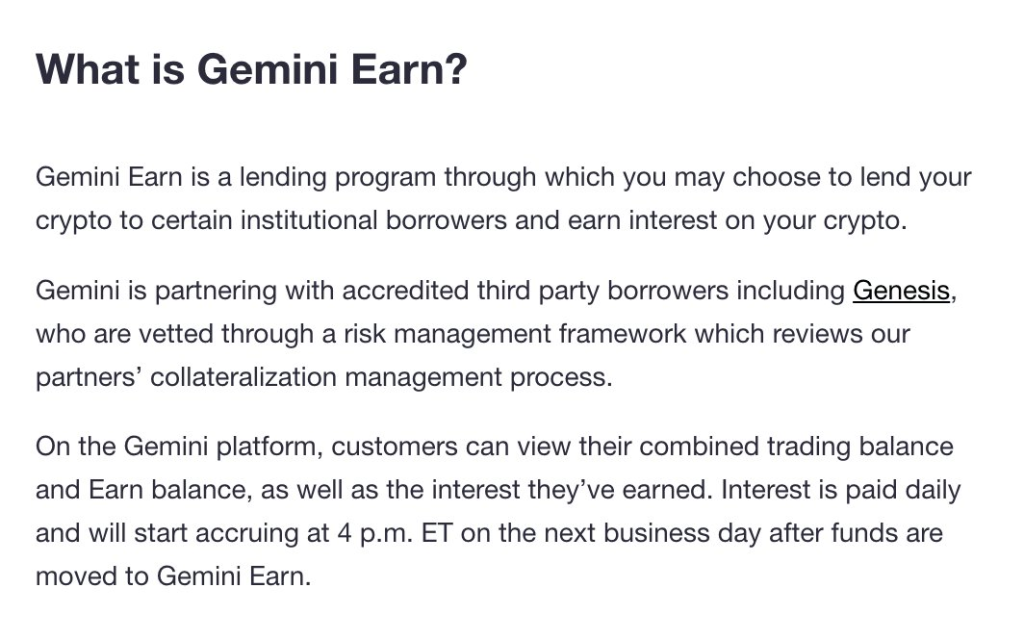

Last week, Genesis sought a $1B bailout from investors to avoid a liquidity crunch driven by the fallout of FTX’s collapse. This was after they announced it would suspend withdrawals, blaming FTX’s failure for “abnormal withdrawal requests which have exceeded our current liquidity.”

Being the epicentre of the crypto capital markets, Genesis halting withdrawals will cast a darker light on the crypto space. Their role in the industry is huge, they help institutions earn yield and are yield products for CeFi platforms, and if this component of crypto falls, all hell will break loose.

Check out Nansen’s data on Genesis’s trading OTC desk below.

3/ Genesis Trading OTC Desk:

— Martin Lee | Nansen 🧭 (@themlpx) November 16, 2022

Has a ton of interaction with Alameda associated wallets, >10% of all incoming and outgoing ETH came and went to Alameda

Almost 6% of outgoing ETH was sent to Gemini and 2.45% sent to BlockFi

FTT is a top 4 token received/sent pic.twitter.com/gYTRzbslui

Will DCG save the day?

While many can speculate DCG has enough funds to back Genesis, the parent company is facing troubles with its other “kids”.

Another subsidiary of DCG, grayscale, is well known for its crypto asset Grayscale trusts, notable GBTC and ETHE are facing troubles.

If these very trusts are forced to liquidate, they will be a forced seller of the underlying tokens to distribute them back to holders.

Also, Read What is GBTC and Why Won’t They Show Their Proof of Reserves

The two trusts own approximately 633.8K BTC (~$10.5B) and 3.05M ETH (~$3.6B).

Forced selling of these assets will create a more giant hole than we have ever imagined, potentially creating a cascading effect on negative price impacts on crypto assets.

If DCG is in danger, not only could this spell danger for Genesis but for all other companies under the DCG umbrella.

While the road ahead will be rocky, if you still have your funds in CeFi platforms, think about shifting them to cold storage or even your Metamask.

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chain Debrief