If you’re risk-averse but still want to do some DeFi farming, stablecoin farms are the way to go. Stablecoins are cryptocurrencies that have their value tied to fiat. It is non-volatile in nature and you do not have to worry that the price will plummet the next day.

There are a few ways to farm yield with stablecoins and for starters, I recommend staking in a single asset yield farm.

By staking in a single asset yield farm, users can have peace of mind and not worry about impermanent loss. Impermanent loss is by far the most common oversight by DeFi farmers. Users might be exposed to so much impermanent loss that they are better off not participating in the yield farm.

1. Bancor Protocol

All DeFi OG should have heard of Bancor protocol. Bancor is the first decentralized trading protocol that started the automated market maker (AMM) model.

Bancor v2.1 sees it address impermanent loss by implementing liquidity protection. It uses its own native token $BNT as the counterpart asset for the liquidity pool. This way the protocol is able to cover impermanent loss and users would only have to stake single assets instead of a pair.

Bancor offers a whopping 42.8% APY for USDT and 37.16% for USDC. It is by far the current best single staking farm that is able to offer high APY for stablecoins.

Besides that, it also offers single staking for other assets too but the APY is significantly lower than just staking stablecoins.

All in all, users can be rest assured that their funds are safe in Bancor as it is a battle-tested protocol that survived the test of time.

2. Anchor Protocol

Launched in March 2021, Anchor took the crypto world by storm. Built by Terraform labs, Anchor is a Terra based money market saving and lending protocol.

It raised US$2 million in funding from some of the biggest names in the crypto world. From one of the biggest crypto trading firm, Alameda Research to one of the leading research firm, Delphi Digital.

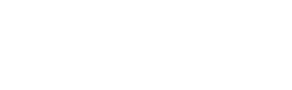

Anchor Earn is currently offering a jaw-dropping 19.48% for its Terra stablecoin (UST) deposits. It is able to offer such an attractive APY is because it uses the borrower revenue to pay the lender for the deposits.

Do note that the yield might decrease over time as currently there is an imbalance between the deposit versus the amount borrowed. With only $US1.5 billion borrowed and over $US6 billion in deposit, it is no surprise that the current yield is unstainable and would decrease over time.

Also Read: Anchor Protocol’s Yield Is Rapidly Depleting: The Solutions, And Will Anchor V2 Save It?

3. Yearn Finance

Yearn Finance is one of the leading DeFi projects built on the Ethereum network. Started in early 2020, Yearn Finance is a yield optimiser that aims to help users get the highest yield on their assets.

Also Read: A Look at Yearn Finance: The DeFi Gateway And Yield Aggregator Protocol

It simplifies complex strategies so just about anybody can participate and earn yields that were once only available to those with the technical knowledge and expertise to execute them.

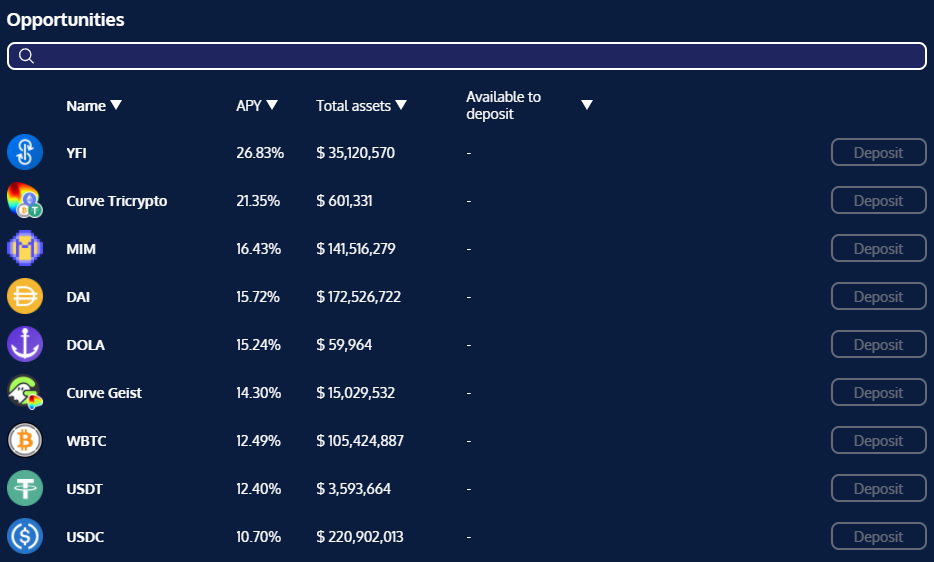

Yearn is currently offering 10-16% APY for stablecoins like $MIM, $DAI and $USDT but the catch is, the high APY is only available on the Fantom network.

If we look at $DAI on the Ethereum network, it is only offering 3.27% APY but once you switch to Fantom network, the APY shoots up to 12.72%.

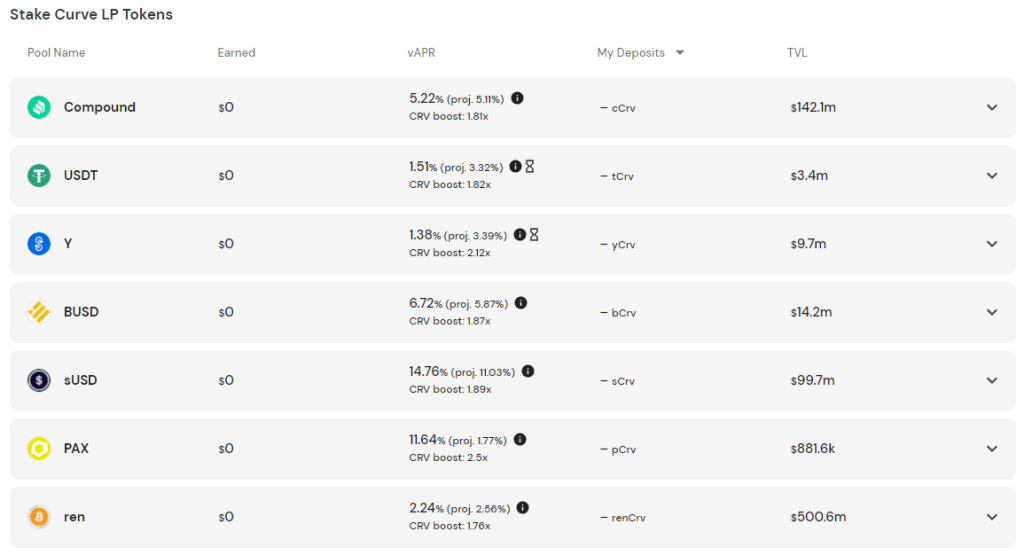

4. Convex

Ending the list with another yield optimizer, Convex Finance. Launched in May 2021, it quickly gained traction and only took a month to attract US$1 billion in TVL.

Convex is a DeFi protocol that is built on top of Curve Finance. It is designed to allow small players to pool their assets and earn more rewards from Curve Finance. Convex was also one of the major players that competed in the infamous Curve war.

Not as high as the other protocol, Convex is currently offering 10.56% APY for $MIM and 6.75% APY for $BUSD. While the APY fall on the lower end of the spectrum, rest assured that your fund is safer in Convex rather than other high APY degen farm.

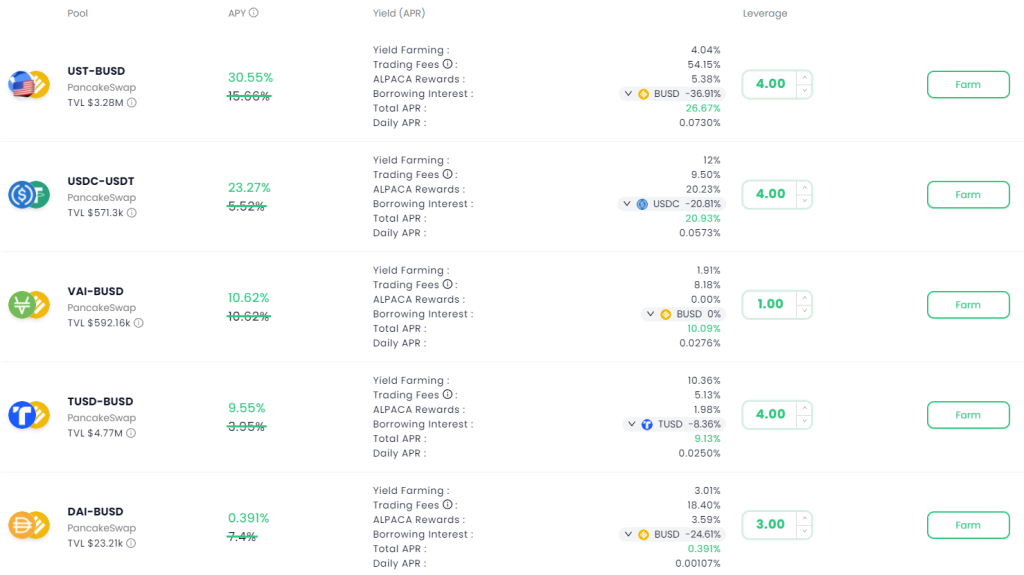

Bonus: Alpaca Finance

Those who are more adventurous can venture into Alpaca Finance. While it does give out an attractive APY, do note that it is not a single stake farm. Fret not impermanent loss is almost negligible as it is a pair of stablecoins and there should be little to no price fluctuation.

All in all, being able to use a non-volatile asset to generate high-interest passive income is game-changing. It is only a matter of time before the flood gate opens and more people venture into crypto to farm the sweet sweet yield.

Happy farming!

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: TIME

Also Read: From SpookySwap To Tomb Finance: Here’s A Guide To Yield Farming Opportunities On Fantom