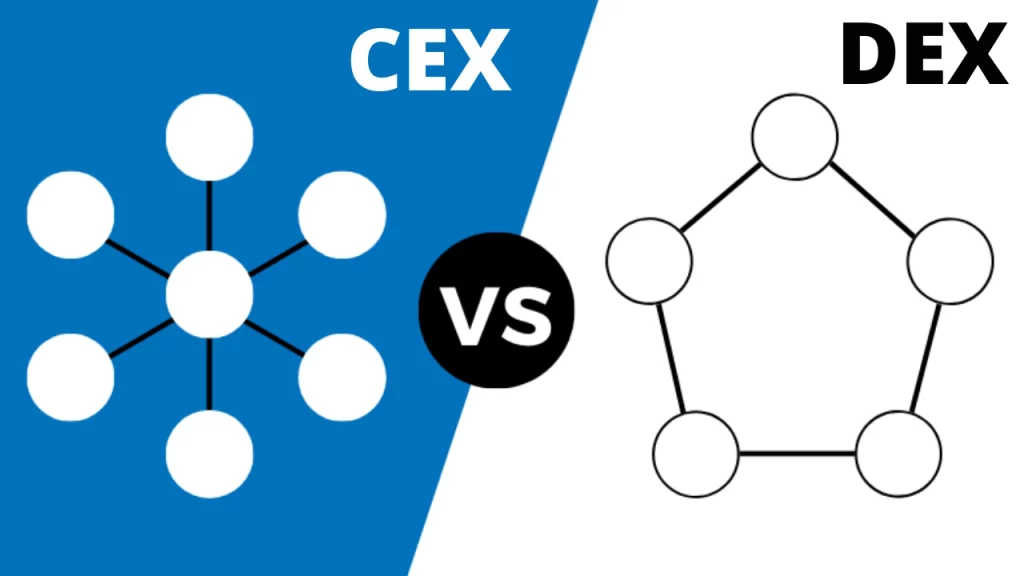

One of the most common ways people use to buy crypto is through a centralised exchange (CEX).

CEXs are online trading platforms that match buyers and sellers via an order book. Order book refers to an electronic list of buy and sell orders organised by price level. An order book lists the quantity being bid on or offered at each price point.

They are the most common method that investors use to buy and sell cryptocurrency holdings.

In contrast, a decentralised exchange (DEX) is a cryptocurrency exchange that allows the exchange of cryptocurrencies based on functionality programmed on the blockchain (i.e. in smart contracts).

The trading is done online securely via direct peer-to-peer transactions or between pools of liquidity without the need for an intermediary.

Pros and Cons of a CEX

Pros:

1. Trading Volume: CEXs are highly liquid. Large trading volumes help prevent drastic price movements in the cryptocurrency’s price after a significant sale is made.

2. Fiat-to-Crypto and Crypto-to-Fiat Conversions: The top CEXs typically support fiat to crypto on and off-ramps, meaning that they allow you to buy bitcoin with local or foreign currency that you are already familiar with such as the Singapore Dollar or the US Dollar.

3. Ease of use: One captivating quality of most CEXs are their user interfaces. With the consideration that most investors are new and unfamiliar with crypto, CEXs do a great job funneling users into the crypto space.

4. Other features: Apart from the vast array of digital assets that CEXs support, they also offer other features such as earning interest or staking your idle assets on the exchange itself, leveraged trading, lending, borrowing, and many others. Some CEXs also allow investors to set recurring purchases, which allow for dollar-cost averaging into their preferred digital assets.

Cons:

1. Rigid know-your-customer (KYC) policies: Majority CEXs subject users to strict KYC policies due to safety and security rationales. They require you to upload a photo of your face and a valid identity card to validate your identity to buy and sell crypto or make withdrawals. Although KYC is a security measure that adds a layer of protection to both users and the CEX, CEXs might not be a preferred choice for users who would like to maintain privacy.

2. Not Your Keys, Not Your Coins: I’m sure many have heard of this before. Your assets are in the custody of the exchange should you choose to leave it there. In 2021, Binance halted withdrawals for 2 hours due to a database glitch. This can cause quite an issue if there are time-sensitive withdrawals required.

We know – there are a lot of abbreviations in the crypto world and more as we go through these lessons. Here’s the crypto Glossary for you to refer to anytime you need it!

This educational course is created in collaboration with Luno Discover – your beginner-friendly cryptocurrency education portal. For more bite-sized learning and webinar invitations, join Luno’s Telegram Channel.