Lending is one of, if not the safest way, to generate interest on your crypto assets. It has become one of the most popular crypto services in the crypto industry.

As an investor, you can lend your digital assets to borrowers to earn an interest. There are three primary ways to lend out your crypto assets:

- Margin lending: There are plenty of traders looking to earn a quick buck in the market by amplifying their positions through borrowed funds. You could lend your crypto assets to them and earn interest upon the repayment of the loan. Crypto exchanges usually do most of the work for you so all that is required here is to make your crypto available for lending on the exchange.

- Centralized lending: There is usually a lock-up period and the interest rates here are fixed. Similar to peer-to-peer lending, you have to transfer your crypto to the lending platform to start earning interest on your assets.

- Decentralized lending: DeFi grant investors the opportunity to lending services directly on the blockchain. Unlike P2P and centralized lending, there are no intermediaries involved in DeFi lending. Instead, lenders and borrowers interact with smart contracts which autonomously set interest rates accordingly to supply and demand.

Pros of Lending:

Easy to use and low fees

For most of us who are testing waters, fees can really eat into our profits. However, you can sit easy knowing that deposits and withdrawals for most of these platforms are free, subject to some caps.

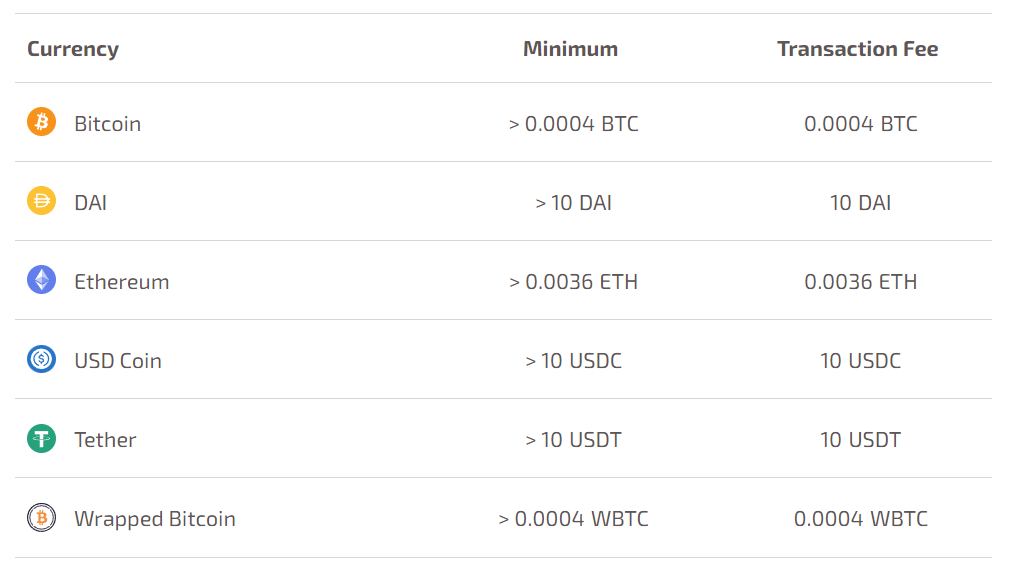

For example, Hodlnaut offers free deposits and one free withdrawal a month for their users. Subsequent withdrawals will be charged with fees as listed below.

Lending your crypto on centralized platforms is also cheaper as compared to using DeFi protocols.

On a centralised platform, you will occur little to no fees for depositing your crypto. For decentralised platforms, you will incur fees when transferring from a CEX to a DEX or when depositing it into protocols.

Low volatility

For those that are looking for an alternative to putting your money in a traditional bank, stablecoins are the answer. Stablecoins are cryptocurrencies where the price is designed to be pegged to a cryptocurrency, fiat currency, or to exchange-traded commodities.

For example, 1 USD Coin (a type of stablecoin) today is worth 1 USD and should be worth 1 USD in 10 years’ time as long as the peg holds.

Hence, the only “volatility” on earning yield on stablecoins is if the platforms change their interest rates. However, most big platforms normally strive to maintain a constant rate for as long as they can.

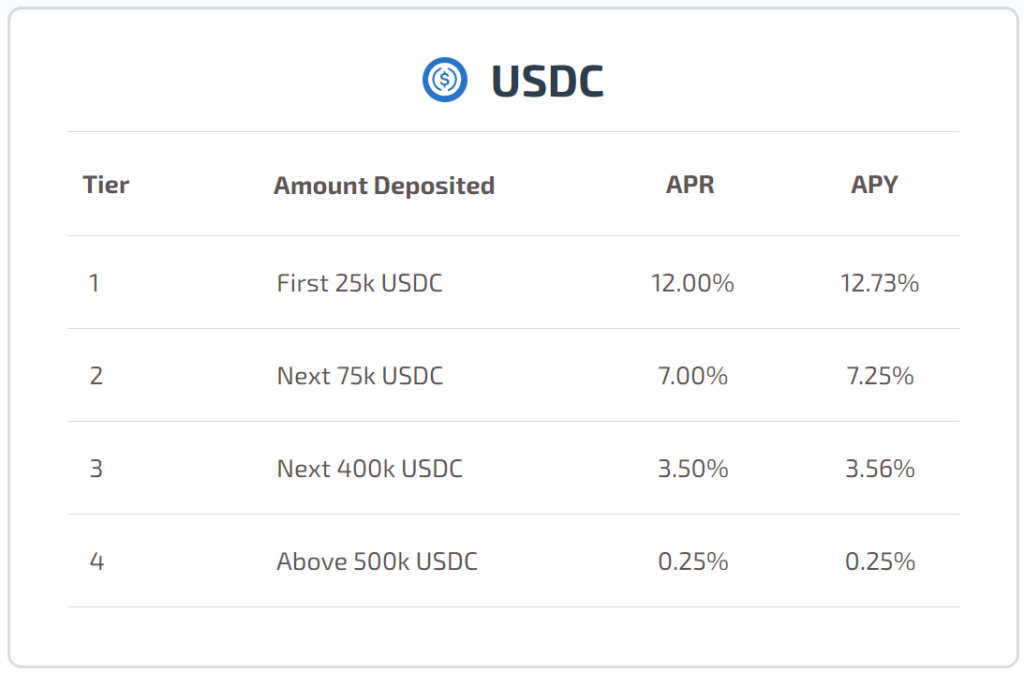

For example, Hodlnaut is paying up to 12.73% APY for stablecoins held on their platform. It is nothing to shout about in the world of cryptocurrency but a huge leap from what traditional financial institutes offer.

Of course, this should not substitute your current savings account with DBS as the degree of risks is far greater.

Ability to earn yield on your favorite coin while waiting for it to moon

As mentioned at the start, the only way to profit in crypto as a lay person in the past was to wait for the price of your favorite coin to appreciate and then selling it aka ‘buy low, sell high’.

Sure, you could stake your crypto, but that involves some level of technical knowledge and isn’t as straightforward. But now, with such platforms, you can earn a yield on it conveniently while waiting for the price to increase!

If you are a more advanced investor who is into technical analysis, you can also alternate between stablecoins and normal crypto based on the current market cycle to maximize your earnings. In short, to earn on stables during a bear or sideway market and on normal crypto during a bull market.

Cons of Lending:

Potential risk of hacking

Firstly, we have all heard of the saying “not your keys, not your coins”. This is very true when earning yield on such platforms.

Although these platforms generally have great security, their AUM is high enough to entice hackers to make a quick buck. There have been past cases of hacking attempts although no funds were lost. So do keep this in mind.

Insurance

Next, you need to be aware that even though some companies offer insurance on your deposits, the insurance does not cover your coins when it is being loaned out, which is most of the time as that is their main business model.

However, you can take heart in the fact that most of these platforms require borrowers to over collateralized their loan. This means that they have to put up more than what they are borrowing.

This mitigates the risk of you losing all your coins even in a severe black swan event. In addition, since this is not a traditional bank, your deposits are neither SDIC nor FDIC insured.

Regulation issues

Regulation on the crypto space has been intensifying of late. The latest victim as we know is Binance.com which is one of the main CEXs that Singaporeans use.

While crypto lending platforms haven’t been targeted around this region yet, there might be a possibility that the earn feature becomes a target for regulation in the future.

Some states in the US have crackdown on such crypto lending platforms. As a result, their residents are no longer able to earn these juicy interest rates. To this I say, earn while we can!

APY is not as high as DeFi protocols

Of course, while the APY that you can earn on the platforms mentioned above are great, it will not be as high as those that you can earn on DeFi platforms (eg. Anchor protocol which yields around 19.5% APY) or on other protocols which allow you to leverage to boost earnings.

However, this comes with its own tradeoffs as well as decentralized platforms do not have customer support for you to turn to when things go wrong. It is also not as convenient as earning on centralized platforms as you have to on-ramp your fiat and do more research in general.

Conclusion

In conclusion, lending your crypto to earn extra yield is an avenue worth exploring. This is especially so if you are doing it with the big names as it is in their interest to protect your deposits as best as they can since this is becoming quite a competitive space and they would want to keep their market share.

However, as with all things, please do further research before plunging in head first.

If you’re interested to start earning interest via a lending platform and are looking to sign up for a Hodlnaut account, you may consider using our referral link or referral code “hpgtm3bXH”, which entitles you to earn 30 USDC when you deposit and hold 1000 USD worth of any cryptocurrency for at least 31 days.