What is Anchor protocol?

Anchor Protocol can be said to be the bedrock of the Terra ecosystem. Launched in March 2021, it made waves in the crypto scene as it offered a staggering 19.5% interest yield for stablecoin deposits.

To put it simply, it is both a savings protocol that offers low-volatile yields on UST and a borrowing and lending platform.

There are four main pillars that make up the Anchor Protocol money market.

1. The Lender

The lender buys some UST and then sends his UST to his Terra station wallet. He deposits his UST and pays a one off terra fee that increases with the amount you deposit, currently capped at $1.42UST. Once the money is in, the lender will now earn interest on his UST deposits which is paid out proportionally every eight seconds per block transaction.

2. The Borrower

The borrower, bullish on Ethereum, will bond 3 Ethereum on Anchor Protocol and receive 3 bonded ETH (bETH). By putting up that bETH on Anchor, he can take a loan of up to 60% of the value of bETH in UST. Borrowers will be incentivized to borrow as they will be rewarded with Anchor tokens when they borrow UST from Anchor. The borrower however is uptaking a risk, if the value of his bETH exceeds 60% LTV ratio, his collateral will be liquidated.

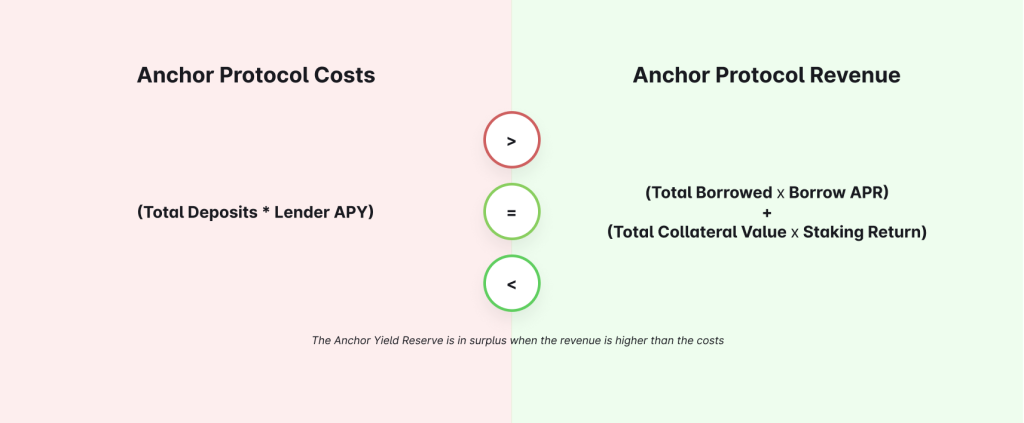

3. Anchor Protocol

Anchor protocol’s main role is to maintain borrower revenue at the rate that will cover the cost of paying the lenders interest on their deposits. This is achieved through smart contracts which imposes a variable interest rate on borrower’s loans and uses the bETH to earn staking rewards. The Anchor Protocol smart contracts are constantly working overtime to ensure that the Anchor Rate payout is sustainable.

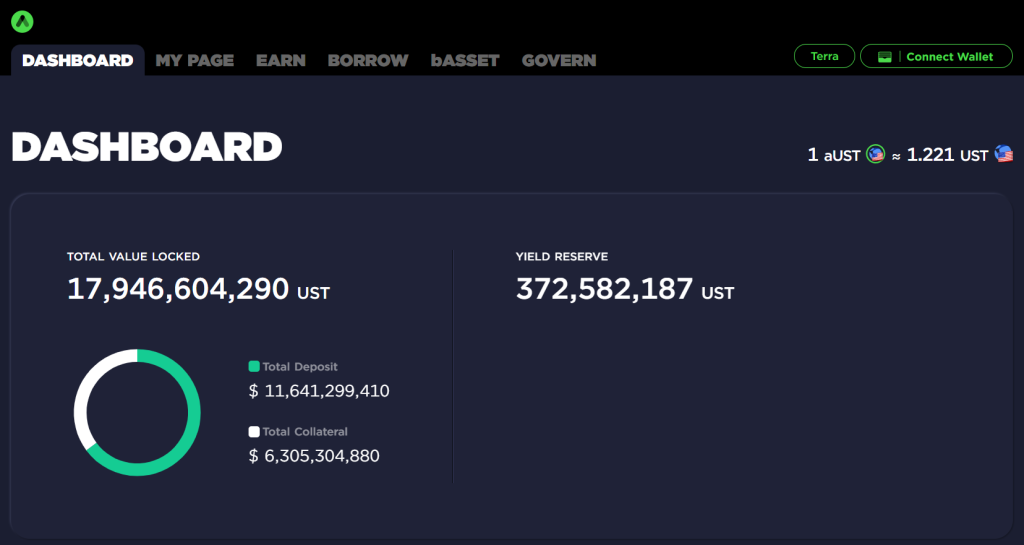

When the amount of interest collected from borrowers exceeds the cost to support lenders, this excess amount will be added to the Anchor Yield Reserve.

Whereas when the cost of paying lenders interest exceeds the amount of interest collected from borrowers, the yield reserve is tapped to pay the lenders interest.

4. Anchor Yield Reserve

As the name suggests the Anchor Yield Reserve functions as a reserve to cover the Anchor Protocol when the cost of paying lenders interest exceeds the amount of interest collected from borrowers.

How does Anchor get its yield?

Anchor gets its yield from 2 different sources. The deposited collateral and the interest from borrowing. The deposited collateral are staked to generate staking yield and the borrowers are charged interest on their borrowings.

These yields are then used to pay the UST depositors. Unfortunately, this fixed rate interest rate creates a negative spread as the cash outflow is much more than the cash inflow.

To combat this issue, a change was made and it moved from the fixed rate model to a dynamic rate model.

5/ Four examples of rate adjustments:

— Anchor Protocol (@anchor_protocol) March 24, 2022

1. Yield reserve ⬆️ by 1.5% ➡️ Earn rate ⬆️ by 1.5%

2. Yield reserve ⬆️ by 3% ➡️ Earn rate ⬆️ by 1.5%

3. Yield reserve ⬇️ by 1.5% ➡️ Earn rate ⬇️ by 1.5%

4. Yield reserve ⬇️ by 7% ➡️ Earn rate ⬇️ by 1.5%

Anchor will now have a dynamic yield that deviates by a maximum of 1.5% a month from the stable 19.5%. The dynamic rate model is actually quite simple, and is an equation that is based on the increase and decrease to its Yield Reserve. As a simple illustration, if the yield reserve goes up, the deposit rate will increase by 1.5%, and vice versa. This is a healthy start to improve the sustainability of the protocol.