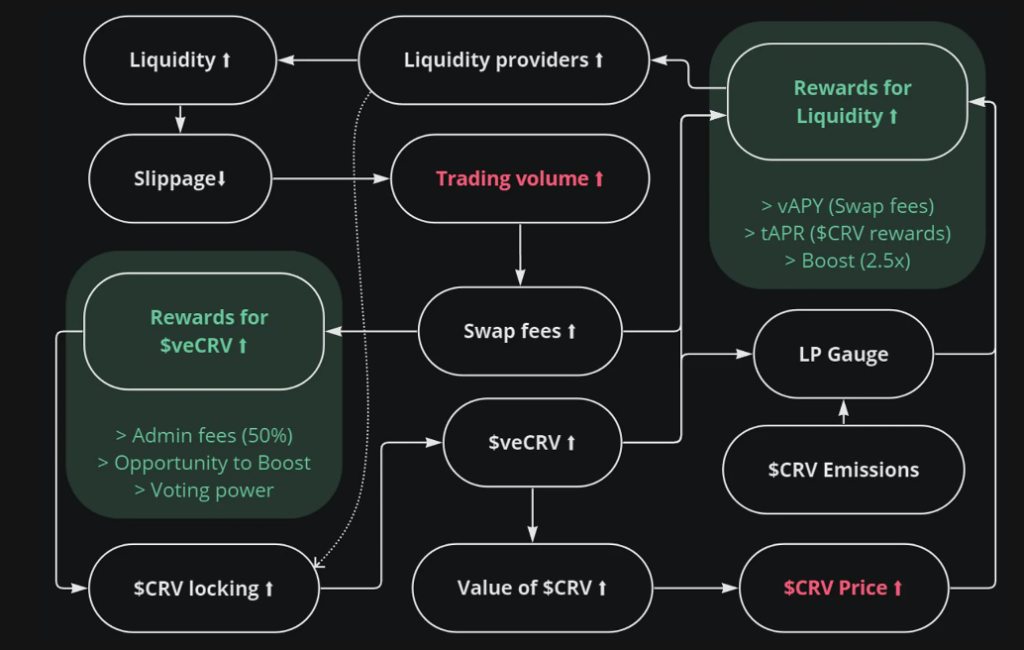

In gist, there are two main sources for rewards coming from the veCRV token and the rewards for providing liquidity. Users would lock their CRV token and in doing so, receive veCRV which they would be able use to vote and provide liquidity. If we go down the voting route, the veCRV token is channelled into the LP gauge, which determines the number of rewards given by the network based on the CRV emissions. As the veCRV is a voting token, the highest vote a pool gets will accordingly receive the highest “payout”.

The second route is through the rewards for providing liquidity. veCRV tokens can be used for LPs which improves the entire liquidity of the entire curve ecosystem, resulting in lower slippage and higher trading volume.

Both these routes will increase the demand for the CRV token, likely to increase the price of the asset.