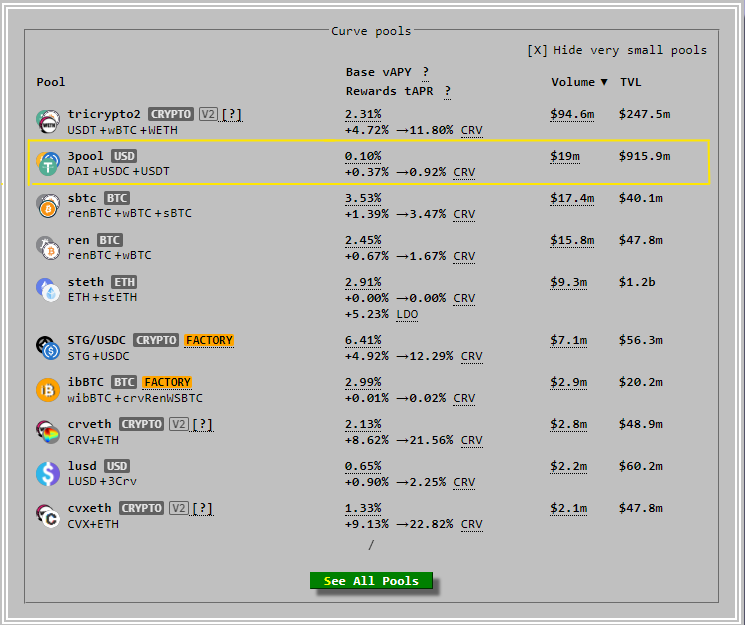

3pool on Curve

Curve’s 3pool is commonly knowns as the Tri-Pool. This pool holds a massive amount of liquidity of the three top stablecoins in DeFi, USDT, USDC and DAI. The combination of deep liquidity and Curve’s optimizations would result in the most capital-efficient way for swapping the mentioned stablecoins.

The 3Pool brings liquidity to new projects through Curve Metapools. By pairing less established tokens with the battle-tested 3Pool, Curve increases their swapping efficiency and aims to reduce system-wide effects if those assets lose their peg.

The 3Pool accounts for the second largest TVL on Curve. It is also associated with a sizeable portion of Curve’s trade volume, which means there are not only a lot of people adding stablecoins to the pool but at the same time, there are people taking them out as well.

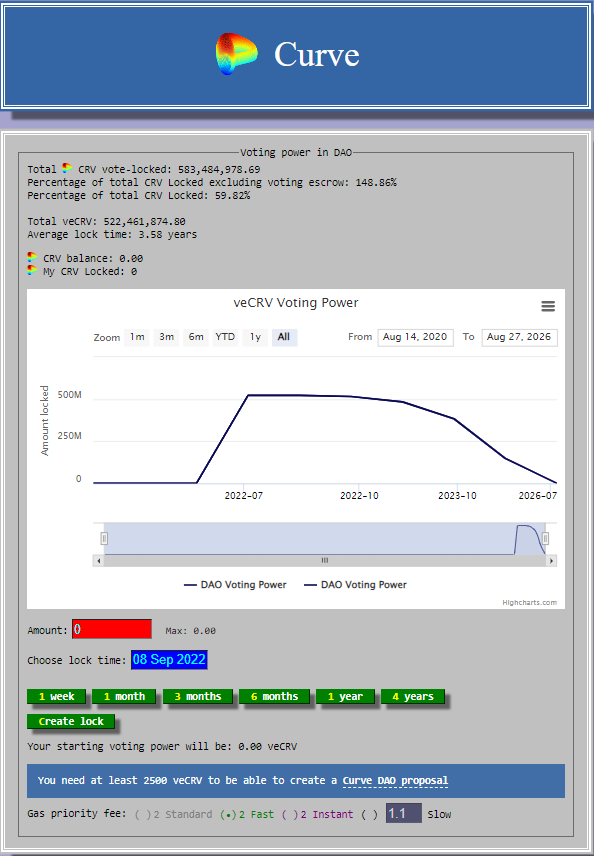

veCRV Token Model

One way the $CRV token can be used is for governance. Users are required to lock up their $CRV token for a certain period of time which gives them “vote-escrowed CRV” commonly known as veCRV. This would give users voting power on various DAO proposals or pool parameter changes.

By locking up their CRV tokens, users would essentially “stake” them for a certain period of time ranging from 1 week at its minimum to 4 years at its maximum. They will receive their veCRV token only after their CRV token is staked.