Crypto.

Yes, the buzzword of 2021 as the crazy surge in the price of Bitcoin and other cryptos saw explosive interest both from the institutional side and retail side and even Grab drivers are talking about them. Why is everyone talking about it?

I briefly mentioned before that 2021 will be the year of crypto, and that is because we saw unprecedented amount of money printing by the Federal Reserve, which drove asset prices up and we saw crazy, sky high inflation of 4.2%.

We went through serveral rounds of FUD, Elon Musk toying with the market and the Bitcoin narrative attacked over and over by big names and also other big names switching their views and joining the crypto train.

With Bitcoin and Ethereum ETFs underway, I expect a wall of money to flow into crypto in months and years to come. Even as I am writing this, crypto is still an extremely young asset class with a short history of only 13 years since Bitcoin was born at the depths of the 2008 financial crisis.

Cryptocurrency ownership and participation are clearly most popular with the younger generations. However, across demographics, a study by Gemini concluded that education is critical in converting those who are curious about crypto into investors.

The more people learn the benefits of crypto and decentralization, the more likely they are to realize the expansive benefits.

Have you been thinking about getting involved in crypto? Decentralisation gives power back to internet users, and there are several ways you can get involved. As a newbie investor into the world of crypto, just how can you get started?

Allow me to guide you into the rabbit hole.

Step 1: Get Started With an Exchange and Crypto Wallet

There are a huge number of global crypto exchanges and wallets that investors can use to purchase crypto like Bitcoin, Ethereum and thousands of other altcoins. You will want to transfer your new crypto assets to your personal wallet so you can hold custody of your private keys.

When purchasing funds from exchanges such as Binance or Gemini, they will automatically be held in an exchange wallet. While decentralized exchanges such as Uniswap, Sushiswap or Pancakeswap are rising in popularity, they don’t have aspects that traditional investors are used to, like customer service and password recovery, so be sure you choose an exchange carefully!

The very first step to being involved in crypto is to use your fiat (cash) currency to buy crypto, and you can even earn yields of up to 10% on your crypto (which I will explain later) and be a long term investor through buy and hold if you put them into centralised custodian solutions such as Nexo and Celsius.

Step 2: Understanding Decentralised Finance

In 2017, we saw the crypto bull run where Bitcoin hit a high of $20K USD and a bust back into the bear market. New market participants at that point in time did not understand the asset and majority of them panic sold, since Bitcoin had a massive drawdown of 80%.

The crypto ecosystem at that point is completely different from the one we see today. In 2017, most projects are busy doing ICOs (Initial Coin Offerings) and what we saw was something like the Internet Bubble of 2001.

The crypto environment back then was too new and no foundation was set up and the world was not ready to embrace the new technology. This however, changed. Ever since the bear market of 2018 to 2020, crypto developers have been busy coming up with new infrastructure for the new decentralised economy and laying the foundation for the new internet.

Despite the negative sentiments, they continued building and innovating, and we finally reached a critical stage where DeFi infrastructure are so advanced that it is ready to take on the traditional finance world and eat it like a snack.

2021 is the year of DeFi and NFT (Non-Fungible Tokens), but today’s focus will be purely on DeFi and since these 2 are major topics on their own, I will only be scratching the surface as to what DeFi is all about and why it is important to understand it.

2.1 Decentralised Finance (DeFi) and Traditional Finance (TradFi)

When we look at what the current financial services landscape is, we refer to it as Traditional Finance (TradFi). These includes your traditional banks offering lending and borrowing services, insurance, mortgage, wealth planning, investments like Mutual Funds, Unit Trusts and derivatives.

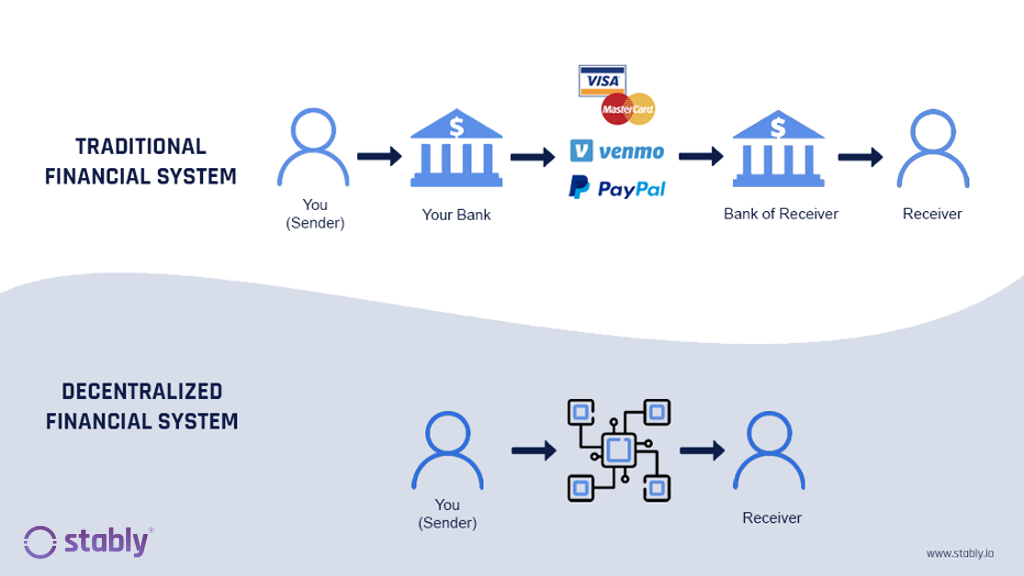

One key feature of TradFi is the involvement of the middle man. You have middle man of various forms throughout the entire TradFi world. Banks as a centralised structure is a middle man between a borrower and lender for example, and as such, in return for being the middle man to ensure trust, they take a cut of the transaction for helping you execute certain financial decisions.

Examples of middle man includes:

- Relationship Managers

- Bankers

- Accountants

- Insurance Agents

- Real Estate Agents

- Stock Brokers

..and many more.

2.2 Middle Man takes a cut along the way

In the traditional finance system we live in, intermediaries get a cut of everything. Which is also why middle man roles were extremely lucrative and high in demand as the salary and compensation were unreal given how lucrative the business is.

Fees, Fees and more Fees.

For example, let’s say you purchase a Unit Trust/Mutual Fund from a local bank. The middle man involved are extremely complicated, and they all get a cut when you put your money to invest with them. They include fund manager’s performance fees, fund management fees, advisor fees, bank brokering fees, forex fees, custodian fees and more.

This means that you are paying exorbitant fees the moment you start investing. Before you earn a profit, you are already paying extra fees regardless if your fund is performing or not performing.

Extremely Low Interest Rates

Another example is bank saving accounts which is an essential part of our lives. Currently, banks are giving 0.05% APY (Annual Percentage Yield) on average, due to the low interest rate environment, the money printing and other factors.

With 0.05%, we are barely earning any yield on our cash, which is being eaten away by inflation which is historically 2%-2.2%.

How does bank provide interest for our savings account in the first place? The banks do this through a process called rehypothecation.

How yields are generated by banks

In simple terms, it is a complicated process of lending and borrowing different assets to achieve yield.

When we deposit our savings into the bank, the bank will essentially pledge them as collateral to perform more complicated transactions and in return for depositing your money, they provide interest payments to keep your money in the savings account.

The issue with this is, banks today are taking a huge cut of the profits and only providing an almost non-existent interest rate of 0.05%. When every bank does this, they normalise the savings interest rate while the mainstream crowd are oblivious and normalises it. (which is in fact, a very sad reality)

TradFi has a emphasis on KYC and AML regulation

In Traditional Finance, we are required to fill up KYC forms and AML (Anti-Money Laundering) declarations every time we set up a savings account, investing account or insurance policies.

Traditional Finance emphasises the trust between the middle man and market participants, and how much the bank trust you will depend on how healthy your cash flow is and whether your income is high enough which will be beneficial for the bank as they can offer you more products.

For example, if your income level is in the high 5 digits, you will most probably be approved with a better mortgage rates or borrowing rates compared to someone with a lower income level.

If you income level is not even the minimum of what the bank specified, then don’t even bother about getting an attractive loan from the bank.

The amount of benefits you receive from bank is almost equivalent to how solvent and how capable you are financially to use the bank’s privileged services such as private banking, institutional investing and more.

2.3 Enter DeFi

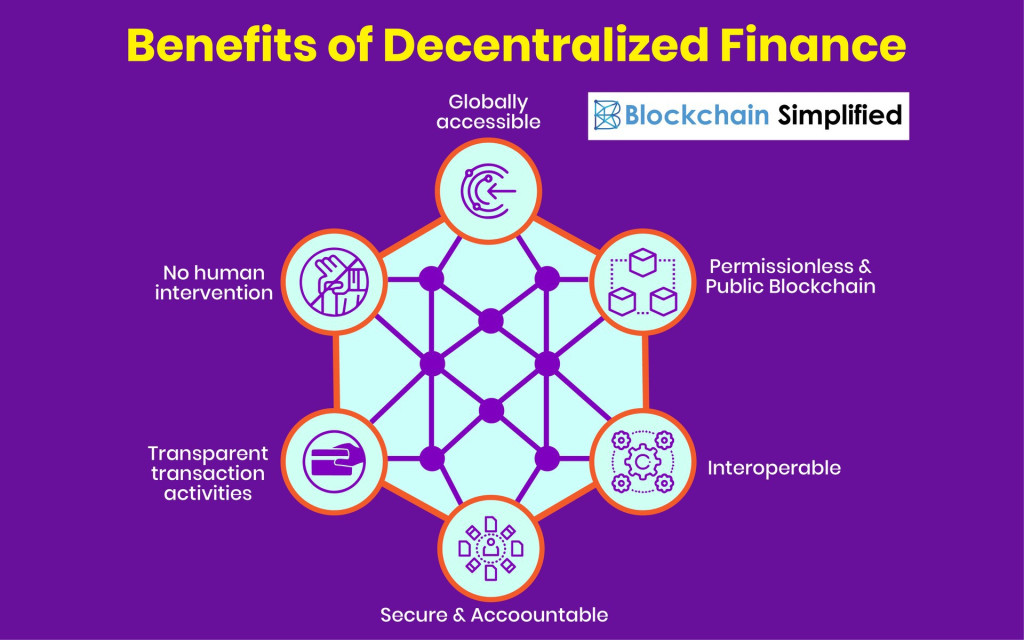

When it comes to Decentralised Finance, the concept of a middle man no longer exists. Users of DeFi operate in a trust-less, and permission-less manner. There is no need for KYC (Know-Your-Client) or declaring of your income because there are no middle man involved to verify your solvency.

How is DeFi able to remove the middle man? It is all thanks to the invention of smart contracts.

Smart Contracts (Pioneered by Ethereum)

To keep it simple, smart contracts are basically self-executing contracts written by code, which include all the terms between the buyers and sellers and needs to be approved before being executed.

Smart contract transactions are 100% transparent on the public ledger, and cannot be changed. Smart contract typically exist in a distributed and decentralised blockchain network such as Ethereum, Binance Smart Chain or Fantom for example.

In fact, smart contracts are already being used in the real world which you can read up more here. I won’t go into the details but essentially the creation of smart contract by Vitalik Buterin, founder of Ethereum, changed the entire crypto ecosystem and its dynamics in the financial system.

With smart contracts, we now have a friction-less, autonomous and self-executing contract which does not require take a cut of a transaction like traditional middle men do.

Will smart contracts eventually replace all middle men roles? The short answer is yes, but only time will tell.

2.4 Use Cases of DeFi

When it comes to DeFI, you can do the same things you do in TradFi, but more efficient and more affordable and more accessible.

You can visit Defi lending platforms such as Maker and Aave which essentially act as crypto banks where you can borrow and deposit money as collateral and take a loan without declaring your income since everything is executed by smart contracts. 8% to 20% APY are typical and normal in the DeFi space. In the traditional world, even getting 7% from a balanced fund is difficult.

The entire system is executed by smart contracts and these 2 protocols are battle tested and audited platforms for users on Ethereum as well.

Aside from lending and borrowing, you can also participate in staking, liquidity mining by being a liquidity provider, do yield farming to gain massive yield on your crypto or even sell digital art as NFT if you are a content creator.

There are infinite possibilities when it comes to DeFi and the sky is the limit. The benefits of DeFi is that the mind-boggling yields of 10% to even 1000% APY are all real yields. The reason why the yields are so high is because there are again no middle man that take the cut, so DeFi allow users to become their own bank and take all of the profits for themselves.

Aside from generating life-changing yields on your assets, you can even do derivates trading in DeFi such as Perpetual Protocol, or even participate in a lottery on Pancake Swap, even better, you can earn yield on synthetic assets such as your Tesla stocks or real estate through Mirror Protocol.

The possibilities are really endless in DeFi and the bulk of alpha, and returns are all waiting to be discovered.

As the mainstream media slowly understands the opportunity, many billionaires and multi-millionaires are already jumping into the fray such as Kevin O Leary, a shark tank investor and CNBC favourite, who recently said that “being able to earn yield of 4%-8% on his Bitcoin is game changing. “

Aside from Kevin O Leary, billionaires like Ray Dalio, Mark Cuban, Howard Marks, Carl Icahn and Elon Musk are all jumping into the Defi space and slowly understanding the immense potential of the space

Step 3: Get involved and see for yourself

Now that I have scraped the tip of the iceberg about what DeFi is, the opportunity is to take the plunge and give Defi a try yourself. Again this is not financial advise and you need to make your own due diligence.

Personally, how I am taking advantage of Defi is by doing yield farming on blockchains such as Binance Smart Chain, Polygon and Fantom. Why not Ethereum? You may ask.

The reason is because Ethereum’s gas fees (transaction fees) are extremely high and its simply not cost effective to transact on Ethereum unless you have 6-8 digit money to minimise transaction cost.

Binance Smart Chain, Polygon and Fantom for example are more affordable and at the same time way more efficient than Ethereum for now, which will be the default for most retail investors for now until Ethereum upgrades to Ethereum 2.0

The easiest way to get started is through Binance Smart Chain in my opinion, which is essentially an Ethereum copy cat but with cheaper gas fees of ~50 cents per transaction. Gas fees are paid in BNB (Binance Coin token) which is the utility token used on the Binance Smart Chain.

Fees will be paid in MATIC on Polygon and FTM (Fantom Token) on Fantom.

If all these blockchain sounds foreign to you, do read up on them yourself as they are all major topics on their own which requires a separate article to address. Essentially, they are alternative blockchains to Ethereum which have their own DeFi ecosystem which you can participate in.

I won’t go into the details on how you can do yield farming because these information can simply be found online, and it is also important that you understand how these things work before you get involved, as the biggest risk in all these is not understanding what you are doing and heading into risk you are not aware of.

3.1 CeFi (Centralised Finance Solutions)

If all these are too complex for you, there are easier and more straightforward ways for you to earn higher yield on your Stablecoins, Bitcoin and more. These will be Centralised solutions such as Nexo and Celsius which are regulated companies that manages your crypto for you.

While Nexo and Celsius does not offer you the crazy, mind-boggling returns in Defi, they still offer a decent 4%-6% on your Bitcoin and Ethereum for example and 10%-12% on your Stablecoins such as USDT, USDC or BUSD. If you are curious to learn how they work, you can check out this post here.

What’s Next for Crypto and DeFi

We have already witnessed a dizzying array of new crypto offerings in the last few years. DeFi is exploring new ways we can transact with each other. Also, many think there is a bright future ahead as DeFi and CeFi fuse solutions in economics together.

It remains to be seen what the intersection of centralized digital currency and DeFi will look like. But DeFi will most likely replace a huge chunk of traditional finance with easier and borderless mobile payment methods. Governments and banks will have no choice but to innovate or risk being replaced.

Will crypto be gone in a few years? No.

Crypto and Defi is here to stay. The only way governments can stop this is if they shut down the Internet. As long as the internet exists, crypto will continue to gain traction and provide an equal playing yield for everyone, not just the rich and powerful.

While I understand that novel and new technological concepts such as blockchain, DeFi and smart contracts may be difficult to understand at first, but once you pick it up, you will future proof yourself and your future wealth which cannot be taken away from you.

I hope that the article gave you a slight taste of the immense opportunity with crypto but again these do not come without risks.

Some General DeFi Risks Exists

By interacting with a smart contract, you are trusting the integrity and reliability of a smart contract, and at times there may be malicious code or codes with loopholes that might be exploited by hackers.

This is why it is important to take note of who the developers are, whether a protocol is battle tested and whether there are audits done by crypto auditors such as TechRate, Certik or Hacken. News projects are typically more risky as there are potential for rug pulls (scams) so be sure to do your due diligence before deploying your money to these smart contracts.

Rug Pull projects usually attract investors to put their funds by putting high APYs of up to 1 million APY which attract greedy/get rich quick individuals to the project. In this case users might lose all their money if they just “ape” into the project without researching first.

Aside from smart contract risk, there are also DeFi risk of your seed phrase and wallet private address, which can be scammed away if you are not careful.

By engaging with DeFi means you understand the risk and despite the risk you are willing to take the risk for the potential upside. Just remember to only put capital you are willing to risk and not over invest.

For the less Savvy peeps

If all these sounds like too much hassle to you, the most sensible path if you are bullish on crypto and wants to earn some interest on your assets will be to put into apps such as Nexo, Celsius, BlockFi or more.

Ultimately, everyone’s risk tolerance are different and allocating to crypto might already sound extremely scary to most investors since the asset class is still extremely new. So only invest with what you are comfortable with and understand what you own.

This article originally appeared on Investing Beanstalk and is republished here with permission.