Bastion is currently the number one protocol on Aurora in terms of Total Value Locked (TVL). With over US$339 million in TVL, it is leaps and bounds ahead of other DeFi protocols sitting on Aurora network.

Bastion alone accounts for over 40% of the total TVL on the Aurora chain. So this begs the question, what is Bastion and how did it manage to get so big?

What is Bastion?

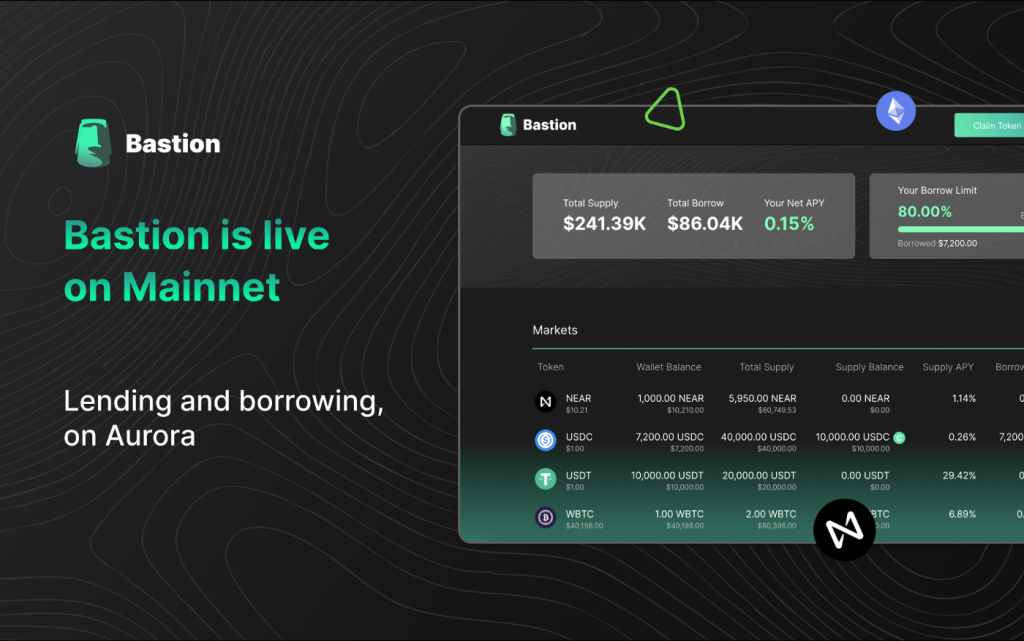

Bastion Protocol is a decentralized money market protocol that aims to be the liquidity hub of NEAR Protocol. It is based on the popular lending protocol Compound.

Also Read: A Look at Compound: DeFi’s Money Market Lending Protocol

Building on top of NEAR Protocol enables Bastion to have low transaction fees, greater capital efficiency, fast transactions and more precise liquidations.

The lending protocol allows users to supply assets to earn interest, put assets up for collateral, borrow assets, leverage long by using the borrowed assets and finally short assets by using the borrowed assets.

Bastion Realms: Isolated pools

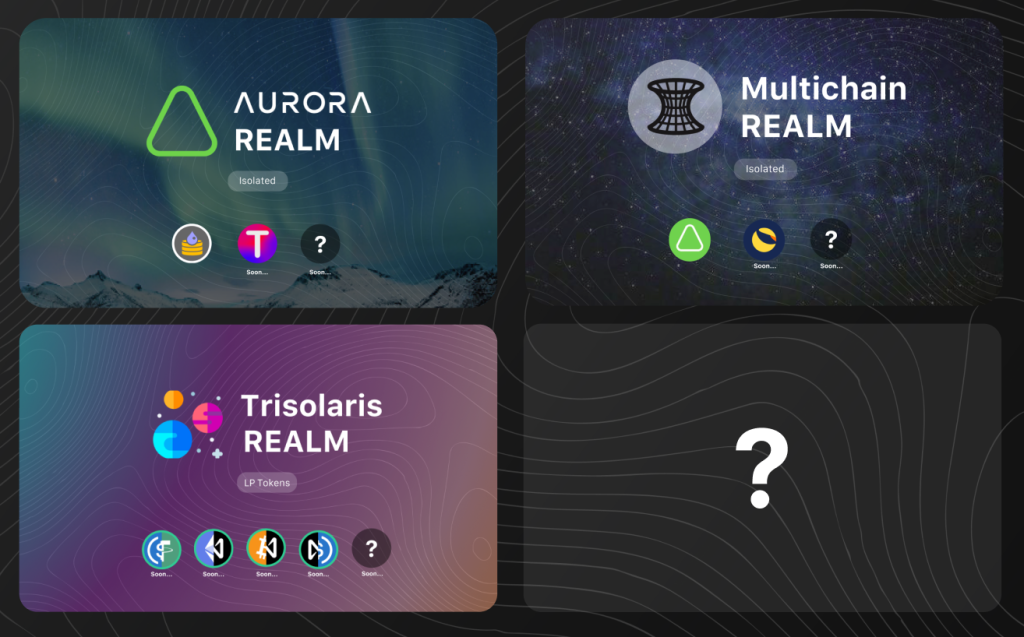

Bastion Realms is a hub and spoke design that connects isolated pools together. This hub and spoke model is very different from the many protocols out there that only have a single cross-collateral pool.

The downside of having just a single cross-collateral pool is that the entire protocol TVL can be drained by a single attack. Bastion counter this issue by introducing isolated pools.

Isolated pools allow Bastion to list more assets without exposing the entire protocol TVL to new risks. But there is a catch. Users are unable to collateralize and borrow assets from a different isolated pool. Bastion remedies this by allowing USDC to be used as a common currency in all the different isolated pools.

Isolated pools also enable greater capacity for customizable parameters. For instance, the reserve factors and liquidation threshold can be changed to allow higher loan-to-value (LTV) ratio enabling greater leverage and higher APYs.

Stableswap: Low slippage

Introducing Bastion Stableswap, the low-slippage AMM for stablecoins, cTokens, wrapped, and staked assets on Aurora. 🔥

— Bastion🗿 (@BastionProtocol) April 4, 2022

Yield-on-yield savings account. Multichain gateway. Algostable magnified peg stabilizer. The Hub of Aurora.

veTokens soon. Are you ready for the Bastion Wars? pic.twitter.com/5ZaNMBJyvj

Other than being just a lending protocol, Bastion Protocol is also introducing its very own Stableswap. Stablecoins are an essential part of the DeFi ecosystem and it is a major turn off to see high slippage for swapping stables.

Bastion StableSwap is a low slippage Automated Market Maker (AMM) for stablecoins. Unlike traditional AMM decentralized exchange (DEX) like Uniswap or SushiSwap, Bastion StableSwap employs a different formula that reduces the price slippage when swapping assets with a close price.

This StableSwap mechanism would result in lower price slippage, higher capital efficiency and greater asset scalability.

Due to the absence of DeFi protocol on Aurora, Bastion could fill the much-needed gap and serve as the gateway to the Aurora network.

Tokenomic – $BSTN

BSTN is the native governance token for Bastion Protocol and it is hard-capped at 5 Billion tokens. BSTN token holders will govern both the lending protocol and the stable swap protocol. Token holders will also be able to vote on proposals and shape the future of the protocol.

The token distribution sees 30% for liquidity mining, 30% for the treasury, 25% for the team and advisors and the last 15% for investors.

The treasury will be used to cover some key functions of the protocol. It will be used as the liquidity reserve, insurance fund, ecosystem grant program and also used to cover DAO operational expenses.

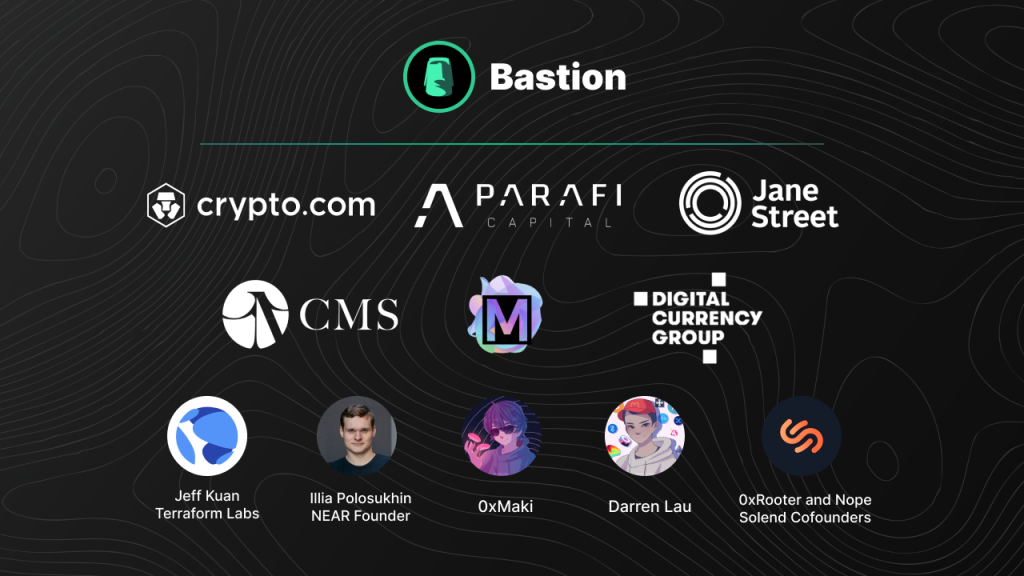

Prominent backers – Tier 1 VC

The seed round was led by Tier 1 crypto VC ParaFi Capital. The funding saw participation by many other big VCs firms from Jane Street, Digital Currency Group, Crypto.com, CMS, and Manifold Trading.

This seed funding also saw support from many notable individuals like NEAR Founder, Jeff Kuan and DeFi star developer, 0xMaki.

TLDR

“We strive to be the most sustainable, high-yield savings account in all of DeFi”

Bastion Protocol

Bastion Protocol is currently the DeFi leader of the Aurora network controlling over 40% of the TVL. It is both a Lending and a stable swap protocol backed by many Tier 1 VCs and investors.

With two important DeFi applications under its belt, it is only a matter of time before other important DeFi applications are built on top of it.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief

Also Read: Tired Of ETH Gas Fees? Here Are The Top Five NFT Projects On NEAR Protocol

Was this article helpful for you? We also post bite-sized content related to crypto — from tips and tricks, to price updates, news and opinions on Instagram, and you can follow us here!