Ethereum has built an empire of greatness, the home to innovative DeFi products, a large canvas for NFTs and where smart contracts are popular. Doing it all in a decentralized manner has its tradeoff, speed and security. While the layer2 scaling solutions are a scaling force to be reckoned with, EligenLayer found an innovative way to revolutionize Ethereum.

What is Eigen?

Eigen enables users to restake their ETH and extend cryptoeconomic security to additional applications on the network. The Eigen smart contract layer will automatically re-stake your ETH by setting withdrawal permissions and enhancing security by validating new applications built on Ethereum.

Staked ETH is currently yielding around 5-6%

— Blockworks Research (@blockworksres) October 18, 2022

But imagine you could use this staked ETH to secure other projects and earn even more yield on your ETH?

A 🧵 on @eigenlayer by @WestieCapital pic.twitter.com/6BKhMSJoxC

Sounds like a perfect win-win for any ecosystem.

To be an Ethereum validator, you are minimally required to commit 32ETH. Still, EigenLayer allows this commitment to secure Ethereum’s proof of stake and other applications services such as Oracles and bridges.

And get this, it does all that AT THE SAME TIME.

But why? As you will not only be securing the Ethereum network, you will do so with other apps, and those apps could get you additional yield on top of ETH’s native APY.

Here is a recap of what the CEO of Eigenlayer Sreeram Kannan spoke about over a discord AMA last year.

1/ We recently spoke with @eigenlayer CEO and Co-Founder @sreeramkannan, during our Discord AMA.

— vVv (@vvvfund) October 8, 2022

Here’s what you missed 🧵 pic.twitter.com/RERIefyZIv

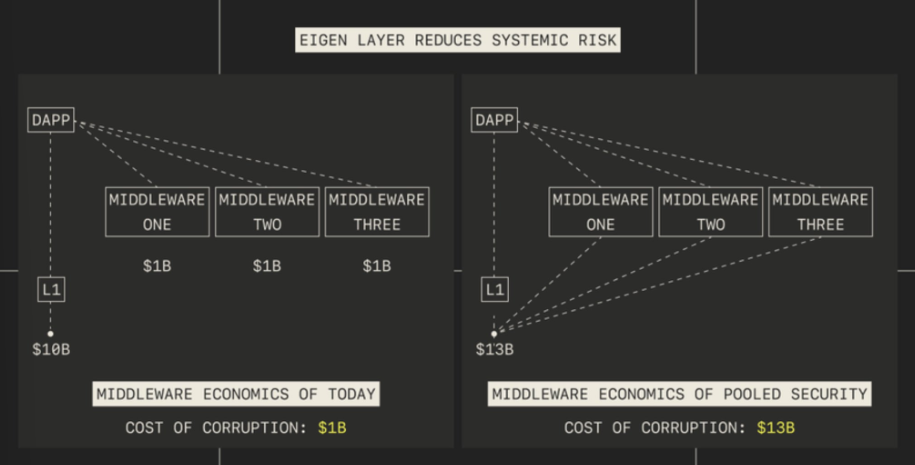

According to NewOrderDAO’s predictions for 2023, “Eigen will be the most important innovation for Ethereum. Through re-staking, which leverages an existing trust network to secure other infrastructure and middleware layers, Eigen significantly reduces security costs and systemic risk.”

The chart above shows that the cost of corruption needed to bring down a particular dApp will be much higher as the middleware security will all be contributed to a pooled security.

If the attacker wants to attack a protocol backed with Eigen support, they have to attack the security provider and the network of ETH validators supporting the protocol.

Their attempt to improve Ethereum as a base layer might be a viable option in a way that we have not seen flashbots modify the Ethereum client to support off-chain transactions ordering auctions for MEVs.

The risks

With your dedicated funds allocated to Eigen, you are also giving control of your staked ETH to Eigen. This gives rise to security concerns over the validator.

Irony eh? It ensures security but derives security concerns over validators.

An application could potentially steal your stake if there is a security flaw. When Eigen communicates with the middleware to secure bridges, oracles etc., there is a chance your ETH gets slashed if there’s any misbehaving.

There could also be a delay in slashing. According to Meir Bank, “it will be possible for Eigenlayer to delay slashing pending a governance process to confirm or overturn a slash before it is finalized.”

This means the role of validators in performing due diligence is paramount for this success. Otherwise, when large numbers of ETH validators run an application, it could seriously impact Ethereum, leading to a considerable percentage of ETH supply loss.

Use cases

Some use cases arise with the full development of Eigenlayer; here is a quick summary before diving into some of them.

I'm far too smooth-brained to have any idea about whether or not @eigenlayer will work. But it's definitely one of the most interesting and potentially groundbreaking concepts to emerge in crypto as of late.

— LlamaCollege (@LlamaCollege) October 29, 2022

Here are some takes by people much smarter than me…

🦙 🏫 ⬇️

Bridges

The best use cases for Eigenlayer are protocols with a low chance of being slashed. For instance, protocols that go live often might not be a good fit as there is always a high chance that a server could crash and eventually lead to stakes being slashed.

On the other hand, Bridges might be a better fit. Bridges such as Hyperlane have a low chance of being slashed because of their flexibility and no liveness requirements for nodes. This gives Eigenlayer a conducive environment for it to thrive.

Other protocols include Succinct, Axelar network along with squid.

Layer2 rollups

While we see the emergence of multiple layer2s storming into the scene, Eigenlayer will run rollup sequencers, enabling sequencers for L2s like Optimism and Arbitrum to be decentralized and secure.

Oracles

This might be another good fit because they are secured by the token’s value, like $LINK. By securing an oracle network with more collateral, oracles can gain 10x in security, reducing the likelihood of a profitable Oracle attack on DeFi.

RPC Nodes

A Remote Procedure Call (RPC node) is a computer server that allows users to read data on the blockchain and send transactions to different networks.

Eigenlayer will enable genuinely decentralized RPC nodes. Existing solutions like the POKT network and either centralized providers like Infura could make a possible move to Eigenlayer. Decentralized RPC is critical to avoid censorship on the client level.

Appchains

The rise of the appchain thesis at the end of 2022 created a lot of discussion among web2 leaders. On the Eigenlayer, various deployment protocols can bootstrap their security for new appchains, with value accrual returning to ETH as the base security as collateral.

Another well-known protocol coming to Cosmos.

— The DeFi Investor🦇🔊 (@TheDeFinvestor) December 2, 2022

In Terra's days of glory, Prism had over $500M TVL.@dYdX and @mars_protocol will also launch their own Cosmos chain soon.

Appchain Thesis is getting more popular🪐 https://t.co/zmHbOsDZcE

Closing thoughts

In the recent interview with Eigenlayer’s CEO on a bankless podcast, Sreeram talked about how Eigen runs on internal governance devnet and the onboarding of first protocols.

This project might have its token, eventually. But will that change anything? I see Eigenlayer as a new way to see Ethereum, not just for security and securing the network, but we must think beyond it.

What if Binance could run BSC but secure it from staked ETH?

What if we could run Chainlink oracles but secure it from staked ETH?

Huge alpha there. Event driven state updates (like collateral refilling, liquidation, atomic arbs with value flow to arb-ed protocols) can be built on @eigenlayer. https://t.co/bSolcnK6hS

— EigenLayer (@eigenlayer) October 20, 2022

What if we could mint a stablecoin on DeFi, but use $ETH staked in our solo validator as collateral?

The possibilities are endless, and while they all come with their respective arguments and trade-offs, it may be a barter I’d take.

Trust and security in crypto are the hardest to obtain yet most accessible to lose; having this installation of Eigen may prove to be one of the better trust layers out there. Eigen is the first in the business, but they probably won’t be the last. As this sector spurs, new ideas and innovation will kickstart new use cases and solo validators, improving decentralization and trust and security.

Also Read: Key Takeaways From Messari’s Top 10 DeFi Trends In 2023

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: ChainDebrief