In the past month, Solana (SOL) has been the topic of widespread discussion, particularly on Twitter, thanks to an unprecedented rally that led to a ~74% surge in its price performance.

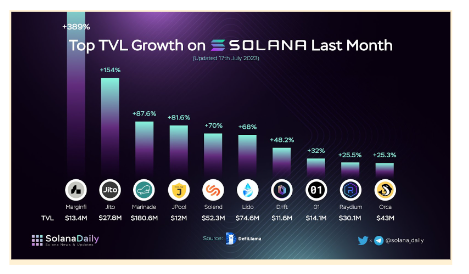

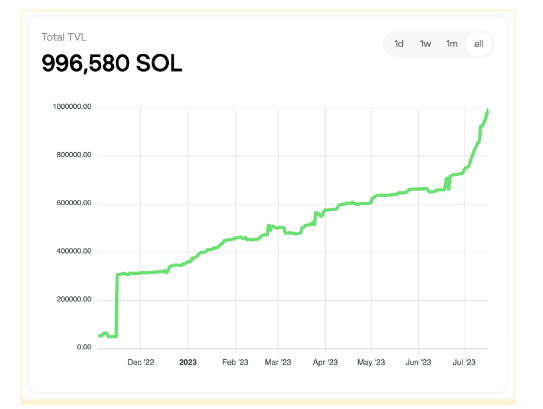

According to DeFiLlama, Solana’s Total-Value-Locked (TVL) also surpassed $500 million in the first half of June, returning to its highest levels post-FTX crash.

This increase could be attributed to anticipation around the expansive ecosystem developments, alongside the resounding opinions of vocal key opinion leaders and native protocol founders on Twitter.

Well-known investors in the space such as Ansem from TCG Crypto and Arthur from Defiance Capital have publicly declared their bullish sentiments on the Solana ecosystem. Arthur0x even showcased his enthusiasm by adopting a Mad Lad as his Twitter profile photo – a notable project in the Solana NFT landscape.

Dear Solana DeFi team,

— Arthur100x (@Arthur_0x) July 15, 2023

Please add support for Wallet Connect if you want Solana DeFi summer to take off. Else institutions will be restricted from using it without the support of an institutional-grade MPC wallet.

Sincerely,

A guy that want Solana DeFi summer to happen

Despite the bear market’s numerous adversities, including multiple native network downtimes (i.e., Feb. 25, 2023), the sunsetting of various protocols such as Friktion, and the decline of FTX – Solana’s biggest backer, many may wonder about Solana’s sudden surge of popularity this summer.

In this article, we’ll delve into a few of the ecosystem’s developments and also explore upcoming advancements.

Brief introduction

Solana is an open-source, layer-1 blockchain developed in 2017. It’s designed to support decentralized applications and cryptocurrency projects, emphasizing speed and scalability.

The network implements a combination of Proof-of-History (PoH) and Proof-of-Stake (PoS) consensus mechanisms, theoretically allowing for more than hundreds of thousands of transactions per second. Its native cryptocurrency, SOL, is utilized for gas fees, running custom applications, and incentivizing network participation like staking.

Also Read: An Introduction To Solana – Why It Is The Hottest Blockchain Right Now

Development of existing Decentralized Finance protocols

Within the Solana ecosystem, existing Decentralized Finance protocols have been continually pushing out new updates despite the turbulent times.

One example of this is from MarginFi, a Decentralized Finance lending platform on Solana. The team recently launched a unique loyalty points-based rewards system to incentivize user activity.

Here’s how it works: borrowers receive 4 loyalty points per dollar deposited, while lenders receive 1 loyalty point per dollar. The longer a user engages with the protocol, the more points they accrue.

The results of the program have been striking. In just 2 weeks since its inception, the program has nearly quadrupled MarginFi’s Total-Value-Locked, pushing it past the $10 million mark as seen in the graphic below. These effects have also trickled down to an increase in the deposit of liquid staking tokens on the blockchain, as users seek to earn attractive yields alongside the point system.

While the sudden growth can be attributed to a potential rumored token airdrop for MarginFi through these points, it highlights the active community that remains in the scene today and can be activated easily again through good incentive-alignment mechanisms.

Zeta Markets, the network’s leading perpetual exchange platform, also recently collaborated with MadLadsNFT to launch Mad Wars.

Mad Wars is a team-based trading competition for both holders and non-holders of Mad Lads NFTs, with many prizes up for grabs. So far, the volume generated has managed to outperform expectations, propelling Zeta to the top spot for perpetual exchanges on the network.

Holy crap we just cracked $7M daily volume on @ZetaMarkets !

— Tristan (@Tristan0x) July 14, 2023

That makes Zeta the #1 volume perp exchange on @solana 🥇

The Mad Wars are off to a flying start ⚔️ pic.twitter.com/15xbW69yEw

Growth of LSDs: JitoSOL, Solana’s first Maximum Extractable Value (MEV) powered liquid staking derivative, has already achieved a significant milestone with a Total-Value-Locked (TVL) of over $20 million.

With the continuous addition of new partnerships such as Kamino Finance’s recent JitoSOL-bSOL vault, the 1 million mark in SOL tokens does not seem too far from reality.

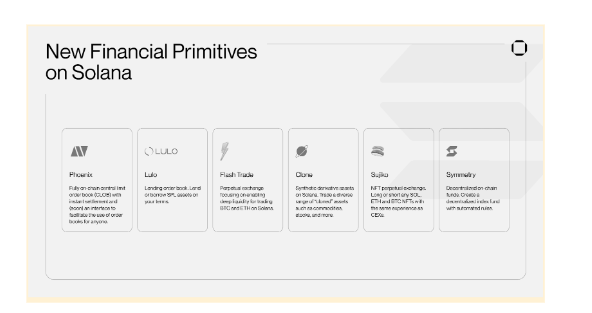

New Decentralized Finance primitives

New and promising entrants are also soon making their mark in the Solana ecosystem. Here’s a brief look into some of these protocols:

- Phoenix is a DEX that utilizes a limit order book design that combines the transparency of Decentralized Finance with the efficiency of a CEX. It pioneers an Instant Settlement feature that deviates from traditional designs, facilitating immediate trade settlements and establishing itself as a robust liquidity hub.

- Lulo, one of the winners under the Decentralized Finance Track section in the 2022 Solana Summer Camp Hackathon, is a decentralized order book lending protocol. It will allow anyone to create a lending or borrowing order at their desired specific rates.

- Flash Trade is a perpetual exchange that introduces an innovative pool-to-peer trading model that ensures constant liquidity and safeguards liquidity providers from harmful arbitrage transactions.

- Clone introduces synthetic derivative assets through ‘clones’ known as onAssets. With its Comet Liquidity System, Clone can help develop highly liquid markets with minimal capital requirements, presenting users with diverse trading opportunities.

- Symmetry focuses on decentralized crypto indices and infrastructure for actively managed funds. Its Symmetry Engine allows both users and projects to create, manage, buy, and sell funds while facilitating liquidity provision.

- Sujiko Protocol offers a DEX that allows perpetual trading for NFT collections with up to 10x leverage, enabling speculation on high-value NFTs. The protocol also maintains competitive affordable fees ranging from ~0.25 to ~1.5%.

Please note that these are not the only protocols in the ecosystem scene, as highlighted in this tweet below.

is it just me or is solana defi sneakily coming back?

— rpc mert 🏎| helius.dev (@0xMert_) July 3, 2023

phoenix, margin, drift, zeta, cypher, meteora, jupiter, mango, jet, betdex, kamino, tulip, debridge, lp, hxro, psyfi, giga, orca, mnde, solend, raydium, openbook, uxd, hawksight, credix, goosefx, lifinity

to name a few🤯

Conclusion

With advancements coming hot in both the native Decentralized Finance and the NFT landscape, Solana is proving its capacity as a strong contender in the cryptocurrency market.

Despite past challenges such as the meltdown of FTX and broader macroeconomic movements, Solana’s growing rally and resilience provide a compelling testament to its potential. With the rich network of strategic partnerships, a vibrant community, and promising developments ahead, one can expect a new era of opportunities, or what might otherwise be referred to as a “Solana Summer.”

Also Read: Solana Has A Layer 2! How Nitro Opens The Gateways To Cosmos

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chaindebrief

Author: Jowella