The Transformative Potential of RWAs

The Real World Assets (RWAs) narrative is heating up, and this could be the pivotal moment for the mass adoption of crypto and blockchain. It is common knowledge that TradFi is plagued by antiquated and fragmented technology, resulting in an inefficient fiat banking and securities system. The inevitable tokenization of real-world financial assets seeks to remedy this long-standing problem as TradFi, and physical assets are represented as digital tokens on-chain.

Asset tokenization represents the conferred rights of ownership to physical and financial assets as digital tokens on-chain. The tokenization of real-world assets enables them to be traded with greater ease, faster settlement and reduced costs with self-executing smart contracts, increased transparency and improved liquidity for traditionally illiquid or semi-liquid financial instruments.

Crypto Narratives Alpha Series 💎 04

— Viktor DeFi 🛡🦇🔊 (@ViktorDefi) February 13, 2023

The Real-World Asset (RWAs) narrative in DeFi is grossly underrated.

The question is, are you paying attention?

Here's a deep-dive into RWAs, and some emerging players to add to your watchlist: ↓🧵

Notable Protocols that have made significant strides in Adopting RWA

Notable Protocols That Have Made Significant Strides In Adopting RWA

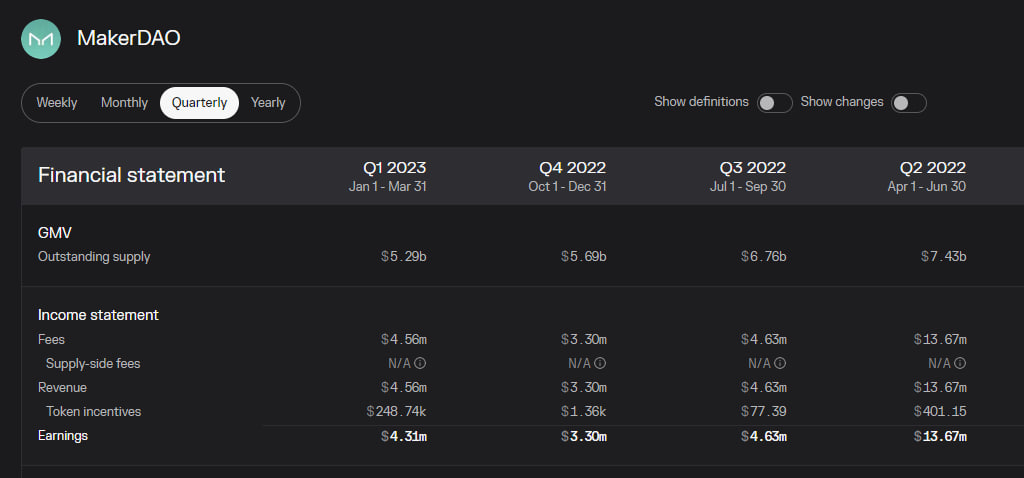

1. MakerDAO

MakerDAO is a blue-chip DeFi project that hardly requires any further introduction. In the past year, MakerDAO has actively worked on diversifying its reserves and establishing other revenue streams. RWAs account for 75% of their revenues and have accumulated over US$600M in RWA collateral.

Key milestones for them include their US$10M partnership with Huntingdon Valley Bank where RWAs are bridged and serve as collateral when lending out DAI, and the recent partnership in December 2022 with Block Tower to fund US$220M of real-world assets via Centrifuge.

2. Ondo Finance

Ondo Finance announced tokenized funds that allow users to be shielded from crypto’s volatility and earn sustainable returns. These tokenized funds enable stablecoin holders to invest directly in TradFi instruments through three separate RWA funds, subject to fees of 0.15%.

The Ondo Short-Term US Government Bond Fund (OUSG) invests in short-term US treasuries through the Blackrock US Treasuries ETF (SHV), the Ondo Short-Term Investment Grade Bond Fund (OSTB) invests in investment-grade corporate bonds through the PIMCO Enhanced Short Maturity Active ETF (MINT). In contrast, the Ondo High Yield Corporate Bond Funds (OHYG) invests in high-yield corporate bonds via the Blackrock iBoxx $ High Yield Corporate Bond ETF (HYG).

Ondo Finance Strategy (@Airdrop_Adv)

— Shiro (@CryptoShiro_) March 1, 2023

Ondo Finance’s goal is to make institutional-grade financial products and services available to everyone, on-chain.

They raised $30M

Token confirmed, airdrop teased.

Requirements: Supply USDC or DAI, Borrow when available https://t.co/AQwM8Pp5TO

3. Maple Finance

Following defaults and a radical overhaul, Maple Finance has distanced itself from uncollateralized lending and leaned towards RWAs to make a comeback.

They removed traditional DeFi over-collateralization thresholds for borrowers as long as they have RWAs to back their debt. Maple has partnered with London-based AQRU to devise new pools that invest in US Treasury bonds and insurance refinancing with yield-generating strategies adopted from TradFi.

Maple provides the blockchain-based technology required to set up and maintain the pool, whereas AQRU is responsible for managing the pool and loan book. For a start, the new pool has a target yield of 10% per annum with a minimum notional of USDC 500k and a 45-day lockup period.

To align with regulatory requirements, the pool will be available only to accredited investors such as asset managers and DAO treasuries that comply with KYC/AML standards.

4. Phuture Finance

Phuture Finance is building one of the largest crypto index funds, it leverages traditional index funds to create one of the largest decentralized crypto index funds. Phuture Finance has three core products, Phuture DeFi Index (PDI), Colony Avalanche Index (CAI) and USDC Savings Vault (USV).

Similar to how traditional index funds are structured to provide investors with exposure to a financial market index instead of a single stock to diversify risks, PDI and CAI are market capitalization-weighted indexes that offer exposure to the top DeFi protocols in the Ethereum and Avalanche ecosystems, respectively.

USV is a vault that generates interest on depositors’ idle USDC. $PHTR is the native token primarily used for governance and incentivizing users.

Mass adoption is coming to crypto, but it’s only a matter of when

— DeFI Saint 🦇🔊 (@TheDeFISaint) January 26, 2023

Indexes are going to be huge and few players are already taking advantage of that.

Want to know who I'm betting on, Find out 🧵

5. Backed Finance

Backed charges on the issuance and redemption of assets are held in designated collateral accounts with their custodian. Backed serves as a service provider and does not engage in any form of investment activities, their primary target group is also accredited investors.

Backed currently does not have a native token and has no plans to launch one. The platform went live recently and received an overwhelming response for its first token, the Backed Core S&P500 or bCSPX. The tokens are expected to be fully collateralized by the underlying assets and fully transferable.

"DeFi cannot grow its collateral assets by 100x without RWAs. The securities market, which is over a $100 trillion market, offers the potential for much greater growth."

— Aylo (@alpha_pls) March 1, 2023

Conclusion

Global institutions such as Goldman Sachs, Siemens and KKR strive to bring traditional real-world assets on-chain. This bodes well for the crypto and blockchain industry, as these assets are worth trillions of dollars. If done right, mainstream adoption of crypto and blockchain is no longer a far-fetched dream.

However, it is noteworthy that TradFi is a highly regulated industry, and greater regulatory clarity is critical to propel financial asset tokenization forward. It is a win-win situation for both TradFi and DeFi, DeFi gains by having another source of collateral option for lending protocols which can, in turn, improve liquidity and mitigate risk, while TradFi benefits from increased liquidity and efficiency as lower operational costs.

Also Read: Why Real-World Assets Are Needed For DeFi To Succeed

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

This article is done by our freelance writer, Clarence Lee

Featured Image Credit: Chain Debrief