Recently, Messari published a 168-pager Crypto thesis report for 2023 a few days before the end of one of crypto’s most “eventful” years. Within the concise and in-depth report were their top 10 trends in DeFi for 2023, and today, we will be taking a look at them and summarising key takeaways going into 2023.

Decentralized Finance (DeFi) has an exciting future. We dodged a bullet in 2022 with FTX’s implosion, and as we continue to navigate this area in crypto on our toes, we can rejoice that we live to build another day.

Taking crypto to the next level is no easy task; we need more than lucrative yield rates. We need new apps and use cases which will make us proud.

1. Revenge of the dApps

While Ethereum’s transaction fees are way down this year, few dApps within generate more monthly fees combined. These are derived from Uniswap, Lido and Opensea collectively.

As more volume is shifted off Ethereum and is accrued towards scaling solutions, Polygon and Optimistic rollups and new customised appchains enable dApps to have more control over their value capture mechanism like dYdX on Cosmos.

We know that the dominant players within Ethereum, AAVE and Uniswap have all launched their protocols on other up-and-coming networks this year, quickly capturing market share in volume and TVL.

Yet, the DeFi market cap relative to Ethereum is close to its all-time lows. Why? The fear of regulatory concerns might explain this. However, with the global financial services industry valued at nearly $23T, DeFi remains one with massive potential.

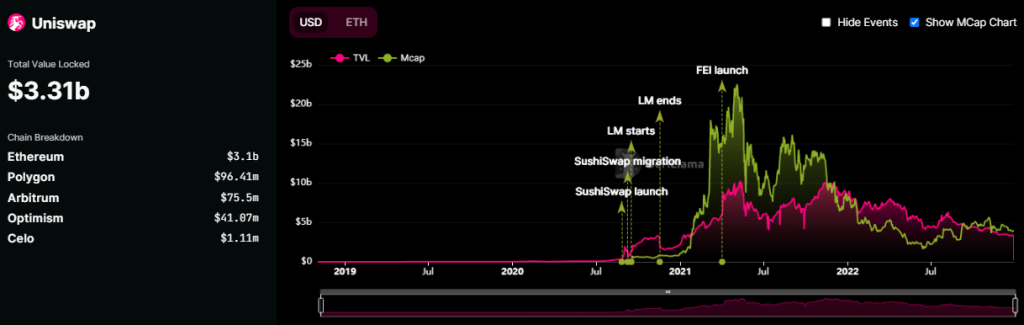

2. The final unicorn, Uniswap

AMMs are the backbone of DeFi, and they have come a long way, showing incredible progress over the past two years.

The introduction to Uniswap v3 has proven to be a game changer when it comes to working capital DEXs are required to run low slippage exchange. There’s not much left to improve the current AMM designs significantly, but AMMs can still compete around offering dynamic fees and their reference pricing oracles.

It is difficult to stand out from the pack if you are in the business of AMMs; it became clear that forks can’t dethrone Uniswap with just marginal improvements.

3. Real-world collateralized DeFi

The collapse of CeFi entities this year proved that decentralization and transparency matter. While centralized lenders get wrecked across the board, DeFi lenders stay resilient and show cleaner loan books.

MakerDAO, in particular, added $500M in exposure to U.S. Treasuries, and now real-world assets account for 57% of its revenue.

News of AAVE launching an overcollateralized stablecoin is also in the air. The GHO Stablecoin, native to AAVE, will allow “facilitators to mint and borrow a limited amount of GHO in a trustless manner while earning yield on deposited collaterals.

One of the biggest DeFi protocols, $AAVE recently announced a new stablecoin, $GHO.

— Frankie (@FrankieBusiness) August 19, 2022

What is the community's response to it? This thread will give you a summary of the Aave stablecoin and what you need to know about it.

A thread🧵👇:

All in all, decentralized lending protocols are more transparent, more collateralized and maybe, better risk management mechanics. DeFi lender’s risk management > centralized entity’s risk management.

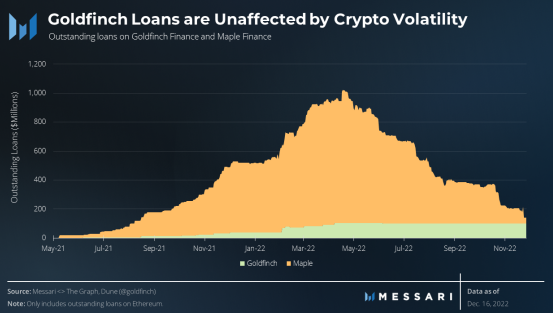

4. Undercollateralized DeFi Lending

This sector in DeFi took a huge hit this year. As overcollateralized DeFi lenders generate a yield from their demand for leveraged and margin traders, it did not help when those yields all went dry, along with the market’s risk appetite.

One example was maple finance, which got caught in a sticky situation amidst the FTX fiasco. Even Goldfinch, with a pristine track record of only lending to non-crypto borrowers, faced its own unique risks.

Also read: What Is Goldfinch Finance And How Does It Bring Crypto Loans To The Real World?

It is too early to predict how undercollateralized DeFi lending will work in its final form. Still, till then, it is difficult for crypto to compete with banks without undercollaterlized lending.

5. Superfluid collateral and synthetics stakes

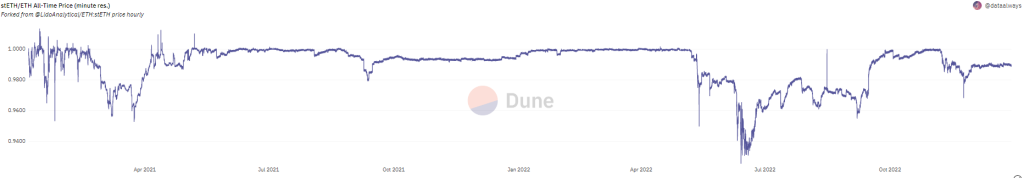

Liquid staking protocols played a significant role in convincing ETH holders to stake their ETH. Earning 5% APR on a liquid asset almost deflationary is extremely attractive.

Projects like Lido and Rocket pool are good places to stake ETH. Not only will this put the digital asset to work, but it will attract participation from more centralized players.

However, a word of caution is that until ETH holders can withdraw their funds from staking contracts, stETH and rETH could lose their peg until ETH can finally be unstaked.

Back in May, the fall of 3AC kickstarted the forced selling of stETH after its peg to ETH broke amidst market turbulence.

Let's recap what happened the past month

— Brandon Hong (@brandank_cr) June 15, 2022

1. Terra ponzi collapse

2. CPI up 8.6%, highest rise in inflation since 1981

3. stETH depeg causing Celsius liquidity crisis

4. Coinbase rescinding offers, firing 20% of employees

5. 3AC margin called

And some of you are still long?

Looking back, this year, how did we survive all of that? However, this sector is expected to grow significantly; some new projects would even give Lido a run for its money.

6. The perp walk: dYdX as an appchain

Despite its bad tokenomics, dYdX has a strong product market fit.

dYdX is by far the best DEX I’ve ever interacted with

— Karl (@karl_0x) December 21, 2022

If only they didn’t have a bad tokenomics design…

Residing as an Ethereum L2, they took the risk of moving towards the Cosmos ecosystem. However, while that may bring increased composability and scalability, it will still be a challenging year ahead for them.

The community in Q3 voted to tame token incentive programs and lowered trading rewards to reduce token inflation. Token emissions seem to be the main blocker for them; till they can find a way to control this area in dYdX, they could soar to higher heights in 2023.

A few months ago, @dYdX announced a v4 transition to Cosmos from their Starkware zk-Rollup. This was the beginning of the question of whether App-specific L1s are more advantageous than App-specific rollups. @joykchen and I compared them based on all available info

— Apollo (🌾,🌽) (@jarrenmims) December 12, 2022

🧵 A thread. pic.twitter.com/nwHriufF80

7. On-chain asset managers

This was the hype last year before entering 2022. This year, asset managers being quiet and almost invisible resulted from DeFi yield plummeting and investors choosing to focus on capital preservation.

Although ETF is one of the most popular in traditional finance, the ones in crypto barely even gained traction.

Wrote a first (out of three) article on crypto ETFs

— wishful cynic (@EvgenyGaevoy) May 25, 2021

a thread (1/n)https://t.co/oEItmbxDGz

8. New novel markets: two truth and a lie

Messari poses a question of two truths and a lie. Can you find the lie?

(a) Environmental and ESG investing efforts are laying the groundwork for individuals to reduce carbon footprints

(b) Real estate finance is one of the largest, expected to take off to be a massive opportunity for crypto protocols and innovation

(c) I believe in prediction markets.

The lie is (c). While the first two points are true in opening new markets within crypto, the third is the most popular.

Today’s prediction market has over $2M at stake on bets surrounding the 2024 presidential nomination in the US. Prediction markets converge on two significant use cases in crypto, speculating on the price of assets and sports betting.

1/ Time for a thread on prediction markets! One of the most fascinating yet poorly understood areas of DeFi, IMHO. Let's explore…

— AriannaSimpson.eth (@AriannaSimpson) May 23, 2019

The demand within the space works in funny ways; perhaps we are still at a maturity where it all boils down to one rule: “where the money goes, I follow”.

9. DeFi censorship

With all that’s happened this year, regulators may now have all the ammunition to bring forth their case in 2023. The coming year will be a decisive year for DeFi censorship.

Most notably, the Tornado cash sanctions, where the detention of one of their core developers is still, unfortunately, holding up.

READ THIS THREAD OR GO TO JAIL FOR 30 YEARS (sorry not kidding)

— BowTiedIguana (@BowTiedIguana) August 8, 2022

Tornado Cash added to US sanctions list – $437m of assets blocked.

What is OFAC, what are sanctions, and what does this mean for DeFi 👇

The new year will likely entail more regulatory clarity, and even so, with that thought in sight, some protocols are even preparing for it. They do so by implementing restrictions on their sites and going into a temporal self-protection mode from jurisdiction crackdowns.

It is also likely that most DeFi users and volume will be KYC’d within the next few years. Non-KYC’d transactions will also be processed.

10. Bullish unlocks

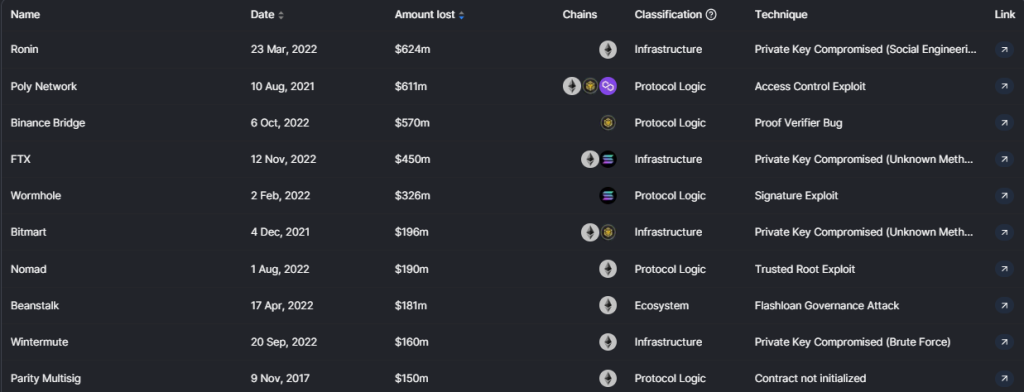

Out of the top ten hacks of all time, 7 of them happened in 2022, amounting to $3B.

Security will be a big play next year, and the KPI will be reflected in the number and how deep hacks are next year. Along with security, sustainable tokenomics design must also be taken more seriously.

With that being said, bullish unlocks, according to Messari, a bull market meme. During the bear markets, watch out for tokens with huge unlocks; they may give you an idea of what they are up to.

Also Read: 30 Crypto Hacks Over $30M, Broken Down

Closing thoughts

You may not be a billionaire in monetary value, but what you are is (most likely) a time billionaire. Make what you will with this information; the coming year is yours to take.

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: ChainDebrief