Goldfinch is a decentralized lending protocol that allows for crypto borrowing with off-chain collateral. It targets emerging markets and aims to bring the world’s credit activity on-chain.

Through game theory-tested incentives, Goldfinch is currently able to provide above-market returns for capital providers while purveying crypto loans to creditworthy applicants who are not required to lock in crypto as collateral.

Important reminder: @goldfinch_fi’s stablecoin rates, protocol revenue, and borrowing volume holding steady while most protocols experience a flatline or decline in core metrics is a testament to the long-term stability of bringing real-world investment to crypto.👇🧵

— Goldfinch (@goldfinch_fi) May 10, 2022

Bringing real-world investments to DeFi

Goldfinch differs from other undercollateralized lending protocols as their core focus is on lending to real businesses worldwide to generate yield for lenders.

The protocol makes crypto loans without requiring crypto collateral — the missing piece that finally unlocks access to crypto for most people in the world.

By incorporating the principle of trust through consensus, Goldfinch creates a way for borrowers to show creditworthiness based on the collective assessment of other participants, rather than based on over-collateralizing with crypto assets.

This provides the basis for establishing an immutable, on-chain credit history, a core foundation of any scalable lending model and a primitive that is missing in a meaningful way for many growing markets globally.

The protocol then uses this collective assessment as a signal for allocating lender’s capital to businesses. The decentralized community of Goldfinch investors make loans to businesses that drive economic growth in their regions, starting with those in emerging markets.

Presently, all loans on Goldfinch are fully collateralized with off-chain assets.

By removing the need for crypto collateral and providing a means for automatically distributed yield, the protocol substantially expands both the potential borrowers who can now access crypto and the potential lenders who can now diversify outside of crypto and gain exposure to real-world assets.

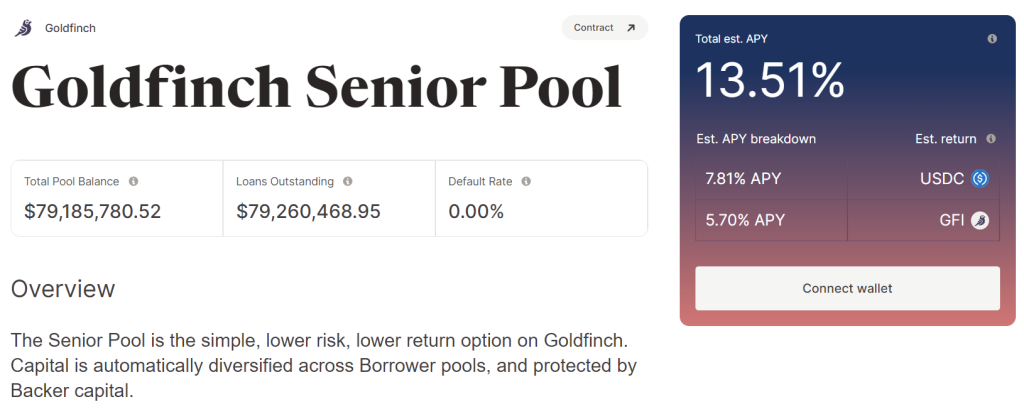

The Senior Pool is Goldfinch’s single diversified pool, optimized for ease.

— Goldfinch (@goldfinch_fi) October 17, 2022

Do you know how it works?

Learn about Goldfinch’s automatically distributed Pool, protected by Backer capital, and how to get started: https://t.co/Q4Rg984XTe

Goldfinch’s Borrowers

Goldfinch serves out to be the one-stop solution where borrowers can benefit the most and where crypto can have the greatest impact. That led them to source towards emerging markets for their lending businesses.

Oftentimes, these companies are incapable of raising funds due to the penurious financial infrastructure available in the country they are incorporated in.

By allowing on-chain capital to be utilized by these budding organizations, they have the opportunity to burgeon into a matured business that could never have happened in the traditional finance landscape.

Goldfinch has enabled financial access for thousands of individuals around the world via its borrowers spanning more than 28 countries.

Some of Goldfinch’s borrowers include PayJoy in Mexico, QuickCheck in Nigeria, Divibank and Addem Capital in Latin America, Greenway through Almavest in India, and Cauris in Africa, Asia, and Latin America. You can view more borrower pools here.

Goldfinch’s Participants

The Goldfinch protocol has three key roles: Investors, Borrowers, and Auditors.

- Investors are participants who provide $USDC to the protocol to be utilized by borrowers. There are two ways to become an investor in Goldfinch: as a Backer or as a Liquidity Provider.

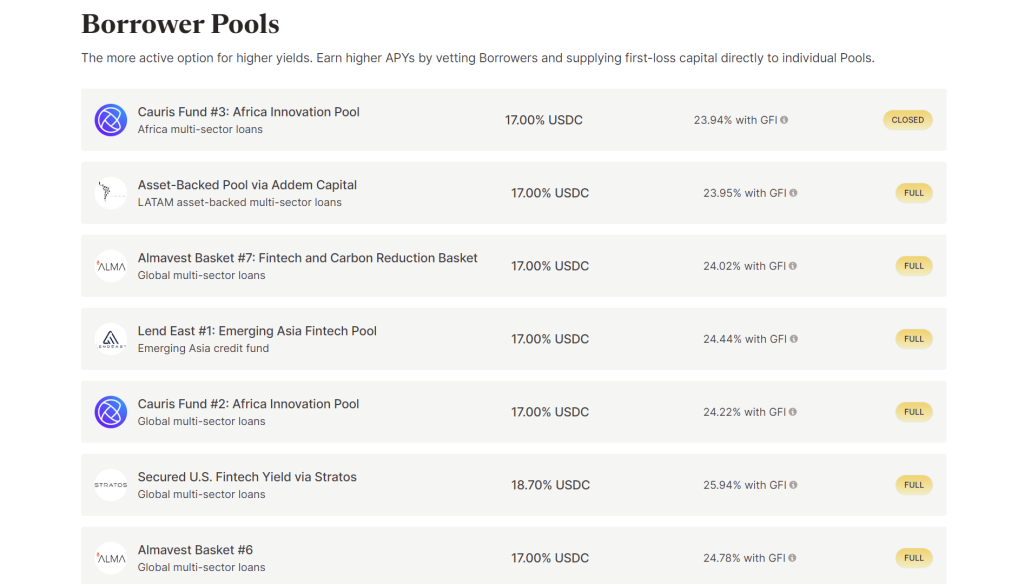

- Backers optimize for yield and specificity. They assess individual borrower pools before deciding whether to invest in them directly with first-loss capital and in return earn the protocol’s highest yields for doing so.

- Liquidity Providers optimize for diversification and liquidity. They supply second-loss capital to the Senior Pool, which automatically allocates its funds across all Borrower Pools according to the assessment of Backers.

- Borrowers are participants who seek financing from Goldfinch, and they propose Borrower Pools to be assessed by the network. Borrower Pools are smart contracts that contain the terms a Borrower seeks for their loan for example the interest rate and repayment schedule.

- Auditors vote to approve Borrowers, a step that is required before they can propose a borrower pool to Backers. Auditors are randomly selected by the protocol to provide a human-level check guarding against fraudulent activity and earn rewards in exchange for conducting this work.

Due to the complexity of being a Backer, for the average DeFi user, being a Liquidity Provider is the simplest and recommended choice. Both Backers and Liquidity Providers have to undergo a mandatory KYC process which will be kept confidential and produces an on-chain NFT representing the ID of the lender.

Below is an overview image of the Goldfinch protocol architecture.

How does Goldfinch work?

Borrowers (currently off-chain lending businesses) propose deal terms for credit lines (Borrower Pools) to the protocol. Goldfinch’s community of Investors can then supply the capital to these credit lines (Borrower Pools) by two methods:

1) Directly to the individual Borrower Pools as Backers or

2) Indirectly by automatically allocating capital across the protocol as Liquidity Providers via the Senior Pool

These businesses (Borrowers) use their credit lines to draw down stablecoins, specifically $USDC, from their pool. Borrowers then exchange the USDC for fiat currency and deploy it on the ground to end-borrowers in their local markets.

In this way, the protocol provides the utility of crypto leveraging on its global access to capital while leaving the actual end-borrower loan origination and servicing to the businesses best equipped to handle that in their own communities.

Tokens

There are two native tokens on Goldfinch: $GFI and $FIDU. Both follow the ERC20 standard. In addition, the protocol utilizes only $USDC for investments and loans.

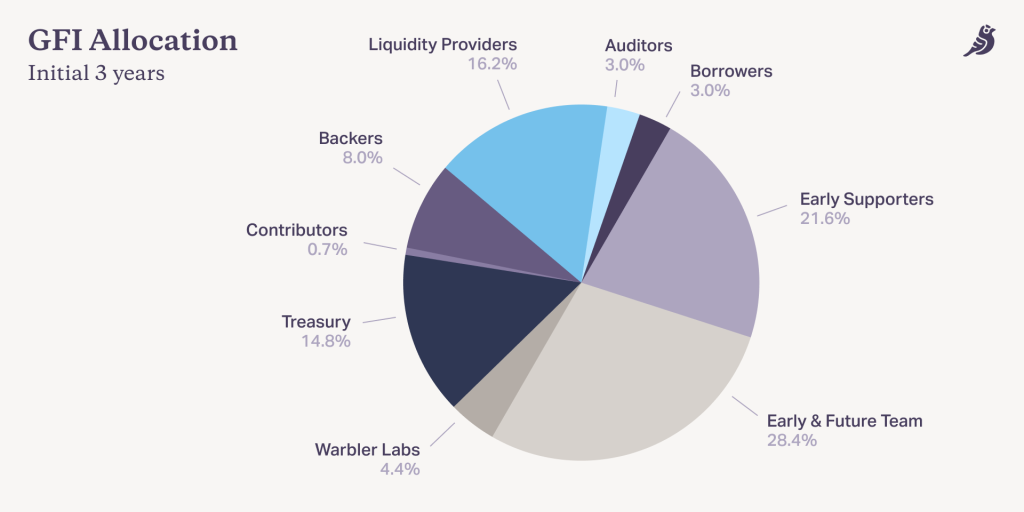

$GFI is Goldfinch’s core native token. $GFI is used for governance voting, Auditor staking, Auditor vote rewards, community grants, staking on Backers, and protocol incentives, and can be deposited into a Member Vault to earn a share of protocol revenue in exchange for helping to secure the protocol’s growth.

$FIDU is a token that represents a Liquidity Provider’s deposit to the Senior Pool. When a Liquidity Provider supplies to the Senior Pool, they receive an equivalent amount of $FIDU.

$FIDU can be redeemed for $USDC in the Goldfinch dApp at an exchange rate based on the net asset value of the Senior Pool minus a 0.5% withdrawal fee.

The exchange rate for $FIDU increases over time as interest payments are made back to the Senior Pool.

Conclusion

Today, there are a plethora of options out there to obtain yield on your stablecoins and decentralized lending is an apparent choice. However, what really sets Goldfinch apart is that it is a platform that “brings crypto loans to the real world” according to West, the co-founder of Goldfinch.

Goldfinch certainly offers attractive rates for lenders with the highest combined APY coming in at 27.6% (17% for $USDC and 10.6% for $GFI). Yields come from real-world lending, and investments are collateralized off-chain, which makes them distinctly different from the usual highly volatile DeFi lending.

If you are looking to diversify your stables, Goldfinch is definitely a protocol you should check out. For more of their analytics, you can access their Dune dashboard here.

🪺Take a break to catch up on the latest from @goldfinch_fi : 🧵

— Goldfinch (@goldfinch_fi) October 17, 2022

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief

Read More: Could DeFi Find A Place In The Future Of Finance? Or will TradFi Reign Supreme?