Terra is a public blockchain protocol deploying a suite of algorithmic decentralized stablecoins which underpin a thriving ecosystem that brings DeFi to the masses.

The Terra blockchain is built on Cosmos SDK; a framework that allows developers to create custom blockchains and build their own decentralised applications (dApps) on top of Terra for different use cases.

LUNA and UST are two native tokens of the Terra network, a blockchain-based project developed by Terraform Labs in South Korea. LUNA was created by them and have been tradeable on cryptocurrency exchanges since July 2019.

How does LUNA and UST work?

In order for UST to maintain peg, Terra mints and burns tokens while also incentivising arbitrage.

Here’s what it means:

Before you can buy UST, you will have to mint some. To do so, LUNA is swapped for UST at the going rate. The protocol takes those LUNA and burns them, which constricts the supply and increases the price of LUNA. The same applies if you are minting LUNA — the UST used to swap for LUNA is burned and the price of UST goes up by a little.

Here’s an example:

To peg UST, a USD value of LUNA is convertible at a 1:1 ratio with UST. For example, if UST’s price is at USD $0.98, arbitragers swap 1 UST for $1 worth of USD in LUNA and make $0.02. This mechanism increases UST demand and reduces its supply as the UST is burned. This in turn will lead to an increase in UST’s price.

When UST is above $1, say at $1.02, arbitragers will choose to swap $1 of LUNA into 1 UST (which is valued at USD $1.02) and profit 2 cents. The supply of UST increases, and demand for UST decreases, bringing the price back to peg.

Anchor Protocol and its boom

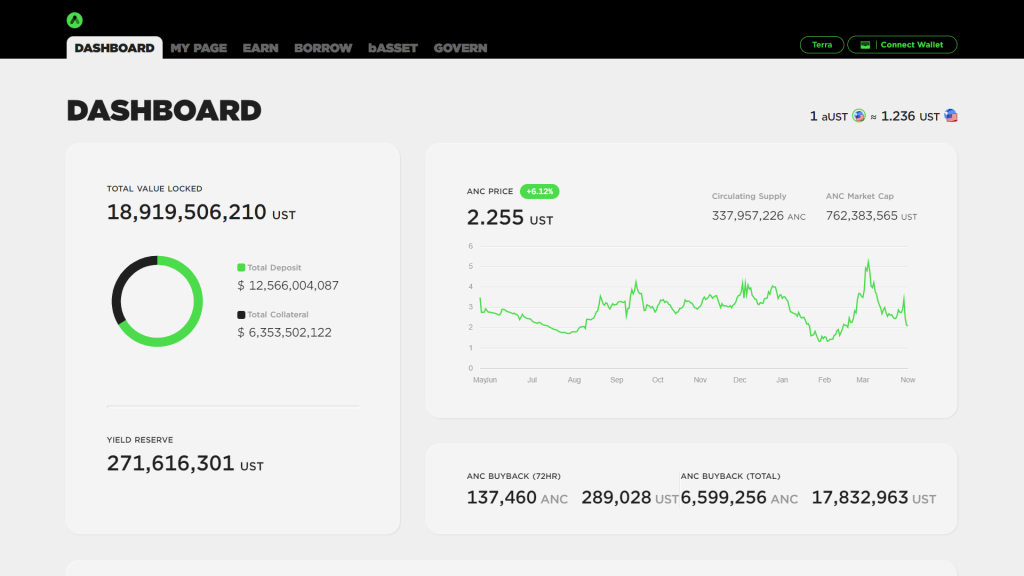

Anchor Protocol is a decentralised money market built on the Terra blockchain. It gained fame for its whopping ~20% APY that UST holders can earn if they deposit their tokens on the platform.

Anchor currently accounts for over half the TVL on the Terra chain.

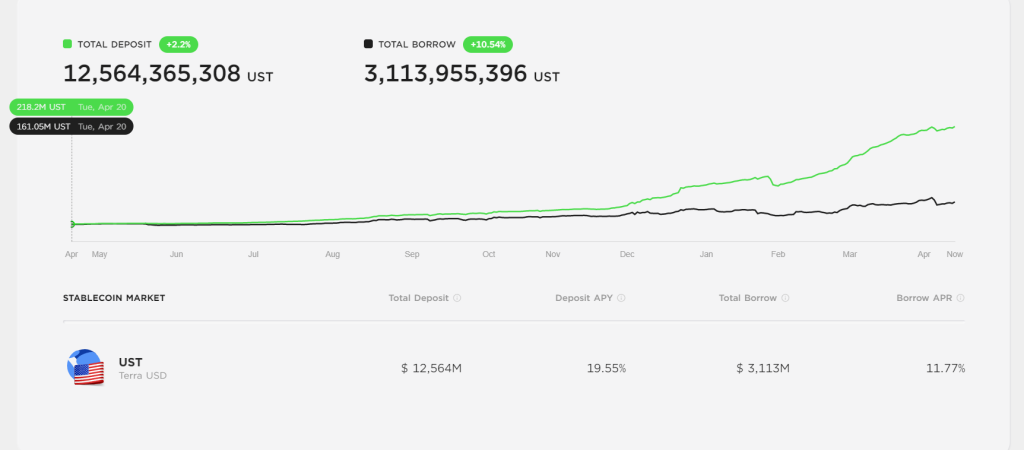

The astronomical rise in UST deposits is evident here. Just a year ago the total deposits were under US$220 million as compared to today’s figure of more than US$12.5 billion. That’s almost a 60x increase in a year’s time!

Despite UST’s meteoric surge in market cap, its trading volume does not coincide. This could mean that plenty of investors are only getting their hands on UST for the industry leading rates that Anchor is currently offering rather than using it for the purchase of other cryptocurrencies.

According to CoinGecko, the market value of Terra's stablecoin UST reached $17.5 billion on April 18, surpassing BUSD's $17.4 billion, becoming the third-largest stablecoin after USDT and USDC. But UST’s trading volume is very low, only 1/5 of BUSD.

— Wu Blockchain (@WuBlockchain) April 18, 2022

Is it sustainable?

Yield reserves are the amount of capital held on Terra to sustain its current yield rate.

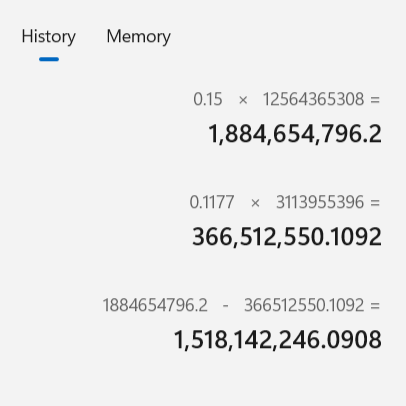

Let’s use the figures above for illustration purposes. The assumptions made here will be:

1) An already discounted rate from the current of just 15% APY

2) Borrowing rate is at 11.77% APY

3) Use of current figures for total deposits and total borrowed

With the above assumptions, Anchor will be on a deficit of 1,518,142,246.0908 UST per year.

Anchor’s yield reserve (excluding BTC) currently sits at just 271,616,301 UST. This will take less than six months for it to be completely drained.

With that said, this did not factor in new deposits and the higher than calculated rate paid out to lenders which only means it will deplete faster.

Also Read: Anchor Protocol’s Yield Is Rapidly Depleting: The Solutions, And Will Anchor V2 Save It?

What happens when the yield reserve runs out?

The APY will decrease dramatically.

The reason for Anchor’s TVL today is due to the fact that it’s offering a lucrative 20% APY for a stablecoin, something that is almost unrivalled.

If and when the APY comes down to a rate where lenders deemed unattractive, Anchor’s TVL could plummet.

This is also a reason why Do Kwon, Founder of Terraform Labs, plans to build over US$10 billion in BTC reserves to avoid an event where UST will depeg.

If there is any confusion left at this point, we will keep growing reserves until it becomes mathematically impossible for idiots to claim depeg risk for $UST $UST is mighty https://t.co/6xCDPWJUTX

— Do Kwon 🌕 (@stablekwon) March 11, 2022

How will the price of LUNA be affected?

The fate of LUNA is directly linked to how successfully UST is able to maintain its peg in any market conditions.

This can be a likely scenario when the APY for lending UST drops significantly:

1) APY goes down

2) Lenders swap their UST back to LUNA as there are better lending opportunities elsewhere

3) Demand for UST drops and a mass panic sell may cause UST to lose its peg

4) LUNA will drop in value along with its TVL

Hence, the failure of UST will negatively affect the price of LUNA.

This begs the million dollar question: What will be the rate where lenders deemed unattractive?

Is Terra and Anchor a ponzi?

A Ponzi scheme is a scam promising high returns with little risk to investors. A Ponzi scheme generates returns for earlier investors with money taken from later investors. Ponzi schemes eventually bottom out when the flood of new investors dries up and there isn’t enough money to go around. At that point, the schemes unravel.

With LUNA up over 650% from exactly a year ago, a number of pundits have claimed that Terra’s growth is unsustainable. In fact, it has even escalated to the point where millions were wagered in regard to where LUNA will be trading around this time next year.

Twitter user “AlgodTrading” is ultra bearish on LUNA and was the one who triggered the bets. Along with Twitter user “GiganticRebirth”, they believe that LUNA will be trading at a price point lower than $88 on 13 March 2023.

Here is a Twitter thread on why Algod thinks LUNA and UST is nothing but a ponzi.

So multiple people have seen me calling $ust/ $luna a ponzi, going to briefly explain why:

— Algod🫐 (@AlgodTrading) February 16, 2022

UST maintains stability through a simple swap mechanism: 1 UST can be exchanged for 1 dollar’s worth of LUNA at any time

Also Read: Terra’s Founder Do Kwon Bets Millions That LUNA’s Price Will Be Above US$88 A Year Later

Closing thoughts

I have always been cautious about Terra. There have been flashes of ponzi hence my reserve in investing in LUNA.

It has no doubt grew very rapidly in a short timespan and still has more upside potential. If you are holding LUNA, it is very likely that you are in profits given how close it is to its all-time high still.

These are just my personal thoughts and many I know are extremely bullish on LUNA and what’s to come, so always do your own research before you decide to ape in.

The reason why everyone invests is to make more money. If you manage to profit even if it is a ponzi, does it really matter?

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Also Read: LUNA Is Now The 7th Largest Cryptocurrency By Market Cap: Why This Is Just The Beginning