I initially wrote this article when LUNA first breached the much anticipated US$100 price point in December 2021.

However, as we all know, the descent after that high was sharp and LUNA shaved about half its value from its peak in December.

But here we are now, with LUNA making another run even during such bearish conditions. In the image below, I compare LUNA’s price action with that of Bitcoin. Probably not the fairest of comparisons but you get the idea.

If you ask me, I think nothing much has changed fundamentally and the points in my article below still stand.

So, if you are wondering if LUNA is still the right play, these three reasons might help with your own decision-making process.

Also Read: Here Are The LUNA Derivatives That You Need To Be Familiar With

Incoming stablecoin regulation

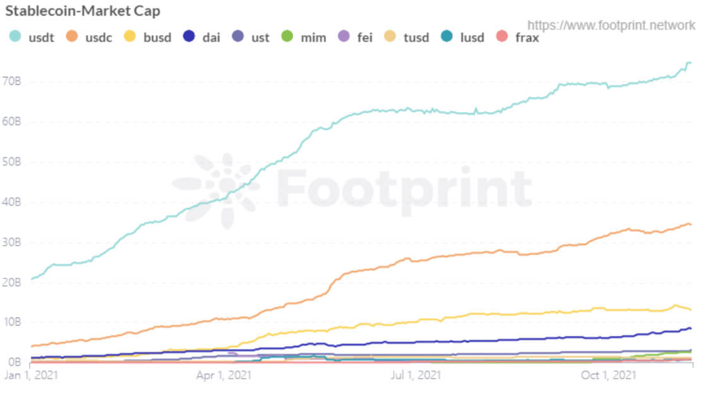

Apart from LUNA mooning this past year, stablecoins have been gaining traction as well. Their market cap at the beginning of 2021 was around US$29 billion. However, this market cap has grown by almost 400% since then.

With their increased adoption comes increased scrutiny by regulators. Apart from the lack of a standardized procedure for stablecoins to disclose the assets that back them, one of the most concerning aspects for regulators is the fact that stablecoins can be used as payment methods by mainstream users who have no idea how crypto works. This could result in a bank run if any unexpected events were to occur.

You see, the world recently found out that the top two stablecoins, USDT and USDC, are not backed 100% by cash as they claimed to be.

In fact, a good proportion is backed by short-term debt, and these markets are generally prone to bouts of illiquidity. Hence, these markets could come under significant stress if the stablecoin issuers try to liquidate large amounts for cash in a short timeframe.

In a worst-case scenario, these could see a negative impact on the broader market. Generally, governments would prefer that such a scenario would never happen.

As a result, the President Working Group and a few other agencies have been rushing to evaluate how regulations can be introduced regarding this aspect of blockchain technology. If, and when, such regulations eventually become law, centralized stablecoins will have no choice but to abide by or cease operations.

However, long before this day, investors will be looking for the next stablecoin to trade with and I believe UST is in a good position to replace the current top stablecoins. UST, being decentralized, will be much tougher to regulate.

If you think this is still a future catalyst, think again. The market cap of UST has been swelling in the past month.

Tons of protocols have yet to go live

Before touching on the second point, it is important to understand that the stablecoin (ie UST) is the most important product by Terra. For every dollar of stablecoin being minted, an equivalent value of LUNA must be burned.

Therefore, as the demand for Terra’s stablecoins increases, so will the amount of LUNA that has to be burned. This reduces the supply of LUNA and ultimately increases the price of LUNA, all else equal.

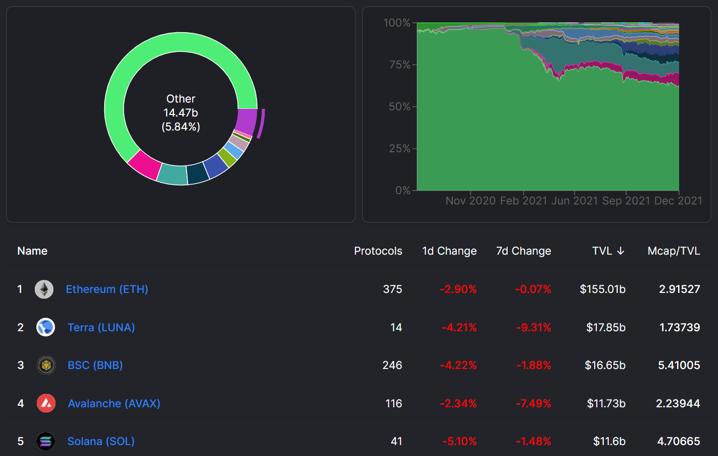

At this point in time, despite having the second-highest TVL out of all blockchains, the number of dapps on Terra is but a fraction of the other top five blockchains.

Just imagine how much more UST will be needed when other key protocols go live. UST is necessary for liquidity-providing and IDO participation among many other use cases.

With the way Terra is developing, it will be a matter of time before every financial aspect of the TradFi world is integrated on the Terra blockchain.

We currently have a new AMM which is Astroport and an investment platform by Mirror protocol among many others.

In 2022, many protocols will be launching and very soon, Terra will be self-sufficient. Investors would no longer have to bridge assets out as every need can be met on Terra alone.

Some of the upcoming protocols will be huge as it taps on the derivatives market and even insurance for an added layer of security

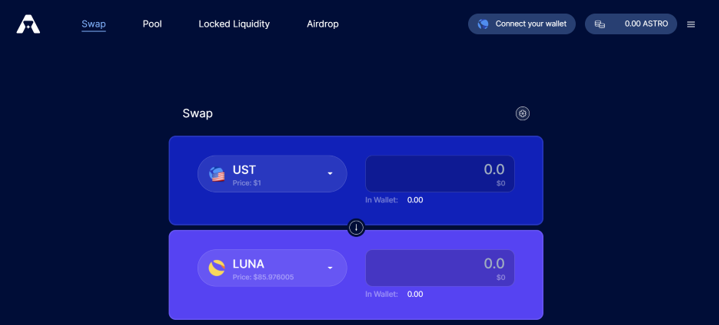

Astroport

Astroport is an upgrade to the current AMM (TeraSwap)on Terra. Astroport will debut with two pool types: the traditional x*y=k pool which was pioneered by Uniswap and the Stable Invariant pool by Curve Finance.

The different pool types will ultimately increase the capital efficiency for investors by lowering fees for stable pools among other things.

Also Read: What Is Astroport? Introducing The Next-Generation AMM On Terra

Prism

Prism is a derivatives protocol that will bring the capital efficiency of yield-bearing assets to a whole new level.

The main premise of Prism is that it will allow investors to utilize the yield and principal component of a single asset separately. There will no longer be the dilemma of whether to stake or provide liquidity. An example is LUNA which will be refracted into yLUNA which can be used for staking and pLUNA which can be used for providing liquidity as an example. This allows users to get rewards from both activities and even to leverage their assets with no liquidation risk (eg. selling yLUNA to buy pLUNA).

Also Read: To Stake Or To LP LUNA? Prism Protocol Allows You To Do Both Concurrently

Vertex

Another derivatives protocol that is in the works is Vertex protocol. This caught my attention recently as I saw a Twitter thread about how they are aiming to bring forex markets to Terra.

Forex markets traditionally facilitate around US$6 trillion in daily volume. Just imagine what a fraction of this amount can do for the Terra ecosystem. Vertex will facilitate hedging and speculation in multiple stablecoin markets and help expand the utility for local currencies.

Another interesting feature in the works is a multi-currency version of Anchor. This means that users will potentially be able to deposit and earn in their native currency which eliminates fx risk. An example is a screenshot from their litepaper below.

Lastly, we have Ozone protocol. It is currently in the final stages of testing as of 28 December. Once this protocol goes live, it will allow users to purchase coverage for their DeFi assets by paying a premium. These potential policyholders will have their coverage underwritten by users who deposit capital into a variety of pools for a risk-adjusted return.

One of the most anticipated uses for Ozone will be for Anchor deposits. This added layer of security will hopefully be able to pull institutional investors into the ecosystem.

Neobank services leveraging on the Terra blockchain

Neobanks are financial institutions that operate digitally with no physical branches. An example is Youtrip, a multi-currency wallet. There are currently three (one operational and two in the works) that utilize Terra’s blockchain to bring about financial services for the mainstream masses.

The main selling point of these neobanks is that their UI will be largely similar to current fintech apps. However, users will be able to reap the benefits of blockchain technology without having to go through a steep learning curve.

Although this is not talked about as much, it is highly crucial to the adoption of Terra’s stablecoins. In my opinion, the Total Addressable Market (TAM) for such companies could be as high as the current M1 money supply. These companies will seek to replace the traditional retail banking infrastructure of today.

Kash

Firstly, we have Kash which operates in Europe and provides savings and investment services and a debit card for spending. The savings product leverages Anchor protocol for that sweet 19.5% yield while the investment product uses Mirror protocol. The debit card is also very useful as it allows users to spend stablecoins without having to convert to fiat.

Alice

Alice offers similar services, less the investments aspect, to consumers in the US. However, they offer P2P payment services which seems much like how DBS’s PayLah works.

Kado

Finally, we have Kado which will offer a suite of three services: Pay, Ramp, and Save. The payments aspect aims to allow the average user to spend stablecoins with ‘real-world’ merchants using the platform itself.

The ramp aspect will allow both users and merchants to convert between fiat and stablecoin effortlessly. Lastly, the save aspect is similar to what Alice and Kado will be offering.

This aspect of UST adoption has only begun with just one operational neobank and a few more in the works. The target market is also generally limited at this time. However, I believe there will soon be more companies who will bring these services to other parts of the world, especially in Asia.

Fitch ratings found that there were around 290 million people who are underbanked in Southeast Asia alone. Just imagine how these neobanks will be able to revolutionize the way banking is done in such geographies. It would be so simple and cheap that traditional financial institutions would never be able to compete.

Closing thoughts

While I have outlined three reasons which I think are major catalysts, these are by no means exhaustive. There are many other reasons that could propel LUNA to new heights such as the partnership with the Washington Nationals, an MLB team, and the $1 billion BTC reserve by LFG.

Although the start of 2022 was rough for LUNA, I believe it is still early days. How do you see LUNA performing in 2022?

[Editor’s Note: This article does not represent financial advice and is the opinion of the writer alone. Please do your own research before investing.]

Featured Image Credit: Cryptocurrency News Room

Also Read: Growing Your Bag Of LUNA: Here’s A Guide To Yield Farming In The Terra Ecosystem