Since its launch in 2018, Uniswap exploded in popularity and is now a very key component in the decentralized finance (DeFi) space. It fulfills the role of a decentralized exchange (DEX) and act as an automated market maker (AMM).

Since this is a fairly complex topic, here’s an attempt to help you understand what exactly Uniswap does and what does a DEX and AMM do.

Context

Traditionally, trading takes place in a centralized exchange such as Binance or Coinbase. These exchanges maintain an order book system where there is a list of buyers and sellers willing to trade a particular asset at the price they want.

For example, if you want to sell one bitcoin at USD10,000 via a centralized exchange, you need to have a buyer willing to buy your bitcoin at the price or higher. These centralized exchange then executes your order and takes a commission from the trade for offering the service.

The problem with centralized exchanges is liquidity – which simply means how many open orders are they at any one point of time. If there is a low liquidity, the number of open orders are low and you may not be able to sell your assets as fast as you like.

How decentralized exchanges work

Blockchain technology ushered in an era of decentralized finance, where there should be no central governing body that controls the financial system. This is how Uniswap was born – a decentralized exchange where no single entity is owning and operating it.

This is made possible by the its underlying protocol design, which adopts an automated liquidity protocol, making it an automated market maker.

Built on the Ethereum blockchain, which is the world’s second-largest cryptocurrency project by market capitalization, it is compatible with all ERC-20 tokens. ERC-20 tokens are the most common type of token built on top of Ethereum.

ERC-20 tokens are fungible in nature, which means that there isn’t a distinction between individual tokens. The fungible nature of ERC-20 tokens is what makes it possible for AMM to operate as anyone can deposit their crypto and provide liquidity into these decentralized exchanges.

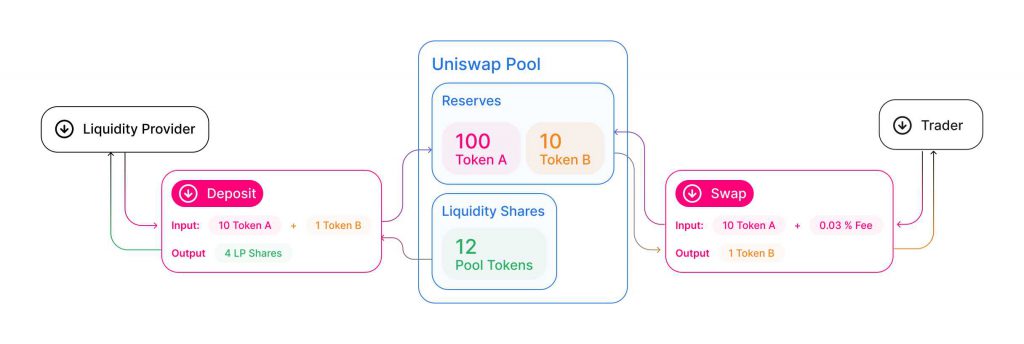

Unlike traditional exchanges which has an order book, decentralized exchanges do not have an order book, but instead, works with a model that involves liquidity providers creating liquidity pools.

Decentralized exchanges such as Uniswap have built in smart contracts that creates liquidity pools that traders can trade against. These liquidity pools are funded by liquidity providers.

Anyone can be a liquidity provider, who deposits an equivalent value of two tokens in the pool. In return, traders pay a fee to the pool that is then distributed to liquidity providers according to their share of the pool.

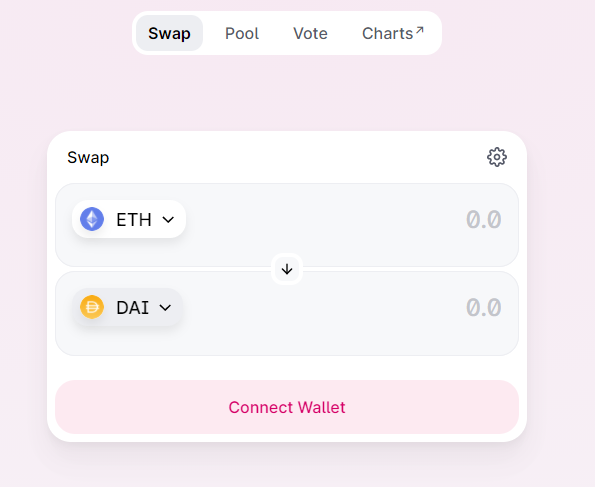

If you are a trader looking to trade your Ethereum into Dai (ETH/DAI), what Uniswap allows you to do is that, you can swap your Ethereum into DAI on Uniswap and this is made possible by all the DAIs available in to ETH/DAI liquidity pool. Your Ethereum will be traded into Dai from the liquidity pool which is funded by liquidity providers from anyone in the world.

When someone purchases ETH from the ETH/DAI pool, the supply of ETH is reduced from the pool, and the supply of DAI is increased proportionally. Therefore, it will increase the price of ETH and decrease the price of DAI.

To be a liquidity provider, you simply deposit an equal amount of Ethereum and Dai into the Uniswap ETH/DAI liquidity pool and in exchange for that deposit, you gain a certain amount of liquidity token which represents your share in the pool.

With the liquidity token, you are entitled to the transaction fees generated and you earn an income on your depositted cryptocurrency.

It is amazing to note that no one centralized entity controls these decentralized exchanges and this is made possible by the blockchain technology and it is all enabled by smart contracts.

How are decentralized exchanges valued

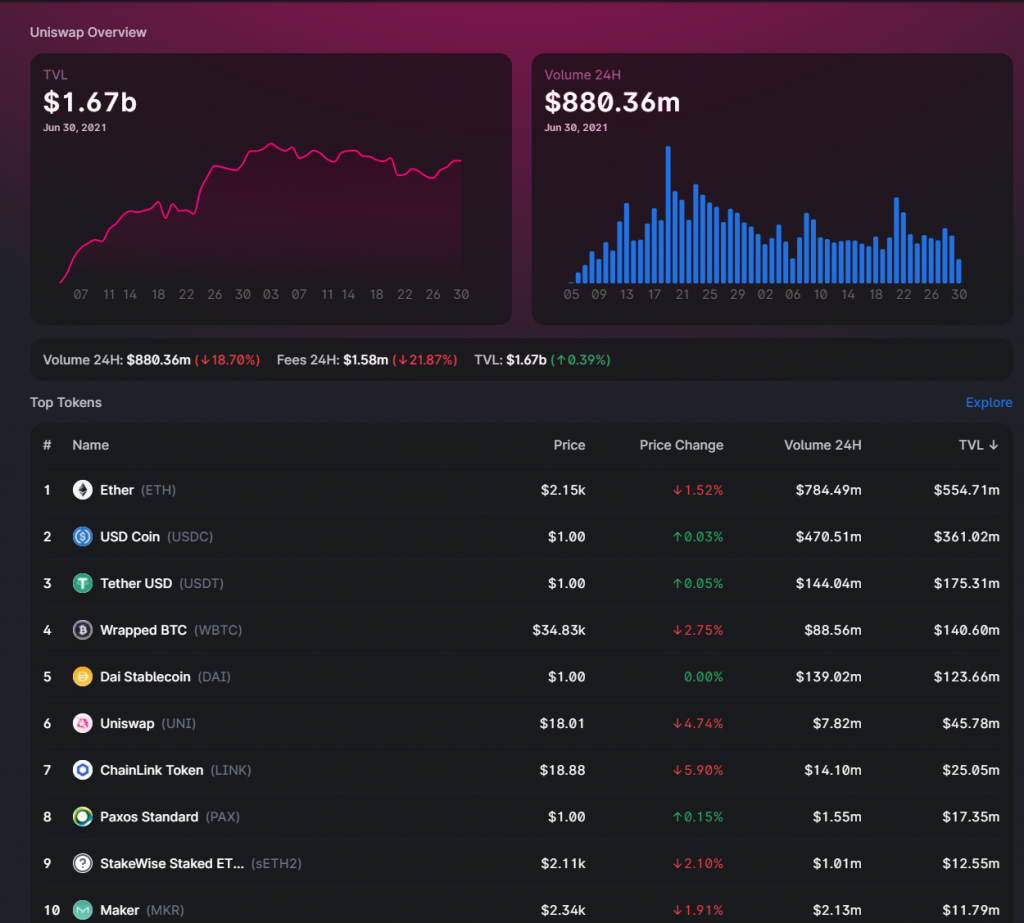

As with all exchanges, the key value of a decentralized exchange lies in how much liquidity they have, and in the case of DEXes, the total value locked (TVL) or the total amount of cryptocurrencies depositted in the liquidity pools.

Another common metrics to keep a look out for is the transaction volume as well as the amount of token pairs and liquidity pools available on the DEX.

Here’s a look at the key metrics of Uniswap:

How to trade on Uniswap

- Head to https://uniswap.org

- Click “Use Uniswap” in the top right-hand corner.

- Go to “Connect wallet” in the top right-hand corner and select the wallet you have.

- Log into your wallet and allow it to connect to Uniswap.5. On the screen it will give you an option to swap tokens directly using the drop-down options next to the “from” and “to” sections.

- Select which token you’d like to swap, enter the amount and click “swap.”

- A preview window of the transaction will appear and you will need to confirm the transaction on your ERC-20 wallet.

- Wait for the transaction to be added to the Ethereum blockchain. You can check its progress by copying and pasting the transaction ID into https://etherscan.io/. The transaction ID will be available in your wallet by finding the transaction in your sent transaction history.

1/

— Uniswap Labs ? (@Uniswap) May 5, 2021

? We are thrilled to announce that Uniswap v3 is now live on Ethereum mainnet!https://t.co/liqYXtQoM2 has been updated to support v3.https://t.co/VeR2ueZfEk

3/

— Uniswap Labs ? (@Uniswap) May 5, 2021

? A liquidity migration contract and interface is available for Uniswap v2 LPs!

? The migration portal works for Sushiswap LPs as well

? Migration and LP guides can be found here: https://t.co/XibQxNMfuB

5/

— Uniswap Labs ? (@Uniswap) May 5, 2021

? Uniswap v3 would not be possible without our incredible community

? Community members have already begun building an ecosystem on top of v3. We’re so excited about what comes next!

Also Read: The Ultimate 2021 Guide On Crypto Yield Farming And How To Get Started