NEW: @NEARProtocol, the speedy smart-contract chain with an eye toward mass adoption, raised $350 million in an investment round led by hedge fund Tiger Global. $NEAR@BrandyBetz reportshttps://t.co/71KFC9FM2E

— CoinDesk (@CoinDesk) April 6, 2022

If you missed the big announcement, NEAR Protocol just raised another staggering US$350 million in funding. This is the second nine-figure raise this year and I am very bullish about NEAR Protocol and the ecosystem.

If you’re not bullish about NEAR protocol, check out this article and it may change your mind.

Also Read: $NEAR: Reasons Why I Am Bullish On NEAR Protocol For 2022

The ecosystem is flourishing with all sought of DeFi projects and what caught my eye is this brand new money marker protocol, Aurigami.

What is Aurigami?

Officially launched in March 2022, Aurigami is a proud recipient of the NEAR foundation grant. It is the first money market protocol on Aurora mainnet.

The decentralised, non-custodial liquidity protocol acts as a bank that allows users to lend and borrow crypto assets.

With over US$145 million in TVL, it is the third-largest protocol on Aurora just behind Bastion and Trisolaris.

Aurigami supports USDC, USDT, ETH, wNEAR, wBTC, stNEAR, AURORA and TRI. It is the first money market protocol that supports stNEAR.

This allows stNEAR holders to stack yield on top of yield like lego blocks. Effectively generating triple yields.

Free airdrops

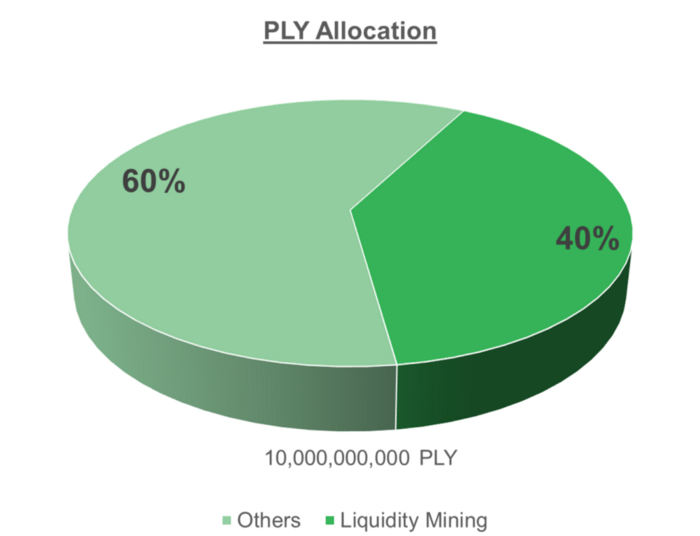

PLY is the native governance token of Aurigami. A staggering 40% of the total PLY supply is reserved for liquidity mining and is distributed on a weekly basis.

This is given out as a reward to the early investor who helped bootstrap the protocol. The Premine period will last until all 20 million PLY is fully distributed.

The full tokenomics is not published yet and it will be shared once the premine period is over.

Notable Investors – big crypto players

It’s not often that you see so many Tier 1 crypto VCs joining hand and supporting a new protocol. The successful seed round was co-led by Dragonfly Capital and Polychain Capital.

The fundraising also saw participation from other crypto big names like Mechanism Capital, Amber Group, Jump Crypto, Coinbase Ventures, Alameda Research, Lemniscap, QCP Capital, DeFi Capital, Folius Ventures, D1 Ventures, and Genblock Capital.

Other notable Angels include Alex Shevchenko, CEO of Aurora; Julian Koh, CEO of Ribbon; Bobby Ong & TM Lee, co-founders of CoinGecko; Matthew Tan, CEO of Etherscan; Alex Svanevik, CEO of Nansen; Santiago R. Santos.

With so many big names backing Aurigami, it is only a matter of time before it becomes the primary money market on Aurora.

Roadmap

Aurigami aims to be the keystone protocol of Aurora and this is just the beginning. It will be Aurora’s one-stop gateway with a suite of features welcoming users into the ecosystem.

The Papermill is an upcoming feature that everyone is waiting for. It combines both game theory and economy modelling into one.

Papermill participants are rewarded for HODL-ing. This game of patience rewards participants based on how long they HODL. The longer they HODL, the more $PLY they are able to claim.

The roadmap doesn’t just end here.

In the future, there will be self-repaying loans where users are able to use yield-bearing assets as collateral. Undercollaterlized lending and flash loans will be available to supercharge capital efficiency.

Furthermore, it will be introducing community governance where the community can vote on proposals and shape the future of Aurigami.

Should you ape in?

It is the airdrop season! Aurigami is giving out free airdrop to anyone who either deposits or borrows from the protocol.

At the time of writing, Aurigami is offering a boosted 5.68% APY on its USDC deposit. The interest paid out is using a combination of USDC and WNEAR. This 5.68% APY doesn’t include the $PLY airdrop.

While the APY is much lower than Anchor Protocol 19.53% APY, I believe the $PLY airdrop is able to make up for the opportunity cost of not farming on Anchor Protocol.

If you want to go full degen, you can use your deposited USDC as collateral to borrow more USDC at 5.79% APY and bridge it over to Terra and farm on Anchor Protocol at 19.53% APY.

TLDR

Aurigami is the first money market protocol on Aurora. It is backed by the biggest VC in the crypto space. It is currently giving out free airdrop to anyone who borrows or lends using Aurigami.

While the current APY for USDC stablecoin is only 5.68%, the PLY airdrop might make it all worth it.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief

Also Read: All You Need To Know About Bastion Protocol: The Leading DeFi Lending Protocol on Aurora