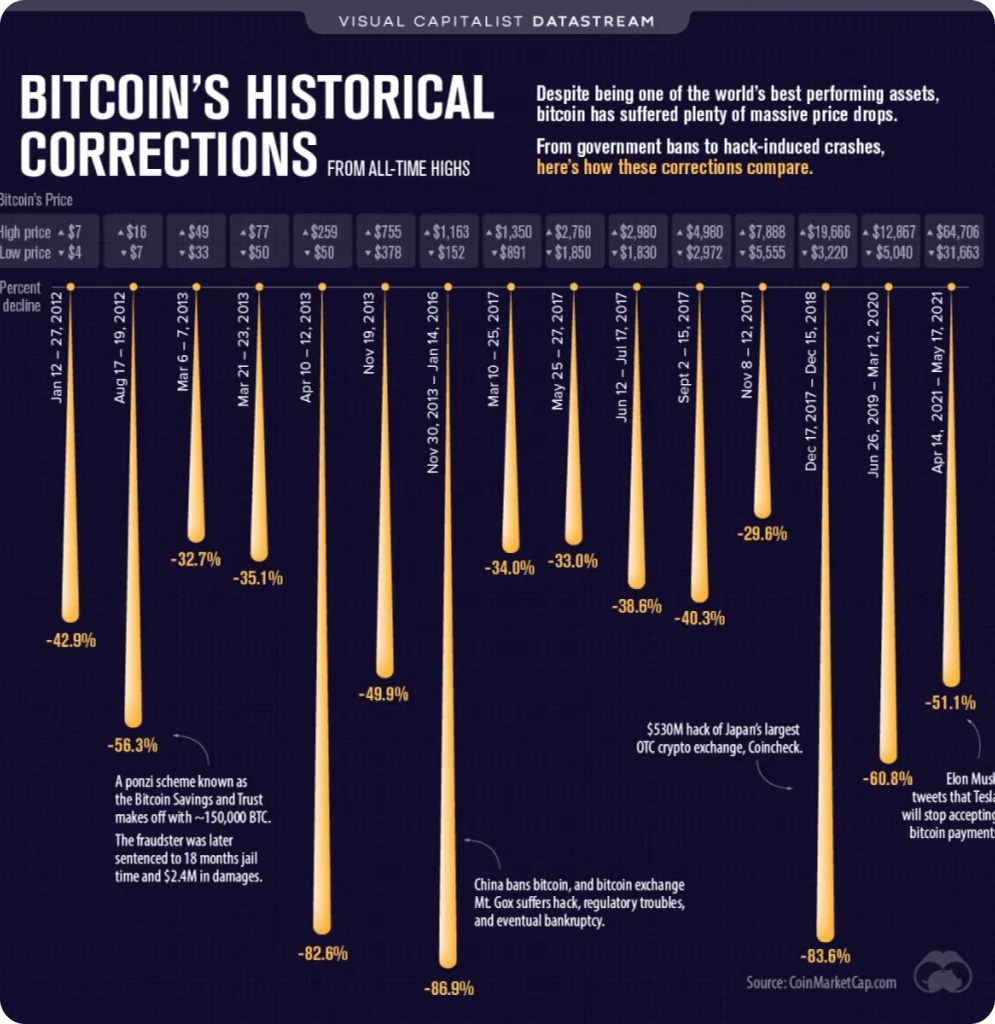

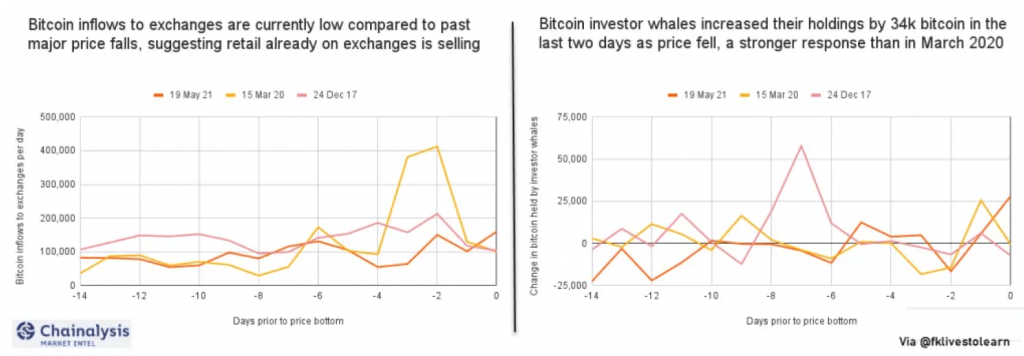

The recent cryptocurrency retracement saw the whole crypto market cap dropped by over 30% and the price of bitcoin dropping by 51% from its high of $64,700 in April to $31,000 in May, making it one of the largest pullback in history.

Here’s a quick look at some metrics and observation which supports a continued bull market thesis in 2021.

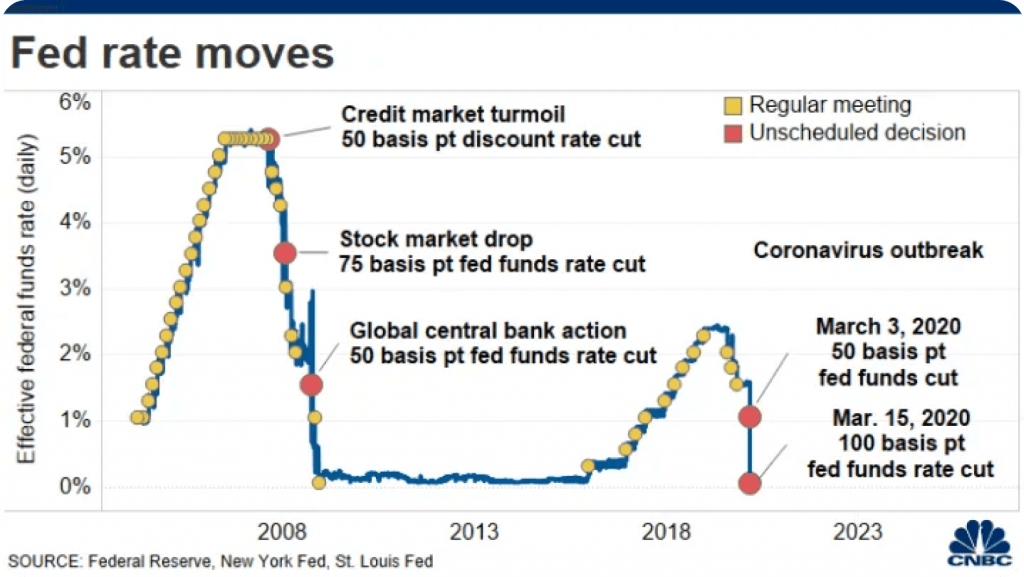

US Dollar rates and purchasing power are in all time low

Following the massive monetary quantitative easing which saw the federal reserve printing billions of dollars to support the US economy, the interest rates for USD remains low and the federal reserves has no plans to increase the rates.

With rates remaining low, assets such as equities or cryptocurrency enjoys a positive tailwind as investors are able to purchase these asset classes at a lower rate.

More money entering the financial system also means that the purchasing power of the USD continues to be eroded, leaving investors hunting for asset classes that can retain value better viz a viz the USD. Hence, investing in equities or cryptocurrency is a better alternative than holding fiat.

All these are bullish signs for cryptocurrency and remains to be the case even after the recent cryptocurrency retracement.

— still very much in tact even though there are taper talks and inflationary data, rates and the dollar still have not reacted, which is still very bullish for risk assets

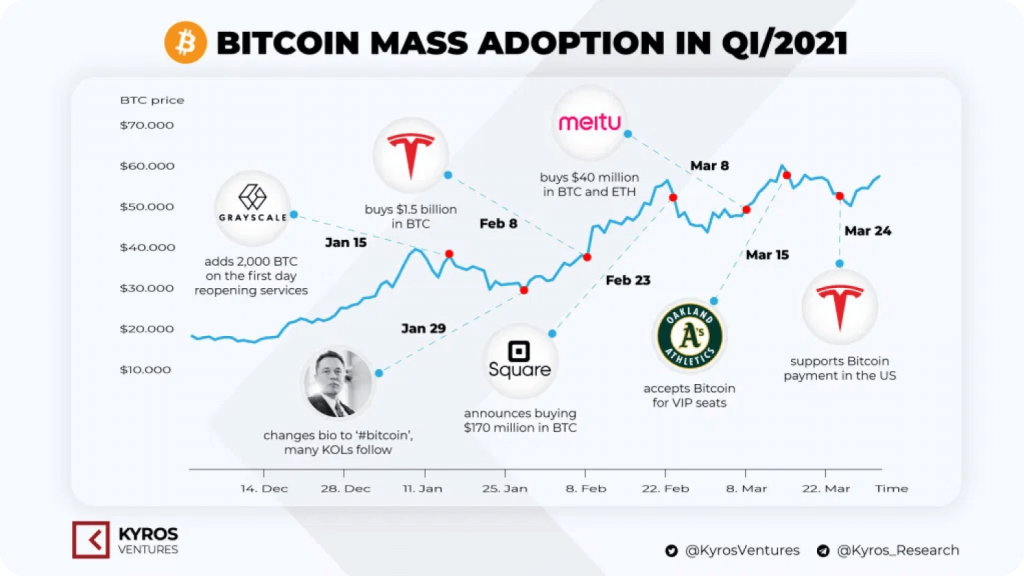

Huge institutional interest

Over the past few months, more and more institutions and banks had expressed interest in adopting cryptocurrency as a new asset class. Here are some headlines examples:

- Institutional Crypto Exchange LMAX Digital Hit Record $6.6B Volume on Bitcoin’s ‘Black Wednesday’

- Wells Fargo: US bank set to offer crypto fund to rich clients

- Citi Reportedly The Latest Bank To Consider Crypto After Soaring Client Interest

- Bitcoin is coming to hundreds of U.S. banks this year, says crypto custody firm NYDIG

- After Bitcoin, Institutions Finally Turning to Ethereum

- Ark Investment tips $20M into Grayscale Ethereum Trust

- Half of traditional hedge funds considering crypto investments, report finds

- Germany allows institutional funds to invest in cryptos

- America’s Fifth-Largest Banking Institution US Bank to Offer Cryptocurrency Custody

- Carl Icahn Says He May Get Into Cryptocurrencies in a ‘Big Way’

These are all just recent news signalling interests from institutions. As compared to retail investors, institutions have more access to capital and will be able to provide strong price supports to cryptocurrencies.

Strong fundamental growth and usage on overall blockchain ecosystem

Compared to the previous cryptocurrency price collapse in 2018, there are strong use cases and volume growth currently in the blockchain space.

In 2021, DeFi, NFTs, gaming are seeing huge amount of usage and volume, which 2018 was characterized by the surge in ICOs which are speculative in nature.

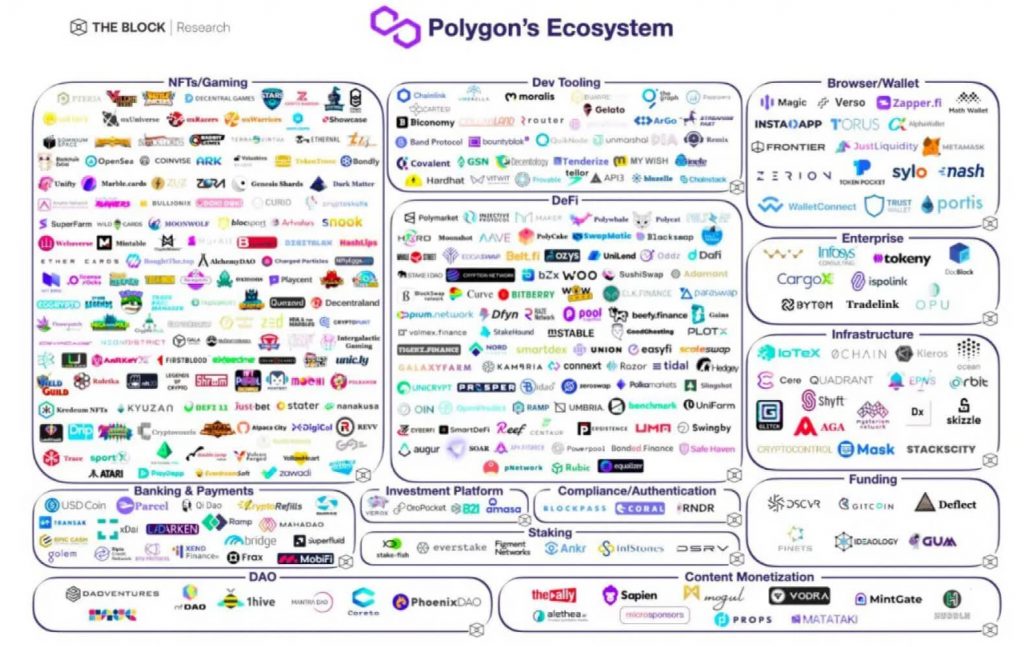

For example, Polygon, a scaling solution which is growing in popularity, has hundreds of Dapps built on top of it, with billions of dollars locked in its protocol to help the ecosystem grow.

Other than Polygon, there are also other blockchains such as Cardano, Solana, Cosmos with its own ecosystem of Dapps and its community.

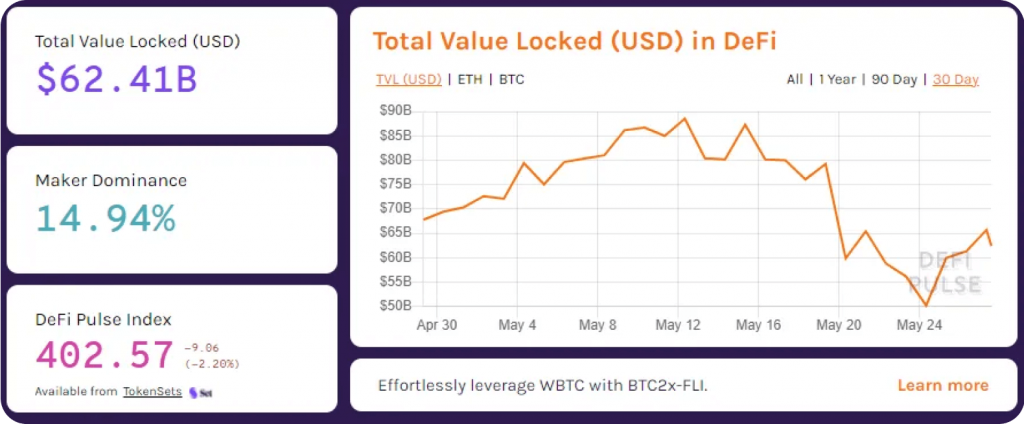

Currently, there are over $62 billion locked in DeFi projects according to DeFi pulse, signalling continued huge interest in the DeFi space. For context, there were less than $1 billion blocked in DeFi projects in May 2020, marking a 6000% year on year increase in TVL.

Other sources estimates the total value locked to be more than $100 billion.

Over $111 Billion Total Value Locked in Defi Ecosystem now. More than 68% value coming from ethereum blockchain.

— Documenting Ethereum 🦇🔊 (@DocumentEther) May 25, 2021

As the price of bitcoin struggles to break its all time high and trades sideways between $30,000 to $40,000 now, DeFi projects continue to grow in popularity and maturity.

The blockchain ecosystem is much more matured as compared to 2018, and it is likely that we are still early in this current crypto market bull cycle.

Also Read: Investor Or Gambler? Here Are The Top 3 Tell-Tale Signs That You Are A Crypto Gambler