The bear market has brought a time of quiet reflection to investors in the space. Did DeFi fail? Does the Metaverse really have a future? Are trading NFTs just a Ponzi? Is my coin better than any others? What makes or break a project? These are some of the crypto questions VCs might not want to answer or tell you the truth on.

Today, let’s deep dive into a thread warning us on what we as retail investors should be wary of.

Crypto isn't a fair playing field.

— Miles Deutscher (@milesdeutscher) May 3, 2022

The truth is that 99% of "retail" investors are at the behest of the top whales and VCs. So, how can you break the mould?

🧵: Here are 5 things that crypto whales and insiders don't want you to know (but you should). 👇

[Author’s Note: This article was adapted from a tweet by @milesdeuscher, a crypto influencer on Twitter. What you read should be used for educational and learning purposes and does not serve as financial advice.]

1. The Problem With DeFi Tokens

DeFi has worked quite wonderfully and reliably for its users. Lending, borrowing, trading spot on a DEX, or even trading synthetic assets or derivatives have been a solid demonstration of what decentralized financial products on-chain are like.

However, one key structural problem exists with DeFi platforms. It is, in my opinion, an open secret: where do the tokens fit in?

In DeFi, liquidity mining rewards exist for a reason: it serves to bootstrap the ecosystem by attracting total value locked and more liquidity, thus allowing it to generate some revenue – e.g borrowing fees, vault management fees, trading fees. But what happens after the bootstrap phase?

Miles argues that while tokens are a good way for decentralizing governance and enable a secondary market, most of these tokens are simply unnecessary.

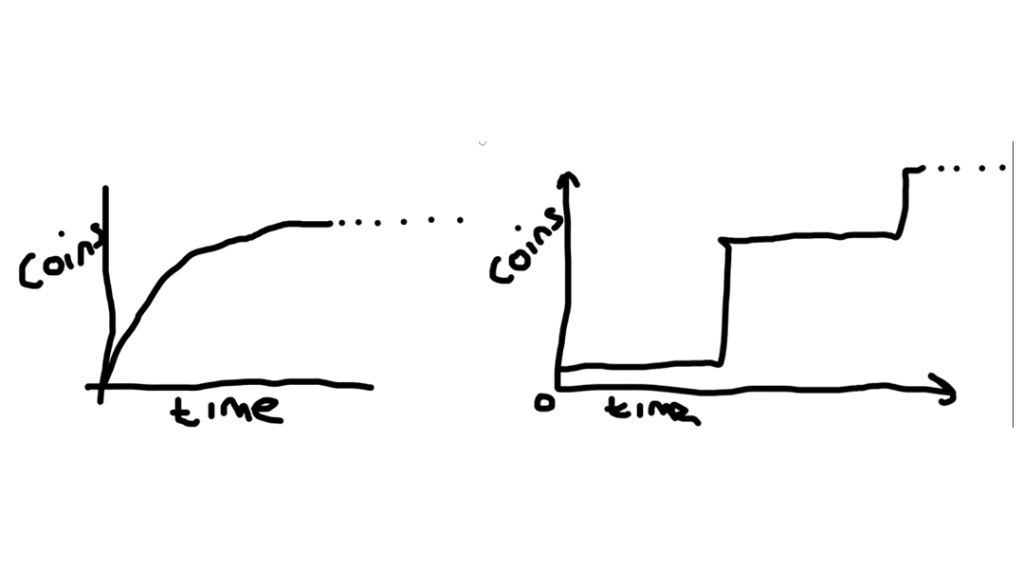

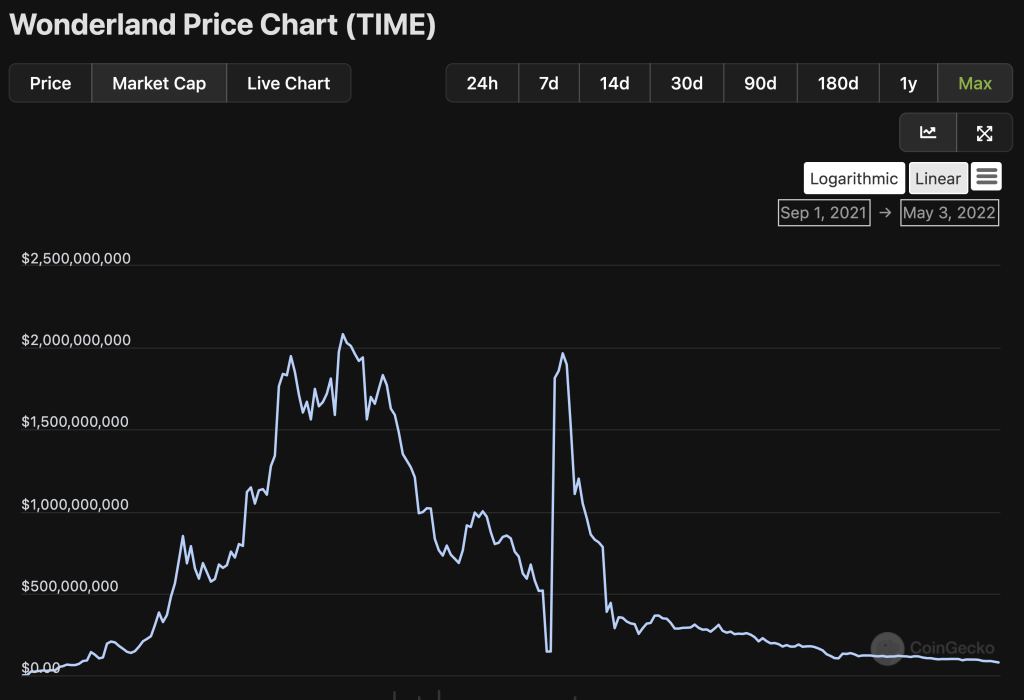

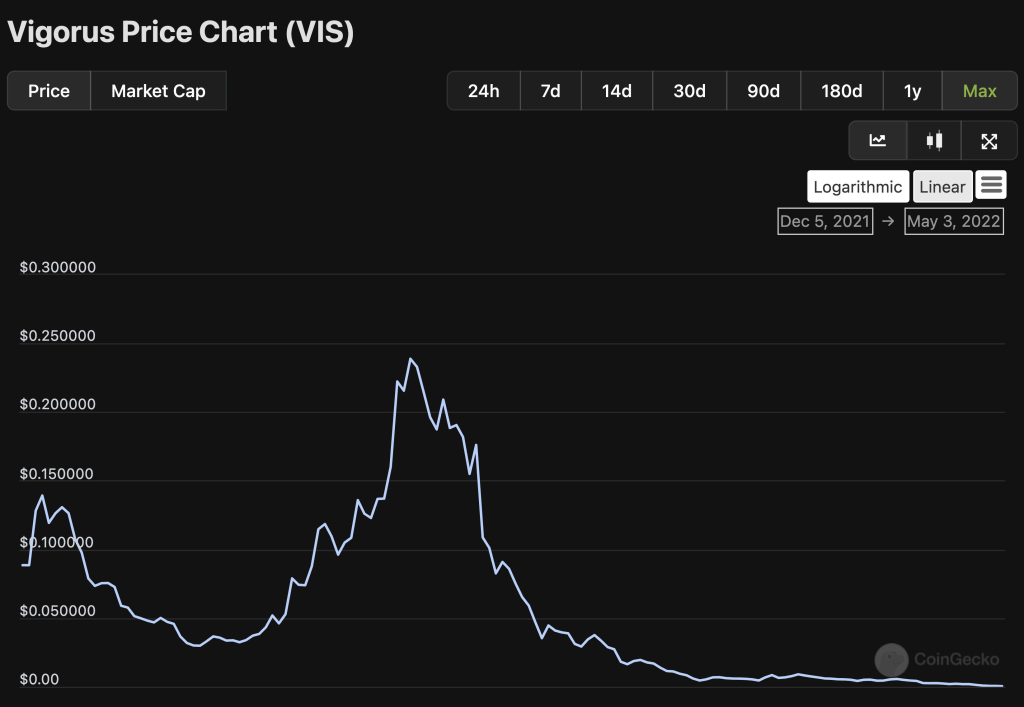

Tokens that do not capture value long term and earn a piece of the protocol’s revenue are valueless and ultimately dump hard once the hype from farming fades away.

Miles also raises a good point on DeFi token emissions: while these are attractive as initial rewards with high APR, they gradually enter the circulating supply and due to inflationary pressures, cause the value to plummet over time.

2. Bullish Crypto Unlocks by VCs? Think Again

2021 is a story of bullish unlocks

— Zhu Su 🔺 (@zhusu) January 7, 2021

In general for projects, VCs and private rounds get into these tokens at massive discounts during seed rounds or private rounds. Here are some details on the private rounds for the following L1s:

- SOL: $0.04

- FTM: $0.043

- AVAX: $0.50

- BNB: $0.15

Most of us retail forget that the market price might fall 50% from your initial entry, but private investors might still be up many times and in heavy profit.

The bullish unlock meme which worked in the past is unlikely to happen in the bear market as massive unlocks happen and private investors want to realize their gains and minimize their losses in a market downturn.

In fact, you should look at the portion of the supply that is unlocked and how steep the “cliffs” are when circulating supply increases.

Consider that token unlocks could also occur alongside protocol emissions, leading to a rapid increase in circulating supply over time.

And when the musical chairs stop and everyone is rushing for the exits, will the market demand be able to support current valuations?

$dydx down 92% and still $2bn+ FDV

— Algod🫐 (@AlgodTrading) May 21, 2022

2022-2023 will be a rough year for altcoins, people will start to understand the importance of FDV’s.

3. Lack Of Product

Miles’ next criticisms can be broadly applied to the wider crypto market, but is most apparent among Metaverse projects and “GameFi” – many of these projects have massive valuations (>$100m) without any actual game/NFT released or any form of actual revenue back to the holder.

While the market is pricing in future growth, how does this apply in a bear market where growth becomes relatively stagnant and unlocks on token supply start happening?

Personally, NFTs and GameFi have been a good exposure for beginners to enter the market and take a look at what blockchain offers. However, we still have a long road ahead, and I just do not agree with the fact that gaming projects that have not created a strong use-case for its token can be worth hundreds of millions of dollars.

4. APRs are meant to incentivise liquidity

In the real world, when companies first launch they often offer promotions to incentivise people to spend money/grow accustomed to their product.

In crypto, instead of incentivising via discounts, DeFi projects use token emissions to incentivise early liquidity.

This model has worked very successfully for the likes of $LUNA (via @anchor_protocol) and @CurveFinance as claimed by Miles.

However, these emissions end up being their downfall. Often times, the tokenomics lead to over dilution and a huge increase in circulating supply.

The question still stands, “what happens when emissions run out?” Well, protocols will need to pivot from incentivising liquidity towards incentivising fees.

Holders should primarily generate a return via fees, not emissions.

5. Crypto Whale/VCs Movements

For this section, Miles gives the age old adage by Warren Buffet: “Be fearful when others are greedy, and greedy when others are fearful.”

Whale holdings are roughly inversely correlated to price, and they tend to accumulate when the market is in max fear, and sell when people are too greedy.

This suggestion does make sense and highlights that most of us retail are often just small fishes in the sea – we often tend to ride the trends of what they are doing and most of the time, end up as exit liquidity.

To me, looking at on-chain data and what wallets are doing is just one part of a strategy you should employ. Furthermore, their accumulation and holdings might not paint the exact picture of what they are actually doing.

You should be aware that whales are just like you, and often, funds and whales do blow up and they can be wrong.

Solutions for retail

So far we have the following problems:

- Farming tokens are inflationary and (usually) valueless. Your holdings are eventually diluted.

- Token unlocks are significant in bear market

- Lack of actual product/delivery compared to funds raised

Does the team have a track record? Who are the investors? Is the current valuation reasonable compared to other projects in the same category?

Examining tokenomics is also important. Here are the following suggested from Miles’ tweets:

- Projects that generate real revenue from fees compared to emissions

- Revenue flows back to holder (a.k.a token value accrual)

- Tangible user growth

- Do not blindly chase yield

Closing Thoughts

I featured this tweet in the article as it highlights some very obvious incentive problems in crypto, and these weaknesses become very apparent in the bear market.

Of course, talking about it during the bull run is usually ineffective as number go up and people that stay in the sidelines apparently have fun staying poor.

It also does not seem clear to me (so far) what the best token value accrual mechanics are, and how exactly do certain projects and alts justify their prices once demand starts to fall off. Finding that one project or protocol that has strong incentive structures tied to their token, and can be sustainable in the long run is my goal in this current climate.

I always take a default stance of skepticism and believe that having strong critical opinions on a project and helps to filter out bad projects before I make a decision. Hopefully this tweet helps you the same way as it did for me – until then, do your own research, and survive.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief

Also Read: House Money Effect: 4 Mistakes That Crypto Investors Will Fall Prey To