Cryptocurrencies have given rise to decentralized finance applications and protocols and one such protocol is Aave, which allows anyone in the world to lend or borrow cryptocurrency assets without any intermediaries.

Similar to Uniswap which is a decentralized exchange, Aave is a decentralized autonomous organization (DAO) which is governed and operated without a single entity but instead by its token holders who vote on changes to the protocol.

Let’s take a deeper look at what exactly does Aave do.

Context

Traditionally, for anyone to obtain a loan, you would need to go to a bank and apply for a loan. The bank will ask you for a collateral, and in the case of a housing loan, the property will be your collateral, in exchange for giving you the loan. You would be required to pay the amount you borrow in monthly installments including the interest.

In decentralized finance however, there is no bank or any middle man. However, there are smart contracts which are computer codes automate and verify these transactions.

In the case of Aave, you can get a cryptocurrency loan from other people instead of from the banks.

How decentralized lending pool works

Similar as how you would in traditional finance, you would also need to put up a collateral in the form of cryptocurrency to borrow cryptocurrency from the Aave pool.

In its early days, in order for you to borrow a cryptocurrency from someone, you would have to find someone on the platform to lend it to you—at a price and terms you both agreed upon.

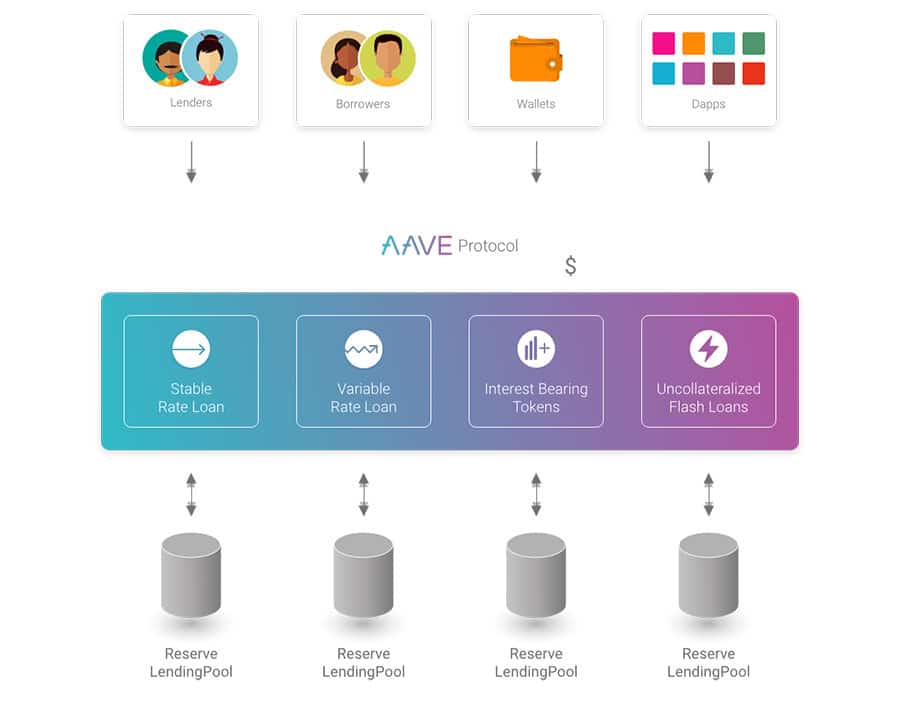

This peer-to-peer lending model has evolved into the current pool-to-peer lending model, and the concept is similar to how a liquidity pool works in decentralized exchange.

The term liquidity pool is also used in Aave – anyone can deposit cryptocurrencies into Aave’s “liquidity pools”. These deposits will become the source of fund where other users can borrow from. Users who deposits their cryptoassets into the liquidity pool will earn “aTokens” which represents the stake of the pool and how much interest they earn from that pool.

Depositors can withdraw their assets at any time, with the entire process taking place automatically.

Decentralized lending protocols like Aave also adopts overcollateralization – which means you have to put up a higher collateral amount that your amount borrowed. This is due to the volatile nature of cryptoassets – is it possible for these lending protocols to liquidate your collateral to cover the cost of your loan.

How are interest rates determined

The interest rates on each asset in Aave is determined by the “utilization rate” of the asset in the pool. If most of the assets are used or lend out, the interest rate will be high to entice more liquidity providers to deposit more capital into the pool.

On the other hand, if no assets in the pool are used, the interest rate charged to borrowers will be low to entice more borrowing.

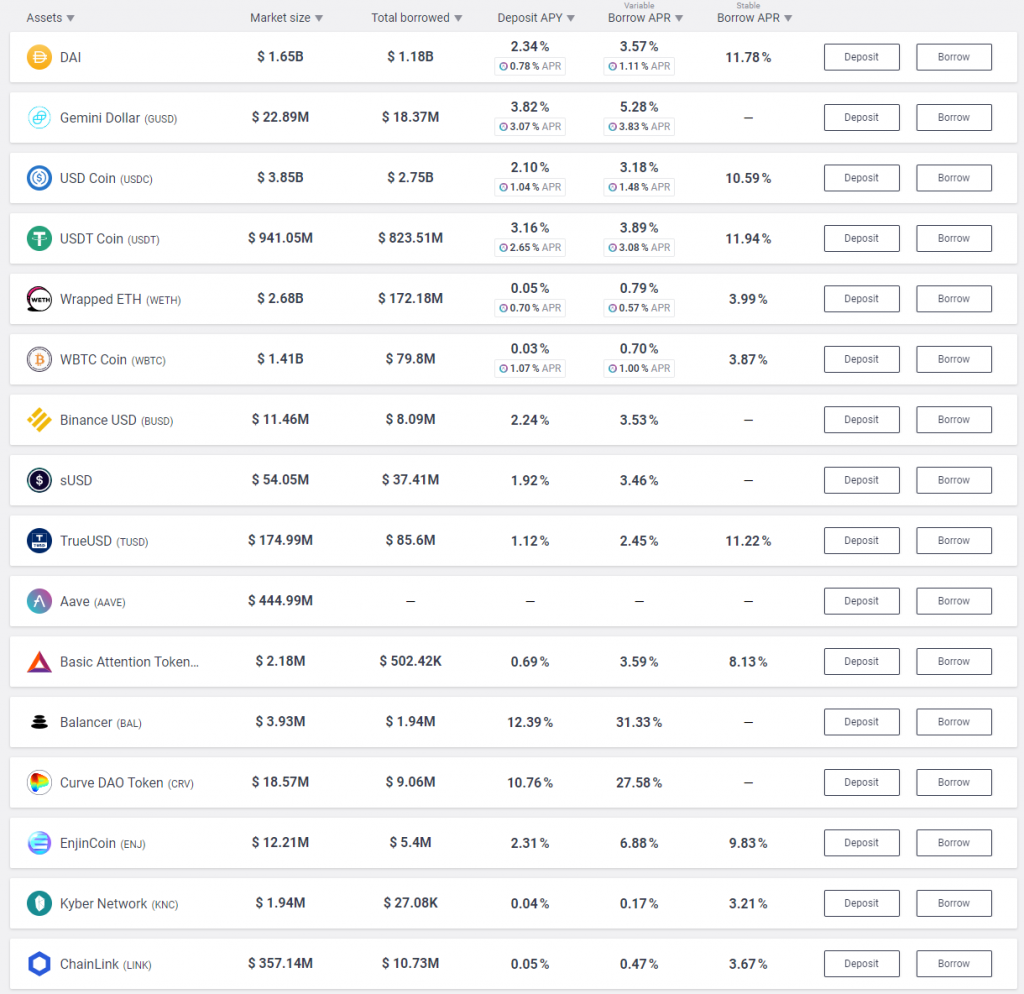

Here’s a look at the current interest rates charged by Aave:

How are decentralized lending protocols valued

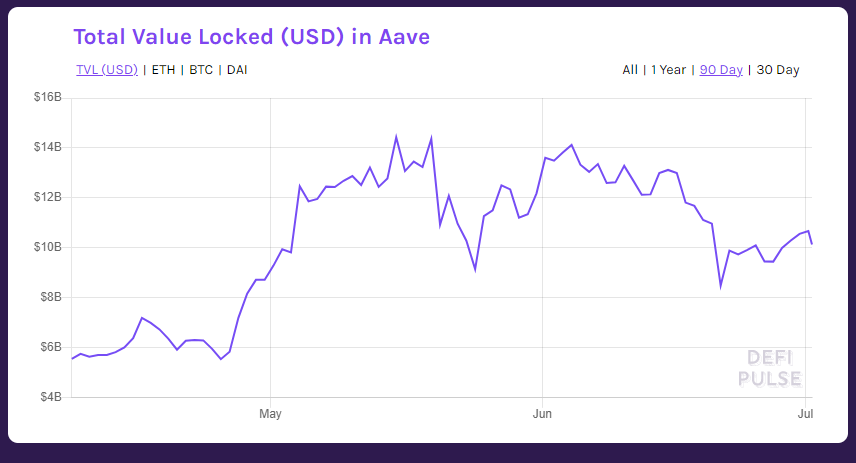

As with all financial institution, the key value of a decentralized lending protocol like Aave lies in the total value locked (TVL) or the total amount of cryptocurrencies depositted acting as collateral .

Another common metrics to keep a look out for is the transaction volume as well as the amount of token pairs and liquidity pools available.

Here’s a look at the key metrics of Aave:

Aave currently has pools for over 20 Ethereum-based assets, including DAI, USDC, BUSD, Link and more.

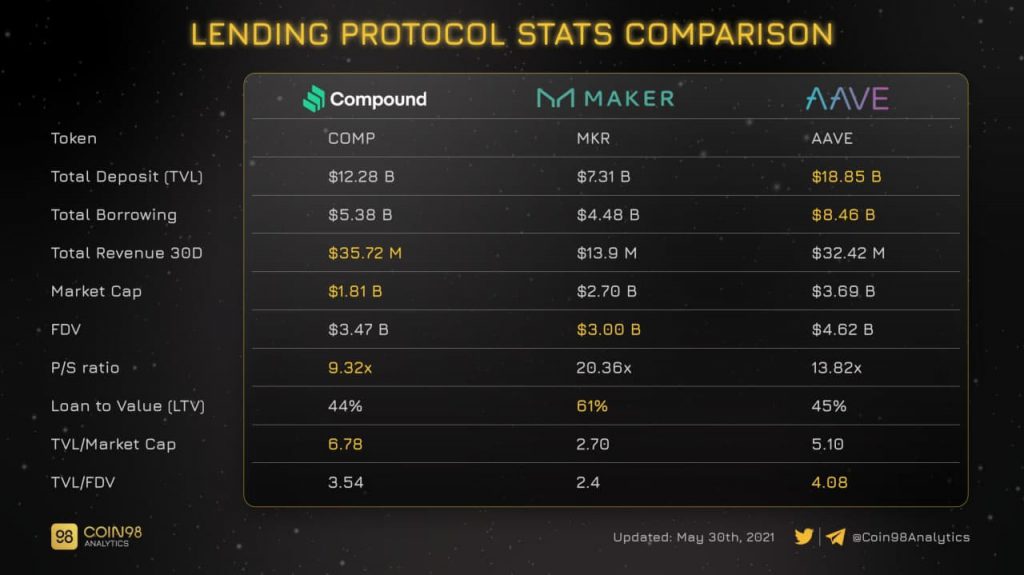

Here’s a comparison of the key metrics between Aave, Maker and Compound by Coin98.