Over the last few months, the prices of cryptocurrency has retraced from its all time high. Bitcoin in particular, saw its price drop more than 50%, from a high of $64,800 to the current price of $33,000.

With cryptocurrency prices and market cap dropping, it is a good time to relook at the fundamentals of bitcoin and why it is here to stay for the long run.

1. Sound Money

Sound money refers to money not liable to sudden appreciation or depreciation in value.

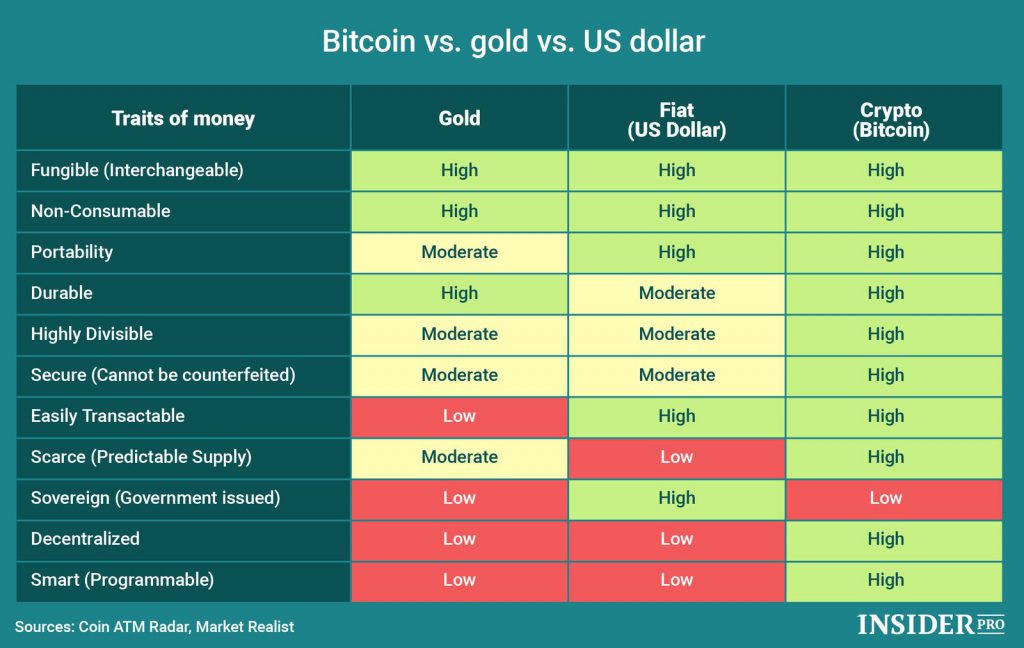

Bitcoin is arguably one of the most efficient form of “sound” money in existence. It has historically maintained its value though with relatively high volatility, has sufficient liquidity for anyone to buy or sell at any given time. It is also durable, portable, divisible, and it is censorship resistant.

2. Scarcity

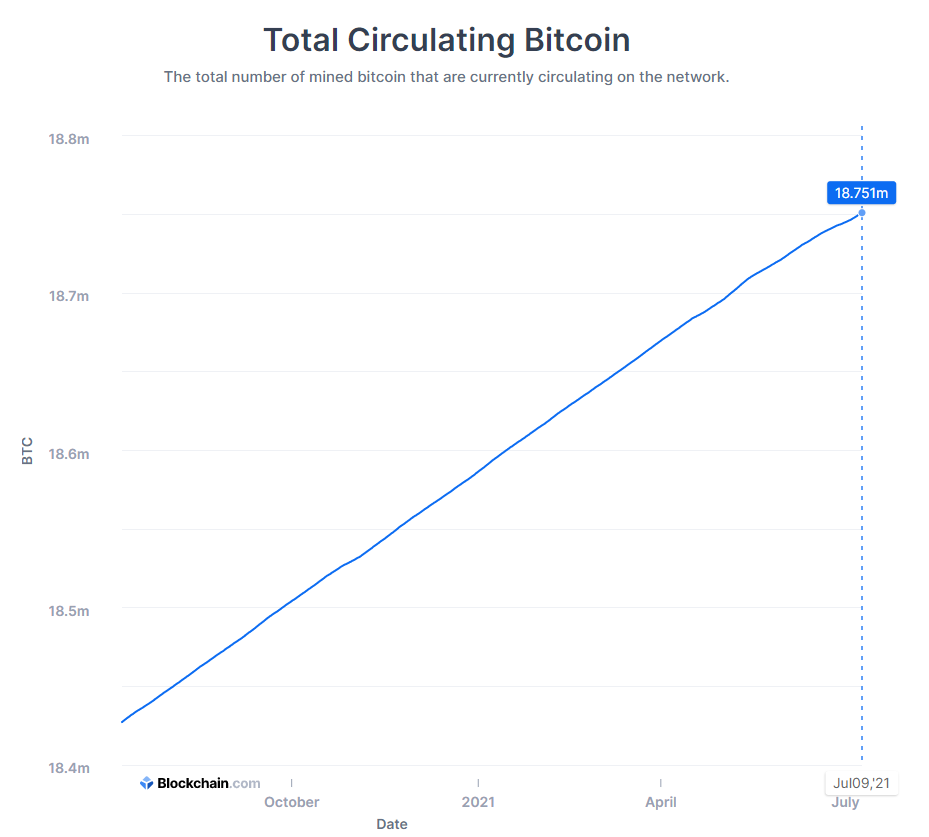

Bitcoin is the first asset in existence which has a supply that is strictly defined and limited. When the Bitcoin protocol was created, it was built such that no matter how many people joined the Bitcoin network, there would never be more than 21,000,000 bitcoins in existence.

As of the time of writing, there are almost 19 million bitcoin in circulation, leaving only 2 million more unmined bitcoins that will ever be produced.

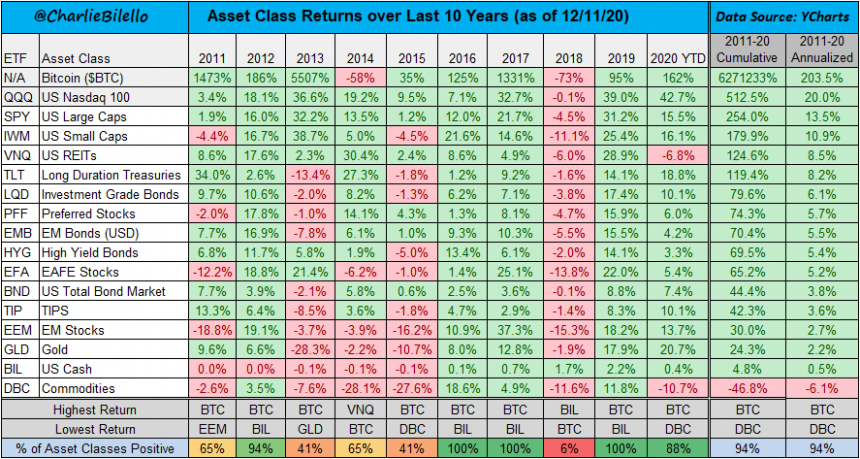

3. Store of Value

Once all 21 million bitcoins are mined, there is no technical possibility of increasing its supply to match any future increase in demand.

Hence, Bitcoin acts as a whole new type of asset class, and may be a better and more efficient form of a store of value asset as compared to other assets in human history.

4. Liquidity

While we have seen high volatility with regards to Bitcoin price movement, Bitcoin has proven to be highly liquid, even with large investors making billion dollar trades. Institutions can instantly buy or sell a large amount of Bitcoin without causing a huge impact on prices.

There has never been a case where you are unable to sell your Bitcoin.

5. Durability

Durability is a major issue for fiat currencies in their physical form. U.S dollars can be counterfeited, torn, or otherwise be rendered useless. Bitcoin, however, is immutable, and is as durable as the hardware you use to store it.

6. Portability

Another feature of Bitcoin is that is it borderless and transactions can happen anytime.

You can send bitcoin across anywhere in the world anytime of the day. This makes it not only portable, but also censorship resistant. Regardless of any economic conditions, be it during a pandemic or recession, bitcoin can be transacted across any two wallets instantly.

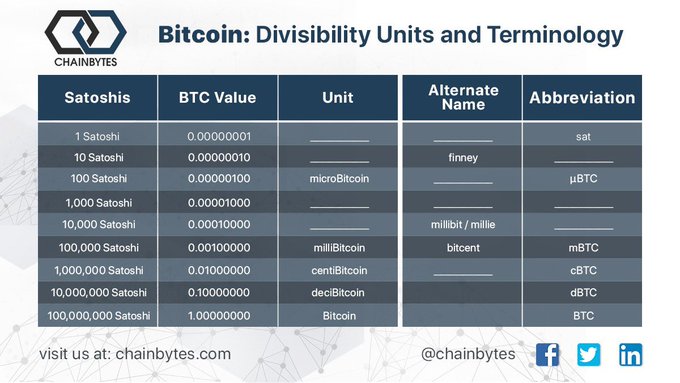

7. Divisibility

A core characteristic of sound money is in its ease to transact. For this case, Bitcoin is actually divisible up to 8 decimal points. The smallest unit, a “Satoshi”, is equal to .00000001 $BTC, allowing for quadrillions of individual units to be distributed throughout a global economy.

8. Decentralization

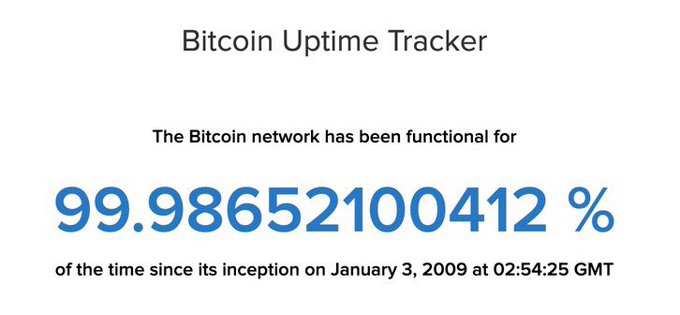

The Bitcoin protocol is secured by thousands of nodes distributed all across the globe.

Due to this, the network maintains full uptime and is resistant to any single point of failure. Anyone and everyone can participate in and help secure the Bitcoin network.

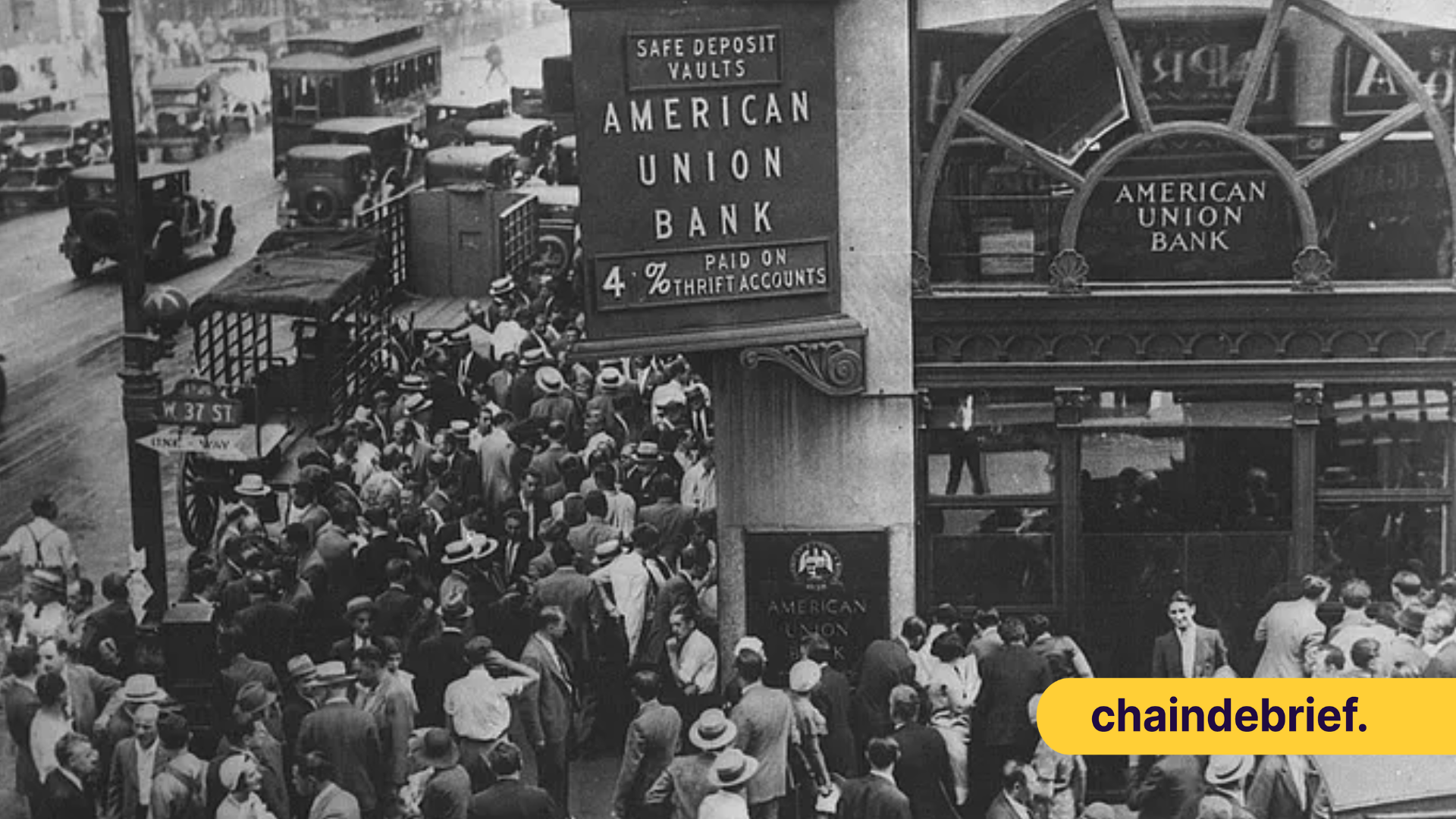

9. Exclusion of the middleman

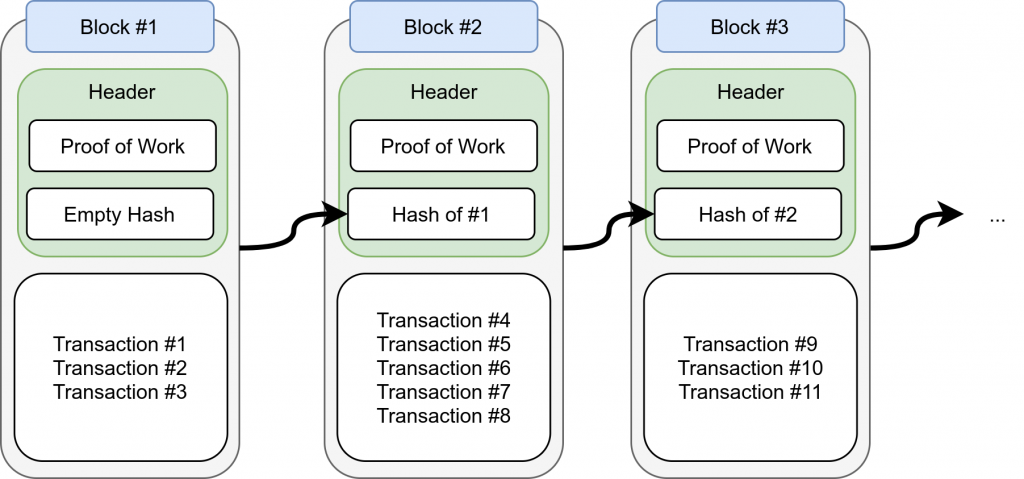

The Bitcoin protocol runs on trust. Instead of putting our trust in banks or other financial intermediaries, we can instead place it in a distributed network of computers that allows for a true peer-to-peer economy.

With Bitcoin, two users can transact with one another and trust that the Bitcoin protocol will verify and execute the transactions from one party to the other. This is done purely via lines on codes on the Bitcoin protocol.

10. Transparency

Building on the previous point, all transactions done on the Bitcoin network are broadcasted out to the network and stored on an immutable ledger accessible to anyone at any time.

Everyone is in agreement with the current state of the ledger, and participants always have the ability to check up on past transactions and verify it.

11. Security

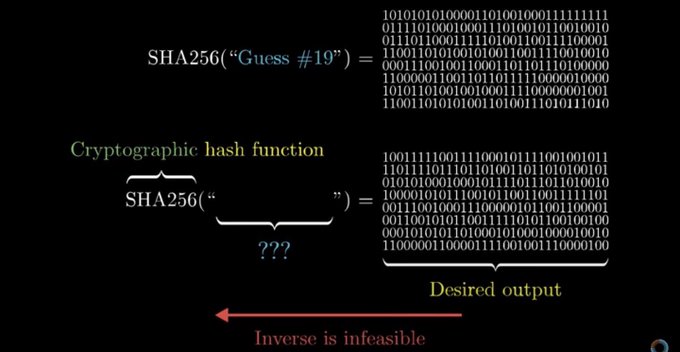

Bitcoin uses the SHA256 security protocol, which is one of the most secure ways to protect digital information.

The complexity of SHA256 as well as the proof of work protocol makes it not only prohibitively expensive, but virtually infeasible for a malicious actor to rewrite or reverse transactions.

12. First Mover Advantage

Bitcoin has a first mover advantage as a notable cryptocurrency and a brand new asset class, and has developed a powerful network effect since its launch in 2009. Its ability to combine network effects in the likes of Facebook along with a monetary incentive has led to growth never seen before on a global scale.

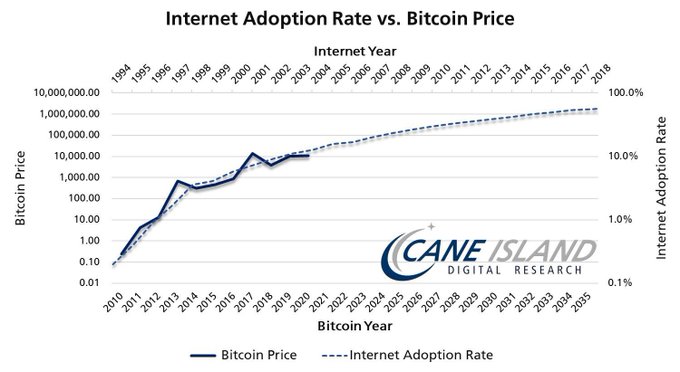

Cryptocurrency technology adoption is currency the fastest in human history.

13. Adoption

The robustness and feasibility of bitcoin as a digital payment solution has garnered the attention from some of the largest names in the financial sector.

We have seen companies such as VISA, Square, PayPal allowing their users to purchase and transact in cryptocurrency. Most recently, El Salvador became the first country to introduce Bitcoin as an official legal tender in the country.

14. Institutions

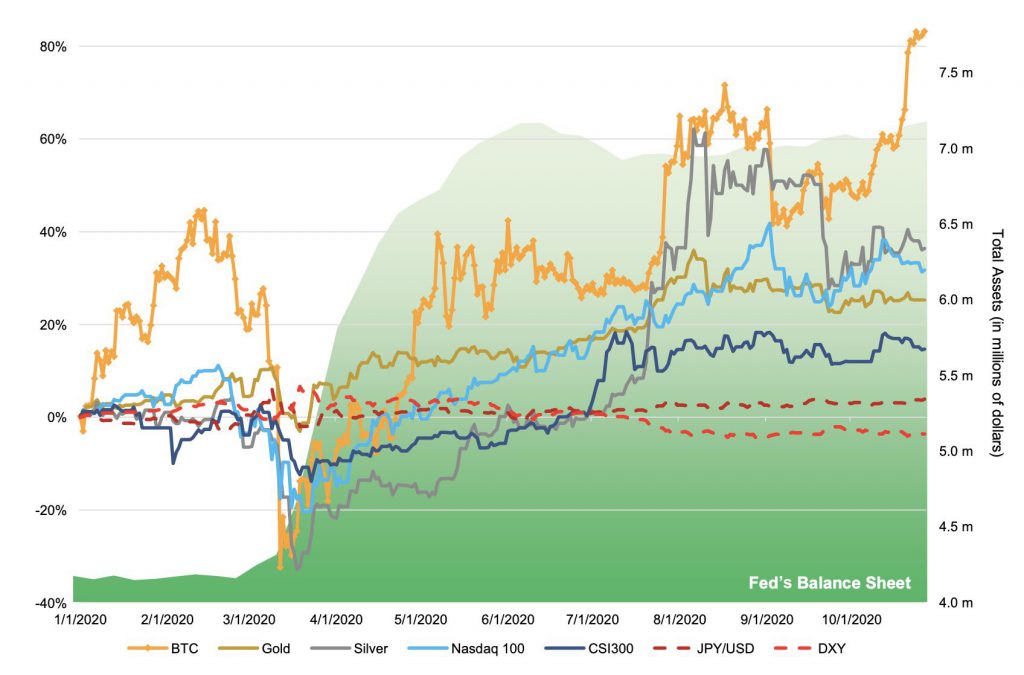

Bitcoin has also proven itself as a store of value with significant liquidity, and has outperformed every asset class in existence. Due to its performance as an asset class, it has gained a lot of institutional interest such as Tesla, Microstrategy, Greyscale Trust and more.

15. Exchange Traded Funds

One of the highly waited news is the approval of a Bitcoin or cryptocurrency exchange traded fund (ETF). An ETF would pave the way for institutions, hedge funds, businesses, and less tech savvy individuals to buy more cryptocurrency. Acceptance of bitcoin as an ETF will allow for hundreds of billions of new dollars to flow into the market.

Ark Invest also recently filed for a new bitcoin ETF called ARKB and is currently pending approval from the U.S. Securities and Exchange Commission.

16. High adoption rate

Bitcoin is growing at a rate which has never been seen before. One of the most prominent displays of the power of Metcalf’s law and exponential growth to date is the Internet – and it is interesting to note that Bitcoin adoption is growing quicker than the Internet.

17. Digital Gold

Bitcoin has proven to be a significant competitor to gold, and is arguably better as a store of value based on the various pointers mentioned earlier. As compared to gold, Bitcoin is highly portable, more secure, decentralized and highly programmable.

Even with its clear advantages, Bitcoin’s overall market cap is at a fraction of gold’s market cap – Gold’s current market cap is at $11.468 trillion while Bitcoin’s market cap is only at $615 billion at he time of writing. 1 Trillion equals to 1000 Billion, making Bitcoin potentially 20 times undervalued if Bitcoin were to be valued equally as gold.

19. Layer 2 developments

There are numerous efforts working towards scaling bitcoin, with the most notable being the Lighting Network.

The Lighting Network allows for instant, high volume micropayments, and is capable of handling a higher transactions per second, thereby increasing bitcoin’s transaction speed as adoption ramps up.

"The Lightning Network is now at the point where instant and near-free settlement is available online." – @PeterMcCormack

— Bitcoin Magazine (@BitcoinMagazine) July 3, 2021

20. Inflation

Inflation in government issued fiat currencies is rampant in third worlds countries and the United States, and has only shown signs of increasing. This is especially so during the COVID-19 pandemic which saw the government around the world printing more fiats to support the economies of their countries.

As of Dec 16th 2020, 35% of all the US dollars ever printed by the government were printed in the last 10 months. All fiat currencies are centralized currencies and central banks around the world are free to print and issue any amount of money they deem necessary.

Bitcoin on the other hand, has a finite amount of supply – there will only be 21 million bitcoins being mined, with almost 19 million of them already in circulation.

Also Read: Ethereum’s 2021 Q1 Network Revenue Grew 200x To $1.7B