Key Takeaways:

- The Monetary Authority of Singapore (MAS) just made a proposal on new crypto regulations for investors

- The proposal includes a risk assessment test, banning of leverage trading and borrowing, and restriction on offerings as incentives

- MAS continues its initiative to research use cases of blockchain announced earlier in June 2022

___________________________________________

Singapore has plans to tide the speculative nature of cryptocurrencies by retail users by making it harder to trade digital assets. While the rules you are going to hear may come as a hindrance to many crypto retail users in Singapore, it is the government’s effort in ensuring investments of retail investors are “ring-fenced.”

Many anticipated this action from the Monetary Authority of Singapore (MAS), especially after the flurry of insolvencies of big crypto players such as crypto lender Celsius and Three Arrows Capital, who were tangled in the crash of LUNA’s stablecoin TerraUSD.

The negative sentiment of crypto from this major event was the common consensus among retail investors as well as those on the outside, especially when the token literally went from US$100 to zero in just a matter of days, many felt the aftermath with their wallets burnt.

As it was a clear indication for the MAS had to step in to prevent this diabolical from happening once again, they recently proposed new rules which may change the landscape of crypto investing in Singapore for the years to come.

1. Risk Assessment Test

This test for retail investors is important for customers to have a certain level of understanding of the possible risk of crypto before partaking in any trades.

Singapore made it compulsory for primary school education. And in my opinion, this ‘risk test’ could be the first step in educating the masses instead of allowing investors to jump in blindly. An arduous and some may say, troublesome step, but a necessary one in ensuring better safety in the country.

Moving forward, don’t you think it will be cool if schools should have basic lessons for investing? and at the end of it, they have this very risky test for assessment.

Especially when the shift towards digitalization may be the coming of age with the new generation, it may be good addition but definitely foresee hard execution on the national level.

2. Ban on borrowing and use of credit cards for crypto

This would include stopping companies from using tokens deposited by retail investors for lending or staking to generate yields.

Crypto prices are “highly volatile” and leverage can bring customers with big losses (and big wins), the central bank said in the paper Wednesday, adding the retail sector shouldn’t be able to use credit cards or other credit facilities to buy tokens.

The restrictions don’t apply to high-net-worth investors though, who can qualify for a wider range of investments in the city-state.

Under the new guidance, which wouldn’t be applied to institutional investors, crypto trading platforms are not allowed to offer incentives like deposit bonuses to attract retail customers.

Leverage is a scary thing, but it is not always dark and gloomy. With the right risk management strategy, trades can be made with minimal downsides. But of course, with subjective risk preferences across individuals, throwing a wider blanket on regulation may be an easier solution for individuals suffering similar losses from what happened with Terra.

3. Restriction on offering as incentives

MAS currently expects financial institutions to ensure that any gift or incentive does not unduly influence the decision of the retail customer to purchase any financial product or service.

These offerings can be in the form of free trading credits or DPTs which can entice retail customers to participate in DPT services without fully considering the risks involved.

Another hit for crypto. This could be damaging for airdrops in the future, especially when they come from rewards to early adopters for a particular project, breaking this sector down will reduce participation as a whole.

The future of DeFi in Singapore

This week in #bitcoin #crypto

— Lark Davis (@TheCryptoLark) January 21, 2022

– Russia's Central bank wants to ban

– EU Regulators want to ban POW mining

– Spain, UK, Singapore banning crypto ads

– Indonesian Islamic leaders declare crypto haram

LOL, when will they learn?

The non-binding guidelines also prohibit publishing ads on public transport, or through broadcast and print media. They are also discouraged from engaging third parties, such as social media influencers, or providing physical ATMs in Singapore for dispensing crypto tokens.

Instead, crypto firms can only market their offering on their own corporate websites, mobile applications or official social media accounts.

As the world gets to grips with tokenization and DeFi, Singapore regulators are also exploring the economic potential and value-adding use cases of these new technologies.

Earlier in June, MAS launched a collaborative initiative to research use cases of open and interoperable networks within the blockchain ecosystem.

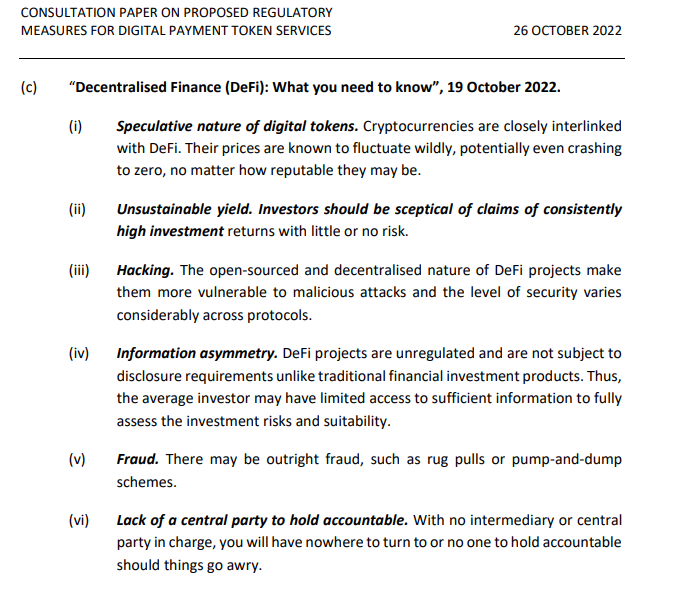

The above-mentioned are proposals by the MAS, but they also brought up relevant pain points the current DeFi actually faces.

At its core, my view on regulations from governing bodies is always meant to have the best interest of citizens, but the dilemma strikes when it goes against the decentralized nature and premise of web3.

Perhaps, there needs to be a common consensus, it should not be a battle between the two, but more of a complement.

There is no doubt harnessing web3 technology right now, on the global level, may come with inefficiencies, but regulation could help sharpen the tool.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief