“My(Vitalik) excitement about Ethereum is no longer based on the potential for undiscovered unknowns, but rather in a few specific categories of applications that are proving themselves already and are only getting stronger.”

In this article, we dissect three items on Vitalk’s new post on why the Ethereum ecosystem excites him, what some of the applications are and which applications he is no longer optimistic about.

What in the Ethereum application ecosystem excites mehttps://t.co/QxCa6EoWDl

— vitalik.eth (@VitalikButerin) December 5, 2022

1. Money

Payments in crypto have come a long way. While some use crypto as a means of investment, others might use it to transfer money internationally; the most meaningful use of crypto remains in the simple transaction for payments.

All the essential items you require to “live” require payments in one way or another. In fact, before NFTs and the wonders of DeFi, the entire premise of crypto started as an alternate payment method.

However, unlike the ease of convenience we Singaporeans use to make payments with “paywave”, crypto has a long way to go, especially in transaction time and transaction cost.

However, “as a side effect of the Merge, transactions get included significantly more quickly, and the chain has become more stable, making it safer to accept transactions after fewer confirmations.”

Ethereum is making steps towards achieving that goal, and they are not rushing it. The merge took a long time coming; they focused on what mattered most, ensuring its success. Along the way, though, we saw new alternatives for scaling; the lights of optimistic and ZK rollups are quickly proceeding in positive favour.

At the same time, the FTX collapse played an important factor in driving interest in transacting on-chain. It reminded everyone that even “the most trustworthy-seeming centralized services may not be trustworthy after all.”

Also Read: Signs The FTX Crash Was Bound To Happen

Stablecoins

Crypto’s positioning here offers several advantages. One of which is the “representation of private money in a cashless society,” but even so, it remains a fact that crypto is volatile, and the volatility can make it difficult the use savings and business.

But that segways perfectly to the idea of stablecoins.

The value of stablecoins has been understood in the Ethereum community for a long time. Quoting a blog post from 2014:

“Over the past eleven months, Bitcoin holders have lost about 67% of their wealth, and quite often, the price moves up or down by as much as 25% in a single week. Seeing this concern, there is a growing interest in a simple question: can we get the best of both worlds? Can we have the full decentralization that a cryptographic payment network offers but at the same time have a higher level of price stability without such extreme upward and downward swings?”

While the successful stablecoins we know about today (USDT, USDC etc.) stem from centralized roots, on-chain stablecoins have various convenient properties. (1) Open use for anyone, (2) Resistant to censorship and (3) Interacting well with on-chain infrastructure, e.g. DEXes.

Vitalik sees stablecoins in three categories.

- Centralized stablecoins; Maximum efficiency, easy to understand but vulnerable to the risk of a single issuer. Eg. USDC, USDT and BUSD

- DAO-Governed RWA (real-world asset) backed stablecoins; Resilient by diversifying issuers but vulnerable to repeated issuer fraud or coordinated takedown. E.g. DAI.

- Governance minimized crypto-backed stablecoin, maximum resilience but requires high collateral requirements and is limited in scale. Eg. RAI, LUSD

These three sort of form a stablecoin trilemma. The USDC today will likely work tomorrow, but in the long term, its “stability depends on the macroeconomic and political stability of the United States.”

On the other hand, RAI is resistant to all these risks but has negative interest rates.

DAO-governed RWA may hit the sweet spot, combining robustness, scalability, economic practicality and censorship resistance.

2. DeFi

What was seemingly started as a financial means to earn might have turned out to be a “monster” which relied on unsustainable forms of yield farming. Vitalik added that “decentralized stablecoins are, and probably forever will be, the most important DeFi product,” but others also play an essential niche.

Honestly I think we emphasize flashy defi things that give you fancy high interest rates way too much. Interest rates significantly higher than what you can get in traditional finance are inherently either temporary arbitrage opportunities or come with unstated risks attached.

— vitalik.eth (@VitalikButerin) June 20, 2020

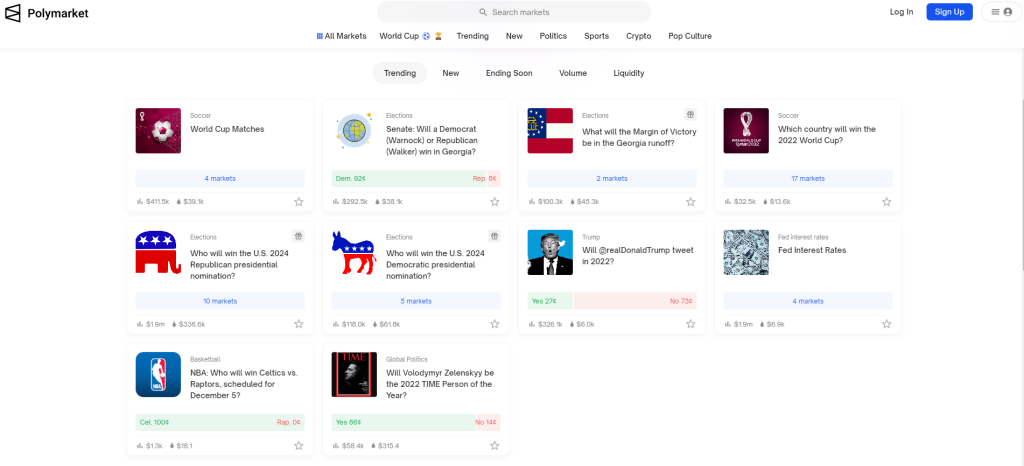

Prediction markets

A prediction market is an exchange-traded market where individuals can bet on the outcome of various events with an unknown future.

Think of it like a Singapore pool, where you can bet on future events, like the results of any sporting matches to FED interest rates.

Prediction markets are valuable as an epistemic tool, and there is a genuine benefit from using cryptocurrency in making these markets more trustworthy and globally accessible.

“I expect prediction markets not to make extreme multibillion-dollar splashes but to grow and become more useful over time steadily.”

Synthetic assets

Especially with stocks and real estate, “the main question is whether or not someone can create the right balance of decentralization and efficiency that gives users access to these assets at reasonable rates of return.”

Layers for efficiently trading

Vitalik refers to a world where trading assets will be accessible regardless of the type of assets users use on-chain. Imagine you can easily trade ETH with the synthetic help of Tesla stock or any more advanced asset class; this layer will have value.

3. The identity ecosystem

Identity is essential in a decentralized world. It gave birth to the demand for naming conventions, e.g. ENS, and verification concepts such as ZK rollups. Broadly, Vitalik categorized digital identity into four examples, 1. Names, 2. Attestations (evidence of proof of something), 3. Proof of personhood, and 4. Basic authentication.

“For a long time, I have been bullish on blockchain identity but bearish on blockchain identity platforms.” While we are searching for a platform that can fulfil all purposes, an attempt to create a centralized platform to achieve all of these tasks will not work.

There is a network effect of these different services to collectively create an ecosystem that provides strong use cases for users and applications. Some give birth to new communities, which may spill over to the existing way of life using digital passports and identification.

Through this Soulbound Tokens, people could easily hands out and use Proof of Attendances Protocol (POAP), Certification NFTs, Affiliation NFTs, etc as an identification method for the wallets that holds it.

— Koinpro (@Koinproco) June 20, 2022

All of the above will lead to a massive challenge in the future, privacy. So far, there is always a way to solve problems. Scalability? Perhaps solved with rollups. In the case of privacy, putting a large amount of data on-chain poses certain risks that users undertake, which can be solved by using ZK-SNARKS.

“Privacy, however, must be worked on intentionally for each application.”

Explain zksnarks to a five year old pic.twitter.com/o6ffIyFSc8

— Kobi Gurkan | ⬡ (@kobigurk) December 1, 2022

The challenges ahead

The main challenges we face in crypto today are that blockchains are not scalable, transactions take a reasonably long time, and the web3 wallets give users low convenience and low security.

While there are solutions out there, with decentralized platforms to hold your funds, rollups helping with scalability, and the rise of EIP-4337 (a proposal on using ZK SNARKS on Ethereum), there needs to be an intentional effort on the application layer itself.

Ethereum roadmap features I'm most excited for:

— pseudo 📜 (@pseudotheos) December 5, 2022

Withdrawals (soon!)

In-protocol PBS

EIP-4844

EIP-4337

Verkle tries

Multidimensional EIP-1559

“Many more stable and boring applications are not built because there is less excitement and less short-term profit to be earned around them.”This can be seen in non-financial applications having little hope of having a break out in the market because they do not have a token at all, but they likely will be the most valuable for the ecosystem in the long run.

Ethereum’s next major anticipated update is the Shanghai hard fork, enabling users to withdraw their staked Ether. The upgrade is scheduled for the second half of 2023.

Also Read: I Asked OpenAI 22 Questions About Blockchain, Here Are The Answers

Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: ChainDebrief