Falling prices, rumours of capitulating, protocols crashing, stale DeFi Activity, and at face value, it seems crypto and its narratives are experiencing a noisy gloom and uncertainty.

Many emerging trends and themes are shaping to define the remainder of 2022 and potentially bring in the next opportunity for generational wealth. Let’s dive in and see what investors should keep top of mind as the second half of the year comes into play.

1. The Ethereum Merge

One of the significant narratives to look out for the rest of the year is The Merge. The run-up, timing, and execution will dominate short-term action surrounding the event, but the actual material impact will come after.

The Ethereum 2.0 upgrade will see the network transition from a PoW to a PoS consensus mechanism which will have massive ramifications across the Ethereum ecosystem entirely.

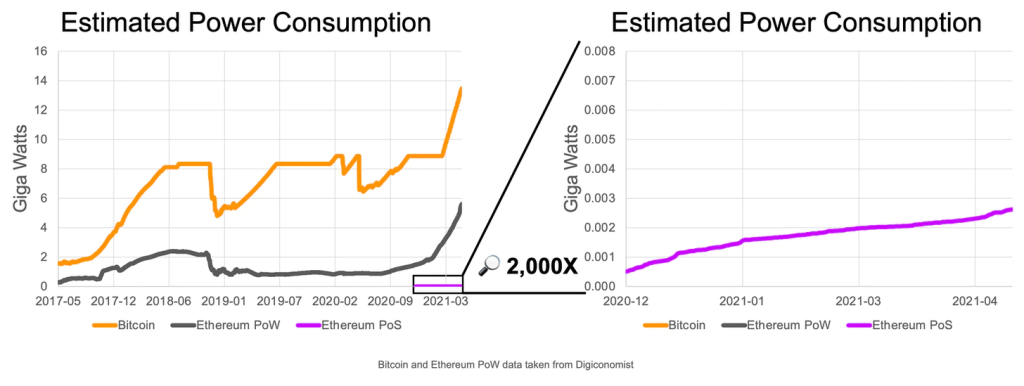

Among the ESG-conscious and institutional investors, PoS will eliminate the need for Ethereum miners and instead result in a drastic reduction in energy consumption, alleviating concerns revolving around the network’s environmental impact.

.

The Ethereum 2.0 upgrade is also a significant bullish catalyst for ETH as an asset. The transition to PoS coupled with the fee-burning implemented already via EIP-1559, this development is likely to lead to ETH being a deflationary asset.

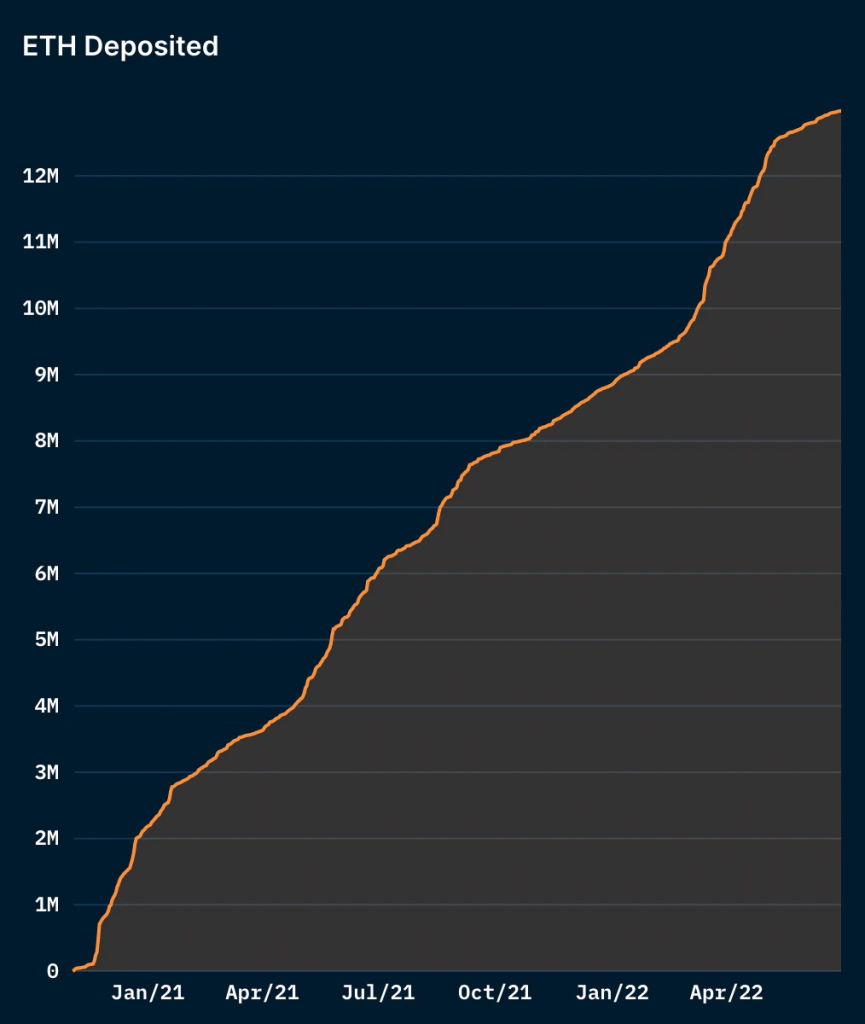

Currently, more than 12.97M ETH is already staked, which accounts for 10.8% of the total supply of ETH. There will likely be a wave of inflow of stakers with the completion of The Merge, restoring investors’ confidence in the 2nd biggest cryptocurrency to date.

Ethereum is also one step closer to “The Merge”. One of its testnet, “Sepolia “, moved over to proof of stake. Just one more testnet remains before the entire network completes the Merge.

How to play this trend

- Hodling/staking ETH itself

- Venture into liquid staking platforms

2. Layer 2 Scaling Infinitely

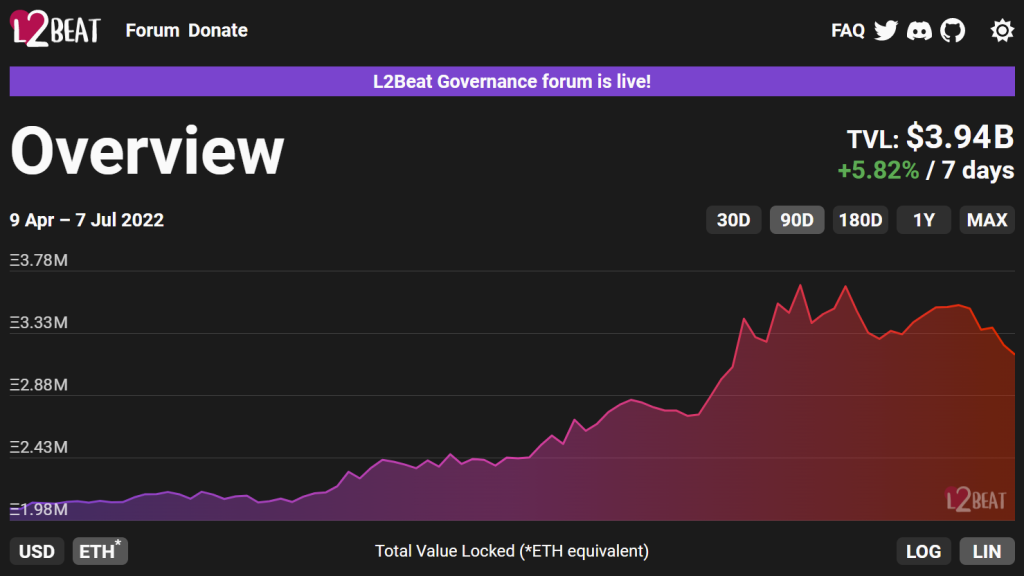

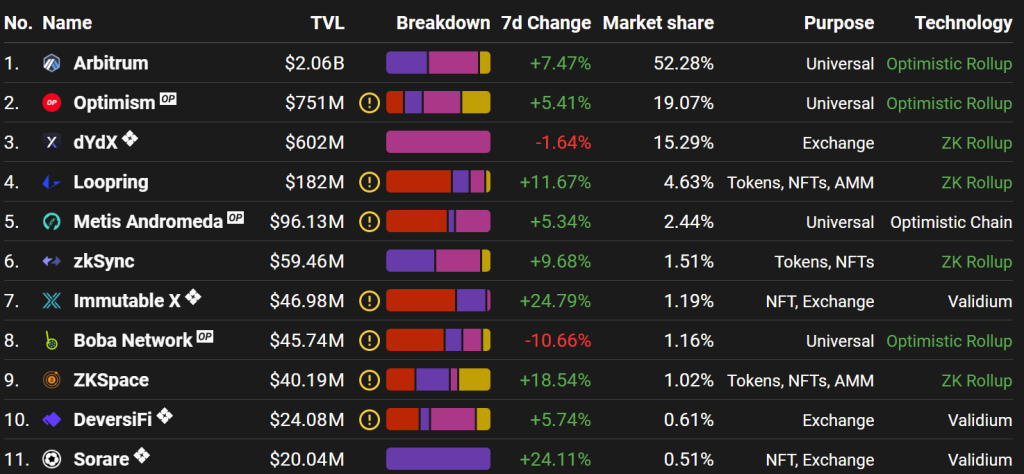

Layer2 TVL has been consistently on the rise, ignoring the market sentiments of DeFi and the total crypto market cap. As they continue to see a steady rise in adoption amongst developers and users, there is currently a US$3.94B in value locked across Layer2s on Ethereum.

Furthermore, most of the L2 native applications that leverage and improve the scalability aspect of a L1 have garnered significant usage. For example, perpetual exchanges like dYdX and GMX recorded billions in trading volumes.

This growth is likely attributable to the launch of Optimism’s native token OP in May. It is the first of the “big four” L2s — including Arbitrum, zkSync and Starkware — to release a token.

One of the “big four”, Optimism, an L2 scaling solution for Ethereum, launched its Native token $OP in May 2022. The other 3, Arbitrum, zkSync and Starkware, are also set to release a native token.

At least one of these other networks will likely release a token in Q3 or Q4, serving as a significant catalyst for onboard developers, users, and applications to respective ecosystems.

How to play this trend

- Invest in or farm individual L2 tokens

- Invest in or farm the governance tokens of L2 projects

3. IBC and interoperability

Cosmos’s goal is to create the “internet of blockchains.” Powered by the Cosmos SDK, developers can create sovereign, highly customizable blockchains that are specialized for individual applications — known as app-chains.

Connected via a trust minimized bridging and communication protocol, inter-blockchain communication (IBC), it ables cosmos for more than 30 chains, frictionlessly transferring assets between enabled networks.

Also Read: Why I Am Investing In Cosmos In 2022, And Why An “ATOMic” Explosion Is Incoming

The idea of seamless interaction with multiple blockchains for an interoperable ecosystem attracted many. dYdX, the most prominent decentralized perpetual exchange by volume, is set to deploy its blockchain o,n Cosmos, who recently launched V4 of their protocol on the blockchain.

However, shooting for the stars will come with some turbulence. The biggest AMM built on Cosmos, called Osmosis, recently found itself in murky waters, with the biggest Cosmos exploit totalling US$5M.

Though onboarding into the ecosystems through traditional means like bridges or exchanges remains difficult. The influx of users, capital and attention in various L1 tokens building on cosmos may kickstart and catalyze ecosystem growth in the remaining months of 2022 and beyond.

How to play this trend

- Invest in the L1 tokens of Cosmos app-chains

- Invest in the governance tokens of native projects built on said chains

4. Macro Uncertainty

Q3 and four will not get any easier. The all-time highs we hear about are inflation and not the coins we hold in our bags. The macro factors of the world affect the crypto market more than we think. Interest rate hikes were put into play to fend off rising inflation rates, caused a downward spiral in the bond, stock and crypto markets.

The rise in rates, flattening yield curve, sky-high commodity prices and perpetual supply-chain issues — atop trillions in wealth destroyed as a result of falling asset prices — have begun to trigger fears beyond the recession and into stagflation.

We are heading towards stagflation. The market sentiment across the board all spoke of fears and uncertainty. It does not help that there is a rise in rates, flattening yield curve, sky-high commodity prices and perpetual supply-chain issues.

(Stagflation or recession-inflation is a situation in which the inflation rate is high, the economic growth rate slows, and unemployment remains steadily high. It presents a dilemma for monetary policy, since actions intended to lower inflation may exacerbate unemployment.)

Significant coins like BTC and ETH took 71.1% and 78.9%, respectively, from their all-time highs. Altcoins, a name categorized as smaller capped assets, have drawn more than 85% from their peaks.

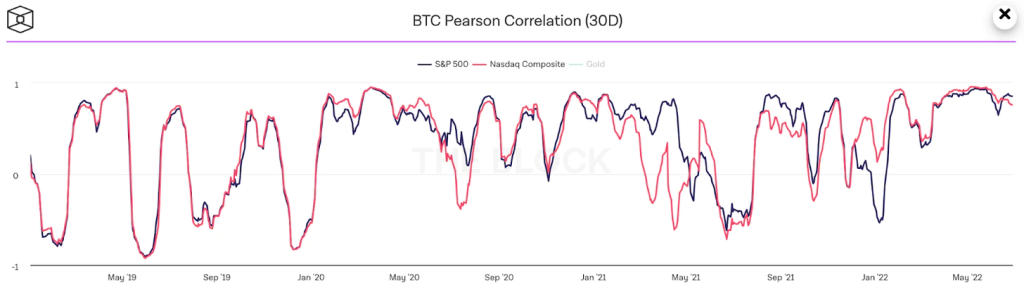

This bloodbath has reinforced the notion that crypto no longer operates in isolation, as there has been a strong correlation between BTC and the S&P 500. That figure currently sits at 0.85.

How To Play This Trend:

- DCA or lump sum strategy to build out long-term positions

- A risky play can be to hedge downside risk via options, perps, or other derivative instruments

Closing thoughts

These four narrative pillars in crypto may substantially impact the crypto market for the rest of 2022. Although the drawing correlation between crypto and the equities market continues to grow in replicating strides, one thing is for sure, unlike equities, fundamentals in crypto are not reflected in its price.

That is where volatility comes in to shake off all those here for a quick cash grab. Savvy investors, though may reap the benefits of paying attention by being rewarded for riding out the volatility in the market.

Beyond the short-term foresight of crypto narratives for the rest of 2022, it would be wise to be rooted in the belief that crypto will be part of the future. It is easy to understand and grasp the concept of what crypto can bring to the table, however, the true test of conviction comes during the bear market.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief

Also Read: Bitcoin Tests The Conviction Of Crypto Holders; When Will BTC Bottom?