Solana’s price, decapitated. Solana’s TVL, vaporised. Solana’s network, down. So, where do we go from here? Is Solana dead? To answer this question, we have to look into Solana as a blockchain, its metrics, and all the FUD as to why some say the fastest blockchain is dead.

Well, the first thing we have to know is that this space is driven by two pillars, narratives (often reflected in price) and on-chain data, and it is through these metrics we try to decipher if the Solana blockchain is dead.

You would think when the statistics reflected on-chain is positive, the asset’s price action would follow in tandem; however, for some scenarios, that is not the case. That applies to Solana; they have a lot of innovations on their horizon, like JitoLab’s MEV boosted validator and Firedancer for its Infrastructure, but they are not reflected in its price.

12th on the rankings

Citing on-chain data as reference, the numbers on DeFiLlama are a clear indicator that Solana’s reign of supremacy is slowly dropping off. The once vibrant ecosystem is now different from what it used to be.

FTX gave them the final knockout blow.

They are now in 12th place on the ranking charts, behind Mixin and DeFiChain, chains I could hardly find information about.

This might lead to Solana’s perfect villain arch story; the greatest comeback is still possible but borderline unrealistic. It is hard to think a successful protocol back in the day could end up in a position like this, but if we look at other on-chain metrics, it may reveal certain traits of a healthy and ongoing ecosystem.

Solana’s developer’s statistics

Some stats revealed quite possibly the inner health of the current Solana dev ecosystem, which seems booming.

It seems like the dev scene within Solana is pretty active. As per the report published by Alchemy, Solana’s active developer teams have grown over 1000% year on year with a 500% increase in API consumption.

These are mad stats but derived from statistics in Q3 2022. To further discover what these new teams are building, taking a look at hackathon activity is your best bet.

Messari’s state of Solana report shows consistent growth in hackathon activity. To date, hackathons have been a massive success for Solana, with plans for ten new Solanace hacker houses announced for 2023.

Ten new Solana @hackerhouses were announced for 2023 – all for builders – spanning Istanbul, Melbourne, Taipei, Tel Aviv and others. pic.twitter.com/TZemWxvzCF

— Solana (@solana) November 10, 2022

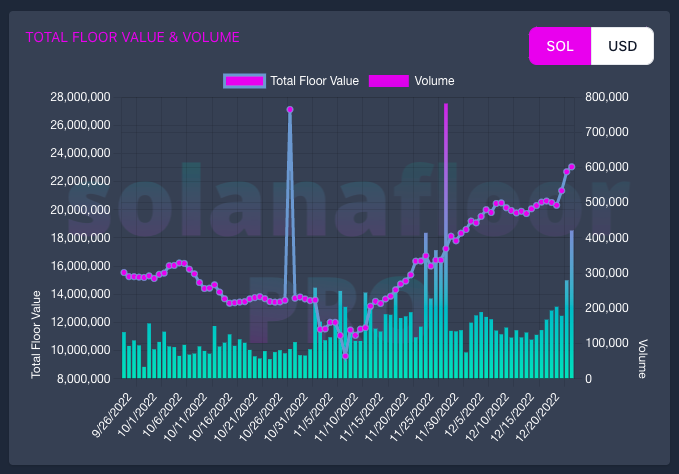

SolanaFloor, an NFT data analytics dashboard for Solana, also said otherwise. According to them, there has been over $5M daily NFT volume involving over 20,000 unique wallets trading daily. Some DeFi NFTs projects even set ATHs.

However, here’s when the falls start tumbling down.

Solana backers

If we have to talk about Solana’s backing, it was by one of the biggest frauds in the history of crypto. While it is of utmost importance that everyone does their due diligence in sourcing the facts and making an informed decision, SBF got everyone fooled.

And the media portraying him to be one of the biggest wonderkid of this era did not help either, instead boosting his credibility.

But what do backers of Solana have to do with anything Solana related?

FTX committing fraud and investing in Solana projects seems to be the main reason for success. If you pen them into an equation without all the money, is the current price of Solana a representation of its true value?

Also, read Signs The FTX Crash Was Bound To Happen.

Another prominent investor in Solana is Multicoin capital. They were the biggest advocator for FTX and Solana before crashing. According to Blockworks, it lost more than half of its crypto funds with the bankruptcy of FTX. They are all intertwined; it brings down everyone else when one falls.

Leaving for greener pastures

Amidst all the chaos and storm, participants within the Solana ecosystem look elsewhere. Two of the biggest NFT projects on Solana are leaving for Ethereum.

With the advancement of layer 2 technology on Ethereum with a healthy user base, all roads lead back to the leading ecosystem in crypto.

Also, read A Complete Overview of Ethereum’s Scaling Solutions; All About Zero-Knowledge, Optimistic Rollups and Layer 3s.

Famous last words truly bit them on the back.

As we saw with any contagion, when one goes down, others will too, and this could play out similarly in Solana’s NFT scene.

While the “throne” in being the biggest NFT project on Solana is now up for grabs, many more might follow if there is little to no activity.

Whats there to deny, its our full time job to invite, evangelise everyone to build on @0xPolygon and provide them whatever support is needed for them to thrive.

— Sandeep | Polygon 💜 Top 3 by impact (@sandeepnailwal) December 7, 2022

On the flipside we’ve received pings from 50+ projects from Solana ecosystems for support. Its mass exodus to Ethereum

Fake it till you make it

I looked months back and found this and the idea that a single person faked developer activity on Solana.

This is pretty wild. Essentially one dev was behind Solana’s DeFi growth last year or $7.5b in TVL using a bunch of fake accounts? https://t.co/pFL48Do5TD

— Luigi D'Onorio DeMeo🔺 (@luigidemeo) August 4, 2022

This is a classic example of not believing everything you read.

Solana’s history of faking things has been allegedly present since its inception. They started out quoting differing circulating supply numbers.

2/45) Starting with blatant fraud at the birth of the project

— Justin Bons (@Justin_Bons) October 28, 2022

In early April 2020, the SOL team stated that the total circulating supply was 8.2M

When in reality, the total circulating supply was above 20M!

As questions & critiques started to pile up over the following weeks;

We can’t party when the music is off

Can a blockchain succeed when its network is down?

The pessimistic answer is no.

The optimistic answer is the blockchain is being battle-tested and more resilient to the next network outage.

While both sides of the argument present valid points, Solana is competing with other layer1s, which are 100% uptime.

On Unconfirmed, @KidKrypt0 breaks down Solana’s 17-hour network outage.

— Laura Shin (@laurashin) September 17, 2021

Topics:

*when/why Solana validators knew something was wrong

*how Solana's community coordinated a network restart

*whether Solana should still be considered a decentralized networkhttps://t.co/0JqlPc2l1v pic.twitter.com/53Wel3oYDt

With hacks and outages this year, you technically can’t hack a blockchain when its network is off. Biggest brain play this year.

Closing thoughts

The answer to whether Solana is either dead or severely undervalued is up to your discretion. There will be FUD, as with any successful chain, but some truth can be derived from that. On the flip side, the prospect of innovation on its horizon is positive, potentially spurring a new catalyst.

However, the end goal and the steps taken towards it should be adoption. We all get lost in the noise and narratives, but we must remember that with real-life use cases, widespread adoption will come. Building towards that goal will eventually ensure exponential growth involving not just a single blockchain like Solana, but an entire collective.

Also Read: A 2022 Review Of The Top 5 Coins And What We Can Expect In The Coming Year

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief