Have you ever found it annoying that you can’t use BTC on Ethereum? ETH on Harmony?

This is because coins that exist on a given blockchain cannot be transferred to another just like that.

You may have heard of wrapped Bitcoin (WBTC) or wrapped Ether (WETH) before.

But what are they? Will you need them and should you care about it?

In this article, we will explore the types of wrapped tokens, how do wrapped tokens work, the benefits of wrapped tokens, and what they mean to you as a crypto investor.

What are wrapped tokens?

A wrapped token is a cryptocurrency token pegged to the value of another crypto. It’s called a wrapped token because the original asset is put in digital vault that allows the wrapped version to be created on another blockchain.

Different blockchains have different functionality. These blockchains are unable to “talk” to each other. The Bitcoin blockchain does not know what is happening over on the Ethereum blockchain.

However, with wrapped tokens, tokens can be bridged between different blockchains freely.

Read More: All You Need To Know About Wrapped Ethereum (wETH) And How To Get It On MetaMask

How do wrapped tokens work?

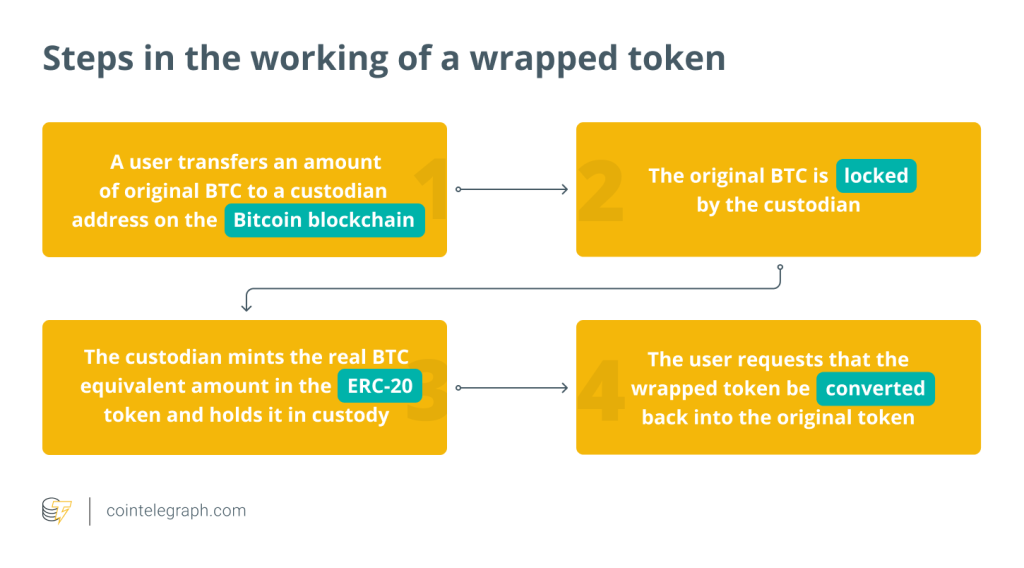

Wrapped tokens are created and destroyed by a process called “minting” and “burning” respectively. To mint a wrapped token for example WBTC, the underlying asset which is BTC, is sent to a custodian who stores the BTC in a digital vault. Once the underlying BTC is locked away, an equivalent amount of WBTC will be minted.

This process is known as “wrapping.” The underlying asset is “wrapped up” in a digital vault using a smart contract, and a newly wrapped asset is minted for use on another blockchain.

The same process is followed in reverse when burning WBTC. The WBTC is removed from circulation, and the equivalent amount of BTC is released from the digital vault and allowed back into circulation.

Just as minting wrapped tokens can be thought of as “wrapping” the underlying asset to create a token of equivalent value for use on another blockchain, burning wrapped tokens can be thought of as “unwrapping” the underlying asset.

Benefits of wrapped tokens

Each individual blockchains have their own token standards (ERC-20 for Ethereum, BEP-20 for BSC, etc.) and the limitation of this is that the native token can not be used across different chains. Hence the need for wrapped tokens. Wrapped tokens allow non-native tokens to be used on a given blockchain.

In addition, wrapped tokens can increase liquidity and capital efficiency across multiple blockchains. The ability to wrap idle assets and utilize them on another blockchain creates more connection between otherwise isolated liquidity.

Lastly, another advantage is transaction times and fees. While Bitcoin is extremely secure and decentralize without a doubt, it is capped by its potential to scale. Bitcoin isn’t the fastest and can be expensive to use. Thus, other blockchains as an alternative. These issues can be mitigated by using a wrapped version on another blockchain with a faster transaction time and much lower fees.

Conclusion

A wrapped token is a tokenized form of an asset that natively lives on another blockchain.

Wrapped tokens are backed 1:1 by their underlying asset, which is stored in a digital vault.

These wrapped cryptocurrencies enable the tokens to be used on other blockchains which they are not native. This interoperability feature has brought Bitcoin and other popular cryptocurrencies to smart contract platforms, including the Ethereum ecosystem.

Wrapped cryptocurrencies allow better deployment of capital as it is more efficient and convenient to move your assets across different blockchains and utilize the different DeFi apps. Users can now shift their funds freely and DeFi apps get to benefit from the shared liquidity.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief

Read More: All You Need To Know About Wrapped Ethereum (wETH) And How To Get It On MetaMask