The biggest crypto event is upon us an we decided to curate a list of how you can prepare for the Ethereum merge.

A Quick Recep On The Merge

The Merge represents the shift from PoW (proof of work) to PoS (proof of stake). Take it as one of the biggest “software upgrades” in the crypto space slashing the network’s energy consumption by 99.5%.

Although this may be a monumental event for Ethereum maxis and might constitutes the largest structural shift in the space, the shift toward the newly PoS mechanism has already been seen across other layer1s dubbed as “Ethereum Killers”.

From Solana and Avalanche who already possess the PoS mechanism to ALGO being dubbed the greenest decentralized blockchain with a carbon-negative network, which has elements of what Ethereum might be striving towards.

But the sheet size of what Ethereum can move is pure massive. The merge is basically only the beginning.

1. What is Happening?

For the completely uninitiated, we start with a list of FAQs and debunk some misconceptions about what the merge entails.

When is the merge happening?

15th September 2022.

Do I need to do anything with the Ether I am holding?

No. All ETH on the Ethereum network under the current PoW consensus engine will be unaffected by the switch to PoS.

You do not need to do anything to protect your funds from entering the merge, no action is needed.

All changes to the Ethereum network will be done behind the scenes, and there will not be any changes in any day-to-day experiences.

One thing to take note though is that you should be on high alert for scams as there are people out there to take advantage of the users with this transition.

Can I stay on the PoW version after the merge?

No. There will only be one Ethereum and the entire network will shift towards the PoS consensus engine. The entire PoW chain becomes the PoS chain.

Does the merge solve high gas fees?

No. The Merge is mainly the transition towards PoS from the existing PoW, eliminating the energy-intensive PoW to a much greener and more efficient PoS. Future updates on Ethereum’s roadmap include sharding, which will directly help improve gas prices.

Will transactions be faster after the merge?

No. Though some slight changes exist, transaction speed will mostly remain the same on layer 1. While the PoW’s target was to have a new block every 13.3 seconds, blocks on PoS will be produced 10% more frequently, a fairly insignificant change.

Can you withdraw staked ETH once the merge occurs?

No. Staking withdrawals are not enabled yet with the Merge. Keep a look out for the “Shanghai upgrade“, probably the next biggest upgrade after the merge, which will enable staking withdrawals.

From the Ethereum main page, expect staked Eth to remain illiquid for at least 6-12 months following the merge.

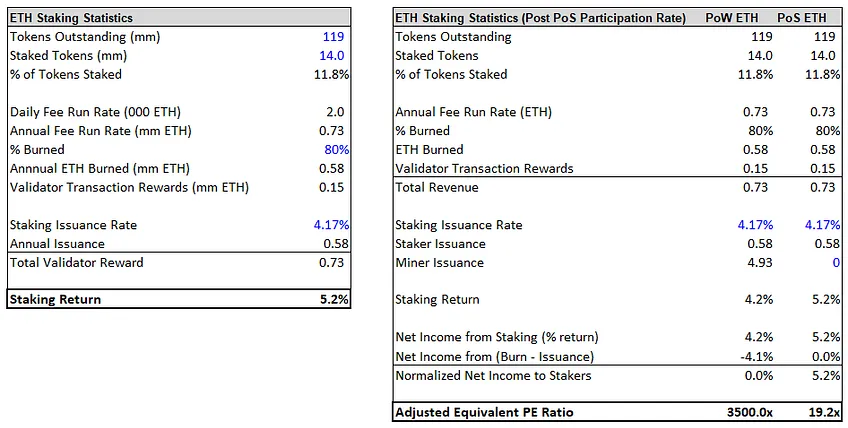

Triple halvening will reduce ETH supply

Halvening is when a block rewards from a certain chain get cut in half. This means that the issuance of new tokens is also cut in half.

Once the merge takes place, it will drastically reduce ETH supply, an issuance shock. Triple halvening essential means dividing its current issuance by half, done 3 times.

Under the current Ethereum PoW issuance with the PoW model, it issues 13,500 ETH daily, which constitutes an increase of 4.3% a year. Based on the current projections, the Merge will drop the issuance rate from 0.3% to 0.4%.

Miners who farm on the PoW chain will become obsolete and are replaced by validators. This might also lead to a reduction of sell pressure and likely increases the price of ETH as the supply decreases.

The deflationary nature of the current Ethereum software, EIP-1559, will furthermore burn a portion of the transaction fees leading to a further decrease in ETH supply.

Will the merge result in a downtime of the chain?

No. The Merge upgrade is designed to transition to PoS with zero downtime.

2. Is the merge priced in?

Pricing Catalyst

To determine whether The Merge is priced in, we need to first define what being priced in means. This boils down to three catalyst which Hal Press of North Rock Digital covered.

Fundamental catalyst. Imagine a stock which is about to report its earnings and everyone has an expectation of it doing well, it will generally not move when its reported earnings are actually good.

Why? When everyone is already positioned for good earnings it is unlikely people will change their position and therefore the price of the stock doesn’t move.

“Fundamentals don’t impact price directly, they only impact price through their ability to create flows on the other side.”

Hal Press of North Rock Digital

Bascially we know what is coming, it comes, and nothing happens to the price. It is already priced in.

One-time flow catalyst. This catalyst usually happens during market unlocks. This catalyst is harder to price in because the market now has to go in and front run that “one-time flow”.

eg. Imagine 1,000 units about to unlock, and of which, 80% will be sold. The market has to first sell 800 units then buy them back when the unlock comes. In general, this will somewhat price in as only an estimate of ~400-500 units will be being sold prior to the unlock.

Even though the one-time flow catalyst is known in advance, they aren’t usually fully priced in.

Structural flow catalyst. Although similar to the above mentioned, structural flow is a continuous flow which occurs an extended period of time, basically One-time flow catalyst multiple times.

This will make it much more difficult to price in, as it grows in the highest similarity with the Merge.

“I don’t think the merge is fully priced in, but it is more priced in than two months ago.”

Hal Press of North Rock Digital

Time frames

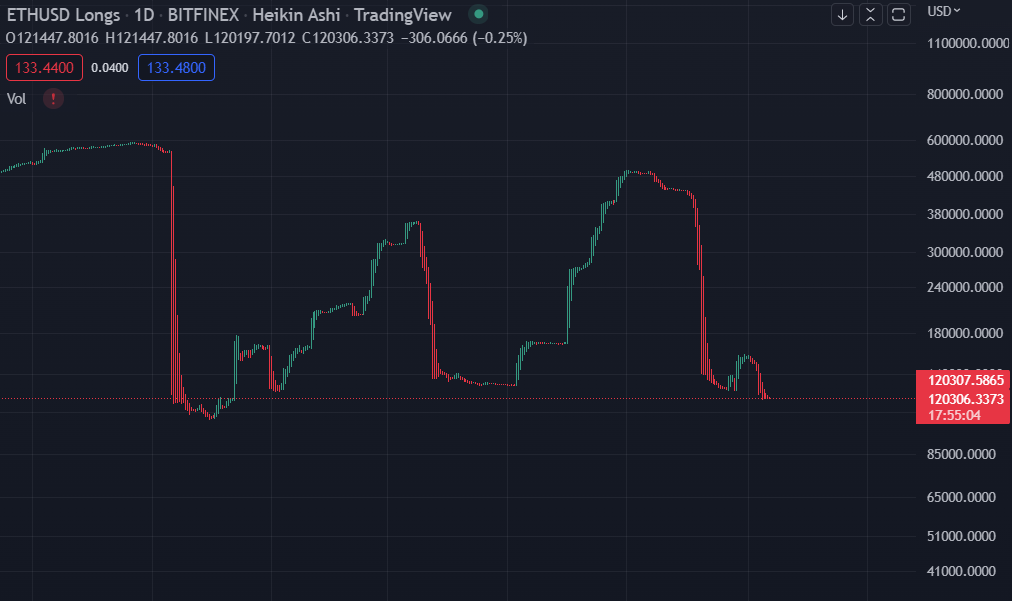

Short term; If you take a look at perpetual funding, you will see it has remained negative for most part since June. This also means that there are more shorts than long in the perpetual market.

The chart above shows Eth longs currently being reduced to its area of lows since December 2021. While this could be due to multiple larger “forces” during the bear market rally, some may speculate others are hedging with shorts as the price of ETH continues higher with the imminent merge.

Apart from the market sentiment, there is also a short term execution risk ahead of the merge. While many are concerned about this risk, the Merge has been a long time coming being tested rigorously over extended years. With many years of preparation, it gives investors some comfort that a technical, though a risk, is unlikely.

Find out more on the potential risks the Merge poses below.

So what could happen after the merge occurs? Normally, we would thinking about “selling the news” but the merge might be something different. The weightage and structural effect it has has significant importance which transecnds beyond just Ethereum itself but one which affects the greater crypto space.

Think of the merge like a new software update for your phone. Just like what Apple just did with their upcoming IOS 16 upgrade, the merge is growing in similar strides in generating hype and excitement.

A successful merge might be met with developers who are ever ready to deploy in building smart contracts and new dApps. This can also be said in kickstarting the NFT space again.

Do what you may in buying the rumor or selling the news, the merge in my opinion could be the instigator towards the “flippening” and is mile away from being a rumour.

Medium term

This period will expect short term traders to sell. The price action within this period is less predictable and it is likely dependent on the macro environment.

Though there are multiple factors affecting crypto’s macro environment, one thing that will drive long term inflow of capital is adoption.

“When adoption is declining macro is hostile, when it is flat, macro is neutral and when it is growing, macro is accommodating.”

Bankless

Keeping a close eye on the crypto total marketcap and stablecoin dominance might be wise if you’d like to assess the health of crypto’s macro position. It is difficult to accurately call every movement which will be made, but I guess we just have to let time play this out.

Long term

As cliche as what I am about to say sounds, the future seems easier to predict. As structural flows are most important in the long term, it reveals the Merge’s impact being the most pronounced and essential in the long term.

As adoption continues, the structural demand of Ethereum will remain with the inclusion of new capital inflows. There are even chatters about the “flippening” and expectations of Eth to surpass Btc as the leading cryptocurrency.

“Ethereum will forever have a flow tailwind post-Merge. Bitcoin will forever have a flow headwind.”

Bankless

3. How to play the PoW tokens

The Ethereum Merge is scheduled to take place on 13 September. Christmas season is here again.

— Bobby Ong (@bobbyong) September 5, 2022

ETH holders will soon be airdropped ETH PoW tokens. What should you do to best position yourself?

Here are 7 steps you may consider to fully take advantage of the Merge:

With the Merge putting miners out of work, some of them are forking ETH to keep a PoW version so they can continue mining.

To get the ETH PoW tokens, you must first hold ETH on a wallet which supports this fork. This would done best if you are using a hardware wallet. Holding them on exchanges may or may not provide you the forked tokens.

Here is a rundown to what you need to do to get the forked PoW tokens.

Bridge all your tokens to ETH Mainnet

You will not be getting any ETH PoW for your ETH held on Optimism, Arbitrum, Polygon, Avalanche or any other Layer 2 scaling solution. Move them back before the merge to get ETH PoW tokens.

Unwrap all WETH to ETH

Although there might be a DEX which helps you unwrap all your WETH PoW tokens, it is best to unwrap them to get ETH PoW tokens immediately.

Removing liquidity from DeFi protocols

You will not get any ETH PoW tokens which are used to provide liquidity. In anticipation of the merge, withdraw them provide liquidity again after the merge.

Degen Play: Borrow more ETH

It has been said the ETH PoW will be based on a snapshot of the amount of ETH you are holding. One avenue to maximize this is through borrowing as much ETH as possible.

If you are borrowing ETH ahead of the Merge, you might want to read this.

— Michael Bentley (@euler_mab) September 6, 2022

With just a few days to go we can see more clearly what DAOs are doing to prepare and how it impacts lenders and borrowers.

Don’t jumpt straight in though, take a closer look how traders are impacting lending markets in the thread above.

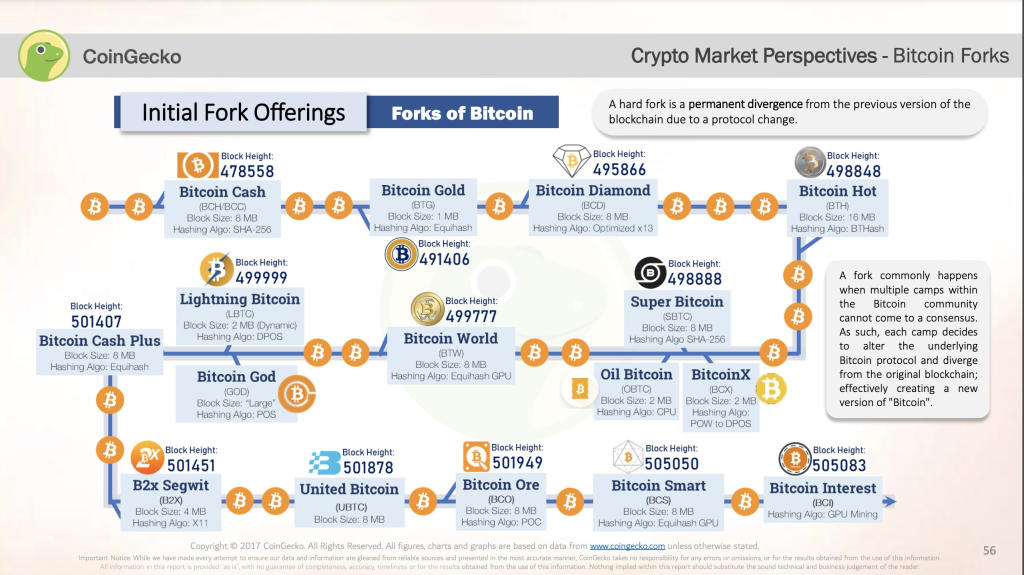

There might be a dozen to choose from

Just like the fork of bitcoin previously, one or more ETH PoW forks may show up. If you do hold your ETH on your non-custodial wallet, you might just be eligible to get all these fork tokens. Take note, some may be scams tho.

Although there are plenty of ways not addressed to play this, one way you can is to sell all your fork tokens immediately. All the tokens above from the Bitcoin fork are basically dead, these forks are created for miners to continue to be occupied in mining, while they do actually have any incentives to grow their community and use-cases.

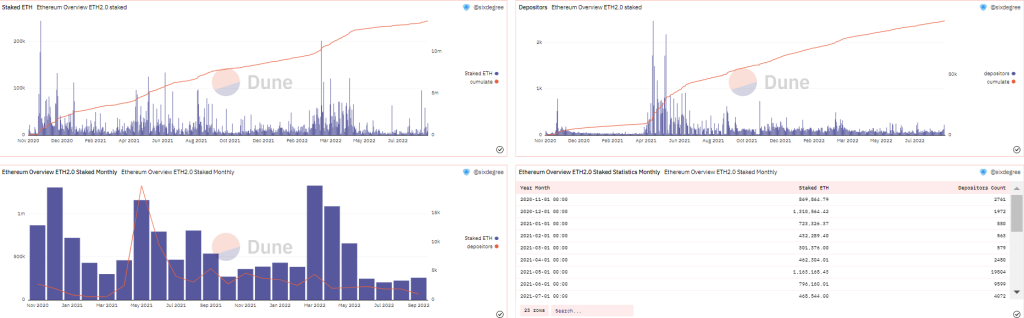

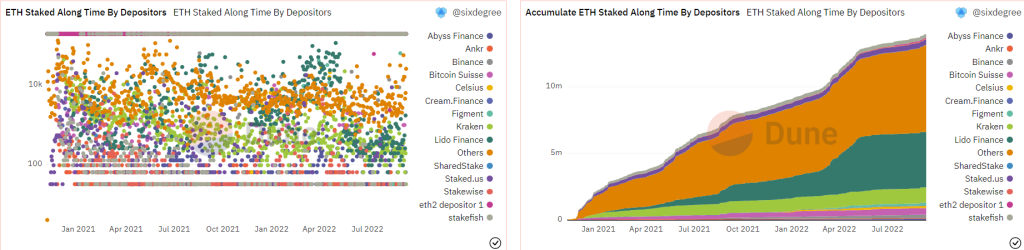

4. Dune Analytics on The Merge

Being a numbers and charts guy in crypto may not be a bad thing. In fact, those who are able to decipher knowledge from charts are the biggest alphas.

@SixDegreeLab on twitter created a Dune analytics dashboard for all your savvy data analytics junkies.

5. What is happening after the merge?

This part is a deeper dive into the technicals, but something everyone should roughly be aware of. Check out @0xAlec‘s article which demystifies the Ethereum roadmap: The Merge, Surge, Verge, Purge, and Splurge.

.@VitalikButerin claims that #Ethereum will be able to to process "100,000 transactions per second", following the completion of 5 key phases:

— Miles Deutscher (@milesdeutscher) July 22, 2022

• The Merge

• The Surge

• The Verge

• The Purge

• The Splurge

A quick breakdown of what each stage means for $ETH. 👇 pic.twitter.com/FnaWww8mHZ

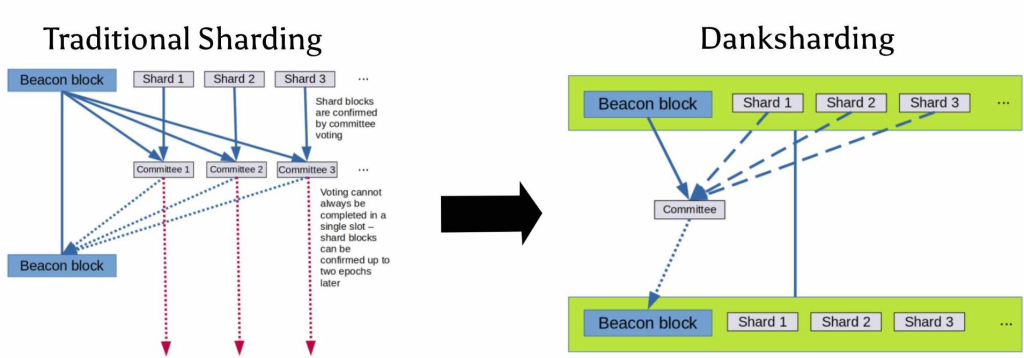

Sharding on Ethereum

Sharding splits the blockchain entire network into smaller partitions, called shards. This is where Ethereum will see a significant increase in the network’s scalability.

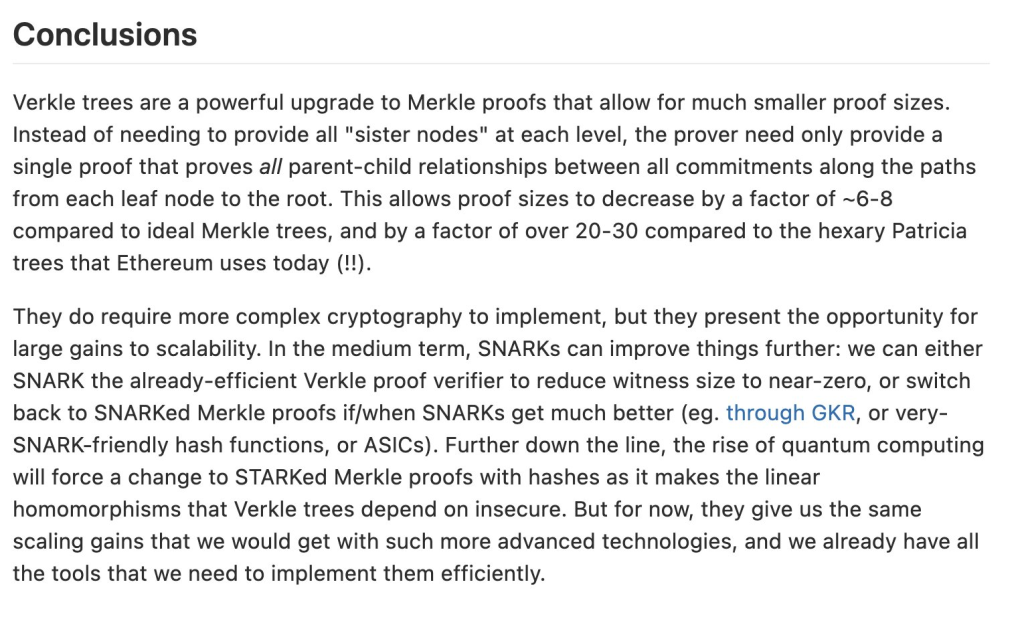

Verkle trees

Verkle trees are a “powerful upgrade to Merkle proofs that allow for much smaller proof sizes.” It ultimately assist ETH in becoming more scalable,

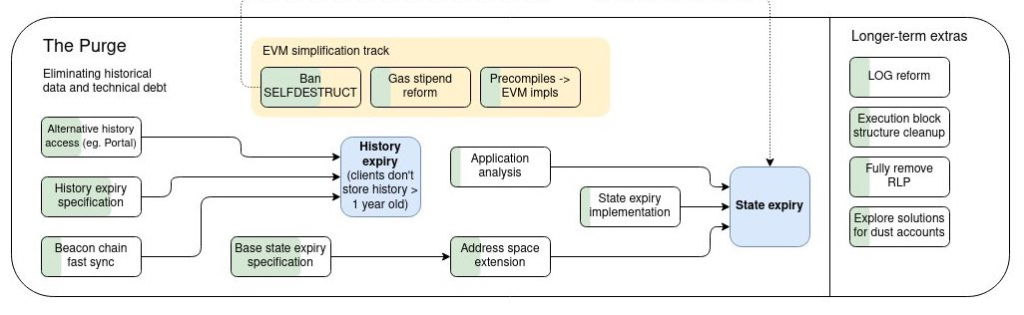

Streamlining storage

This will result in a reduction of network congestion. This part post merge will reduce the hard drive space needed for validators, it eliminates historical data and bad debt.

The next gen of ZK roll ups

With the help of Danksharding which will unlock exciting capabilities for the suite of ZK rollups. They will now be able to make synchronized calls with the execution layer on Ethereum.

What this means is it enhances new L2 primitives like distributed liquidity and fractal scaling, setting the stage for innovative, next-gen dapps being built on ZK rollups.

Closing Thoughts

“The difference between #Bitcoin and #Ethereum is that Bitcoiners consider Bitcoin to be 80% complete, but Ethereans consider Ethereum to be 40% complete.”

@VitalikButerin

This only shows that of the untapped potential evident with Ethereum. Perhaps the entirety of this read constitutes slightly in favor of the merge, but it would give some insights and pointers for bears to consider.

The merge is only the beginning. As the rest of Ethereum’s roadmap continues to unfold, new inflow of capital and innovation will also see new use-cases solving current issues of the world. This is a major milestone for crypto, as it is destined for greater heights in the future of web3.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: ChainDebrief