Yesterday, popular Decentralized Exchange Curve Finance saw several liquidity pools exploited due to a bug in smart contracts utilizing an outdated version of the Vyper coding language.

With approximately USD$24 million stolen from various Curve pools, its native Curve DAO token saw a 12% dip over the last day. Over USD$1bn was also withdrawn from various pools on the platform in response to the attack, with Total Value Locked sinking almost 50%.

As the Curve token continues to fall, crypto research platform Delphi Digital has highlighted more than $100m in loans taken by founder Michael Egorov against his Curve holdings, which are approaching possible liquidation.

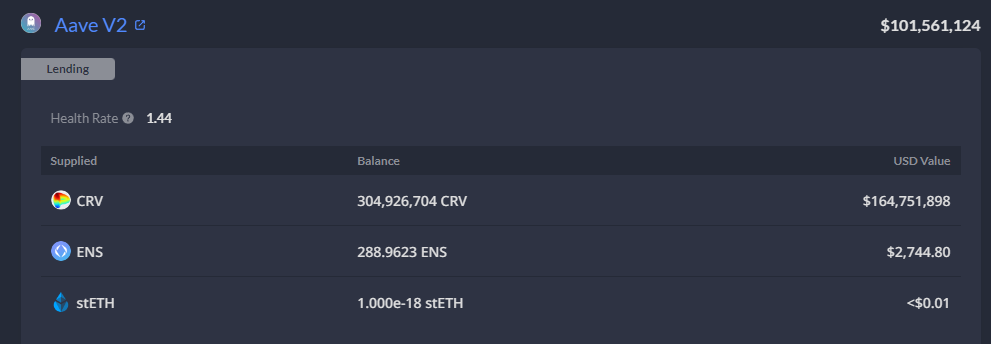

Web3 portfolio tracker deBank identifies his address 0x7a1 as having taken a USD$70m loan on Aave against approximately USD$164m of collateral, mostly in the form of Curve tokens.

Egorov also has another USD$43m in loans across multiple other platforms including Frax finance and Abracadabra against USD$83m in collateral on his public address.

According to Delphi Digital, his positions on Frax Finance are currently at the largest risk of liquidation to their variable Time-Weighted Interest Rate, which changes with utilization and time.

As users continue to remove supply-side liquidity from Frax Finance, Egorov could be paying up to 10,000% APY on his loan soon, liquidating his position “regardless of Crv price”. His Aave position, on the other hand, will be up for liquidation at a $CRV price of approximately USD$0.32 or about a 50% fall from current prices.

Egorov Controls 47% of CRV’s Circulating supply

According to data from Coingecko, 74% of the Curve DAO token remains locked up in various pools or lending protocols. Due to its vote-locking mechanism, Curve holders are heavily incentivized to stake their tokens for extended periods of time in return for various incentives.

As such, Michael Egorov’s stake currently represents 47% of the total current circulating supply.

With entire ecosystems including Frax and Redacted Cartel built around Curve Finance, a sudden liquidation of its founders’ holders could result in bad debt across DeFi.

There's a risk of a black swan event in DeFi.

— olimpio (@OlimpioCrypto) July 31, 2023

As per Defillama, if CRV drops below $0.37, there's 300M CRV to liquidate in Aave -most from Curve's founder

The problem? There's not a single Exchange or DeFi protocol where one can sell such a large CRV amount.

Risks explained 🧵 pic.twitter.com/Ug12IsJ3et

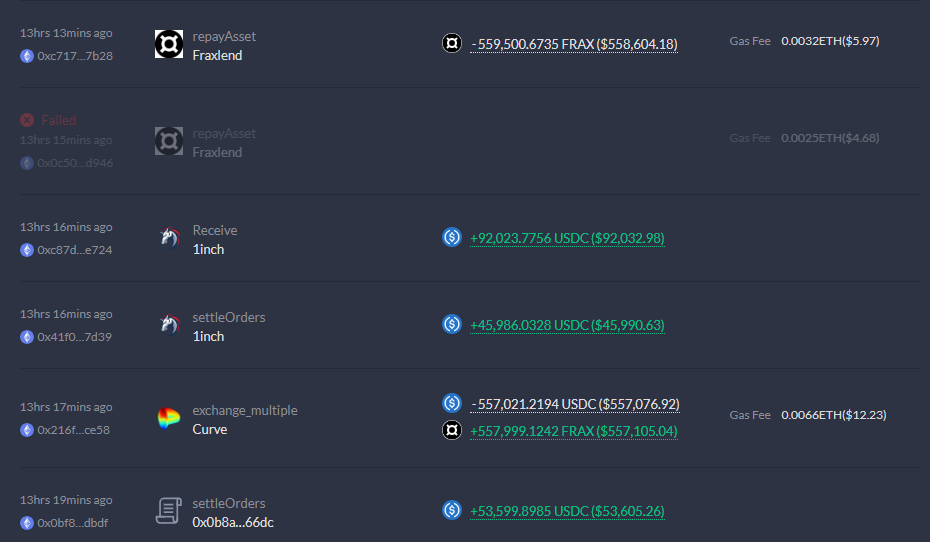

While it seems that Egorov has been actively paying back some debt on various platforms, the repayments have yet to instill confidence in the ecosystem due to their minute size compared to the outstanding loans.

Also Read: Kaiko Research: Bitcoin Volume Dominance Plummets amid Altcoin Rally

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chaindebrief