While Binance has previously stated that they will “fight to the full extent of the law” against the SEC, it seems that their banking partners have a differing viewpoint on the matter.

Just today, Binance U.S. has announced that they will be suspending USD deposits starting today, and may cease all withdrawals as early as June 13th, 2023.

The SEC has taken to using extremely aggressive and intimidating tactics in its pursuit of an ideological campaign against the American digital asset industry. https://t.co/AZwoBOgsqS and our business partners have not been spared in the use of these tactics, which has created… pic.twitter.com/rlIe6swIoY

— Binance.US 🇺🇸 (@BinanceUS) June 9, 2023

“Irrespective of the baseless claims, and in light of the commission’s increasingly aggressive tactics, our payment and banking partners have signaled their intent to pause USD fiat channels as early as June 13, 2023″, the statement says.

“To be clear, we maintain 1:1 reserve for all customer assets …. We encourage customers to take appropriate action with their USD.”

In the past day alone, an impressive sum of over $120 million has flowed out of Binance as users proactively prepare for potential regulatory actions by the SEC.

$64.5M net outflow from Binance US in the last hour

— Nansen 🧭 (@nansen_ai) June 7, 2023

Mainly because of 2 large $MATIC withdrawals worth about $62M pic.twitter.com/aCbm24yqcv

This follows another $64m in outflows in under an hour following the SEC moving to temporarily freeze Binance US’s assets.

Also Read: Binance Statement To SEC: We are prepared to fight it to the full extent of the law

Binance US Has Previously Faced Challenges Establishing Bank Partners, Report Says

In a report earlier this year, The Wall Street Journal revealed that Binance US encountered difficulties in securing banking partners to facilitate their customers’ cash transactions.

This followed the failures of Silvergate and Signature Bank, which left Binance US without banking services – having to use a middleman bank to store funds on its behalf.

Further attempts to establish a banking relationship with banks, such as Cross River Bank and Customers Bancorp failed, said the report.

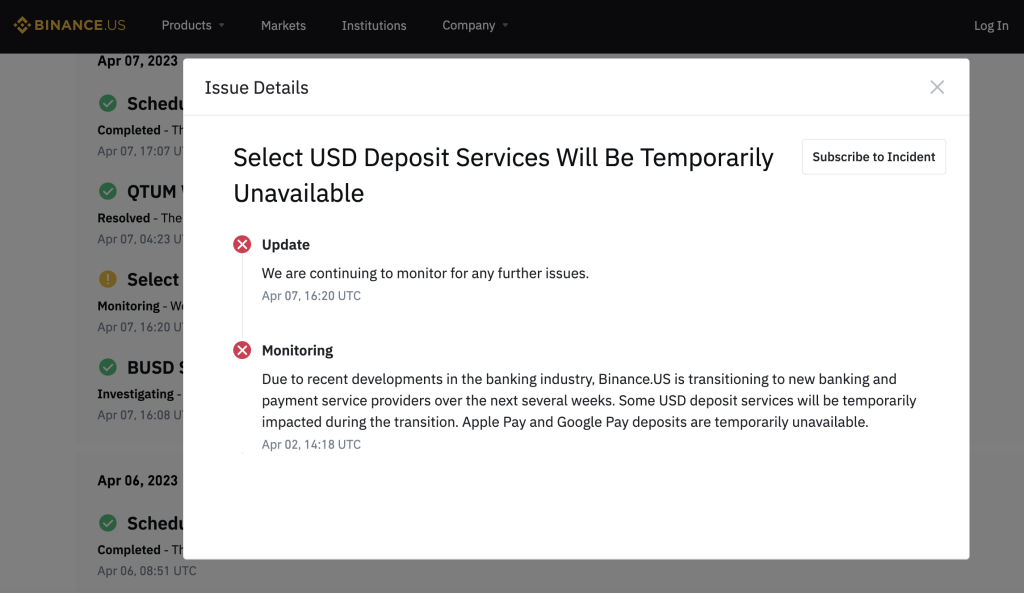

US-based customers were directly affected by the absence of a banking partnership, and were unable to perform select deposit services during the period.

Also Read: SEC Sues Binance and CEO “CZ”, Claims BNB and BUSD are Securities in Latest Filings

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chaindebrief