With cryptocurrencies making headline after headline and becoming well-known to the public, we have seen a rise in interest in the head-spinning returns they can produce, even compared to the insane bull-run the stock market has been on the last couple of years.

With everyone wanting a slice of the pie, how do more traditional investors gain exposure to crypto without having to set up a new wallet or moving exchanges every time the government cracks down on the market?

Why not just buy Bitcoin?

“Not your keys, not your crypto” — self-custody is a headache to traditional investors, who may be used to purchasing a stock through a broker and not worrying about security.

However, with crypto, one hack of your wallet could lead to your entire portfolio being transferred to a random address and lost in the blockchain, with no bank for you to demand a refund from.

Some may also prefer to stay away from the well-known volatility of the crypto market, and while their proxies may still be volatile, they are nowhere near the stomach turning 20% swings we have grown to expect.

Others may simply not want to purchase cryptocurrencies and deal with the 24/7 markets but acknowledge that some exposure would be good for their portfolio. So, what alternatives do we have?

Grayscale Bitcoin Trust

The Grayscale Bitcoin Trust (OTCQX: BTC)

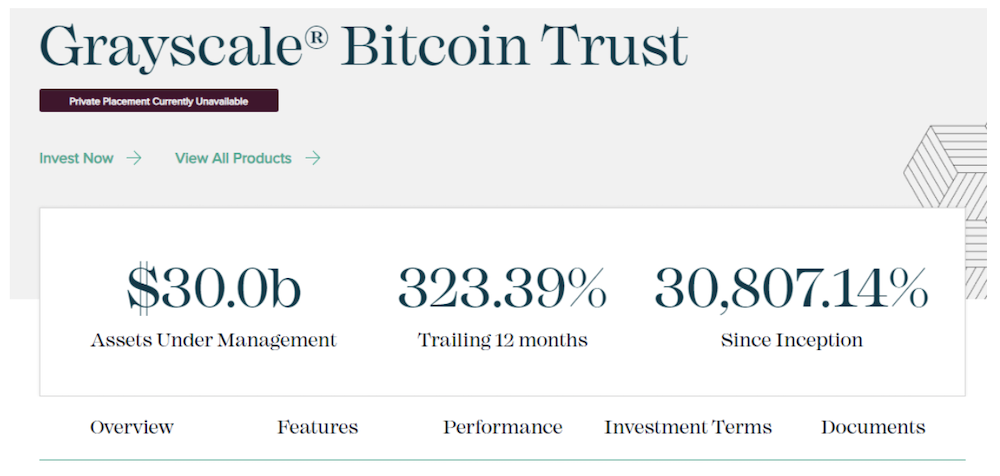

Grayscale Bitcoin Trust (GBTC) is the world’s largest Bitcoin and Ethereum investment fund, currently managing about USD$30Billion AUM (Assets Under Management) and the first United States-based cryptocurrency investment fund.

However, to join the fund, one must first already be an accredited investor, basically having a net worth of over a million USD, and therefore most of us probably are not qualified (but if you are, great!).

Instead, we can buy shares of GBTC on the OTCQX market, available on most brokers. Though the OTC symbol may call for some red flags, the OTCQX market has much more stringent rules than other OTC markets and does not facilitate the trading of penny stocks, shell companies or companies in bankruptcy.

Being able to trade shares of GBTC means that you can also short bitcoin for speculative purposes or as a hedge against your own portfolio, which is impossible if you only hold the crypto in a wallet.

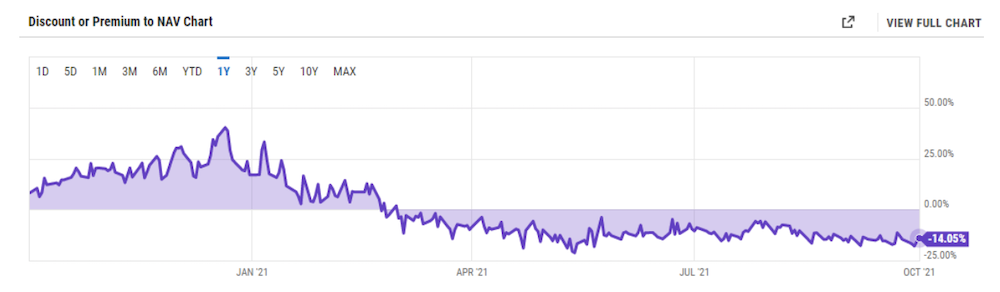

For those who want to purchase shares of GBTC, take note that there is a premium for the stock with respect to the underlying asset as GBTC is not an ETF (Exchange traded fund) and therefore has a premium on its NAV(Native Asset Value).

Currently, GBTC shares are trading at a 14% discount to its NAV, far away from its 132% all-time-high during Bitcoin’s 2017 rally.

Bitcoin Mining Companies

Another popular way to get exposure to the crypto world is through Crypto mining companies. These companies generate a return by leveraging huge economies of scale to mine cryptos, usually Bitcoin, and sell them when markets peak.

Unlike large funds that have to buy the asset, miners use sophisticated hardware to solve complex computational math problems, mining new coins which they can turn for a profit.

These companies are red-hot in the market now, with the top few outperforming Bitcoin in the last year, sometimes generating revenues of up to a million dollars an hour depending on the price of Bitcoin.

Marathon Digital Holdings, INC (Nasdaq: MARA)

Marathon is the largest cryptocurrency mining company by market cap, is currently trading for about USD$33 a share with a 1 year ROI (return on investment) of 1,592%.

Aimed at aggressively scaling their network, they plan to reach a 2.24 return on every $1 invested by 2022 by capitalizing on their pool of miners.

Hut 8 Mining Corp. (Nasdaq: HUT)

Hut 8 is one of the many newcomers to the space, currently trading at USD$9.27 a share with a market capitalization of USD$1.521 billion.

Boasting a 1-year ROI of 494%, they have burst onto the scene with their use of green energy to mine Bitcoin and hold more than 20% of their market capitalization in Bitcoin.

However, constant share dilution has led to some negative sentiment from shareholders and may affect prices going forward.

Riot Blockchain, Inc. (Nasdaq: RIOT)

Riot has been around since March of 2016, and is currently trading at USD$26.10 a share with a market capitalization of USD$2.504 billion. T

heir 1-year ROI sits at 903%, in between HUT8 and Marathon. They also have notable investors in Vanguard Group and Blackrock.

With so many options, we can look at certain Key Performance Indicators, which are functions of the company’s profitability.

The primary long-term focus for crypto mining companies would be hash rate (a measure of the miner’s performance where 1EH/s would result in roughly 4000 Bitcoin mined a year), cost per kW h(Kilowatt-hour) and cost per Bitcoin mined.

| MARA | HUT8 | RIOT | |

| Share Price (USD$) | 33.17 | 9.27 | 26.10 |

| Market Cap (USD$) | 3.305 | 1.521 | 2.504 |

| Hash Rate (EH/s) | 1.9 | 1.37 | 2.3 |

| Cost per kWh (USD$) | 0.045* | 0.0274 | 0.025 |

| Cost per BTC (USD$) | 5,612 | N.A | 13,814 |

Companies that hold Bitcoin on their balance sheet

If both the above options don’t suit your fancy, you can take a look at companies that hold cryptocurrencies on their balance sheets, whether it be because the companies work with the blockchain or their treasuries are simply bullish on it, Bitcoin’s price going up means their company’s value goes up – and traders may get to reap the rewards on their stock prices.

MicroStrategy Incorporated (Nasdaq: MSTR)

Microstrategy is a company that provides business intelligence, mobile software and cloud-based services as their main revenue-generating sources, trading at USD$612.46 with a market capitalization of USD6.31 billion.

Its CEO, Michael Saylor, infamously opted to replace traditional assets on their balance sheet, typically treasuries, with Bitcoin — becoming the first publicly traded company to do so. This was despite their business not being directly related to the blockchain, but a decision made to strengthen their reserves.

Since then, MicroStrategy has accumulated at least 105,085 Bitcoin, carrying a value of roughly USD$5billion, making up 75% of their market capitalization.

Correspondingly, shares of MSTR have a 1-year ROI of 319%, despite a long plateau pre-Bitcoin acquisition.

Square, Inc. (NYSE: SQ)

Square is a financial services and digital payments company, founded in 2009 by Jim McKelvey and Jack Dorsey — who also founded Twitter — and trades at USD$239.29 with a market capitalization of USD$110 billion. I

In February this year, Square added to their Bitcoin position, making it (at the time) 5% of its cash and cash equivalents. While not close to Microstrategy’s 75%, it shows that Square is willing to diversify its balance sheet and could continue to do so if Bitcoin prices become attractive enough.

Square’s CEO Jack Dorsey is also Bitcoin maximalist who has opened up the option to purchase Bitcoin on Square and has since started dabbling in altcoins for his NFT plays.

As he ventures further into the crypto space, we may see Square snapping up even more Bitcoin and possibly Ethereum to add to their balance sheets.

Coinbase Global (Nasdaq: COIN)

Coinbase, an American Centralized Cryptocurrency exchange platform, unsurprisingly holds at least 4,487 Bitcoin and a multitude of other cryptocurrencies on their balance sheet. At the time of writing, it was trading at USD$231.16 with a market capitalization of USD$60.538 billion.

Ahead of its public listing earlier this year, it disclosed at the time that it held $316 million worth of crypto assets, which has likely grown a sizeable amount by now.

Though the stock fell hard in their IPO, they have since beat Q2 estimates by far and announced almost increasing earnings every quarter, fueled by the increasing growth in crypto currency. If you believe in the crypto market, you almost definitely must believe that Coinbase will be here for the long term, and that their stock prices will be growing alongside Bitcoin.

Despite all the volatility, investors cannot neglect that there are huge returns to be made from the cryptocurrency market. The way you approach the volatility can differ, and if you are looking for an alternative way to get exposure, crypto proxies may just be the way to do it.

Featured Image Credit: Bitcoin Market Journal

Also Read: Bitcoin: Is $100,000 By End-Of-Year Still Possible?

If you find this useful, do follow us on our socials, as we build up our audience base and crypto community!

Facebook: https://www.facebook.com/chaindebrief

Twitter: https://twitter.com/ChainDebrief

Instagram: https://instagram.com/chaindebrief

Telegram Channel: https://t.me/chaindebrief

Telegram Community: https://t.me/joinchat/Q3MVCzJrnOM1MzM1