Key Takeaways:

- Bluejay Finance just launched their token, $BLU, for public sale

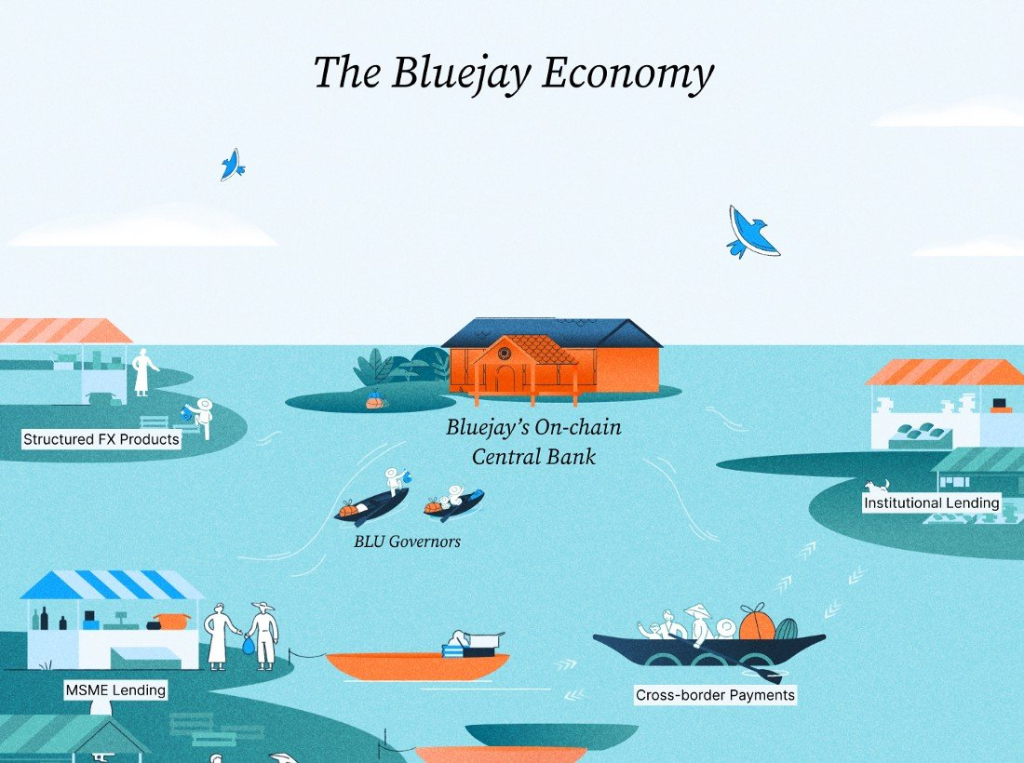

- Bluejay’s goal is to serve individuals who do not have access to financial services through non-USD stablecoins

- The $BLU token will be used to build infrastructure which allows the automatic capitalisation of the treasury and the minting of bluSTABLES

___________________________________________

“Bluejay’s mission is to bring access to finance to those who need it the most.”

Those who “need it the most” are the majority of the underbanked or unbanked individuals. Prevalent in South East Asia, over 70% of the population falls in that category, where financial services seem to be out of reach for them.

As traditional finance is not able to cater for these same groups of people, another sector is democratising access to finance and money by making services more accessible and available in a faster and cheaper way.

Blockchain technology provides a fundamentally different way of monetary transactions that are faster, cheaper, and more transparent. Not only will this benefit those who need finance, it could also spur economies.

Bluejay believes that for local economies to adopt DeFi, DeFi must first be served in local stablecoins together with their native currency that they are familiar with.

Bluejay’s mission is to bring financial access to those who need it the most.

— Bluejay Finance (@BluejayFinance) October 18, 2022

To build a new financial system, with more opportunity & fewer barriers.

Can we achieve this aim? We believe that with your help, together we CAN.

3rd Nov – Join the movement.https://t.co/jTTFIVvZkS pic.twitter.com/90Y9M2pRwm

Ultimately, they form the foundation for the building blocks that will bridge DeFi into emerging markets.

Bullish.

Their bet on real-world asset lending

Even with recent DeFi turmoil, the bluejay team continues to strive and stay committed to creating a more open financial system with stablecoins on DeFi.

Real-world asset lending is where DeFi first meets traditional finance. Real-world asset lending includes tokenizing assets like real estate while allowing users to borrow against that for small-to-medium businesses in emerging markets.

By building non-USD stablecoins to denominate loans for real-world assets, it removes fiction when it comes to foreign exchange risks, transaction costs and user experience.

By leveraging on the existing decentralized finance (DeFi) infrastructure, the ecosystem can offer the under-banked population services like

(1) Access to safe-haven assets like USD for short-term saving through Decentralized Exchanges (DEXs)

(2) Instant & low-cost remittances to other currencies through DEX

(3) Mid to long-term savings plans through different asset management & lending/borrowing protocols.

Real-world application as the next wave in DeFi

With a real long-term economic value in mind, Bluejay’s stablecoins are all about supporting the use cases which will drive it.

But moving towards the heavily skewed ideology that DeFi is home for the speculators might be difficult. Especially with the current connotations and outlook of DeFi being an unsafe place to participate in.

However, with the creation of local stablecoins, the product market fit for DeFi and the natural world has never been greater.

Their strategy for this long-term vision involves four different stages. Infrastructure – allowing the effective move of stablecoins for local fiat on/off-ramps, Partnerships – enabling the flow of stablecoins with ecosystem partners through payments and real-world asset lending, Products – inclusive of derivative contracts and Platforms – scaling through allowing others to build on top of Bluejay.

The value accrual of $BLU

Tomorrow is the big $BLU token sale!

— Bluejay Finance (@BluejayFinance) November 2, 2022

Let's hear from @yemyat91 on why you should take part in the treasury bootstrap event.

Full statement below. pic.twitter.com/PN4w4DWPfG

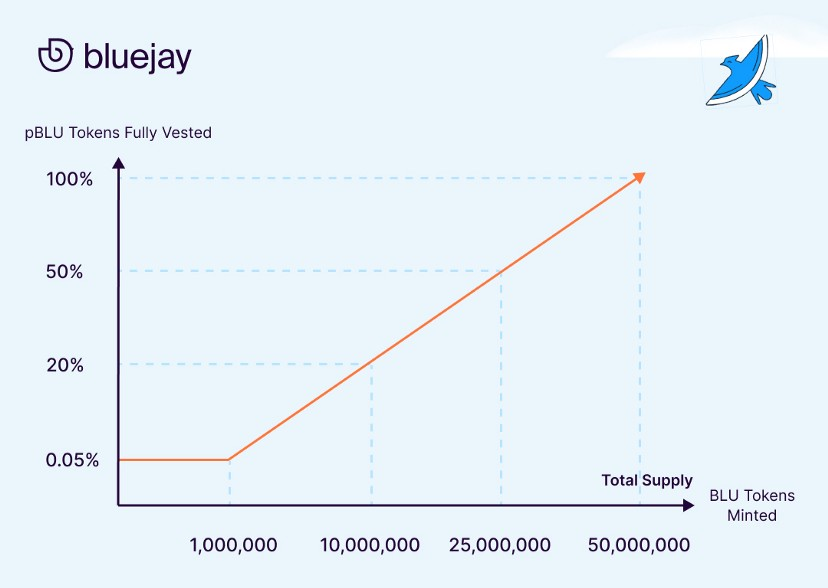

BLU’s initial supply of 1,000,000 tokens will be issued during the initial token sale. These tokens have a public sale price of 10 DAI, with the whitelisted sale price reduced to 5 DAI for qualified individuals.

One of the core functions of the BLU token is to allow for the automatic capitalisation of the treasury, which in turn provides for the minting of bluSTABLES.

The BLU token does not have a maximum supply, it is not meant for a pump and dump but an avenue to aid the entirety of the underbanked societies.

Find out more details about their tokenomics here.

With sustainability in mind, a good revenue model is one of the most critical components for long-term success.

In achieving this, they have three primary sources of revenue.

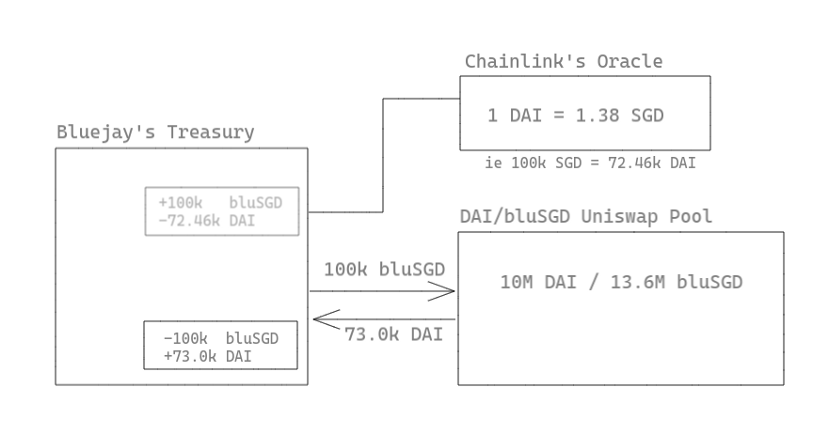

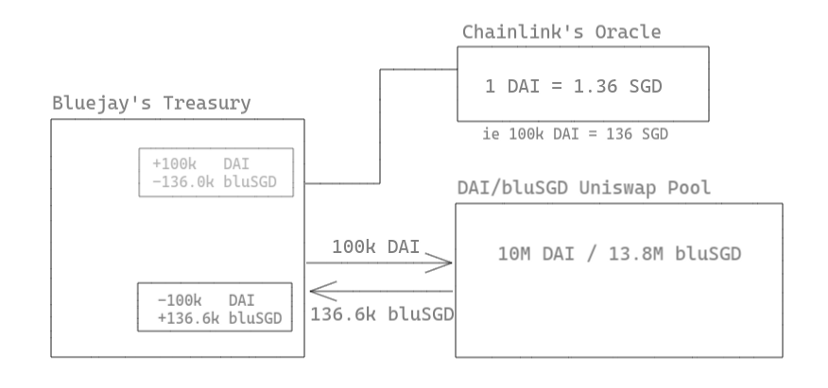

1. Arbitrage

Since the price on the liquidity pools may not always reflect the actual market price determined by the external oracle, there are often when an arbitrage opportunity exists.

In one scenario, the system is in an expansionary cycle where the stablecoin is more expensive on the pool than on external forex markets.

As seen below, the stablecoin price on Chainlink’s oracle for 100k SGD = 72.46k DAI while being more expensive in the pool at 100k bluSGD = 73k DAI; the protocol will mint additional stablecoins and sells them, which nets the protocol 73k DAI-72.46k DAI = 540 DAI.

In a contractionary cycle, where the stablecoin is cheaper on the liquidity pool, the protocol buys stablecoins from the market for cheap and burns them. This effect will net the protocol with a value of 600 SGD (136.6k-136k).

2. Swap transaction fees

The Bluejay treasury accrues value by owning the bulk of the liquidity in the stablecoin pools.

In the example above, we see that if there is a monthly trade volume of 10M DAI, the protocol will make 30k DAI from just providing the liquidity (assuming 100% pool ownership).

3. Evolving revenue generator contribution

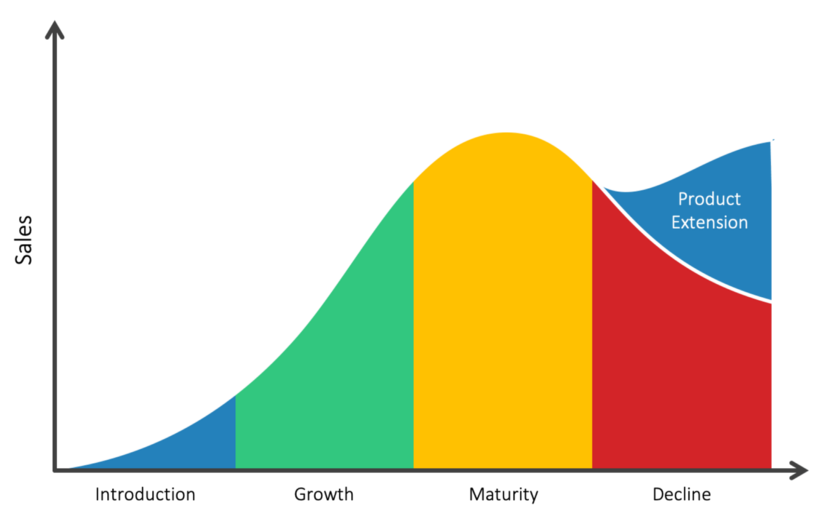

The revenue generated by the different product life cycles does not contribute equally.

The bulk of the revenue in the introductory stage will mainly come from arbitrages of the stablecoins. In the growth stage, the protocol will expand into various markets as its utility expands, likely to increase revenue generated from trading or swap fees. Revenue generated from transaction fees will continue to grow and form the main bulk of revenue generation in its maturity stage.

The Bluejay liquidity flywheel

This is one of the best token models I’ve seen in Crypto ensuring all network participants in the ecosystem are rewarded and incentivized.$BLU Stakers earn #RealYield

— Alpha Seeker (@AlphaSeeker21) October 24, 2022

Mint bluStables to participate in your local economy.

Be an owner to @BluejayFinance OnChain Central Bank! https://t.co/n03i9I31vi

The swap fees generated from protocol-owned liquidity pools and arbitrage revenue generated from stability mechanisms are then accrued back to, and as such, strengthen the protocol’s treasury.

With a stronger treasury position, the protocol can:

- Mint additional stablecoins in the same currency to meet demand from growing use cases.

- Mint different currencies to expand into new markets.

- Deploy more capital for the protocol’s stability mechanisms leading to better price stability.

- Set aside a reserve pool to be more resilient in adversarial market conditions.

With real-world use cases such as cross-border payments and real-world asset lending rising in popularity, each use case represents a tremendous market opportunity.

As Bluejay expands with more use cases, the demand for BLU tokens amongst users and businesses will also increase. More adoption will bolster bluStables, which directly influences the flywheel effects of the Bluejay protocol’s design, in creating a capital-efficient on-chain central bank.

Closing thoughts

With their launch of the BLU token on the 3rd of November, Bluejay is ready to make a significant change in Asia, especially for the underbanked.

Their goal in rebuilding the financial stack for Asia, which works for people on the ground, is a commendable play. Not only will their use cases be relevant to individuals in Asia, but they could also ignite something even more significant, global crypto adoption.

Pioneering this will be arduous, but it will not be long until people on the ground see the actual value of what they are currently lacking.

Also Read: CEO Of BlueJay Finance Left Google To Pursue Crypto, Offers Financial Inclusion To The Underbanked

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: ChainDebrief