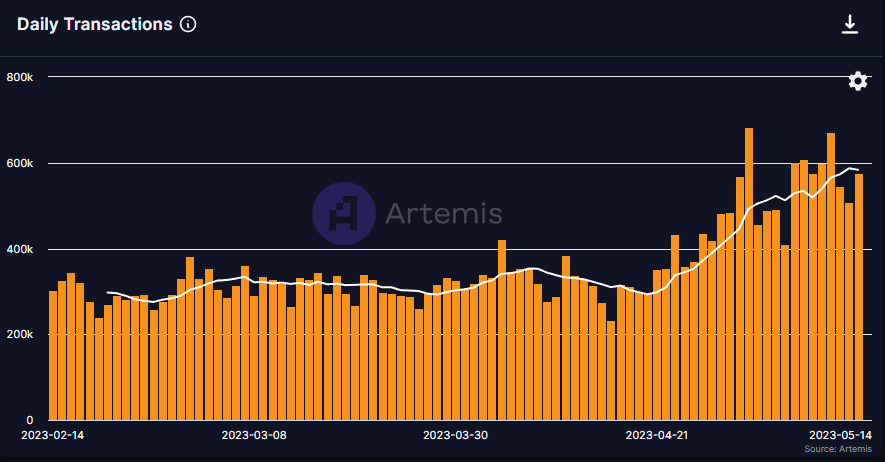

Bitcoin daily transactions have surged past 600k and the average Bitcoin transaction fees as of 8 May reached a whopping USD 30.91, these are levels not seen since the 2021 bull market.

Citing heavy transaction volumes and a surge in processing fees, Binance even halted Bitcoin withdrawals twice in a span of 12 hours on May 7 and 8 due to fee miscalculation!

Why is that so?

There is a large volume of withdrawal transactions from Binance still pending as our set fees did not anticipate the recent surge in $BTC network gas fees.

— Binance (@binance) May 8, 2023

Our team is working to accelerate the confirmation of all pending transactions.

We'll provide updates here.

Some Bitcoin maximalists who are detractors of BRC-20 tokens will likely tell you that people apeing into these tokens are to blame!

What are these BRC-20 tokens and why are they to blame for the surge in transaction fees?

Also Read: Design Better Tokenomics with a16z

What are BRC-20 tokens?

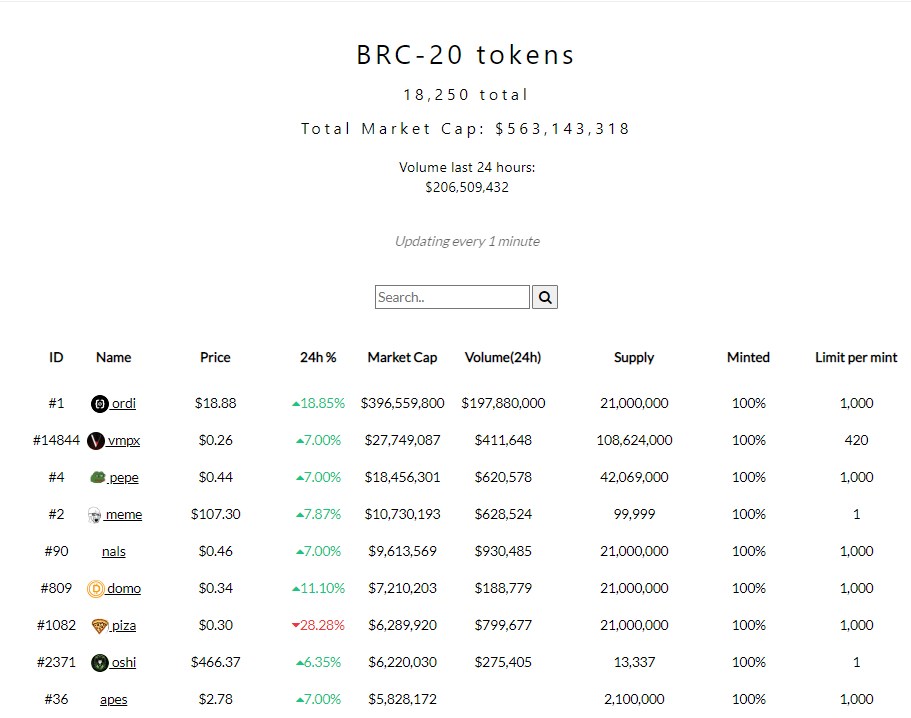

These tokens are new tokens on the Bitcoin network based on the BRC-20 standard that was created by domo (@domodata) on 8 March 2023. The first and most popular one is a memecoin known as ORDI.

Users can mint and trade these fungible tokens by inscribing data in the form of NFTs on satoshis (there are 100M satoshis per Bitcoin) via the Ordinals platform.

Through the use of ordinal inscriptions to attach data to individual satoshis, many BRC-20 tokens have been created.

An experiment into "brc-20's" and fungibility on bitcoin with ordinals 1/x pic.twitter.com/9khKLbEPk6

— domo (@domodata) March 9, 2023

The market capitalization of BRC-20 tokens has surged past USD 500M. BRC-20 transaction volumes have also surpassed that of regular Bitcoin transactions, accounting for more than half of all BTC transactions on multiple days since 29 April.

While BRC-20 tokens have gained in popularity, critics are quick to highlight that these tokens defy Bitcoin’s original vision of a simple and efficient peer-to-peer electronic cash system.

The process of minting and transferring of BRC-20 tokens requires the user to inscribe a new ordinal and hence requires more data as compared to a regular BTC transaction.

As a result, this has intensified the competition for block space and led to a spike in transaction fees.

BRC-20 vs. ERC-20 Token Standards

Although @domodata drew inspiration from Ethereum’s ERC-20 token standard when creating the BRC-20 standard, both token standards have fundamental differences.

First and foremost, unlike the ERC-20 standard, the BRC-20 standard does not have smart contract capabilities and this severely limits its utility and value. BRC-20 tokens cannot interact with other protocols and dApps.

Secondly, the ERC-20 token standard is an established token standard that has proven to be stable. The BRC-20 standard is merely a proposal that has yet to be finalized and it may not be fully integrated with crypto wallets and exchanges.

In fact, @domodata highlighted back in March that “It is unlikely that balances will be safely tradable using existing marketplace infrastructure.”

Updated the gitbook to address common questions and my intentions for the experiment going forward.https://t.co/h6fksQ1oAe

— domo (@domodata) March 10, 2023

Hence, even if the BRC-20 standard becomes widely accepted, it may be some time before markets are fully liquid.

Thirdly, the BRC-20 token standard was conceived as a means to issue and transfer fungible tokens on the Bitcoin blockchain by exploiting a loophole in Bitcoin’s 2021 Taproot upgrade. Most active BRC-20 tokens are memecoins.

ERC-20 tokens, on the other hand, are primarily designed as utility tokens that serve different functions within the Ethereum ecosystem.

Closing Thoughts

The popularity of BRC-20 tokens was propelled by the ongoing memecoin mania. A vast majority of the 8,500 tokens minted using the BRC-20 token standard are memecoins with little to no utility due to the lack of smart contract capabilities.

This hype has resulted in high demand for blockspace and sky rocketing transaction fees that inevitably drew the ire of some Bitcoin maxis.

While Bitcoin miners have benefited from the surge in transaction fees due to the high BRC-20 transaction volumes, it is important to note that the BRC-20 standard has its flaws and is still in an experimental stage.

In my opinion, the underlying ordinals inscription technology would evolve and survive the test of time but not the BRC-20 memecoins as these are more likely to be a passing fad.

Written by: Clarence Lee

Also Read: How To Launch Your Own Memecoin In Under 30 Seconds

“[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: ChainDebrief