The reason you’ve opened up this article is probably because project you’re eyeing is going downhill — a sudden crash, or perhaps, maybe the whole crypto market is in a major bloodbath — and you’re contemplating whether you should buy the token at it’s “discounted” price.

Before you actually press that “buy” button, here’s what you should know before making your move:

What is “buy the dip”?

The term “buy the dip” refers to buying an asset, like a stock or cryptocurrency, after its price has declined from a recent high.

Ideally, you’re buying the asset at a “discounted” price during a short-term decline, knowing that the price will bounce back and thus, you’ll make money.

Understanding risks

There could be hundreds of reasons on why an asset has dropped in value, it could be some form of unfavorable news, high levels of inflation or even Elon Musk tweeting about something.

Like all trading strategies, it doesn’t guarantee profit. Remember, buying that asset at a bargain doesn’t always mean it represents good value, there’s always a possibility that it might go to zero.

We should understand that buying the dip requires great research and experience. Even the veterans struggle on identifying whether the value will be back up soon or not.

Tips to lower risks

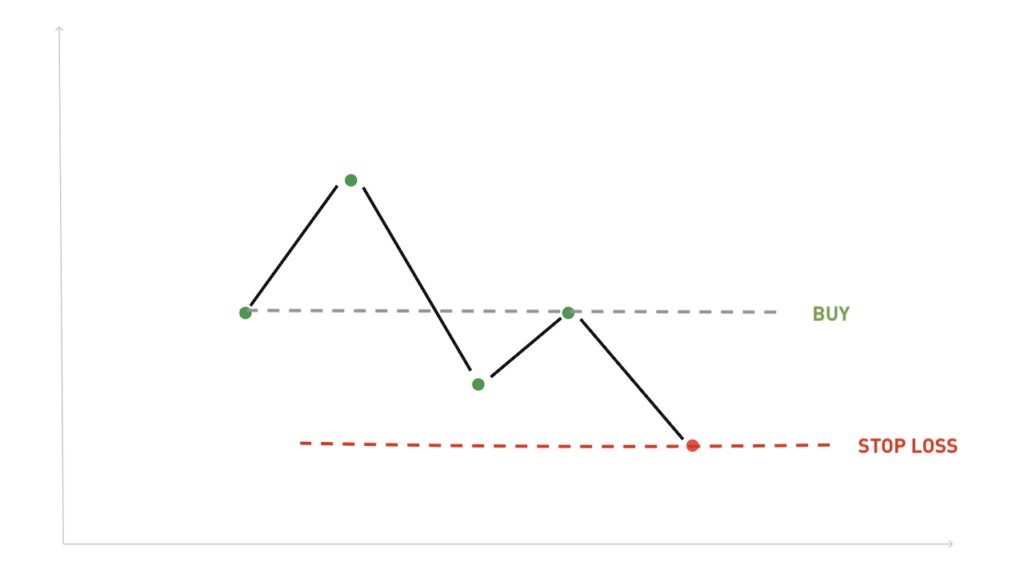

1) Stop losses

Let’s say you want to buy an asset that has fallen it’s value, a trader would usually cut their losses by setting a stop loss.

A stop loss is a universal risk management technique that can be applied to both stocks and crypto trading. Traders use this order type to set a specific price level, at which an existing order would automatically close if the candle touches it.

For example, if a cryptocurrency falls from US$150 to US$140, the trader may decide to cut their losses if the stock reaches US$130.

They are assuming the stock will go higher from $130, which is why they buying, but they also want to limit their losses if they are wrong and the asset keeps dropping.

2) Converting to stable coins

Perhaps you want to save yourself from all the stress in the bear market and that your holdings might continue to decrease it’s value, another option you may consider is to convert them into stable coins.

Stable coins are usually tied up to the US dollar value and maintain their value at a fixed price. Should you decide to convert a part of your portfolio into stable-value assets, this will “lock-in” the value and save you from all the volatility the market is going through at the moment.

If the timing and insight is right, moving in and out of the stable coin strategy helps many investors in growing their portfolios by larger withdrawal and buy-backs.

Some popular stable coins out there are: Tether ($USDT), TrueUSD ($TUSD), MakerDAO ($DAI), Paxos Standard ($PAX), and Gemini Dollar ($GUSD).

Conclusion

The first step to being successful in buying the dip is to know the market. Therefore, do your own research before investing and avoid listening to noise.

Though it might be tempting to buy the dip, it’s always important to not be reckless and invest everything that you have into crypto.

Make sure that the amount that you’re willing to put in is a comfortable amount to lose. We must remember that the crypto market is volatile and the last thing you want to end up with is an empty wallet.

Also Read: What Are Stablecoins And What You Need To Know About Them