The world’s 13th largest bank Citibank, with $1,951.16 Billion in assets joins neighbouring banks HSBC and J.P Morgan in cryptocurrencies and is looking to expand on the division of its digital assets, crypto.

Key insights include that Citigroup is hiring a digital assets risk manager focused on cryptocurrency, stablecoins and DeFi, as part of its broad push to hire up to 100 individuals it builds the division of its digital assets within its Institutional Client Group.

In line with its efforts, Citigroup has also appointed Puneet Singhvi as head of the division, in which he previously headed blockchain for its Global Markets team. As the new head, he will report to Emily Turner, who oversees business development for the group.

"It’s clear that digital assets will be a part of the financial services and financial markets, the future of them," @Citi CEO Jane Fraser says, later adding: "Real-time payments will be here in the near term, and digital currencies may be part of that future." pic.twitter.com/jKUi01vLxu

— Yahoo Finance (@YahooFinance) October 25, 2021

In an interview with Yahoo Finance, the CEO of Citigroup, Jane Fraser, talked about the future of finance and its possible integration with the crypto industry and digital currencies. The company revealed its intent to access the needs of its clients in the digital asset space, as Fraser talked about the potential use cases for crypto-assets and their capacity to improve the legacy financial system.

Fraser believes that this nascent asset class will be the future of finance and real-time instantaneous payments, “We see benefits from the digital asset space in processing, fractionalization, programmability, and transparency”.

Citigroup’s latest crypto expansion comes as many institutional banks are also looking to expand into the crypto world. In recent months, there has been a general increase in crypto hires among financial services firms. According to data from Linkedin, hires for crypto talent have increased by nearly 40% in the first half of 2022.

Despite the concerns of regulatory issues, Fraser believes that it does significantly have potential in the next decade.

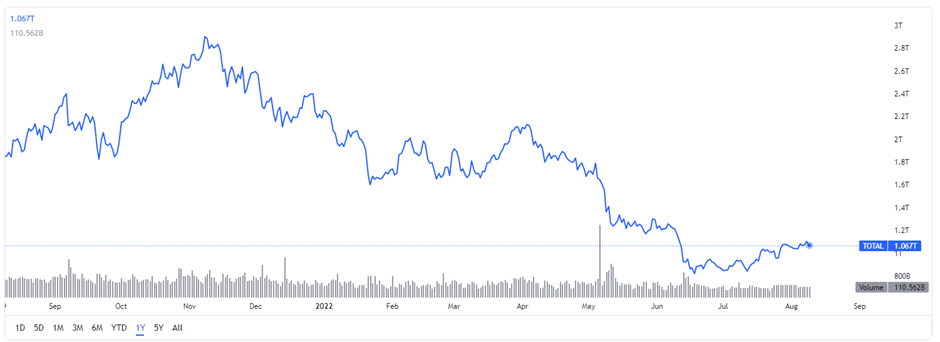

At the time of writing, the total crypto market capitalization is at 1.067T.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: ChainDebrief