Although the failures of prominent cryptocurrency entities like Three Arrows Capital and FTX are frequently cited to criticize Web3, it’s important to note that their decline stemmed from internal problems unrelated to cryptocurrency itself.

Interestingly enough, a major factor contributing to their downfall were their accounting systems – or more accurately, their lack thereof.

This was a point stressed by Karthik Rajeswaran, VP of product for Headquarters (HQ.xyz), during his keynote speech on crypto accounting.

However, even when Web3 companies strive to ensure accurate accounting practices, they encounter numerous challenges such as the absence of a universal standard, the intricacies associated with cryptocurrencies, and the uncertainty surrounding regulations.

Rajeswaran highlighted a crucial concern, which revolves around the inherent volatility of cryptocurrency markets and the challenges that arise when attempting to manage and monitor them during the accounting procedure.

For example, the FASB, or Financial Accounting Standards Board, treats crypto as indefinite-lived intangible assets.

As a consequence, the balance sheet reflects only the lowest observed value of an asset throughout its lifespan, even if its value later increases. In the realm of cryptocurrency, where double-digit fluctuations within a single day are frequently observed, this poses challenges for companies in accurately managing their accounting practices.

While there is already a new proposal being developed by the FASB to address this issue, the aforementioned example comprehensively encapsulates the multifaceted nature of accounting practices in the rapidly evolving Web3 era.

Also Read: Circle Singapore Obtains Major Payment Institution License From MAS For Digital Payments Tokens

How HQ.XYZ Streamlines Accounting Workflow for Web3 Companies

Often, crypto entities encounter significant obstacles in their work due to many existing solutions being centered around Web2, which fail to account for the unique intricacies and dynamic nature of the industry and its specific requirements

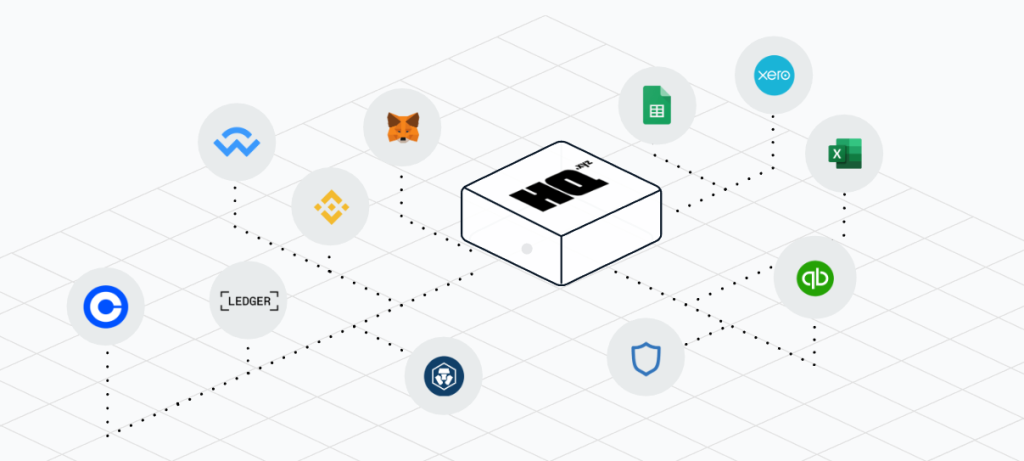

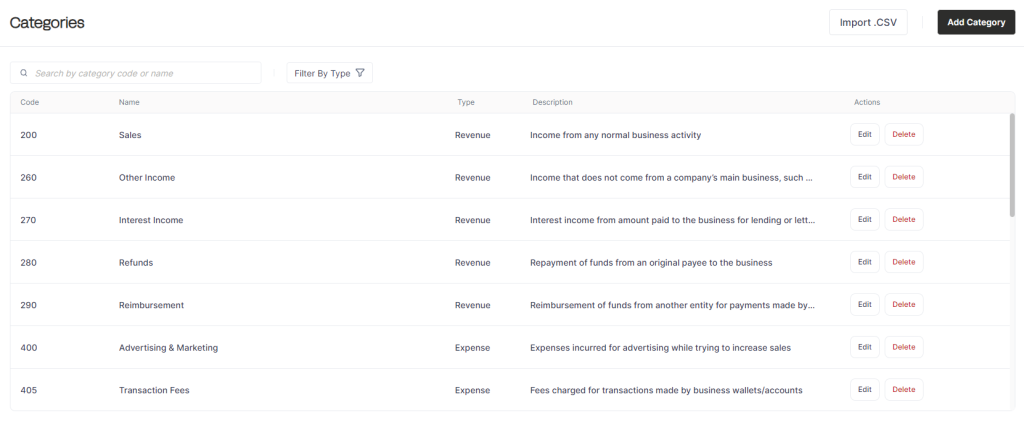

HQ.xyz, a finance dashboard for Web3 teams that automates financial activities and reporting, uses integrated dashboards that give firms a real-time overview of payment workflows, treasuries, and book-keeping.

Using their long list of integrated tools, including Metamask, Ledger, and Google sheets, companies are able to seamlessly track their finances not only over different wallets, but also in a multitude of currencies.

Moreover, Headquarters has advanced well beyond the prevalent “copy-and-paste” approaches that were common in our early-stage industry. Instead, they have actively sought feedback from other Web3 operators, allowing them to refine their strategies and offerings.

A perfect illustration of their commitment to user convenience is their HQ MultiSend widget, which empowers users to effortlessly execute multiple transactions simultaneously, all while alleviating concerns about potential errors in sending their cryptocurrency to incorrect addresses.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chaindebrief