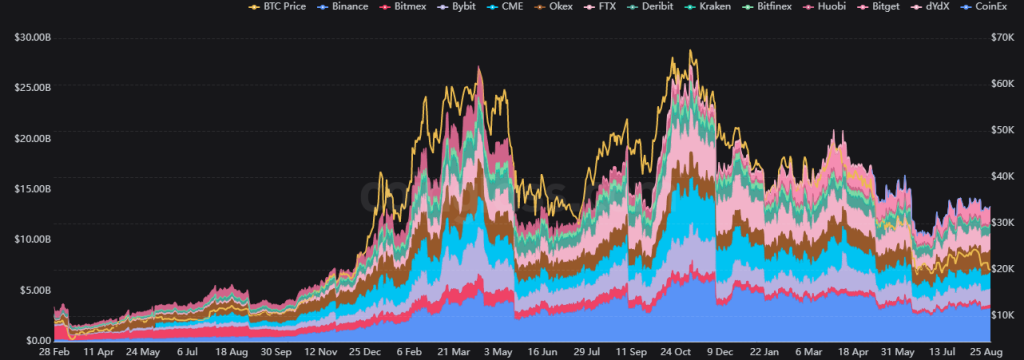

This bear market has been choppy, with participants still betting heavily on both sides of crypto. Despite the overall macroeconomic conditions, open interest still remains relatively high.

With an average of 13 billion worth of longs and shorts being built daily, both retail and institutional seem unable to leave the market.

While those betting against the market were getting hammered last month, the Federal Reserve remaining firmly hawkish has left longs on the losing end.

[DB] POWELL: HISTORY CAUTIONS AGAINST `PREMATURELY’ LOOSENING POLICY

— db (@tier10k) August 26, 2022

This follows a trend of rising CPI (Consumer Price Index), with core inflation in the United States peaking past 6%.

Prior to 2021, core inflation on the 25-Year averaged 2%, topping out at about 3%.

While the volatility of cryptocurrencies remains astounding, it remains benign when compared to the sheer losses equity markets have faced recently.

Also Read: Inflation Rises To 9.1%, Making Sense Of How It Affects The Crypto Market

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: ET money