Insider trading has been a pertinent issue across all financial markets. As the price of cryptocurrency fluctuates, the cryptocurrency market saw a massive influx of new traders, especially those looking to cash in some profits.

One stock market tactic that has become more prevalent in crypto trading is “front-running”.

Front runners are constantly abusing cryptocurrency exchanges via insider transactions on the Ethereum network.

More recently, Binance and Coinbase have been accused of facilitating insider trading due to their great influence on the market.

Let’s take a look at how insider trading works and how you can avoid losing money to it.

What is front-running?

Front-running is when traders take advantage of an insider tip that could significantly affect the price of crypto and use it to their advantage to make a profit out of it.

Essentially, this gives traders an ability to buy or sell a cryptocurrency coin in advance. Traditionally, this is done in a stock market exchange, where stocks are exchanged on paper, and front running was alluded to rushing to the front of the line when a huge exchange was coming.

This isn’t too different from the crypto world. What’s different is the technique used to facilitate this trading, and that it happens more online than offline.

In the crypto world, bots are used to front-run transactions, as they automatically synthesise and evaluate information available on the market and perform front-running for users.

Bots typically jump the queue by inserting a higher transaction fee (gas) for placing the order, so that the trader who initiated the transaction is forced to pay the price that they didn’t see coming.

For example, if a crypto trader knew that a certain cryptocurrency is going to be purchased by Jack Dorsey, they could automatically queue the order before that, causing the price to jump when that transaction is initiated by Jack and thereby immediately put a sell order, making maximum profit from the trade.

Bots are not the only way for front running and sometimes there are still manual purchases by individuals who have inside information.

They may choose to do this way in advance to avoid detection as transactions are completely transparent on the blockchain such as Etherscan.

More importantly, Binance and Coinbase have the largest trading volume in the spot market and hence have the greatest influence on the listed cryptocurrencies. Is it possible that they could be facilitating some inside trading?

A breakdown on Coinbase

These findings were identified between the time period of November 2017 to February 2022, which was mainly to determine whether the bull news was reflected in the market ahead of time.

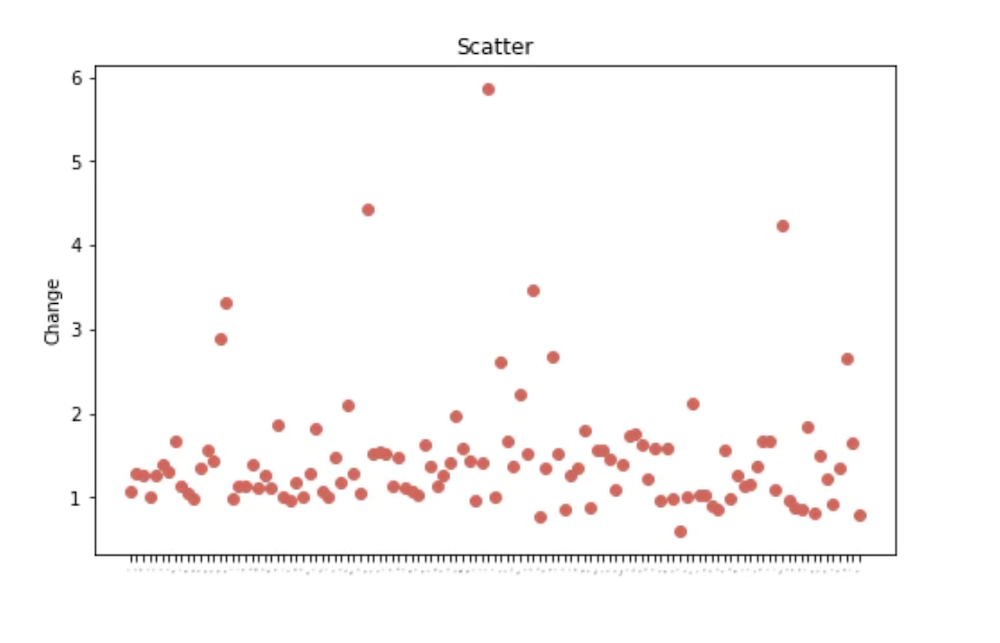

Recently, about 135 new cryptocurrencies were selected on Coinbase, with 17 of them removed as the listing price was the ILP and therefore there wasn’t enough historical data. This resulted in a total of 118 being selected.

18 of them rose more than 1x, some with bullish news in the last seven days while some do not. These were removed so that the range of data is more accurate.

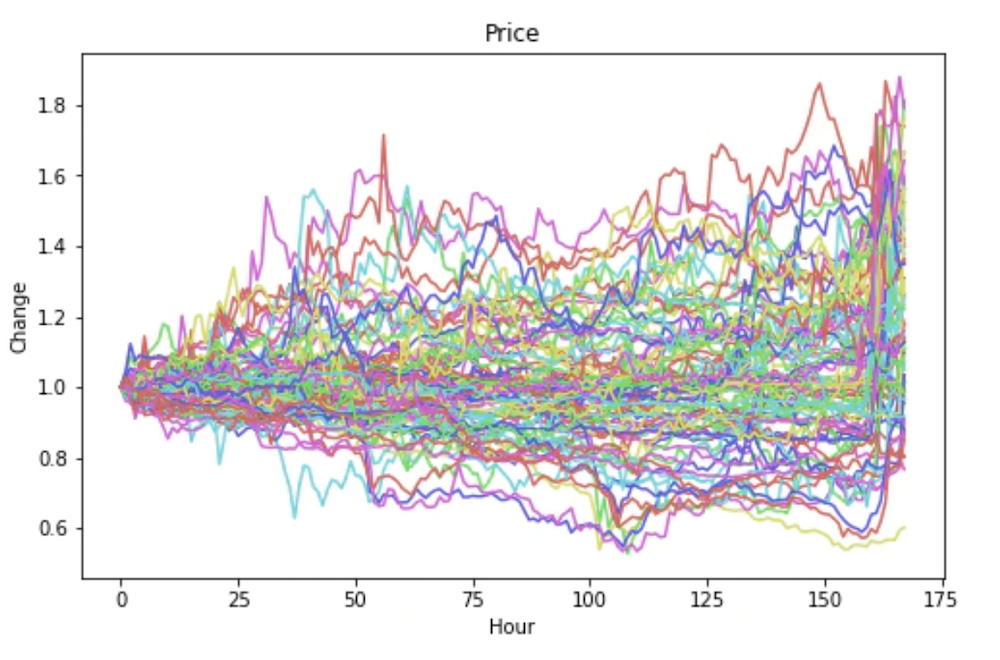

More importantly, after removing these cryptocurrencies we are left with 100 of them. The chart below shows the price movements of the remaining cryptocurrencies.

Interpreting the hour of these prices, the distribution highlights a significant right-skewed pattern with the mode > median > mean.

It is important to note that these were all listed in a bull market, so it is possible that they may already be on an uptrend before listing. (indicating it is not likely that there is insider trading)

That is why it is important to consider the BTC trend over these periods as a comparison as most altcoins have a high correlation to the King of all Crypto.

As compared to Bitcoin, altcoins have a significant positive skew (right skewed) in pricing, while Bitcoin is almost normally distributed without significant similar findings to altcoins.

This could indicate that there could be some inside trading as its price rose significantly before listing not in line with the trend of Bitcoin.

However, it is important to note that there are many other dependent factors that could affect the pricing of these coins also and we cannot draw conclusion immediately.

A breakdown on Binance

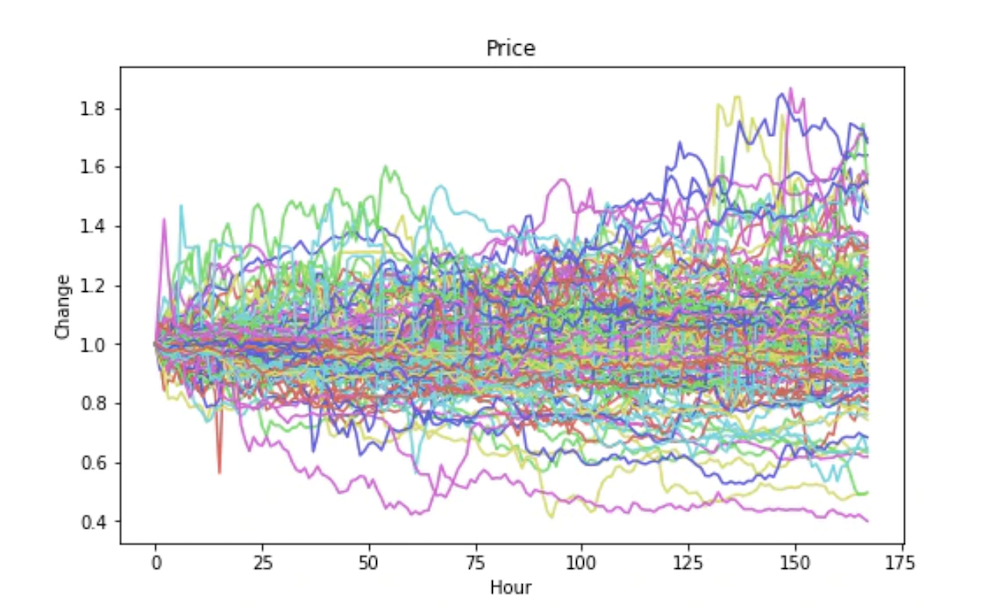

As compared to Binance, a total of 311 cryptocurrencies were selected. Similar to Coinbase, 144 of them were removed as the listing price of the ILP and hence there was no significant historical data available. In the end , only about 167 made the listing. 15 of them were up more than 1x and hence data is only taken for 153 listings.

The distribution is slightly skewed to the right just like Coinbase, but not as much. If we compare Bitcoin movement to the prices of these altcoins leading up to its inception of the exchange (7 days prior), its movement is not significantly different from Coinbase’s chart of Bitcoin. (previous chart above) This could suggest that short-term volatility has little impact on the short-term movement of a new cryptocurrency listing only.

Closing thoughts

In summary, there are some key takeaways to be noted here. Both Binance and Coinbase’s new cryptocurrencies outperformed Bitcoin in pre-listing week.

Since Bitcoin’s average increase in each time period was insignificant (near 0) and with a completely different distribution from the altcoins stated, this indicates that the news was indeed reflected in the price of the cryptocurrency in advance to some extent. It is possible that there is some form of insider trading occurring within these exchanges.

That being said, there is probably insider trading in both decentralized and centralized exchanges, and it is not up to us to enforce or prevent this from happening. More importantly, we should consider how we don’t fall victim to these inside trading tactics.

A good rule of thumb is to never purchase a cryptocurrency just because it was listed on an exchange. Always wait about 2-4 weeks for the price to stabilise before purchasing anything, to prevent yourself from buying the picotop.

Consider fundamentals as well before any investment decision. This could help save you from poor investments.

Featured Image Credit: Chain Debrief

Also Read: Investor Or Gambler? Here Are The Top 3 Tell-Tale Signs That You Are A Crypto Gambler

Was this article helpful for you? We also post bite-sized content related to crypto — from tips and tricks, to price updates, news and opinions on Instagram, and you can follow us here!