APY is a common term used in both traditional finance as well as decentralised finance (DeFi). APY stands for Annual Percentage Yield and it is a measure of how much you can earn from your assets over the course of a year.

Do note that APY and Annual Percentage Rate or APR is fundamentally different as APY accounts for compound interest, but APR does not.

It is not uncommon to see protocols providing high-interest rates and mouth-watering APYs of over 100%. If you dig deeper you can even find protocols offering APYs north of 1000%.

So naturally, this leads to the question of how are the protocols able to generate such high APYs?

It all boils down to where the yield is generated from as not all yield is created equally.

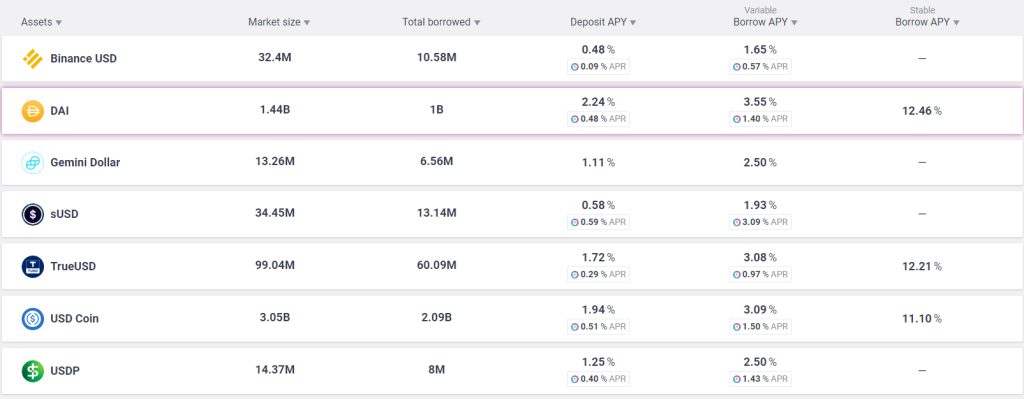

1. Demand for leverage

DeFi opens up many possibilities even the ability for users to lend and borrow assets from one another.

Lending is a service done by traditional banks but now in the world of DeFi, even you can be a lender and earn that interest rate.

The protocol acts as a bank where the interest rate of borrowing exceeds the interest paid out for lending. If a user borrows USDT for 5% interest, the protocol would pay out a percentage of the interest to those who provided liquidity to the protocol.

The interest yield is driven by the demand for leverage where users who borrow the assets expect to earn more profits than the interest payable.

This creates an environment where the yield responds to market demand and is more sustainable in the long term as it does not rely on other mechanisms for base yield.

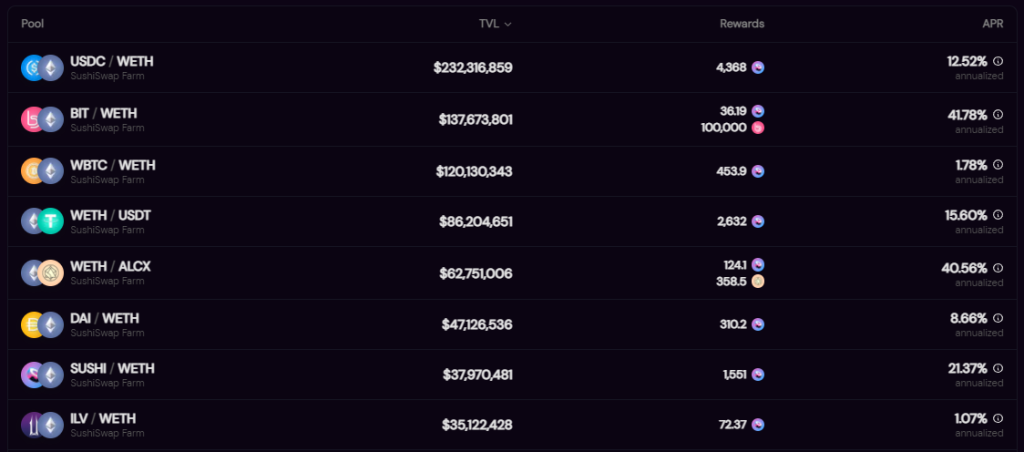

2. Yield farming

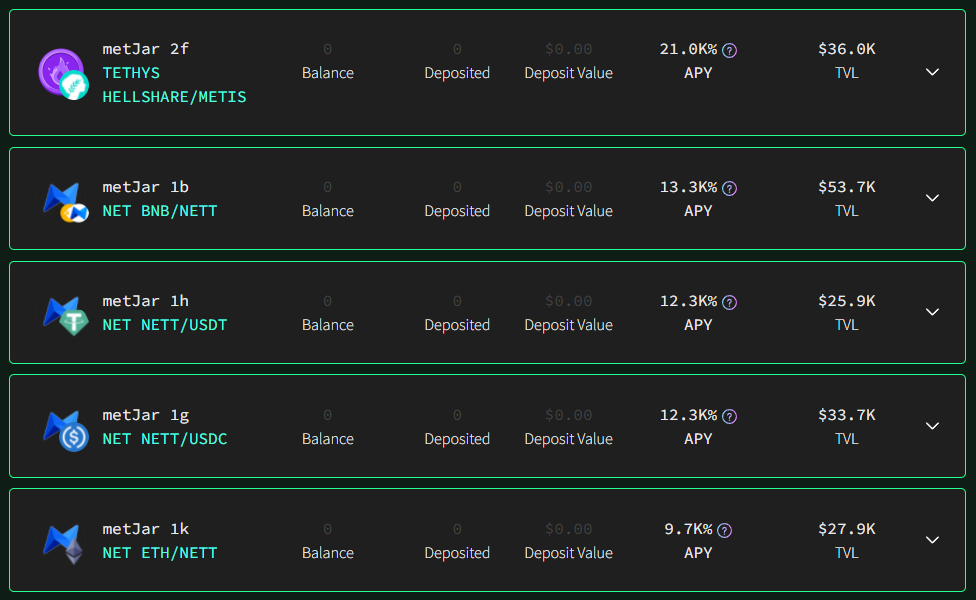

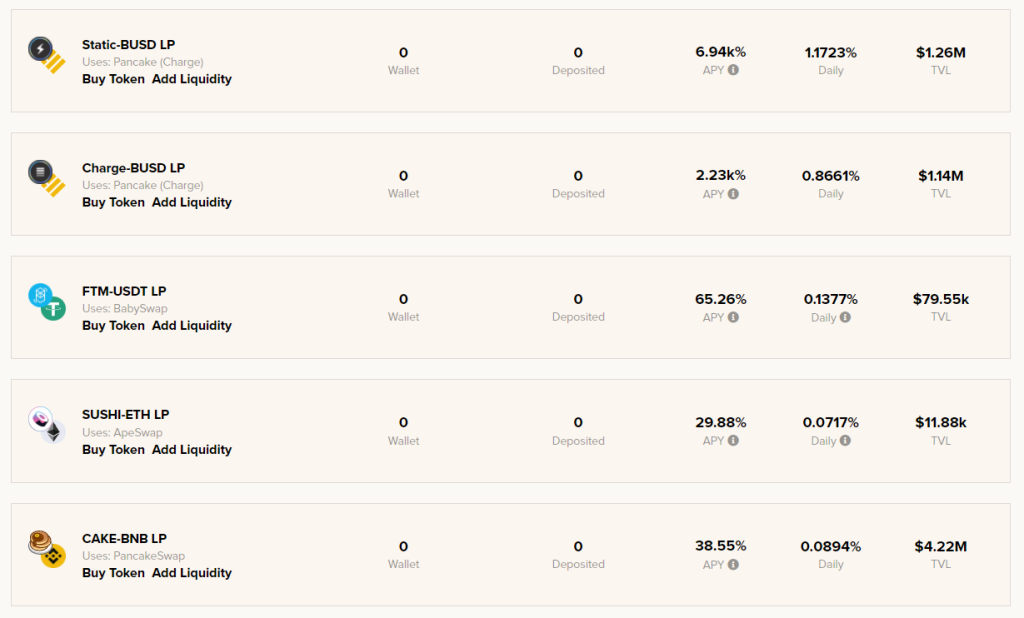

Another source of robust yield is from yield farming. It was the hottest trend of DeFi Summer in 2020, there were endless farming opportunities with insane APYs everywhere. Today, most of the platforms have matured and the APYs is not as high as they used to be.

Users who provide liquidity into a pool will be able to earn a cut of all trade done on that pool. Liquidity providers have to provide cryptocurrency pair in equal value to the pool.

For instance, if the liquidity provider wants to participate in the USDT-ETH pair, US$100 worth of ETH and US$100 worth of USDT must be deposited into the pool. And whenever a user trade on the USDT-ETH pair, you get to earn a cut on the trading fee charged on the trade.

Do note that some liquidity pools are more exposed to impermanent loss. This is also the reason why most farms would provide higher APYs to liquidity pools with more volatile assets.

3. Liquidity mining

Here is where things start to get crazy and APYs start to soar.

One of the biggest challenges that DeFi protocols face is attracting liquidity. Liquidity mining is where protocols start to offer crazy APYs to incentivise users and bootstrap liquidity.

While liquidity mining might look similar to liquidity farming, there is a stark difference from yield farming as liquidity mining compensate liquidity provider with native token on top of the trading revenue.

DeFi OGs would definitely remember the infamous vampire attack that SushiSwap launched on UniSwap. It first starts by incentivising Uniswap liquidity provider to take on its platform by offering SUSHI token rewards then it starts to drain liquidity from Uniswap itself.

Without a doubt, this is a fantastic way to bootstrap liquidity but it also comes at a cost. The aggressive token distribution to maintain the high ARYs is not sustainable in the long run unless the demand outpaces the inflation rate.

Over the years, many protocols used this strategy but not many were able to survive the test of time.

4. Yield optimizers

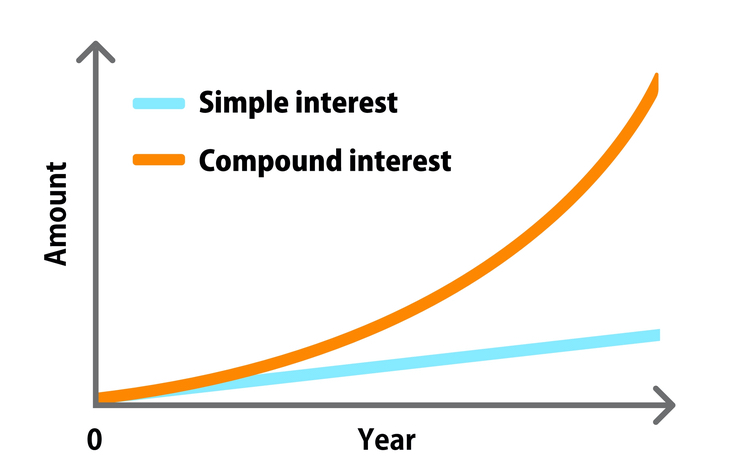

Compound interest is often known as the 8th wonder of the world and the most powerful tool in finance.

Compound interest is when the interest earned on the asset is reinvested to generate additional interest. This is without a doubt a game-changer as it creates a snowball effect and the growth of the investment is exponential.

Yield optimizers help users optimize their yield through various strategies. One of them is to auto compound the yield generated.

Typically, the yield generated is not reinvested automatically, and users have to collect and reinvest themselves. If a user wants to reinvest their earnings manually, it would require a few transactions and the gas fee might be too expensive that it is not worth it to reinvest.

The yield optimizer helps to solve this issue as it auto compound the earning for the user. This yield compounding effect is reflected on the high APYs of the auto-compounding farms where APYs can reach over 10,000 APYs.

Furthermore, it is easy to use as users would just need to deposit the liquidity provider token onto the yield optimizer protocol and let it work its magic.

Without a doubt, compound interest is an investor’s best friend.

Wrapping up

All in all, while some DeFi protocols are able to provide attractive returns with high APYs, always keep in mind that there is no free lunch in this world and try to get a sense of where that yield is coming from.

Knowing where the yield is generated from will help paint a better picture of the project and the sustainability of the APYs. Do exercise caution when apeing into high APYs protocol as you might be funding the next crypto rug.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image: CNBC

Also Read: Earn Yield From Stablecoins: Where You Can Stake Them And How Much Interest You Can Earn