As crypto assets are a relatively new asset class, it may be hard to properly evaluate the fair value of each protocol.

On top of the commonly used price over earnings ratio, another possible way to evaluate crypto assets is via its market cap over its total value locked.

Market Cap Over Total Value Locked

The cryptocurrency market cap is calculated as the price of the virtual currencies times the number of coins in the market. This gives cryptocurrency investors an idea of the overall market size.

On the other hand, the total value locked represents the amount of assets that are currently being staked in a specific protocol.

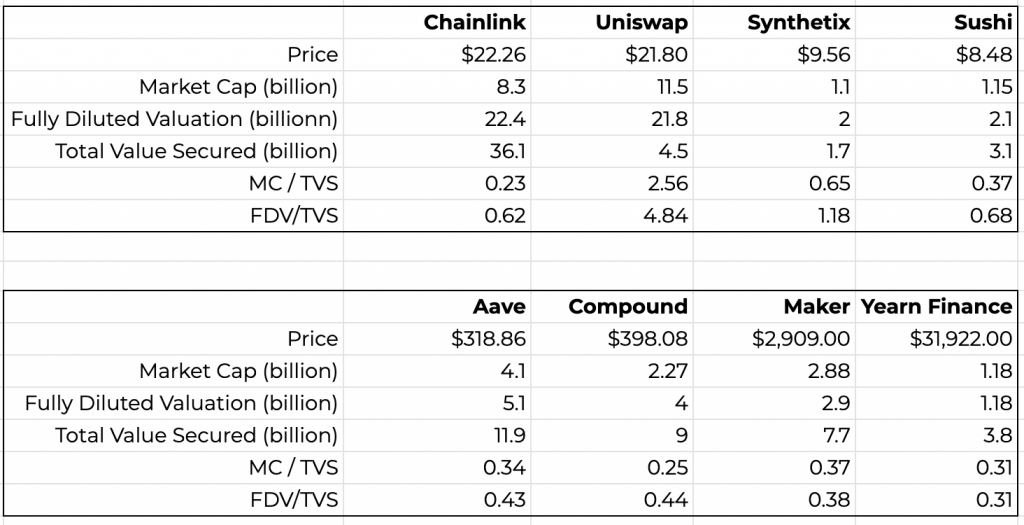

Here’s a look at the various market cap over total value locked of selected protocols:

| Crypto Protocols | Chainlink | Uniswap | Synthetix | Sushi |

| Price | $22.26 | $21.80 | $9.56 | $8.48 |

| Market Cap (billion) | 8.3 | 11.5 | 1.1 | 1.15 |

| Fully Diluted Valuation (billionn) | 22.4 | 21.8 | 2 | 2.1 |

| Total Value Secured (billion) | 36.1 | 4.5 | 1.7 | 3.1 |

| MC / TVS | 0.23 | 2.56 | 0.65 | 0.37 |

| FDV / TVS | 0.62 | 4.84 | 1.18 | 0.68 |

| Crypto Protocols | Aave | Compound | Maker | Yearn Finance |

| Price | $318.86 | $398.08 | $2,909.00 | $31,922.00 |

| Market Cap (billion) | 4.1 | 2.27 | 2.88 | 1.18 |

| Fully Diluted Valuation (billion) | 5.1 | 4 | 2.9 | 1.18 |

| Total Value Secured (billion) | 11.9 | 9 | 7.7 | 3.8 |

| MC / TVS | 0.34 | 0.25 | 0.37 | 0.31 |

| FDV / TVS | 0.43 | 0.44 | 0.38 | 0.31 |

From the table of comparison above, it seems that some protocols are still trading at below what their peers are trading at, and may present good purchasing opportunities.

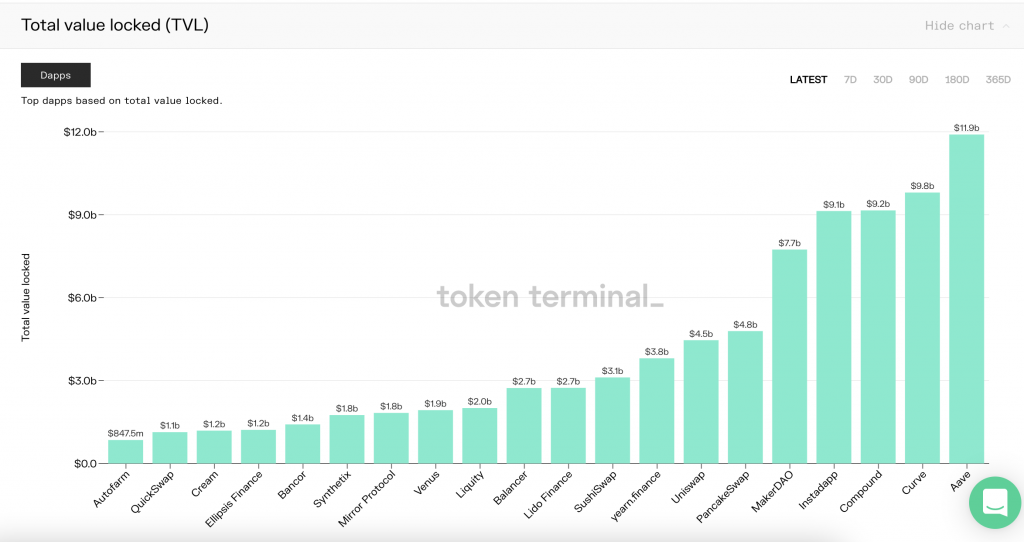

The total value locked is derived from protocol tracking platform token terminal:

It is also worth disclaiming that this is a basis of comparison and there are other factors that determines the value of a crypto protocol, for example, the growth of its user base, the growth of its value locked, as well as upcoming products and feature launches.

Also Read: On Chain Metrics You Can Use To Value Chainlink And Why They Are Important