When I first entered DeFi, farming was.. magical. For the life of me, creating liquidity pairs or staking single sided pools that gave more than 1000% APY took me on a roller coaster ride. Not all farms were a win, especially when impermanent loss and shit-coins were a part of the equation.

Learning how to differentiate between short term shitcoin ponzi-farms and long-term farms that were sustainable allowed me to develop a better farming strategy. On a monthly basis I get minimally 3-10% of my entire farming portfolio as harvest, which I then reinvest or park as stables for “buying the dip”.

This article hopes to shed light on some long-term (SAFU) farms I am with the hopes that you do not squash my yields! WAGMI indeed.

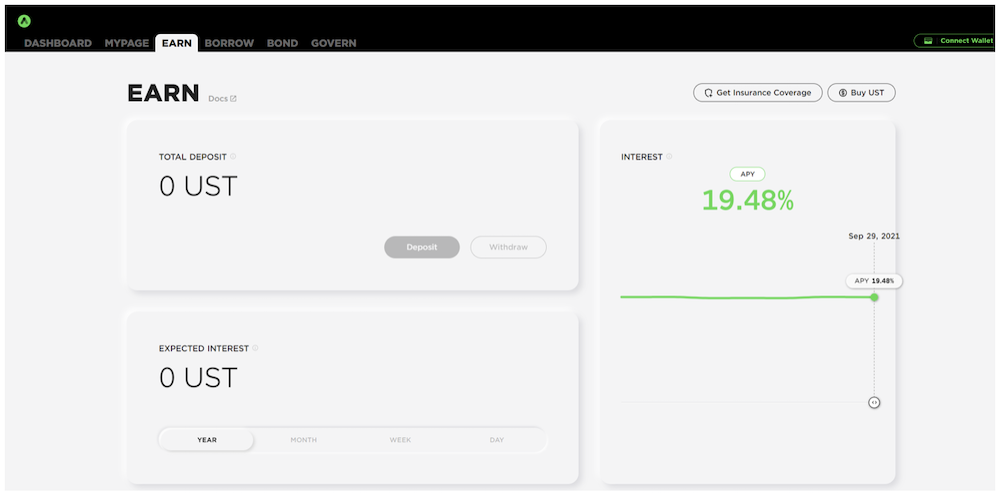

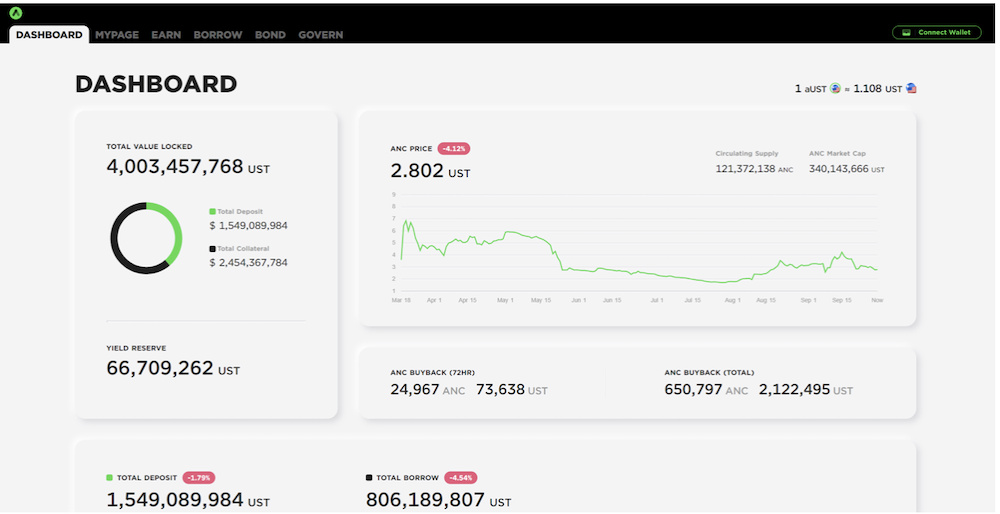

1. Terra Network: Anchor Protocol

Anchor Protocol offers 19.48% on UST stables, which is one of the highest for single side staking. The easiest way to onboard your UST would be to trade your USDT for UST at Kucoin, and send it over to your Terrastation Wallet.

A good range of swop would be 0.996~ UST per USDT upwards, which also means you will lose approximately 0.4% in the swop, and the fees for sending your UST from Kucoin to your Terra Wallet would cost a 4 UST, along with a small fee in depositing and withdrawing your UST which you would have to account for in your final “yields” obtained.

Monthly after accounting for these fees I would be getting about 1-1.5% interest on my UST.

The great thing about Defi Farming/Staking as compared to deposits offered by local financial institution is the flexibility and terms – no minimum sum of commitment, which balances the field even for new players who are looking to kickstart their financial journey.

Anchor protocol has been quite a huge volume of UST locked up in their vaults, and are one of the top used protocols in Terra network.

I have also done a liquidity pair of ANC-UST parked at a short-term compounding farm (ApolloDao) earning me a good 97.16% APY and an additional 7.54% Apollo APR.

I was willing to take the impermanent loss from this LP, as overall I do believe in the long term $ANC is a strong contender in the Terra Network, and the value of my LP would go up with time alongside getting some great harvest from farming this!

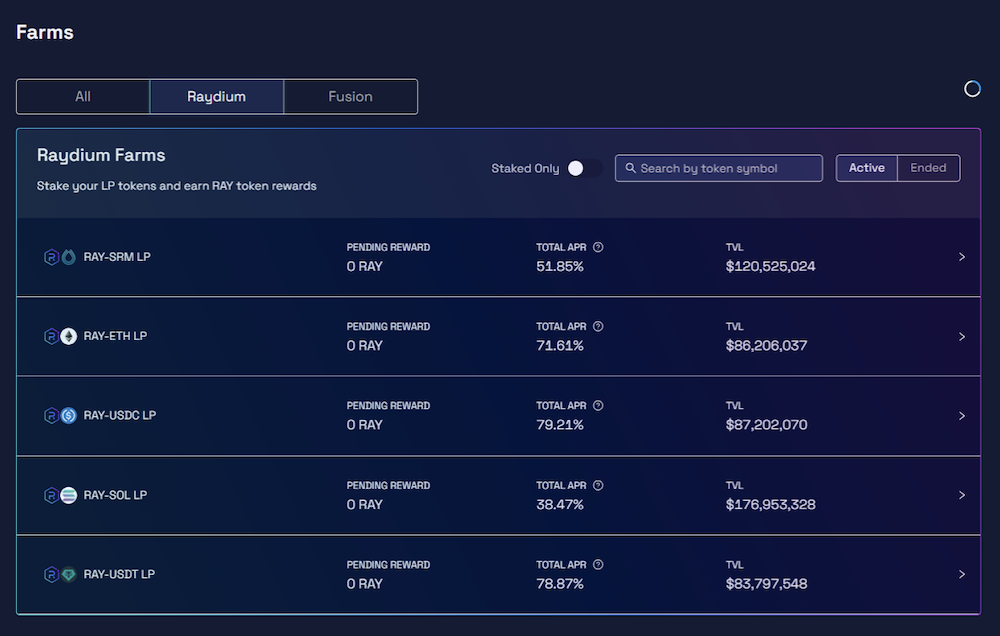

2. Raydium Farms

Raydium is a coin I generally long, and their farms APR has been relatively good with dips expected when the coin value dips. I have been in the RAY-USDC LP for quite some time now and sat a rollercoaster ride with $RAY dipping to $3 then back to $14 before stabilising at $10~ right now.

In the long term, I am unlikely withdrawing my RAY-USDC LP as I have covered the initial cost of my RAY-USDC LP through selling the $RAY tokens harvested so far. At this point, the farm is relatively risk-free for me, as any harvest alongside the LP I have will be pure profits.

There are other protocols that work alongside Raydium LPs such as Solfarm, an automated compounder. I chose to stick with farming at Raydium instead as I didn’t want my LP size to increase, I wanted to be able to de-risk and choose when exactly I would like to dump my $RAY tokens. Getting my harvest in $RAY would also provide me the option to stake for participation in the Acceleraytor IDOs on Raydium that could possibly earn more from selling the allocation earned.

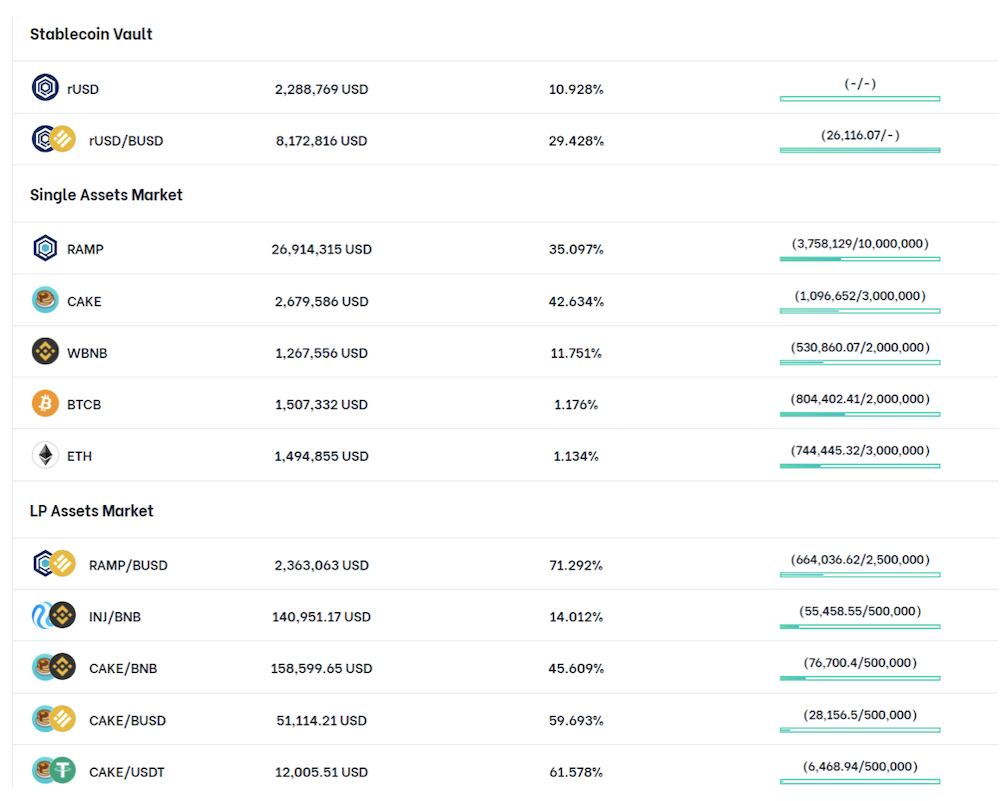

3. RAMP

Ramp is a multi-chain DeFi lending platform that allows you to deposit collateral assets for high yield and borrow rUSD stablecoin against asset deposits. One would be able to transfer rUSD liquidity seamlessly across networks.

Ramp is a protocol on ETH, BSC and Polygon. To explain, I will look into the BSC network for their protocol and explain some simple strategies that would allow you to gain better yields.

Depositing my single side assets on Binance Smart Chain into Ramp (coins like $BNB, $ETH, $CAKE) earns me some great compounded interest that directly accrue on the coin itself.

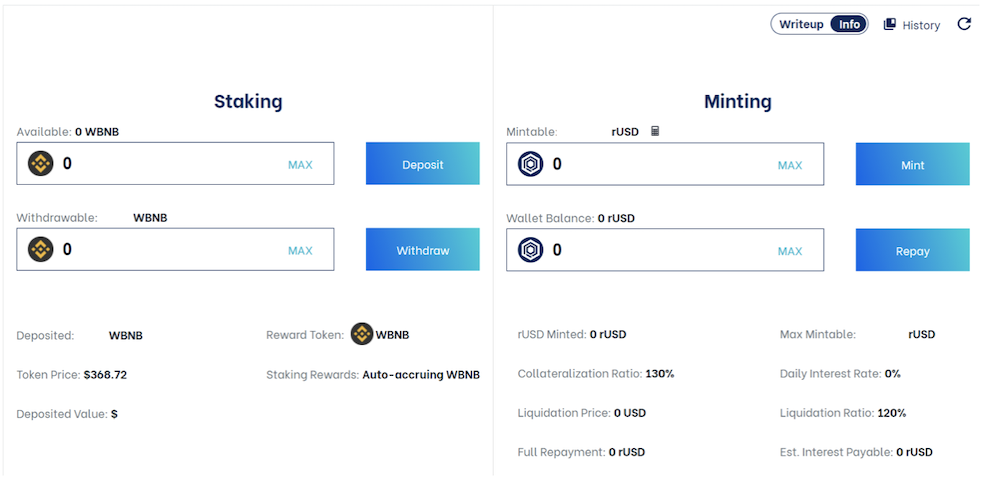

An example below is how I have staked my $WBNB on the single staking pools of RAMP. This earns me an interest of 11.751% directly paid back to my $WBNB token.

Now, one can simply stop here and just earn the interest paid below which are decent, or move towards leverage farming which I do. Do note that depending on how much you leverage, there are certain risk involve as well.

(Figures on deposit and mintable amount were all blanked out for privacy reason)

When staking an asset, it can be used as collateral as above and allow you to mint $rUSD. However, the $rUSD minted may cause your $WBNB to be collateralised and dumped if the asset token you staked faces a sharp dip in price.

To give an example, you could have minted the maximum when $WBNB is $368.72, however your assets might go down in value causing your collateral to go down.

In general, RAMP collateral to mint ratio is about 75%, which would then equate to:

Staking $1000 worth of $WBNB = mint $750~ of rUSD at 0% interest

This would mean you would run the risk of your $WBNB being seized if it drops below the liquidation ratio of 120% should $WBNB dips more than 20%. You would need to watch the general price of the assets you stake if you maximised your minting collateral at RAMP.

To play it safe, you could choose to mint a lot less $rUSD than the maximum allowed (say 40-50%) if you were lazy to watch the general price rollercoaster of your staked asset.

Now you may ask..

Why mint rUSD?

Simple, because on top of earning interest on the staked asset ($WBNB in this case), I get to earn additional interest on it being collateral by withdrawing $rUSD to further stake and earn more interest.

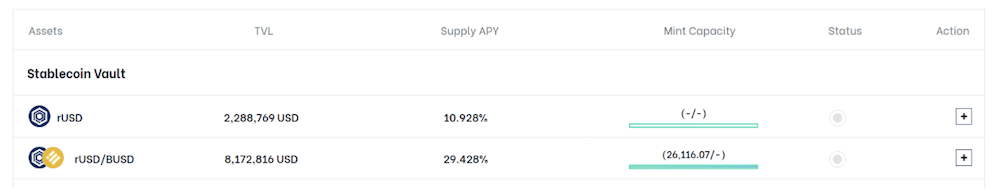

This form of leverage yield farming would allow you to earn an additional 10.928% APY in $rUSD if you do a single side staking from your minted token, or you could use the $rUSD and swop some to $BUSD to form your rUSD-BUSD LP (and pay some fees for these conversions), to enjoy the 29.428% APY.

The additional interest would otherwise not be earned but do carry some form of risk when deciding how much to leverage while minting the $rUSD.

Planning your farm

When doing up my “yield farming strategy” for my portfolio, my goal was to have the harvest from my farms pay my monthly expenses. Everyone has a different risk-reward and goal while planning – be it staking, farming or leverage farming, there is no one-fits-all strategy.

Here’s hoping the yields remain healthy so farmers can keep on farming!

Featured Image Credit: Binance Academy

Also Read: Side Hustles: 5 Ways To Make Extra Income Out Of Crypto