Those in the space long enough should know about the 2017 ICO (Initial coin offering) boom in the crypto market. Many startups and projects used ICOs to raise funds for their ventures. The boom was driven by the rising price of Bitcoin and other cryptocurrencies and a lack of regulation in the ICO market.

Most notably, Ethereum, a decentralized platform for building decentralized applications and smart contracts, was one of the first successful ICOs in 2014. Binance, a cryptocurrency exchange platform, raised funds through an ICO in 2017 and has since grown to become one of the world’s largest and most popular cryptocurrency exchanges.

However, this hype was followed by a fall in the crypto market. Many projects that raised funds through ICOs failed to deliver the promised product, leading to decreased trust in ICOs and tighter government regulations.

Sparrow, a Singapore-headquartered exchange offering “Digital Asset Solutions”, may have just failed to deliver on ICO promises.

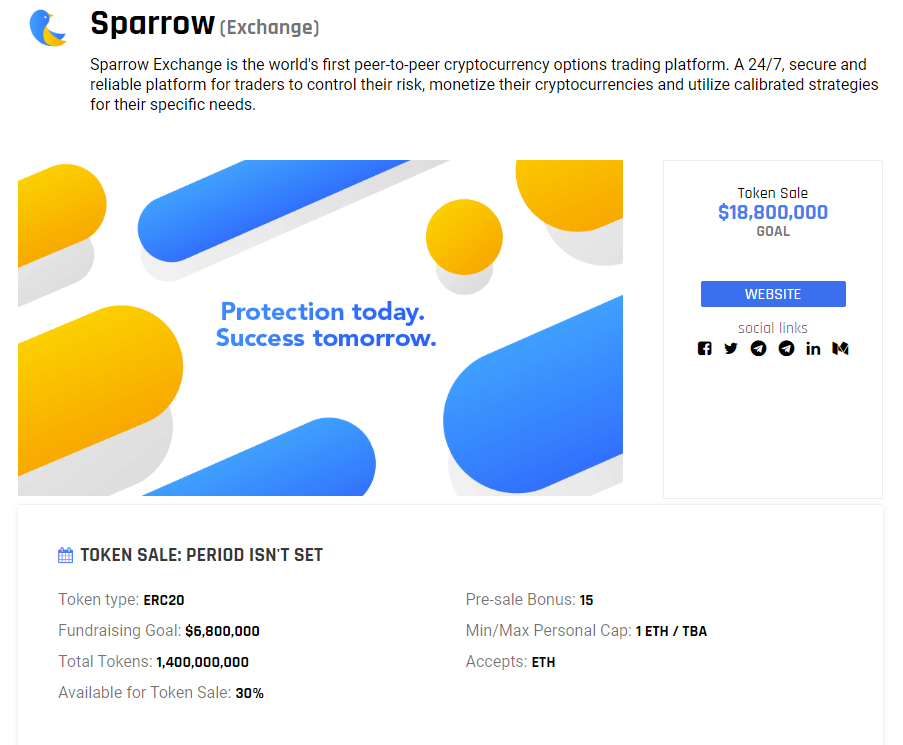

In 2018, Sparrow Exchange, led by its CEO Kenneth, sought funding from investors through an ICO. The company aimed to create a token exclusively for its platform. The Sparrow token would be used for transactions on the exchange.

This is a common practice among other cryptocurrency exchanges, which often have their own native tokens that can be used to pay for trading fees and various other purposes.

Examples include the $FTT token of FTX and the $BNB token of Binance.

According to ICODrops, Sparrow had a goal of $6.8M with 1.4B tokens. If this were true, each token would be valued at $0.004.

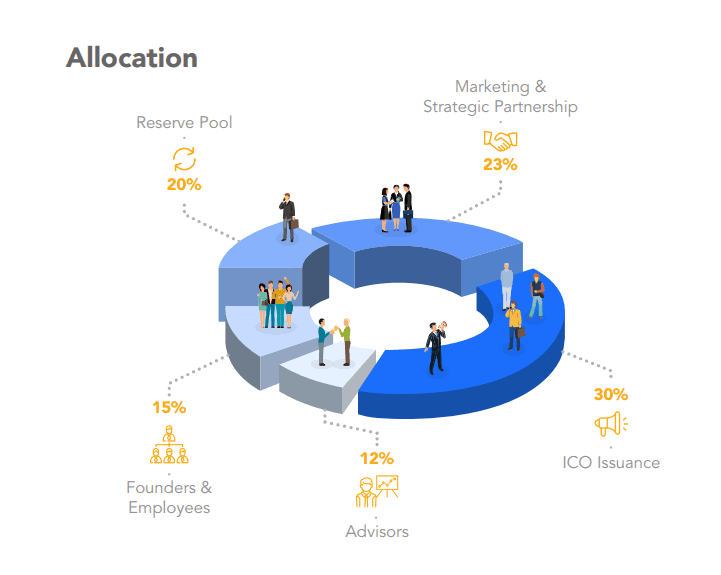

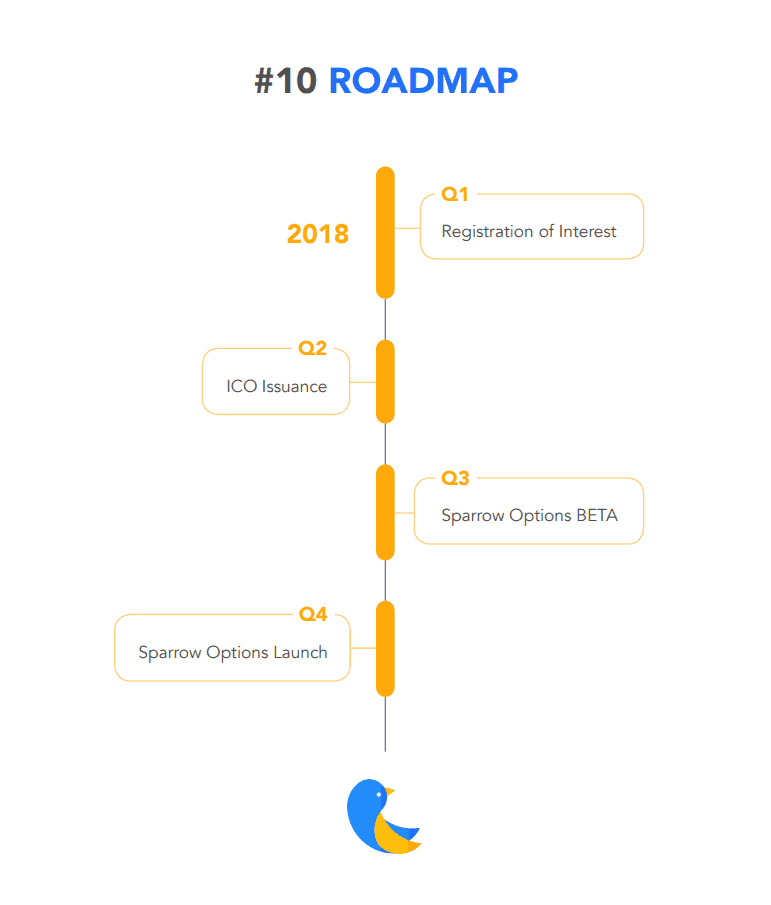

ICODrops also included screenshots of Sparrow’s token allocation and roadmap for its ICO.

Brought up by a few of the ICO investors, Kenneth also informed them that their goal was to create a cryptocurrency token that would appeal to portfolio managers. The token aims to provide solutions that reduce downside or liquidity risks.

However, despite several promises, the coin failed to be listed through significant fluctuations in the cryptocurrency market.

Similarly, there has been no progress even two years after the ICO, causing concern among investors who had expected the launch shortly after the fundraising.

In the initial meetings between Kenneth and ICO investors, the CEO stated that this process would be similar to other pre-Initial Public Offering (IPO) structures, where listings would happen approximately six months after receiving the coins.

Below is the conversation between Sparrow’s Kenneth (CEO) and Adrian (CIO) and with ICO investors Sean Lim from NWD Holdings and his managing partner Tan Thiam Chye when they first met on 12 May 2018.

In addition, Sean (ICO Investor) said the “Sparrow team strategically reference well-known investors and partners, such as Li Ka Shing’s family, Jackie Chan’s son, HyperChain Capital, former bank traders, and Dymon Asia traders as participants in the funding round to attract more investors.”

On top of the $5M they raised in the private token sale (ICO), Sparrow raised $3.5M in their Series A funding in 2020, with participation from Signum Capital, Du Capital and FinLab EOS VC.

Kenneth and co-investors of Sparrow’s Private Sale of Tokens for ICO recently met in October 2022 to talk about the next steps for ICO.

Before the 2022 meeting, there were several attempts made by the ICO investors to reach out to Kenneth to clarify when the ICO listing is going to happen. According to Sean, “numerous excuses, reasons, and possibly lies were told to me through the years about the ICO. But the last straw was when Sparrow didn’t list during the bull run in 2021, which was a major red flag.”

“Kenneth also offered to make good by paying us back the monies in cash by instalment or a trust deed when he receives shares from Amber post-acquisition,” said Sean. Furthermore, when asked for a proposal to pay ICO investors back in cash by instalment, Kenneth replied that he is “not liable again and will only pay back in shares purely out of goodwill.”

Amber Group, a Temasek-backed crypto firm, recently acquired Sparrow Holdings for their MAS licence.

The case has been reported to MAS, who is investigating the matter. We have also contacted Sparrow Exchange for any comments on the matter.

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chaindebrief