Crypto natives or investors would know that every other day there are new projects and protocols launched on the many different blockchains.

This makes it hard and can be a daunting task even for the most experienced crypto investors to keep up with all the development and do due diligence on them.

Everyone always says to “do your own research” or DYOR, but few share how to actually do it. Here’s how you can do your research on a crypto project that you may be interested in:

Collecting information from the website

When I first hear about a particular project, here are the steps that I will usually take:

Go to the official website to find out what they do

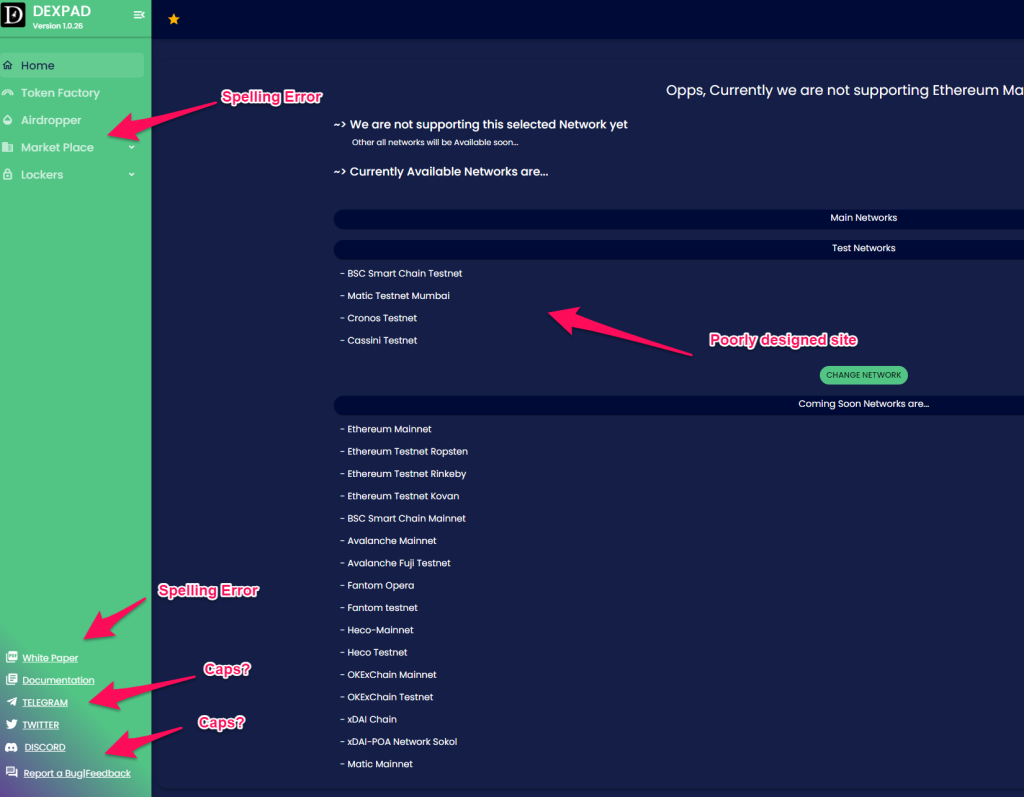

Some of the red flags i am looking out for is a poorly designed website and usage of vague language. Websites should properly communicate what they do and be professionally designed. If it is not properly designed, or has spelling errors or design errors, I am most likely going to close the website and never look back.

Furthermore, if I don’t understand what the project do, I am going to exit too. This is quite important to me because I need to have a basic level of understanding on what I am investing in so that I have the conviction to hold the crypto when prices crash 20% or even 50%.

Take a look at the roadmap

Next, I will take a look at the roadmap of the project. This helps me determine if the team has put in thought on how they want to grow the company, and also allows me to track and compare what they had actually delivered.

Common information that can be gleaned from a website is also the team behind it. What I am looking out for is whether the team has the experience and also the technical expertise to execute on the vision of the project. If the founding team has successfully launched other protocols, that is usually a huge plus point for me.

Look at investors and backers

The last piece of information that I am trying to collect from the website is the investors and backers. Some common big name investors are like Defiance Capital, Delphi Ventures, Coinbase Ventures, a16z, Three Arrow Capital, Spartan, Arrington Capital, Blockchain Capital, Binance Labs, DeFi Capital and a lot of others. The more investors back the team, the more confident I am in the project.

For example, this dex is obviously not a project I will look at as there are many obvious red flags (and the first thing you do when you visit the website is they request to connect to your MetaMask wallet).

Time spent: 10 – 15 minutes.

Collecting information from external sources

After understanding what the project does from the website, next I will try to read up and find out more information from external sources.

This allows me to gather information on whether there are any potential red flags around the project, its weaknesses, and what skeptics are worried about.

Here are some external sources I usually check:

- Crypto natives usually reside on Twitter and Sub Reddits, where most of the information and discussions are held. Thus, I tend to visit the respective Twitter and subreddit thread to check on how strong are the communities around each project are.

- For Twitter, what I am looking out for is whether the project is followed by prominent Twitter influencers. Twitter followers can be purchased easily, so one way to identify ‘red flags’ is to see if the account is new but has a lot of followers without followings from key influencers.

- I will also try to check on the sentiments around these protocols and whether people actively sharing about the project. This can be done via the hashtag of the project on Twitter.

- Another way is to join telegram groups to discuss with like minded crypto enthusiasts.

Time Spent: 30 minutes to 2 hours

Determine if the project is overvalued or undervalued

After passing the first and second phase, the next step for me is to see if the project is overvalued or undervalued.

- The first thing I do is to look at the chart for price movement — if the price has gone up significantly, I will likely wait for a retracement. Chasing high is not recommended, but if I have very high conviction based on the research I did, I will initiate a small position on the project while waiting for any retracement.

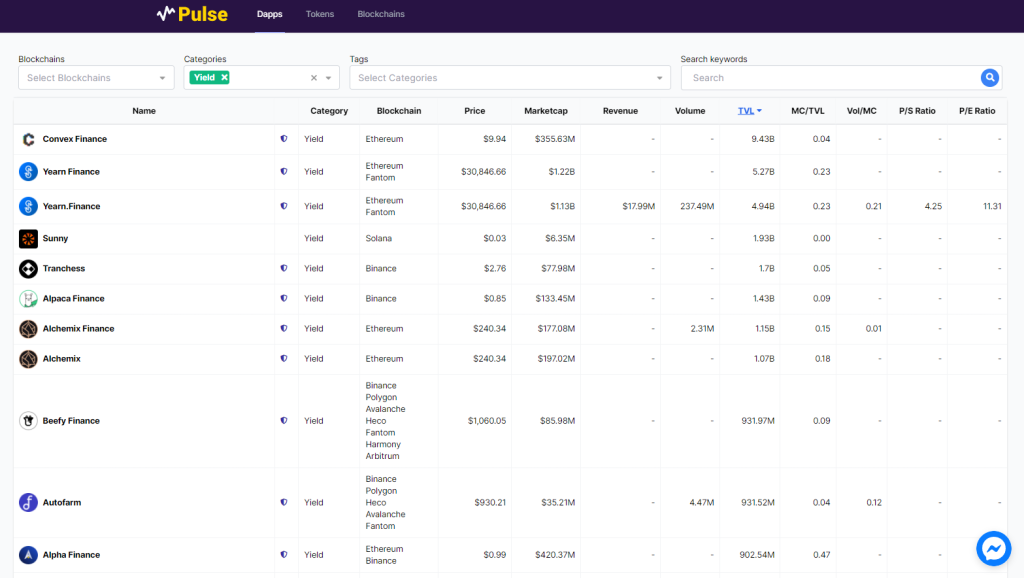

- Beyond just price movement, I will take a look at the market cap of the project. Anything below $500 million market cap for a high TVL growth project is worth looking into for me because the risk reward is still appealing. For high market cap projects, I will compare it based on the market cap over TVL ratio against other similar protocols to determine what is the upside and the current fair value.

- For example, Luna currently has a market cap of around $17 billion with a TVL of $9 billion, with a dozen of protocols earmarked to launch on their ecosystem the next few months. Solana on the other hand, has a market cap of $50 billion with a TVL of $11 billion. While it is not an apple to apple comparison, assuming a rational market (which we know crypto is not), Luna should be worth at least the same market cap as Solana if we were to compare based on TVL. That puts an upside of at least 2-3x for Luna.

- Once you go through this exercise, you will have a mental “price” for the project and that gives you the conviction and confidence to buy more and hold your position if the prices drop or crashes 50%.

- At Chain Debrief, we are building a comparison tool called Pulse to make it easy for users to track and compare protocol’s TVL. While this is the first version, you can try it out and give us any feedbacks for improvement.

@CryptoCobain @Cryptopathic

— Ape Lunatic (@ApeLunatic) October 8, 2021

Path, this is $LUNA , it has 8 DeFi protocols sucking up 9B TVL . Def something you want to look into . @anchor_protocol @mirror_protocol @ApolloDAO @LidoFinance . 50 plus more protocols coming on in the next couple months. pic.twitter.com/XaV6cvm3OC

Time Spent: 30 minutes – 2 hours

Finally, the last step for me is to size my position. There is no correct way to do this but the more conviction I have on the project, the higher the amount i allocate to the project.

If you are interested to read, here’s a look at my portfolio breakdown and allocation strategy.

Featured Image Credit: AltFi

If you find this useful, do follow us on our socials, we’d appreciate more followings and discussions as we build up our audience base:

Facebook: https://www.facebook.com/chaindebrief

Twitter: https://twitter.com/ChainDebrief

Instagram: https://instagram.com/chaindebrief

Telegram Channel: https://t.me/chaindebrief

Telegram Community: https://t.me/joinchat/Q3MVCzJrnOM1MzM1