In the previous Elrond article, we examined the technical features of Elrond and how it is user-friendly, business-friendly, and developer-friendly.

In this article, we shall analyse Elrond’s business model. Essentially, its blockchain is able to incorporate the core functions of a fundamental financial settlement layer for the global economy, and this is executed by means of a DeFi 2.0 module.

No, this is not the protocol-owned liquidity DeFi2.0 that we are all so familiar with. Actually, Elrond was the first blockchain to coin the term DeFi 2.0, and its own rendition of DeFi 2.0 points to Elrond’s reimagination of banking – an era of Autonomous Banking, where financial services are near-instant, inexpensive, programmable, and decentralized.

Rationale behind Elrond’s DeFi 2.0

The current financial system is extremely inefficient. Despite technological advancements, we still need to wait days for transactions to process, pay fees for payment processing, have different payment systems for different countries, and have to follow the operating hours of financial institutions.

DeFi addresses these issues as blockchains operate with no downtime and transactions are processed instantaneously with negligible fees (with the exception of Ethereum).

Yet, no matter how good the tech is, it is completely useless if there is no adoption which, ostensibly, is the case now.

For crypto chads like us, interacting with different protocols on different chains has become second nature. However, for most normies in the TradFi sector, the complexity of blockchain adoption is massive inertia.

To facilitate adoption, Elrond decided to integrate all the core DeFi components together and overlay them with an intuitively simple user interface.

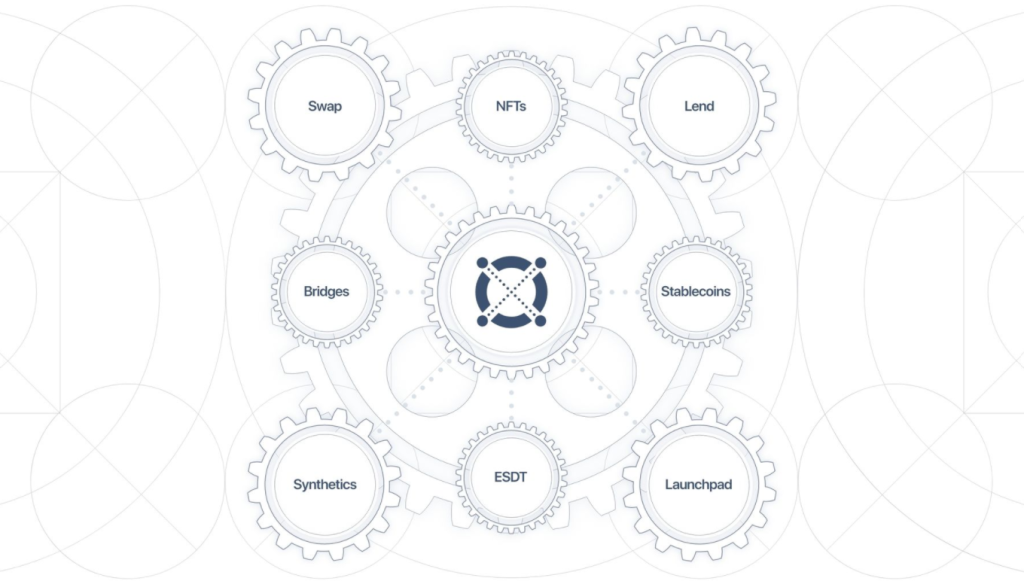

All these are then packaged as a DeFi 2.0 module, and the individual components it consists of are as follows:

1. Elrond Standard Digital Token (ESDT) Stablecoins

According to Elrond, stablecoins are the simplest and most effective first step for integrating blockchain utility in the TradFi system.

Stablecoins are tokens whose value is pegged to a fiat currency, and this recognizable denomination provides a smooth transition for TradFi institutions.

Presently, Elrond has incorporated USDC, and there will be more stablecoins going live soon.

2. Elrond NFT Standard

Non-fungible tokens provide true ownership for digital media objects. With artists and creators migrating online, NFTs are cornerstones that drive blockchain adoption to the mainstream.

3. Elrond Launchpad

The Launchpad module enables new projects to bring the most innovative and creative ideas to market, getting funding and launching directly within Elrond’s vibrant and thriving ecosystem.

4. Elrond Swap

Automated Market Makers (AMMs) provide deep liquidity to digital assets, thereby enhancing market efficiency. Additionally, anyone will be able to provide liquidity in pools to generate yield.

5. Elrond Lending

Borrowing and lending are fundamental cornerstones of an efficient financial system. This Lending module will provide automatic, easy, and instant access to liquid capital, collateralized by one’s holdings.

This will introduce more liquidity into the ecosystem and enables users to generate yield by lending their capital.

6. Elrond Synthetics

Elrond Synthetics module will make financial instruments available for tokenization. This means that traditional assets like stocks can be digitally represented to allow fractional ownership, ease of transfer, deep liquidity, and global distribution and accessibility.

7. Elrond Bridges

For Elrond to be a highly interoperable blockchain, it needs to be connected to other chains and this is enabled by cross-chain bridges. These bridges will enable smart contracts on one blockchain to interact with smart contracts on another. As such, Elrond’s Bridge module enables global liquidity to flow seamlessly through Elrond’s Network, granting everyone the opportunity to leverage Elrond’s user-friendly, business-friendly and developer-friendly blockchain.

Maiar

These seven DeFi components are then bundled into a mobile application AKA Maiar. Appearance-wise, Maiar provides users with a simple user interface akin to any TradFi mobile banking app.

However, functionally speaking, Maiar is actually a crypto wallet in disguise as it is capable of interacting with blockchain-native protocols. But unlike most crypto wallets like Metamask’s lengthy 0x address, your Maiar address is your phone number.

This digital identity layer is aided by the backend storing a mapping from phone number to wallet address. As such, while the backend does the heavy lifting, the front end offers convenience and simplicity, allowing users to send money to their contacts, similar to DBS Paylah!

Social payments aside, don’t forget the core DeFi services that are integrated together with Maiar. Now imagine using Paylah to leverage on your crypto to earn yield or buy NFTs and synthetic stocks. Pretty cool right?

Similar to the digital identity layer, all the complex steps taken to interact with blockchain protocols are relegated to the backend.

By overlaying a simple user experience on top of Elrond’s high bandwidth and low latency financial system, the blockchain can now be usable by nations, banks, businesses, and startups.

Furthermore, Elrond believes this will open a new adoption path for the rest of the unbanked world since this is packaged as a mobile application that is accessible to anyone, anywhere.

Execution risks

Nevertheless, it should be noted that all I’ve written so far is merely based on Elrond’s DeFi 2.0 plan for the future and is not indicative of their future success. Evidently, Elrond is still in its infancy and to my knowledge, only the AMM has launched.

The subsequent components will be launched individually with a 2-month spread. As such, only time will tell if they are able to implement their version of DeFi 2.0 successfully.

Wrapping up

Now that we understand Elrond’s business model, my next article will take a deep dive into Elrond’s main dApp, Maiar’s Decentralised Exchange (Maiar Dex).

Stay tuned!

Featured Image Credit: Chain Debrief

Also read: Introducing Elrond ($EGLD): The Internet-Scale Blockchain