[Author’s Note: This article was adapted from Rareliquid, a crypto and stocks Youtube channel, and and none of what you read should constitute as financial or investment advice but for educational and learning purposes.]

The crypto space may be a daunting place especially for beginners. With new projects being created on the fly, it is important to do your due diligence in evaluating any projects you plan on investing in.

This article sheds light on a conversation with Anjan Vinod on how to evaluate crypto projects. Vinod is the Vice President of Parafi Capital — an investment firm focused exclusively on the blockchain space.

Here are some strategies he employs to evaluate a crypto company.

Looking at the team

It all starts with the team. Some questions you have to ask yourself before investing into new crypto projects include — who is the team building on the product/protocol? What is their background? Are they the right team to take on the project?

VCs utilize their understanding of the background of the team which gives them a gauge on the team’s strengths as well as their weaknesses. Their access include networking with project founders to reference calling in attempt to fully understand the company.

At the end if the day, the team is building the product and is responsible in delivering their goals. Understanding the team entirely, would give you a sensing on whether they are able to pull off their vision.

As retail investors, we might not have the access VC firms do, but the open source nature of some DAOs/projects gives you access in reaching out to developers directly.

Stand out qualities in a team

DeFi is amazing, but creativity in the space over the past six months has been lacklustre. Few aspects of the team that would easily help them stand out is innovation and the ability to back it.

A brand new Layer1 or any EVM with the right team, technical background, solid experience in bring the product to market to entrepreneurship in founders are key aspects in a stand out team, one you potentially would pay interest in investing in.

Cohesiveness is also key. Did these founders meet three months ago in a hackathon, or are they well established individuals who have relative experience in the space?

Understanding the product

Figure out the product. Figuring out their competitors. Figuring out the market landscape.

Figuring out the product — This point will enable you to comprehend the product’s essential mechanics and how it functions. It would give you a sensing on which stage the product is at and how it compares to the rest of the market.

Figuring out the company’s competitors — Understanding the competitors allows you to see where the product stands. A product with a vase number of competitors might find difficulty in being able to stand out, while another with little to no competitors might prove to shine in being differentiated in product offering. You have to think about what the company plans to do in order to scale 10-100x.

Figuring out the market landscape — Understanding the market landscape starts with the product’s main differentiator. Even if they launch this product, what would prevent others from stepping in copying or forking the success?

The following are some key performance metrics to keep an eye on when it comes to DeFi protocols: TVL (Total Value Locked), trading volume, number of active users. Also look into the token design, will there be value accrual or utility over time?

Read More: Your First Step Into The Crypto World: Top 10 Free Crypto Tools

Tokenomics design

Is a token actually needed?

2017 was the boom of ICOs for the creation of tokens within the crypto space. Companies did not really need a token but utilized this avenue as a fund raising tool without any thoughtful use of token models.

Fast-forward to 2022, where token modelling is the background in forming a fundamental case for a specific project. Tokenomics helps with protocols in governance and bringing in new users.

This step is key in determining a long-term investment with a particular project.

What is the purpose/utility?

The token has been generated and given to the team/community/ various stakeholders. What’s next?

A Layer1 token might be staked to validate transactions for the securing the network. There might be a governance layer regarding a DeFi token to help vote on different changes within the protocol, etc.

For holders to hold the token for the long term, it must have a value attached to it which is derived from its utility.

How it is distributed?

Who are the core stakeholders of the project? If the project is a DEX, it might be the traders/liquidity providers. If its a money market, it could be the borrowers and lenders. If it is a game, it may be gamers who play the game or game integration partners.

Identifying these groups is key. If tokens are being allocated to the team, it could be a red flag signalling a cash grab. Another could be to private investors — large amounts allocated to these group of investors might induce selling pressure in the future.

Additional ways to evaluate crypto

When you are looking into a crypto project, you can almost view it like how you would view an equity investment.

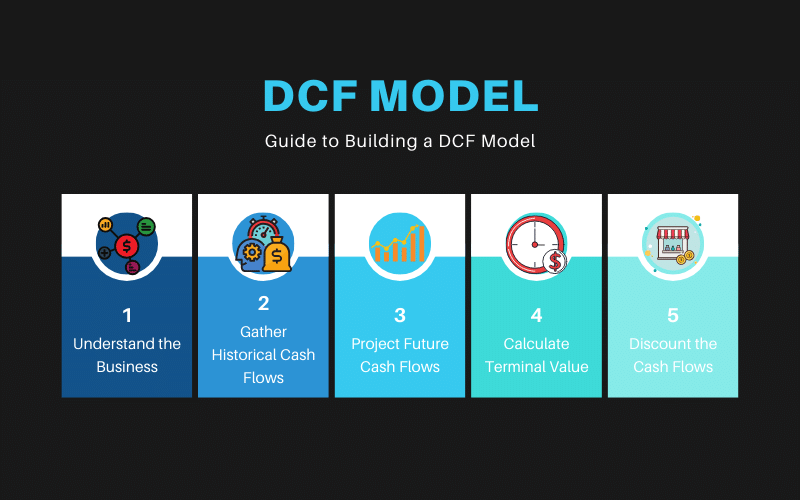

You first look at the revenue and cost of the project and calculate the projected (there are multiple ways out there) cash flows for the next 5-10 years.

You then discount all of that to present value.

(Discount rate would be the forgone rate of return if an investor chose to accept an amount in the future versus the same amount today)

That present value would be taken as the market value/market cap of the project. Divide your projected market cap value with the total number of token supply would give your an estimated price per share.

Based on your forecast, you then would be able to compare it with the current day price to derive if the token is over or undervalued.

Find out more on Discounted Cash Flow (DCF) Modelling.

The beauty of crypto is that you don’t need to see numbers only during quarterly earnings but in real time. You get a transparent view with the protocols which does not exist in the large public companies we know of today.

When is the right time to sell?

There are two factors to take into consideration when deciding when to sell — internal and external forces.

Internal forces could be how long you are comfortable in holding this position. Your position might have a huge run up but came down significantly and you rather remove it from your portfolio. Alternatively, you could just be a HODLer.

External factors goes back to the fundamentals. There is a whole range of fundamentals to consider and may come to great difficulty if you decide to sell just by looking at the price.

A good indicator as to when you should sell is a disconnect between the fundamentals and the price. Just because something has gone up in value does not equate to a sell as fundamentals might also improve.

Track these fundamentals over time and ask yourself if the project is overvalued.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image: Chain Debrief

Also Read: Investor Or Gambler? Here Are The Top 3 Tell-Tale Signs That You Are A Crypto Gambler