Ever wanted to execute complex farming strategies but just have no clue on whether it’ll be worth it?

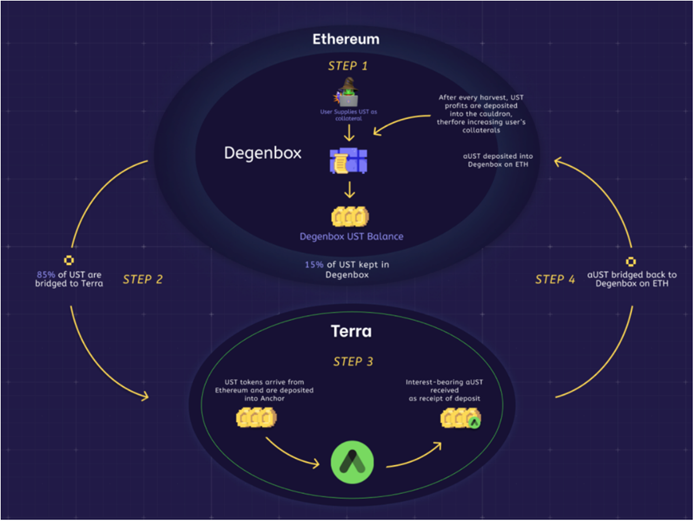

While concepts like degenbox on MIM/UST, arbitrage opportunities, leveraged yield farming may be common concepts to most crypto natives — many people still do not use them. I’d say this comes down to three main factors:

- Lack of information

- Turned off by “extra steps”

- Too little capital to bother

Risk-reward is something that many in crypto (myself included) have no clue how to manage, especially when so many of us have full-time jobs or studies outside of crypto to take care of.

However, the success of yield optimizers like Beefy Finance shows how eager users are to deposit their money in protocols that farm for them. As the crypto space leans bearish, it is likely that more and more people will be looking for delta neutral or at least automatic yield.

Farming as a Service (Faas) gives normies like you and I the ability to engage in these protocols indirectly without having to bother with points 1-3 above. Basically, you buy a token, stake it, and have experienced farmers do the work for you.

These protocols build a farming wallet through investments and taxes on their token transactions.

Generally, these taxes are about 12% and are denominated as such:

– 8% Treasury

– 2% Holders

– 2% LP pools

What differentiates FaaS projects?

Farming is all about connections — after all, your network is your net worth. The larger or more connected the team is, the more likely they will get access to exclusive partnerships or early access which can lead to immense gains unavailable to retail investors.

Certain other KPIs include wallet size, ROI and liquidity.

While many of these projects are still relatively small, as launches become more exclusive and DeFi expands, there is a high likelihood that these projects will eventually take off.

Notable FasS projects

$MCC or multi-chain capital is a project with 24,000 holders, available on both the Ethereum and Binance chains.

With a reduced 6% tax, their project has scaled quickly to a US$23 million farming wallet and has grown to include nodes.

$FFF or Food Farmer Finance is a relatively new entry available on both the Fantom and Ethereum. With a Youtube personality at its helm, they have reached almost US$1 million AUM thanks to strong network effects.

$CCC or Cross-Chain Capital has brought FaaS to the Avalanche network and already has about 4,500 holders.

Their recent fractionalized yield system through its $HUNT project has helped lower the barrier to entry of Play-To-Earn games such as Crabada.

Conclusion

While there are many who may simply pass such projects off as a scam, there are reasons why hedge funds are so popular on Wall Street. Being able to park your money somewhere and generate yield while not having to press multiple buttons a day frees up your time substantially.

Furthermore, unlike rebasing tokens, these projects usually pay out in the native token of their chains, such as $FTM, $AVAX or even $ETH.

This helps to reduce the dilutive nature of many farms, which usually have token price dump over time.

While many may turn away from this space, it may pay to keep an eye on the clear winners in this space and bet big on them.

Featured Image Credit: Oobit via Medium

Also Read: What Are The Differences Between Staking And Farming? Here’s What You Should Know