Key Takeaways:

- Claims of Alameda Research is insolvent

- CZ of Binance liquidating $550M worth of FTT equity

- Metamask may be the best alternative to hold your funds

___________________________________________

How it started

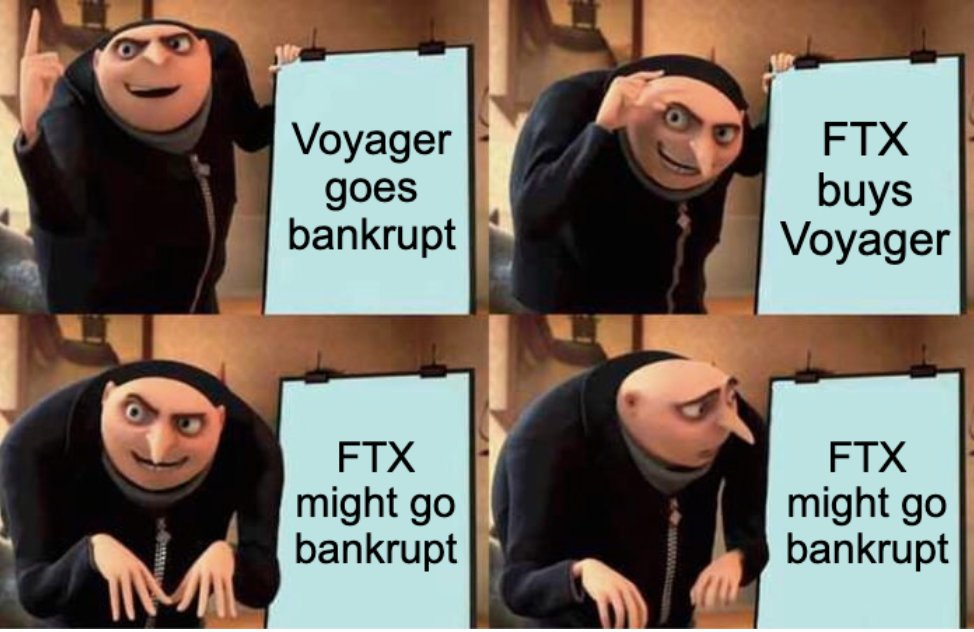

It all started as FUD, with claims that Alameda Research is insolvent. A report from Coindesk shared some critical financial details from Alameda Research, the crypto fund controlled by Sam Bankman-Fried (SBF), also the CEO of FTX.

So SBF controls one of the most significant crypto hedge funds and one of the largest crypto exchanges; what could go wrong?

The hedge fund’s Q2 balance sheet revealed that the firm’s most significant asset holding is $FTT, the FTX token. The FTT token on Alameda’s balance sheet is roughly 1/3 of its total assets, equaling 88% of Alameda’s net equity.

This also comes as an anomaly; with Alameda holding a significant portion of its assets in tokens issued by FTX, SBF is printing billions out of thin air to take up massive loans.

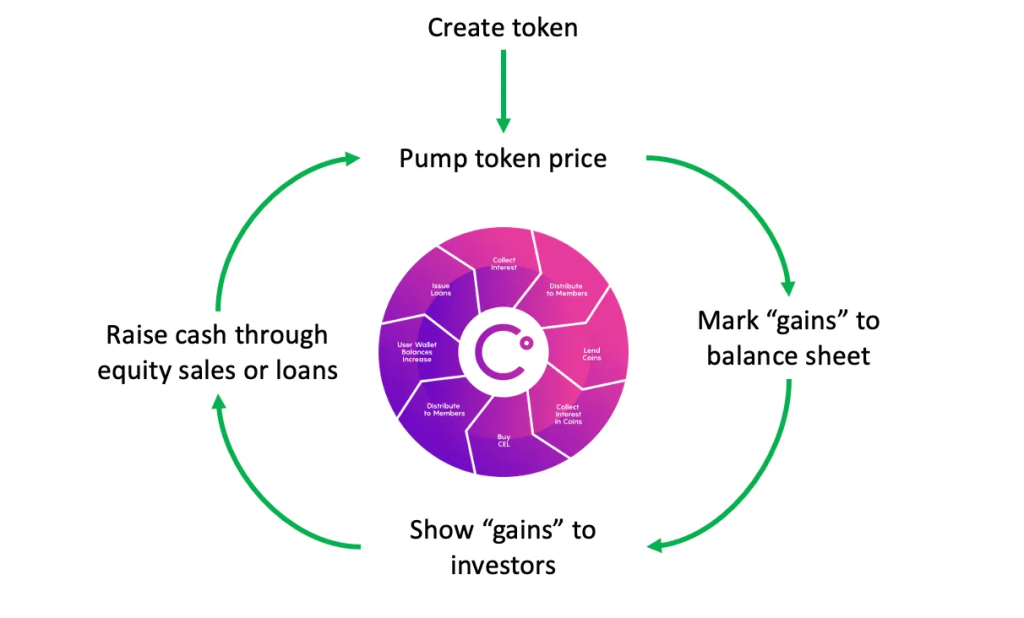

Especially when a similar mechanism was used, it saw the fall of the Celsius Network. In a manipulative (allegedly) fashion, here’s how this unsustainable financial cycle works for them to pump their bags.

TLDR based on @DU09BTC

- FTX prints FTT out of thin air

- FTX lends FTT to Alameda Research

- Alameda Research borrows USD stables against FTT

- Alameda Research sends USD stables to FTX

- Repeat = infinite money

It starts with token creation, which can be done simply with codes on a blockchain (it may be more challenging than I’m assuming it to be).

Next will be to pump the token’s price by buying tokens with your customer’s assets. At this moment, you hold most of the tokens for yourself, which means there are fewer tokens out there to pump.

After the token pump, you can add your “assets”, showing billions of dollars on your balance sheet.

You do some baity marketing to hook investors to buy into your token, who are already likely overpaying.

With real money now, you can basically do anything you want. You could even use that money to buy failed crypto companies.

Alameda’s wallet to track

Here is the list of Alameda’s wallets for you to track

ETH: http://etherscan.io/address/0x2faf487a4414fe77e2327f0bf4ae2a264a776ad2…

• Arbitrum: http://arbiscan.io/address/0xa60113f7d43130919802b0863abdcdb956664fd5…

• BSC: http://bscscan.com/address/0x41772edd47d9ddf9ef848cdb34fe76143908c7ad…

• Polygon: http://polygonscan.com/address/0x6e685a45db4d97ba160fa067cb81b40dfed47245…

Binance dumping FTT effect

With Binance’s exit from FTX’s equity last year, CZ’s team received roughly $2.1B equivalent in BUSD and FTT.

Binance has always supported communities, but according to CZ, “we gave support before, but we won’t pretend to make love after divorce.”

Liquidating our FTT is just post-exit risk management, learning from LUNA. We gave support before, but we won't pretend to make love after divorce. We are not against anyone. But we won't support people who lobby against other industry players behind their backs. Onwards.

— CZ 🔶 Binance (@cz_binance) November 6, 2022

According to Olimpio on Twitter, Binance started the dump yesterday, while Alameda offered to buy all FTT at $22.

Even institutions are afraid

Every $ manager who is fully confident that FTX is not going under is also withdrawing their assets for risk management purposes

— Jason Choi (@mrjasonchoi) November 7, 2022

Only way this resolves is if FTX puts out an official statement with full audit

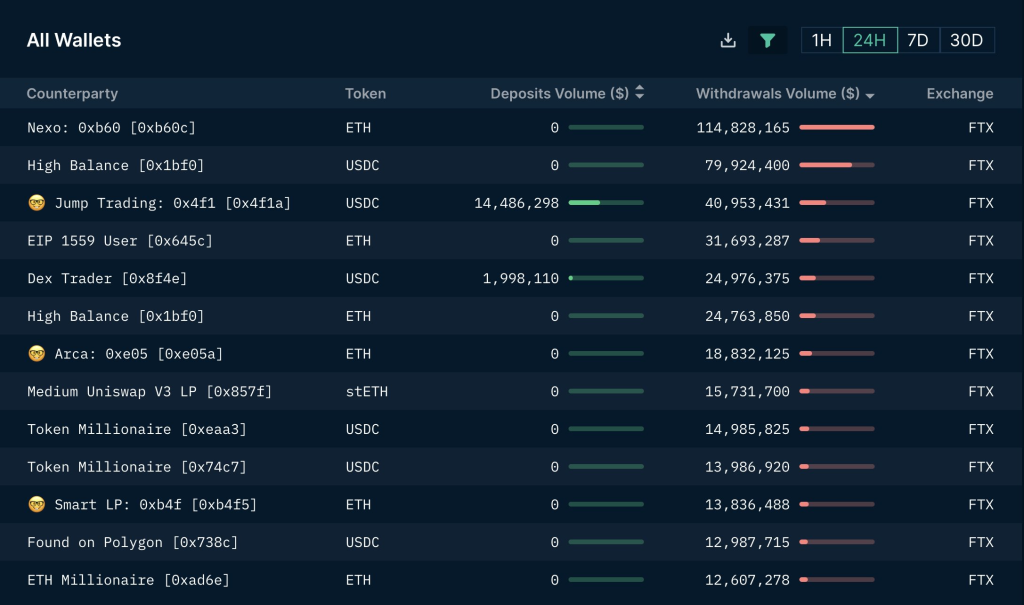

Nansen Intern showed us a list of wallets that made massive withdrawals from FTX.

Alameda trader’s response

Crypto trader CarolineCapital from Alameda replied to CZ with an offer for all the FTT Binance plans to sell.

Not only did this cause massive volatile price action, but it affected both longs and shorts trading the FTX token.

Here is the summary of how the interaction between Caroline and Binance has on the market.

Alameda insolvency rumour : FTT ⬇️

— Wise Advice By Sumit Kapoor (@sumitkapoor16) November 7, 2022

Caroline clarification tweet : FTT ⬆️

Binance selling their holdings : FTT ⬇️

Caroline says they’ll buy it all: FTT⬆️

Ftt on roller coaster, Welcome to #crypto, welcome to volatility 🥵@SBF_FTX @carolinecapital

Although Caroline came out to dispel the rumours circulating about the balance sheet, the market still did not settle with ease.

A few notes on the balance sheet info that has been circulating recently:

— Caroline (@carolinecapital) November 6, 2022

– that specific balance sheet is for a subset of our corporate entities, we have > $10b of assets that aren’t reflected there

The FTT token is currently down 14.1% on the seven days and 64% on the year.

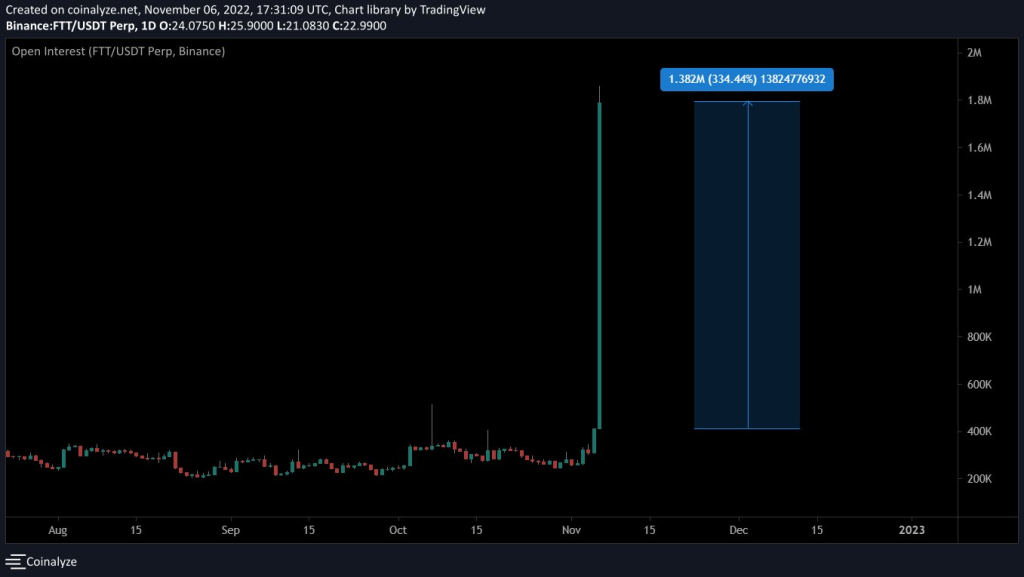

Increasing open interest

Following uncertainty and the reaction of CZ’s position to dump their FTX token, the market is sizing their bets. This amounted to a 334% increase in open interest in the FTT token.

Open Interest – Open interest refers to the total number of outstanding derivative contracts that have not been settled. For each buyer of a futures contract, there must be a seller. That contract is considered’ open’ when the buyer or seller opens the contract until the counter-party closes it.

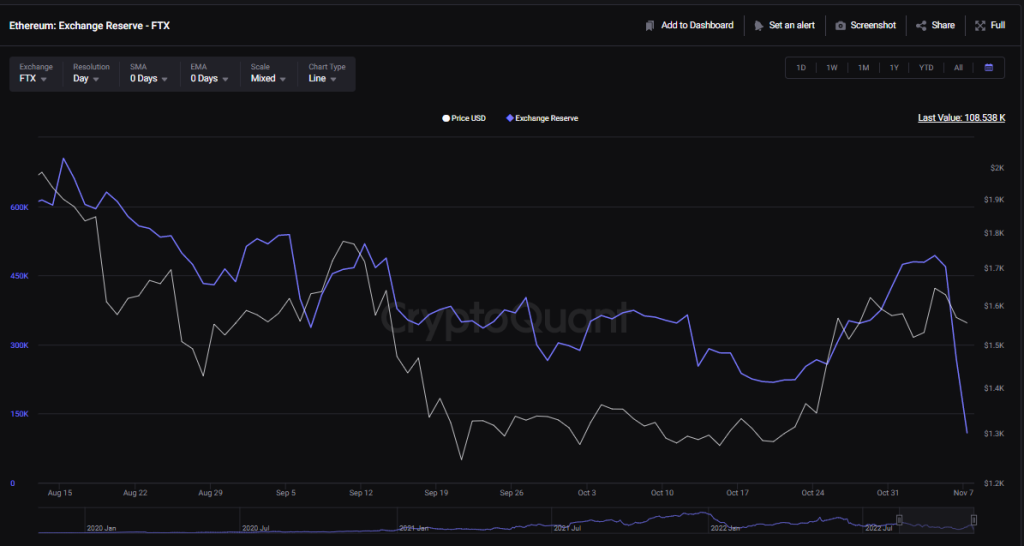

According to CryptoQuant, FTX’s ETH reserves have dropped to the lowest level since November 2020. The current FTX ETH reserves are 108,246.43, and its ETH reserves have decreased by nearly 300,000 in the past two days.

Withholding withdrawals

With all the news going around, the increasing fear among investors holding their funds on FTX is also rising.

What made matters worst was when withdrawals weren’t as smooth as before, increasing fears that the exchange had halted withdrawals.

otter was frantically withdrawing coins from FTX when the insolvency rumours hit

— otteroooo (@otteroooo) November 7, 2022

got this error message multiple times

feeling of failing to withdraw funds before an expected bank run

ABSOLUTELY SUCK

transfer went thru eventually, may be it's the fabled browser issue

🦦😮💨 pic.twitter.com/LMPRymos9q

To the time of writing, FTX has not made any official statement withdrawals are paused but tweeted that leaves are slow as they were refilling hot wallets, and the processing took the entire day.

ah sorry – to be clear:

— FTX (@FTX_Official) November 7, 2022

FTX is fine, withdrawals were slow as we refill hotwallets but have been processing all day

Relocating your funds

We are not sure if Alameda is insolvent, but there is no downside to withdrawing your funds to the blockchain.

There is no harm in doing this. It is your funds; you choose what you want to do with them.

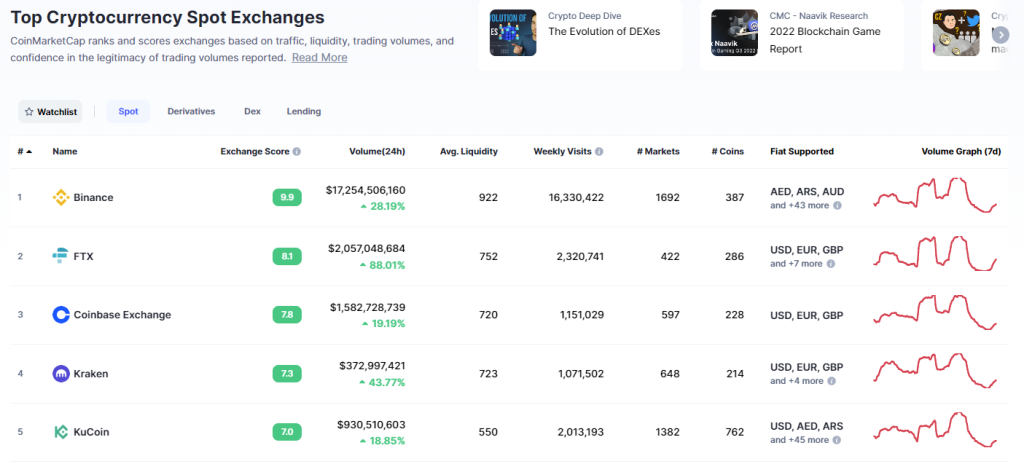

Other than FTX, here are the four other top exchanges so that you can relocate your funds.

Kucoin

I am holding my funds in Kucoin. Kucoin has one of the best alternatives, especially if you are a leveraged trader.

They offer a ton of coins, not as much as FTX, but they still serve their purpose if you look at smaller-cap coins.

Find out how you can deposit your funds on Kucoin from FTX here.

Metamask

However, if you are tired of all the FUD around CEXs, it might be wise to transfer your funds to Metamask or any other web3 wallet.

It is probably the safest place to hold your funds, but ensure you familiarize yourself with how it’s done securely.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: ChainDebrief