Key Takeaways:

- While Bitcoin being 69% down from ATHs may feel like max pain, there is likely more to go

- This bear market will run through terrible macroeconomic conditions

- By reimagining max pain scenarios, we can prepare ourselves for the worst to come

___________________________________________

This bear market was home to one of the most disastrous events in crypto history. The overnight collapse of $LUNA, a top 10 cryptocurrency, exposed multiple flaws in the industry.

From Three Arrows Capital to various CeFi platforms, entire firms collapsed under the weight of Terra Luna, and liquidations mirrored the downward cascade of prices.

While $BTC hitting 17K may have been the bottom to many crypto participants, there is firm evidence that we are not yet out of the woods. But how much lower can we honestly go, and would that really make much of a difference?

Let’s explore.

Also Read: VCs Talk About Their Perspective And Learnings From The Market

There’s Still Too Much Money in Crypto

A recent tweet by Coingecko founder Bobby Ong exposed a harsh truth.

At Token2049 in SG this week. This place is crowded. Over 7k attendees, countless booths, and dozens of after parties with free-flowing alcohol.

— Bobby Ong (@bobbyong) September 29, 2022

We are supposedly in month 10 of a bear cycle. I think we are in for some tough times next year. People don't feel poor at all YET.

Even though this bear market is different, with projects having war chests and firms being smarter about their capital expenditure, there is simply still too much money left to be spent.

From retail to suits, the smell of lingering despair has yet to fill the room.

Last week saw the largest Bitcoin liquidation in FTX history, and more than USD$1.7 Billion were taken out of trader’s hands over the last 10 days.

During the bull market, blind longs were an easy trade, and were profitable over almost any timeframe.

But what happened when prices started crashing through every support level, and retail was left knife-catching?

Traders have been conditioned to expect breakdowns at this point. Shorters won’t be able to mentally handle the slightest breakout and rally without imploding their accounts. pic.twitter.com/MO199DQcet

— SM17 (@SMtrades_) October 7, 2022

This bear market has traders too comfortably shorting, even at the most depressed prices. Expectations that any rally will get broken down or distributed at key resistance have been overwhelmingly strong amongst retail.

When we thought one last capitulation was needed to flush out leverage, no one thought it would be to the upside.

Max pain from a price scenario would wick out leverage on both sides, catching late longers and early shorters. While we should not expect a V-shaped recovery into quick breakdowns, a constant shift in trend would break even the most tenacious trader.

We’re Not Yet at Max Boredom

Given crypto’s nascent nature, it’s not terrible that one of the best indicators on many lists for a bottom is max boredom.

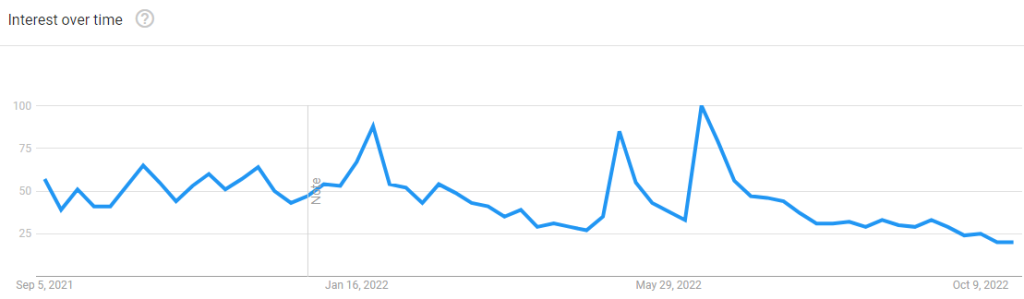

While Google searches for Bitcoin seem to have plateaued, this generally reflects interest from external parties. In the meantime, crypto Twitter remains euphoric over every Elon tweet, and the on-chain spaces are still rife with shitcoins.

In fact, every FOMC sees a major spike in the open interest across a whole slew of cryptocurrencies.

1/ Today, we announced our $150M Series A funding round. This is a testament to our team's technical expertise, the strength & activity of our ecosystem and the vision & ethos we all share. https://t.co/GGnn4TY9Lw

— Aptos (@Aptos_Network) July 25, 2022

Old narratives like “more transactions and higher throughput” are still receiving millions in funding, and airdrops are still in full swing.

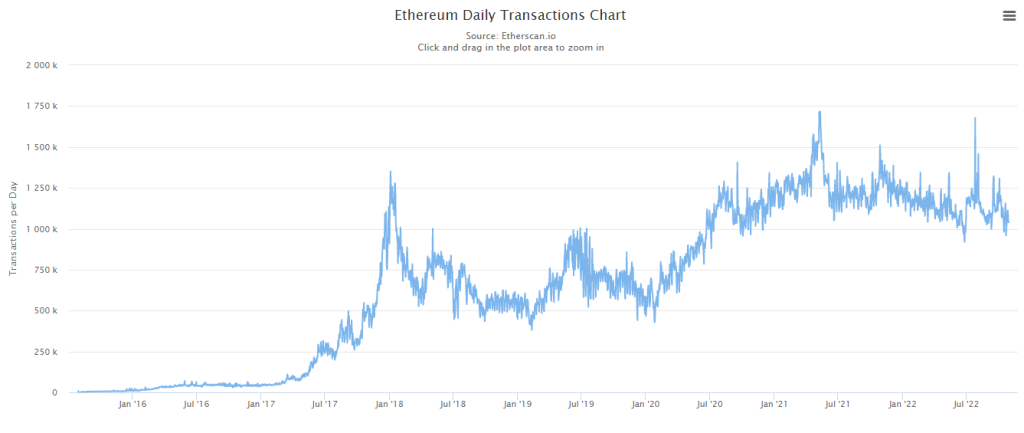

Daily transactions on the Ethereum blockchain are also barely a hair below bull market numbers. While this may be due to gas fees being a fraction of the cost now, the strength of on-chain activity means user activity remains steadfast.

Be it participating in the latest ponzi or trading NFTs, participation in the crypto ecosystem remains close to all-time-highs.

In contrast to previous bear markets, where on-chain transactions fell 50-75%, it is likely that there will more users eventually exiting the ecosystem, or at least abandoning chains.

Until on-chain activity peters out and volatility grinds to a halt, it is unlikely that the worst is behind us.

Governments Have Yet To Rule Out Web3.0

Recent U.S regulations took a heavy stance against on-chain privacy, with the Treasury Department sanctioning Tornado Cash.

While those regulations only had a real impact on money launderers, they showed how quickly “decentralized” entities agreed to comply with governments.

Heard about the latest @MAS_sg proposals for crypto?

— Chain Debrief (@ChainDebrief) October 27, 2022

Here's 3 important things to take note of

Last week, the Monetary Authority of Singapore released a proposal that may ban leverage trading on crypto, a surprising move for the seemingly crypto-friendly nation. The proposal could also prevent Singaporeans from receiving airdrops or participating in yield-farming opportunities.

Bitcoin was meant to be decentralized money. But with each cycle, the power in Web3.0 seems to be reverting to overarching entities.

One of the most worrying examples of this has been the United States Securities and Exchange Commission investigating Bored Ape Yacht Club creators Yuga Labs.

The SEC is investigating Yuga Labs, the creator of the popular NFT collection Bored Ape Yacht Club, over if its digital assets sales violate federal law @robinsonmatt

— Anna Irrera (@annairrera) October 11, 2022

(the full story)https://t.co/bvkAMFW3Mw via @business

While the issue at hand, whether NFTs could be considered securities, seems like a redundant question to crypto natives, it is a very real issue which could set a major precedent for the entire NFT scene.

Imagine a scenario where Opensea is forced to delist not only BAYCs, but also other NFTs that launched in a similar fashion.

While this is an extremely unlikely scenario, the crypto space has been filled with wild turns. From Tornado Cash’s developer being arrested to an entire ecosystem collapsing overnight, the worst-case scenario is often on the table for Web3.0.

Holders Still Hodl Hopium

With $BTC crashing 69% from the peak, many hodlers have started accumulating, due to the high risk-reward ratios. After all, a return to the previous all-time-high is one thing that we could cumulatively agree upon.

At current prices, a return to peak bullishness would translate into approximately a 3.5x, a trade only fools would pass up on.

Take the same trade and plug it into Ethereum, or any other altcoin that you believe will stand the test of time, and you have a 10-100x.

But what if that return never comes?

This bear market still has a few legs to run, and it will do so in some of the worst macroeconomic conditions possible. And while crypto is currently in a relief rally, it often lags behind the wider market.

If this were the bottom for the wider stock market, that would be a great sign for crypto. But more likely than not, we will see further downside in equities over the next 2 years.

Long-term investors and speculators alike are probably setting their bids in the 18k range now, salivating at the opportunity to catch the pico-bottom

But when the 100% increase in M2 money supply, rising interest rates, and poor policy decisions catch up to us, where will Bitcoin prices be?

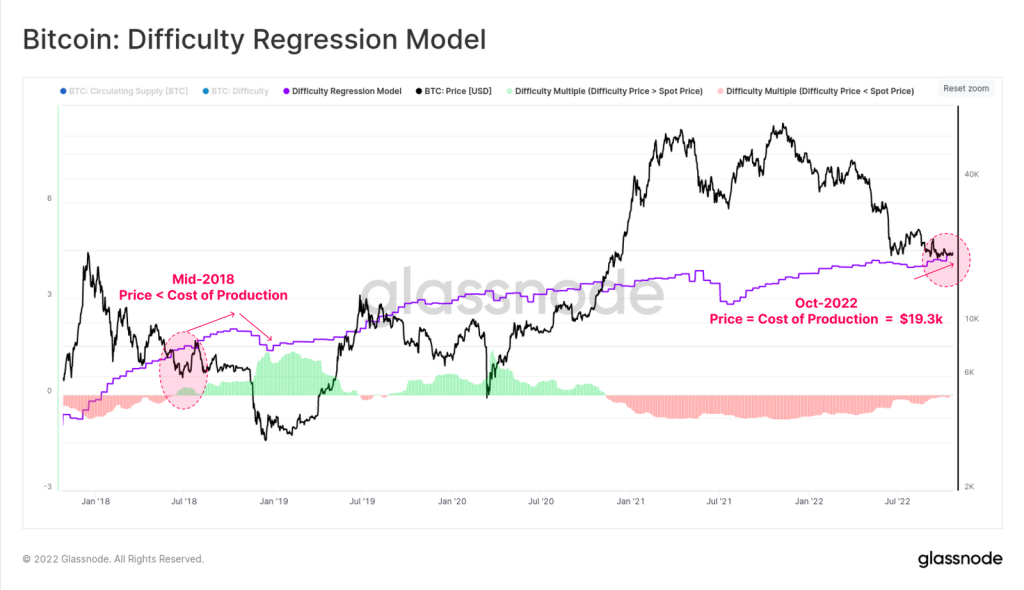

A microcosm of this can be seen with miners having to sell their $BTC in order to cover costs.

Despite one of the largest Bitcoin mining companies, Core Scientific, selling a majority of their holdings recently, more than US$1.5 Billion, or 78.2K $BTC is still held by various mining companies.

While they have been distributing into the market, poor liquidity coupled with low demand means that when they start unloading, we may see a substantial leg down.

And that’s just with miners – when the remaining crypto participants realize they have to sell to buy food and pay for necessities, it won’t be pretty.

While $BTC pushing $17,000 would be expected by many, what happens if we have a sudden breakdown below $9k.

Would you be comfortable bidding then?

An Opportunity For The Nimble, Not Hodlers

I often think that those still in the crypto space will make it. After all, if you’re already down 90%, and 90% after that – what’s another 90% more?

However, reimagining the worst possible scenario opens up a whole new perspective for max pain.

What if NFTs are banned? What if airdrops get restricted? What if another stablecoin crashes or an exchange goes down?

While we remind ourselves that these are simply “what ifs”, they remain possibilities we have to consider. Becoming a forced seller, after all, is one of the worst outcomes possible.

Should we shy away from this potential once in a lifetime opportunity to accumulate? Or wait till the next bull market for safe longs?

There is no bear market.

— Hsaka (@HsakaTrades) November 2, 2019

There is no bull market.

There is only…

* takes a fat rip *

the market. pic.twitter.com/vbUcs1S1Fk

Crypto rewards the nimble, and being open to a wider range of max pain scenarios will help you prepare contingency upon contingency.

Fortunately for us, if you believe in crypto for the long-term, the only way to lose is by not playing.

Also Read: MAS May Ban Trading For Retail – Here’s 4 Other Ways To Profit in Crypto

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief